Commodities backed by green inflation and limited supply

Commodity markets were clearly booming in 2021, with the sector as a whole having its best year since 2000. Over the years of plentiful supply and stable prices, investment in new production has been limited, and supply struggled to keep up as the post-pandemic surge hit. As energy, ranging from oil to gas and coal, is the main driver of the global recovery, these sectors have seen an increasingly diminished supply which will eventually has led to the current energy crisis.

We anticipate that it will be another year in which constrained supply and inflationary pressures will support gains in commodity markets. Global decarbonization will increasingly cause the so-called green inflationwhere rising demand and prices of raw materials needed to support this process will collide with inelastic supply - partly driven by regulations such as ESG - preventing some investors and banks from supporting mining and mining activities.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In general terms, S&P GSCI Total Return indexenergy dominant rose by 40%, while the Bloomberg Commodity Total Return Index, with a more cross-exposure and greater share of the troubled precious metals sector, recorded a return of 27%; in terms of value expressed in USD, both indices easily outperformed the index gain MSCI World in the amount of 23,3%.

Energy

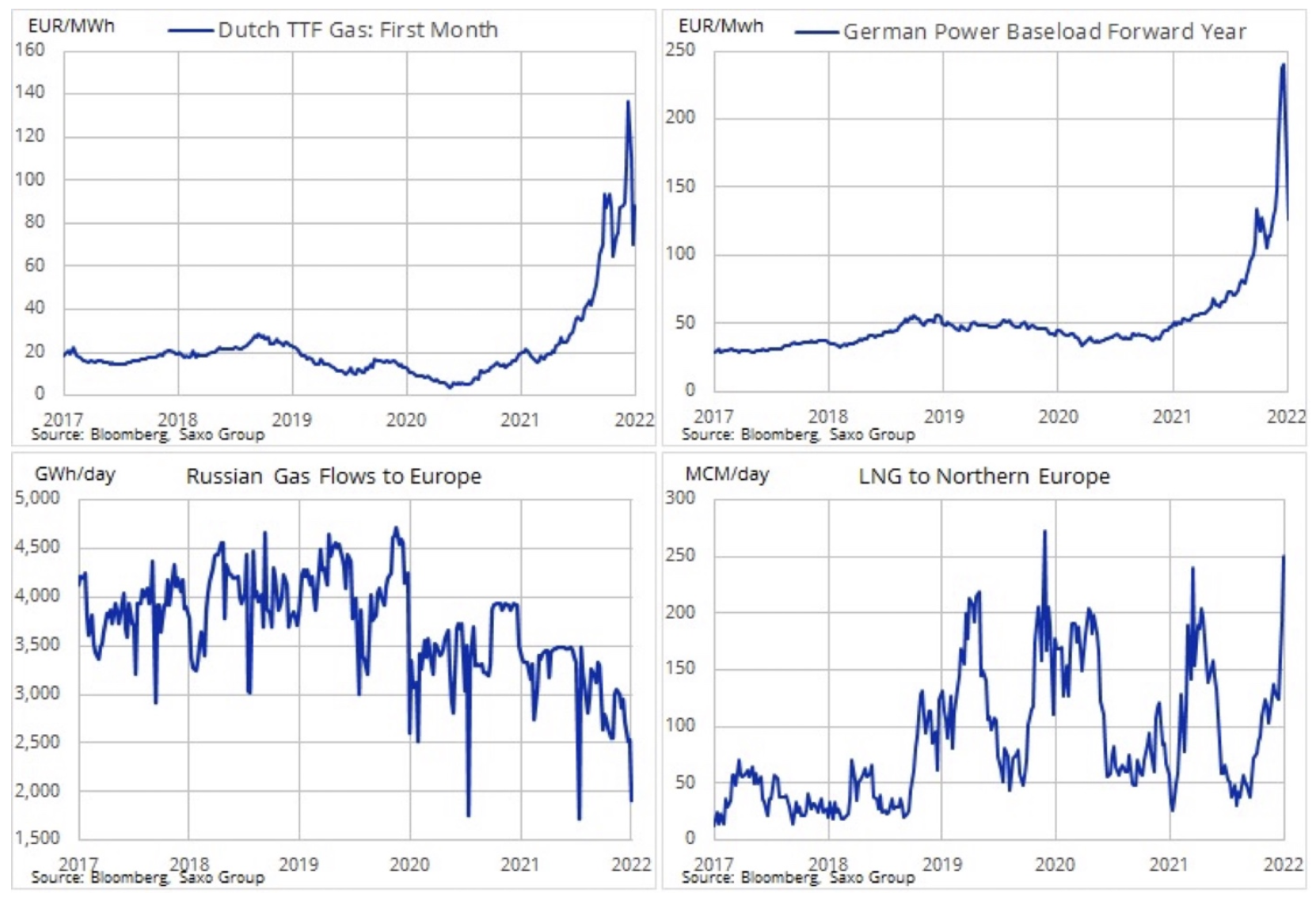

The strong recovery in global energy demand, coupled with a lack of investment - due in part to regulation and the drive to increase production of renewable energy - has contributed to rising prices for all fossil fuels. The forecast for 2022 points to a further limited supply, and hence - higher prices. The most visible imbalance between supply and demand was seen in Europe and Asia in the second half of 2021, when gas prices in Europe in December reached 60 USD / MMBtu at one point - more than ten times the average price for the last five years.

