Raw materials: Year of metals – Saxo Bank forecasts for Q1

The new year can become the time of metals, with particular emphasis gold, silver, platinum, copper i aluminum material. In precious metals, we believe the prospect of lower real yields and lower costs of holding non-interest-bearing positions will support demand, especially for exchange-traded products where investors have been net sellers over the last seven quarters. Industrial metals could benefit from supply disruptions, industrial restocking as financing costs fall, and continued demand growth in China offsetting weakness in the rest of the world. This will be driven, among other things, by the green transformation, which will gain momentum. In some cases, replacing demand for copper and aluminum from traditional end-users who may suffer from weakening economic prospects in 2024.

Gold and silver will benefit from lower real yields and financing costs

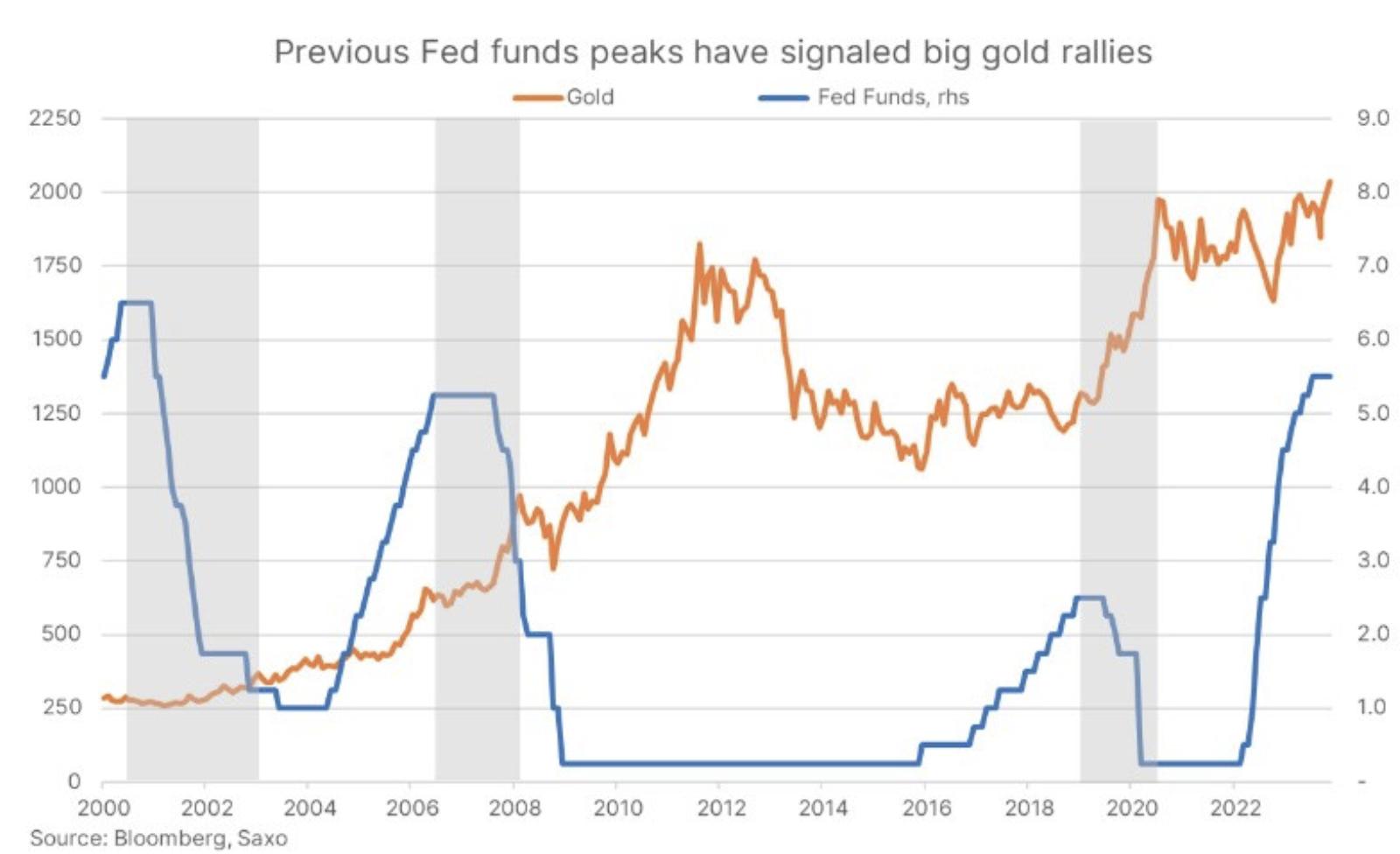

After surprisingly strong results in 2023, we see further price increases in 2024. Gains driven by a triad of hedge funds chasing momentum, central banks continuing to purchase bullion at record pace, and renewed investor demand ETF, such as asset managers - have been absent for almost two years due to rising real yields and increased costs.

Considering it's American Federal Reserve leans towards rate cuts, we see that the current number of expected rate cuts are justified by a soft landing, whereas a hard landing or recession would create an even greater need for rate cuts. Record purchases by central banks over the past two years were a key reason why gold managed to rally despite a sharp rise in real yields, and why silver suffered more during correction periods. It didn't have that consistent, fundamental demand. For ETFs, demand is likely to return and with continued demand from central banks, potentially supported by a weaker dollar, we could see gold hit a new record high of $2300. Silver may find additional support from the expected copper rally and attack the 2021 high at $30, signaling a decline in the gold/silver ratio below the 10-year average near the ratio of 78,3.

In the case of platinum, the combination of largely inelastic demand and the risk of reducing uneconomic supply has the potential to widen deficits and tighten market conditions. This would fuel a recovery in ETF assets from a four-year low and, as with silver, raise the prospect of platinum outperforming gold next year. This could potentially lead to a $250 reduction in the discount towards a five-year average of around $750 ounces.

Copper and aluminum prices supported by supply disruptions and green transformation

The industrial metals sector may also benefit from the prospect of lower financing costs, which will bring the industry's long-awaited restocking period from China to the rest of the world. Copper remains our favorite industrial metal as demand is expected to be strong, as seen in China last year. This pushed listed stocks closer to multi-year lows. There is also an increasing risk of supply disruptions and production reductions.

We have witnessed major supply disruptions, particularly of copper, the so-called king of green metals due to its multiple uses. These disruptions were caused by the government-enforced closure of the mine Cobra Panama powered by First Quantum. Other mining companies such as Rio Tinto, Anglo American and Southern Copcop are seeing declines, mainly due to growing challenges in Peru and Chile. Overall, this paints a picture of a mining industry struggling with rising costs, lower grades of ore and increasing government intervention.

For now, given the wide range of challenges that mining companies will face in the coming years, with some having increased overall production costs and thus impacting their profitability, we prefer direct exposure to base metals, primarily through ETFs .

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)