Filtering signals - how to choose the right opportunity to enter the position

It can not be hidden that trading is an extremely individual activity. There are no two traders who think in the same way and who have the same skills. Each of us has certain predispositions that make some things come easier and we have to work more over some.

Apart from certain aspects of investing, a kind of selection of games is extremely important, which lets you choose better and worse signals in the candles. Trading is a field where you constantly need to learn, even after a few years, without learning the right habits, choosing setups can be stressful and difficult for us. Especially at the beginning of our journey, it is very important so as not to fall into the overtrading trap and protect our capital. You can not replace experience, but using certain principles, you can develop the ability to "look at" the chart and find the best investment opportunities on it. Before you open a position, it is worth paying attention to a few tips.

Be sure to read: False Breakouts - Control of the play in the Forex market

Pay attention to pinbars

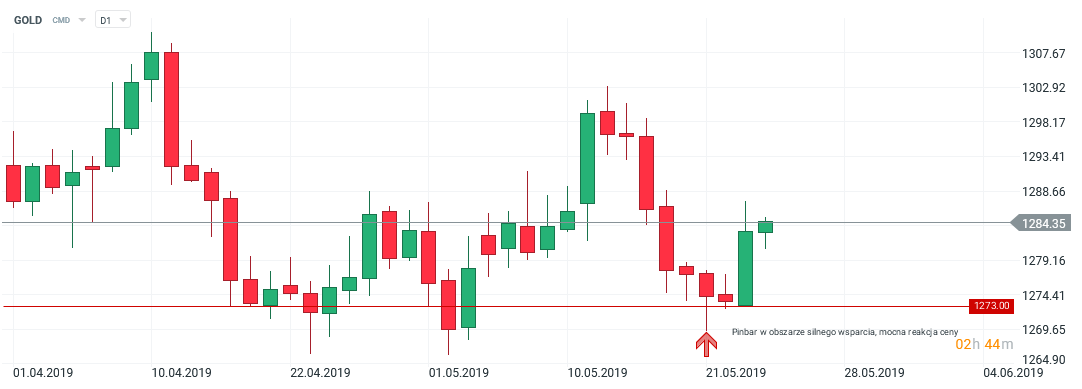

If you see a long-shadowed candle on the graph, which in addition is found in the area of strong support / resistance, very often such a signal has a high probability of success. When a candle wick hits a given level and we deal with a false punch, it reinforces the given setup. This shows that the market has not been able to maintain the zone and it is likely that we will be dealing with a move in the opposite direction. The length of the candle's shadow is also important. Generally, the longer the shadow, the stronger the rejection of the price. Of course, it is not that every pinbar works and self-mastery of this technique will allow us to earn money on the market, but it is worth paying attention to the situation when these types of candles appear in the areas of key zones.

Pinbar on key support, GOLD D1 market, xNUMX XTB xStation

Do not play a raise right away

Very often, many investors get caught in a breakout trap. The market is very often knocked out, but equally often such breakouts turn out to be false. There is no single technique that would identify whether a puncture is not a typical fake, but opening a strict position on an important level, whether it's support or resistance, always carries a greater risk. In 90% of cases, it is not worth placing a raise before actually getting into it. It is much better to wait in such a situation, for example, to close a given candle and additional confirmation in the form of a retest. Of course, it happens that the market does not give a second opportunity to join a given traffic, but in most cases, waiting for retest allows to protect capital, and gives a strong additional confirmation. An example is the situation on GBPAUD from a few days ago. At the higher interval the upward trend, on the lower one, breaks the important level around 1.85630. When playing the breakout, we enter immediately after closing the marked candle. As you can see another candle completely negates the signal, better wait for confirmation.

Example of false positives, GBPAUD H1 currency pair, xNUMX XTB xStation

Look for follow-up signals after correction

A very frequent mistake of many traders, is to play "both" parties. One of the best filters we can apply is simply opening items that are only compatible with the current price movement. Very often such signals appear after adjustments to support in the uptrend, as well as resistance in the downward trend. Even if the adjustments are relatively small and flat, positions consistent with the trend are always more likely to succeed than to reverse. Keep in mind that the price is never so high that it can not be higher and by analogy, the fact that we have reached a certain minimum does not mean that we will not descend to the lower levels.

Example of a strong trend and flat adjustments, GBPUSD H4 currency pair, xNUMX XTB xStation

Do not open positions in consolidation

Especially at the beginning of your journey with trading, it is worth taking very cautious approach to consolidation signals. It often happens that we have many candles in a given range and, for example, one pinbar, which can be a signal to open the position. Very often, this type of signal is not correct. Of course, experienced investors can even find an interesting and profitable setup in consolidation, but in such situations, it is always better to wait for a momentum and a stronger move to one of the parties.

Look for additional confirmations

Always, even if the signal seems perfect to you, you should look for additional confirmations. What kind of confluence we pay attention to should depend on our investment style. It's interesting to combine eg signals on key support and resistance with the overbalance method, and certain fibo levels, mainly 50% and 61,8%. Interestingly, you can also use the correlation between given currency pairs. In theory, the more confirmations, the better it is to remember to focus on quality, not quantity.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)