Over the past six months, the weakness of an energy market geared to decarbonising energy production has become increasingly apparent in Europe. This resulted in the so-called green inflation, fueled by extremely high gas and electricity prices that threaten the most energy-intensive industries while undermining consumers' willingness to spend money and keep the economic recovery on track. While in Europe, natural gas is seen as a bridge between coal and renewable energy sources, in Asia, coal remains a key energy source, particularly in China and India, where the demand for coal has grown in line with the growing energy demand last year. Accordingly, and despite the need for global decarbonisation, the amount of electricity generated worldwide from coal has increased by around 9%, reaching a new record level in 2021. The International Energy Agency estimates that this year the demand will record another record and may remain at such an elevated level for the next two years.

While the risk of European shortage of gas has been more or less mitigated thanks to a mild winter during the holiday season and a large supply of LNG, the structure of future prices points to further bottlenecks for consumers and economic sectors across the continent. Dutch TTF gas futures for February 2023 are priced just 10% below spot price, still more than four times their long-run average.

In 2022, supply in the oil markets appears to continue to decline and several OPEC + producers are already struggling to meet their quotas. Against this background, and given that US production is struggling to return to pre-pandemic levels, we maintain a positive long-term outlook for the oil market. It faces long years of potential underinvestment as major players are losing their appetite for major ventures, in part due to uncertain long-term outlook for oil demand, but also, increasingly, due to ESG credit constraints on banks and investors (environmental, social and governance issues) and an emphasis on green transition.

Global oil demand is not expected to peak in the near term, which will put even more pressure on production reserves, which are shrinking every month as production increases by OPEC +. According to OPEC and IEA, the market may be oversupply in the first months of 2022, but as production reserves begin to run out and demand peaks before the pandemic, we expect Brent crude oil to reach at least $ 90, and in the second in six months it may even exceed USD 100.

Industrial metals

Metals saw strong growth in 2021, but most of the 32% spike in the London Metal Exchange Index occurred in the first half of the year, so the year ended with some degree of uncertainty. After reaching a record price in May, copper remained sidelined for the rest of the year amid continued concerns about the outlook for the Chinese economy, in particular the struggling Chinese real estate sector. Aluminum, one of the most energy-intensive metals to produce, also surged sharply in 2021 and the forecast remains constructive given the supply disruptions in late 2021. This is an additional argument for analysts predicting an increase in the supply deficit this year , incl. due to the projected decline in productivity growth in China due to increased government efforts to combat air pollution; for the same reason, non-Chinese producers are very reluctant to invest in new potential.

Despite the predictions that the energy transition towards less dependence on coal in the future will generate strong and steadily growing demand for many key metals, the outlook for China, in particular for copper, is currently the great unknown, as the real estate market is responsible for a significant part of Chinese demand. . However, given the small supply of raw materials from the mining industry, we are confident that the current negative macroeconomic factors related to the slowdown in the Chinese real estate market will begin to weaken in the first months of 2022.

This is due to, inter alia, from the fact that People's Bank of China and the Chinese government, unlike the US Federal Reserve, is more likely to boost the economy, particularly in the context of green transition initiatives that require industrial metals. With both copper and aluminum stocks low, we believe this could lead to prices returning to, or even exceeding, last year's record levels, in our opinion. The side exchange rate prevailing for months contributed to the reduction of speculative long positions, thus increasing the likelihood of another wave of buyers as soon as the technical forecast improves; for HG copper, this signal is likely to come after the break above $ 4,50 per pound.

Precious metals

Gold and silver were the only sectors to decline last year, but given the negative impact of rising bond yields and the stronger dollar, a negative gold performance of around 3,6% was acceptable from a diversified portfolio perspective. As the commodity most sensitive to the dollar and interest rates, gold will draw some, but not all, of its directional inspiration from these two markets. Gold it is often used by fund managers as a hedge against unforeseen events, both macroeconomic and geopolitical. The mountain of money provided by governments and central banks after the first wave of the Covid-19 pandemic contributed to the minimization of macroeconomic risks while pushing the stock market sharply.

As in 2021, gold started the year on the defensive and once again the initial weakness was fueled by rising bond yields after the US Federal Reserve signaled it would step up its efforts to fight inflation. In the first fiscal week, the real yields of 0,3-year US bonds rose sharply by 1%, but instead of reacting sharply as it was in the corresponding periods of last year, gold managed to stay around $ 800 / oz, i.e. the level of around which it oscillated in the second half of 2021.

As of early 2022, gold appears to be stuck in a wide range between $ 1 and $ 740. Key to the short-term direction is how it will balance the opposing impulses from the potential risk of a sharp rise in profitability in the face of increased market uncertainty, as well as from the dollar, which may struggle to replicate last year's solid performance. However, given that the market is already pricing in around four interest rate hikes in 1, with the first one scheduled for March, and inflation already above 860%, we wonder how much, from a gold valuation perspective, the data and expectations may worsen. in the short term.

