Soft commodities decline in value, diesel supports crude oil

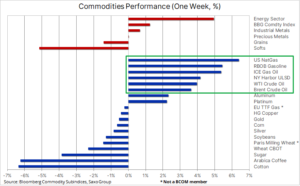

Last week, the situation on commodity markets was mixed, with the strengthening in the energy sector, led by fuels, offset by a weakening in the agricultural products sector - in particular the so-called "soft" raw materials, which fell to the level of the annual minimum, mainly due to the persistently low prices of coffee and cotton.

Overall, the dollar continues to exert a strong influence on the direction of a number of key commodities, including gold, which gained support as a result of increasing speculation that FOMC may soon postpone policy implementation to assess the economic impact of the current cycle of rate hikes.

Industrial metals index gained slightly, focusing on developments in China after the end of the XNUMXth National Congress of the Chinese Communist Party and on the dollar, which has slightly depreciated. At the same time, precious metals found some support from the recent shift in bond and dollar sentiment amid speculation that we may be approaching the peak of the US Federal Reserve's aggressive monetary policy.

The recent recovery in the gold market came after speculation intensified that the Fed was preparing to slow down the pace of interest rate hikes early next year. This assumption is supported by the FOMC's readiness to allocate more time to assess the economic effects of the rapid pace of interest rate hikes and quantitative tightening. However, some of the initial gains were netted at the end of the week as the dollar strengthened again - particularly against the euro after the ECB surprised markets with a softening, and also against the Japanese yen after the Bank of Japan maintained its yield ceiling. and the government announced the implementation of wide-ranging fiscal stimulus. The Bank of Japan does not allow the correction of government bond yields, which may contribute to a weakening of the yen unless the other major central banks start easing policies.

Crude oil supported by the forecast low fuel supply

Crude oil is likely to see an increase for the second week in a row, but without trying to break through the resistance so far, suggesting that the market still has difficulty finding direction and none of the overarching topics are decisive enough in this regard. The strengthening was the result of an increasingly limited supply on the fuel products market, record-breaking weekly oil and fuel exports from the United States, a weaker dollar, as well as large purchases from China in connection with the plans by local refineries to increase fuel exports by the end of this year.

While crude oil has remained broadly within the range since July, the market for fuel products continues to tighten as supplies in Europe and the US are increasingly scarce, increasing refining margins on gasoline and distilled products such as diesel, heating oil and aviation fuel. The main factor in this regard remains the product market in the Northern Hemisphere, where the scarcity of diesel and heating oil stocks is still a matter of concern. The chaos in this market was caused by the war in Ukraine and sanctions against Russia, the main supplier of refined products to Europe. In addition, the high cost of gas has accelerated the shift from gas to other fuels, particularly diesel and heating oil.

The situation has recently worsened even more with the decision OPEC + about a production cut from next month. While the continued release of US (light sweet) oil from strategic reserves will support gasoline production, OPEC + production cuts will primarily affect Saudi Arabia, Kuwait and the United Arab Emirates - producers of medium / heavy oil, which produces the most distillates.

As long as the product market remains constrained, the downside risk for crude oil - despite the current fears of recession - appears low, so we reiterate our forecast for this quarter's Brent price range between $ 85 and $ 100, with a tightening product market increasingly degree tilts the scales in favor of growth.

Difficult times for coffee, cotton and sugar

The Bloomberg Soft Commodity Index recorded decrease by 5% on a weekly basisincluding a 6% drop in Arabica coffee price to 175 cents per pound. This is the 2023-month minimum for this commodity as cash managers continue to pull back from long positions which are now becoming increasingly risky amid concerns that a global economic slowdown will hurt demand as Brazil's 2024/23 harvest forecasts 173 show signs of improvement. However, the fact that stock market monitored stocks are still at their 50-year low, while technical analysis shows a heavily oversold market, could mean the market is about to establish some support - potentially around 2019 cents a pound. This level would represent a 2022% adjustment of the 86-260 rally line from XNUMX to XNUMX cents.

The sugar price was negatively affected by the weakening of the Brazilian real, which encouraged exportsand thus increasing supply while forcing the exit from recently established speculative long positions. Cotton, which depreciated 53% from its May peak, has dropped to an almost two-year low on sluggish supply demand as consumers around the world cut back on spending.

Weekly export sales from the main supplier - the United States - have decreased compared to last year, and total sales in the current season are well below last year's and long-term average. The main culprit behind the slowdown in sales is canceled orders from key buyer China, as textile demand has fallen victim to the current economic downturn. This development is reflected in the weakness of the MSCI World Textiles, Apparel and Luxury Goods Index, which fell 35% year-on-day compared to a 22% decline in the overall MSCI World index.

Gold is nervously awaiting the FOMC meeting on November 2

At Saxo, we are reiterating our positive mid-term but cautious short-term outlook for gold. In our last analysis we discussed how the recent rebound has been fueled by speculation that the FOMC may soon halt further aggressive policies to assess the economic impact of the current rate hike cycle, which currently rates the peak federal funds rate just below 5% compared to the current level 3,25 , 4%. Moreover, we maintain the view that long-term inflation will ultimately be around 5-3%, well above current market expectations of below XNUMX%. If it were to be true, it would cause a significant correction in the price of zero-coupon inflation swaps, which could support gold in the form of lower real yields.

However, speculative and non-speculative investors are likely to refrain from acting, until we get a clearer picture of the Federal Reserve's approachthat is why this week's FOMC meeting is so important. Speculative traders in the futures market have suffered significant losses over the past few weeks, which discouraged them from aggressively entering the market until more specific information was available, according to weekly reports by the Commitment of Traders. The same applies to gold-backed stock traders, who have been almost continuously net sellers since June. The total amount of gold held by investors has dropped to 2 tonnes, a 965-month low, down 30% from the April peak.

After being rejected again in a key support area ($ 1), gold must at a minimum break above $ 615 - and thus bridge a series of lower highs - before the month-long downtrend can end. However, a number of minor resistance levels remain on the way to this level, notably $ 1 and $ 735. For now - until the momentum is restored - it is worth observing profitability, geopolitical developments and the dollar exchange rate to gain directional inspiration. The currency appreciated after the ECB and Bank of Japan meetings, thus reducing the support for commodities - in particular gold, for which there has been a high negative correlation in recent weeks.

More analyzes of commodity markets are available here.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)