Opportunities in a deglobalizing world - Saxo Bank forecasts for QXNUMX

In Asia, the dependency model on China is disintegrating, and new supply chain links and increased regional cooperation mark the next step in improving the region's performance in 2023.

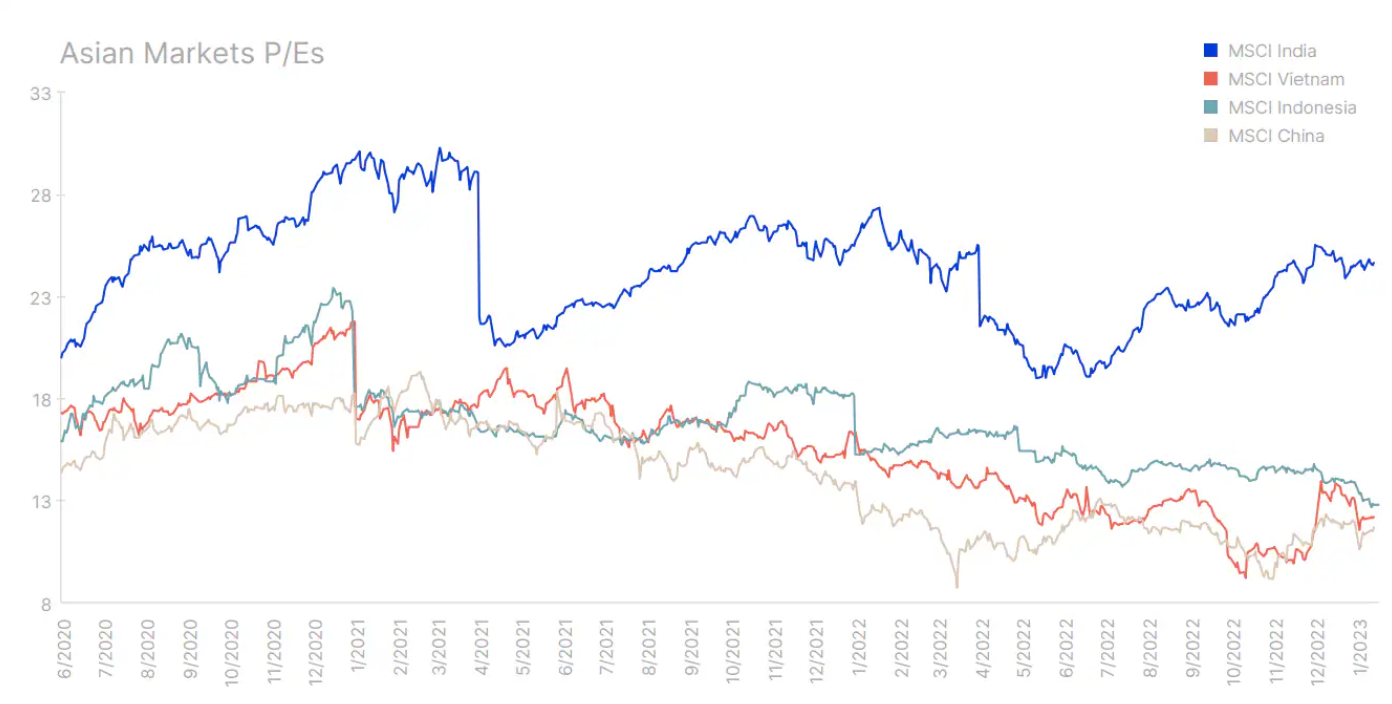

Asian stocks kicked off 2023 on a strong note: the MSCI Asia Pacific and MSCI Emerging Markets indices went up in January and overtook the US S&P 500 index. Changes in China's policy and a weaker US dollar contributed significantly to this. However, the risk of a slowdown in the global economy, as well as higher inflation persisting for a longer period of time, should not be ignored. Domestic demand forecasts in Asia are also at risk due to the increase in interest rates in 2022. At the same time, geopolitical risk remains important, which makes forecasting difficult.

Another important point to consider is the fact that Asia's dependence on China is decreasing, as evidenced by the region's better performance in 2022 despite the slowdown in the Middle Kingdom. As the Chinese economy reopens to the world, new supply chain models may emerge and regional cooperation may become stronger, making Asia more important in the global economy.