Against this background, and given the continued strong position of emerging markets and the central bank, we maintain a positive outlook for gold - and potentially even more so for silver - as soon as industrial metals, as expected, begin to appreciate again. The expected strengthening to the new maximum, however, may not take place until the second half of the year, especially if - as John Hardy claims in his forecast for the currency markets - Federal Reserve will continue to keep increasing interest rates until something breaks.

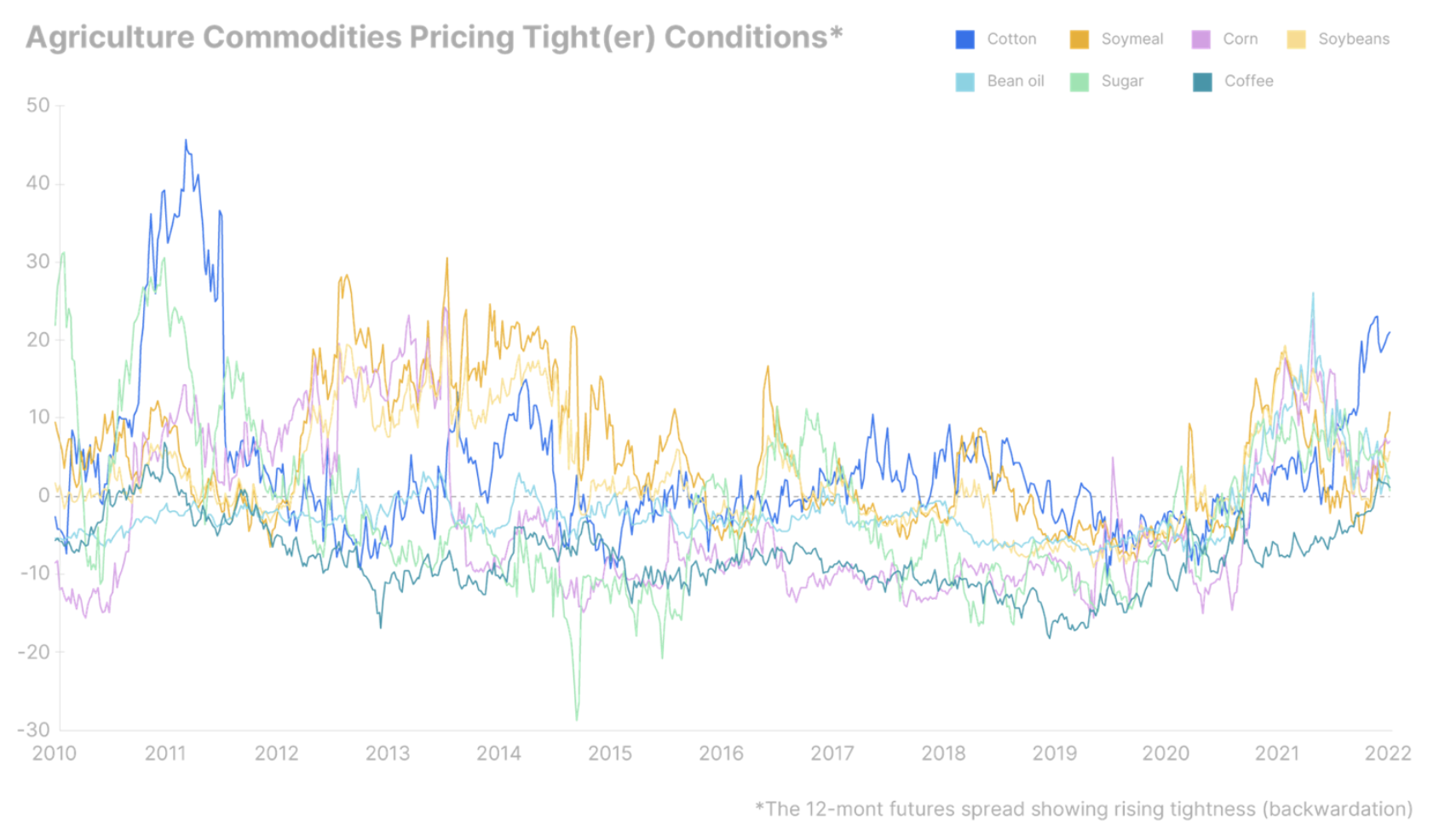

Agricultural products

The FAO World Food Price Index ended 2021 with an annual increase of 23%, with the highest increases in the sugar and vegetable oil sectors. While we anticipate some calming in 2022, climate and weather risks remain of concern as supplies shrink. In addition, there is a gas-related increase in fertilizer prices which, in combination with higher fuel costs, can shift to crops with lower fertilization rates.

Crops supporting the growth of renewable fuel production, such as maize, soybean oil i sugarespecially given the prospect of higher oil prices with limited production. In addition, Arabica coffee - which has already reached its ten-year high - may rise further if forecasts of a decline in production in Brazil due to adverse weather conditions in the coming months come true.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)