Asia is gaining momentum with new supply chain models

The escalation of the China-US trade and technology war has prompted many companies to diversify their supply chains to reduce the risk of sanctions. Already the pandemic has highlighted the need to tackle concentration risk, as supply chains for everything from basic industrial components to medical supplies and even toilet paper have been overly dependent on China. Finally, Russia's invasion of Ukraine and its impact on gas supplies to Europe has led many countries traditionally associated with US foreign policy to consider the resilience of their supply chains and the possibility of avoiding over-dependence on Russia or China by sourcing from friendly countries.

For example, Japan not only seeks to diversify its LNG suppliers and restart its nuclear reactors to ensure a stable energy supply in the long term, but also seeks to become independent of China and Russia for food to reduce the risk of supply cut-off. More broadly, Japan has embarked on a war path, as evidenced by increased defense spending, closer cooperation with Washington, and unequivocal condemnation of Russia's attacks on Ukraine. This means that a new economic and geopolitical arrangement may emerge in Asia.

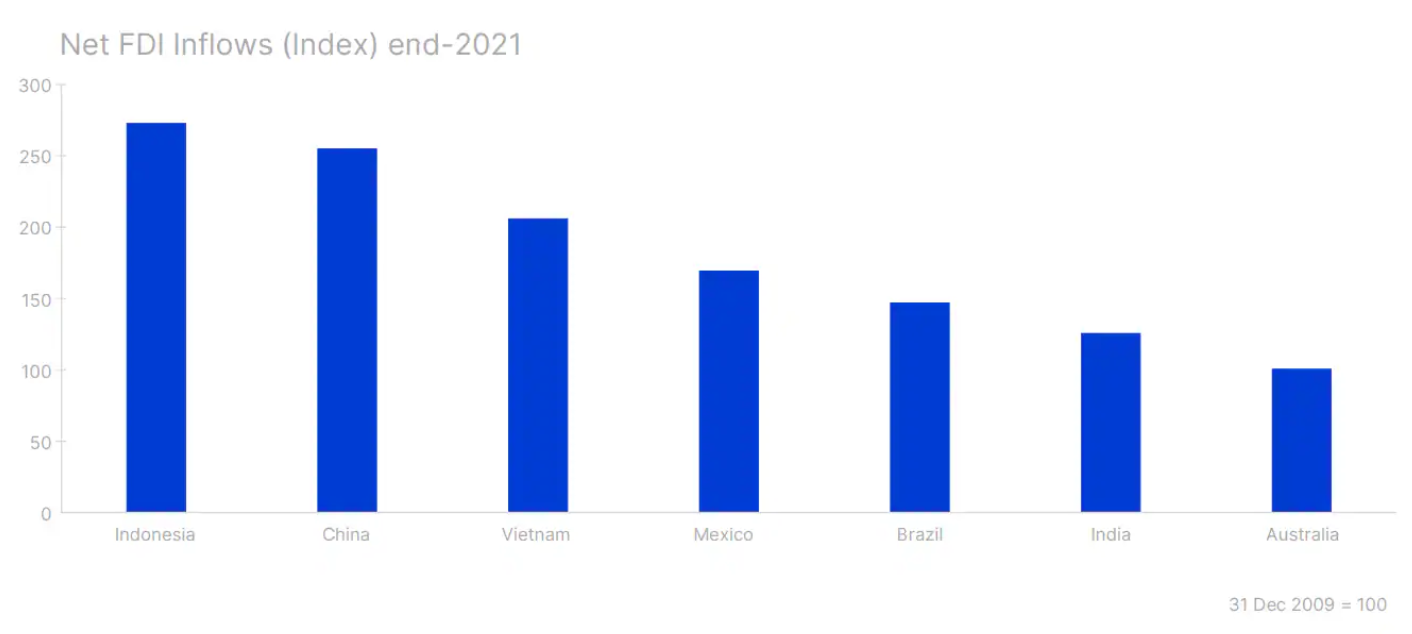

The winners of the China+1 strategy

A group of Asian countries are emerging as potential winners in the wave of deglobalization and decentralization trends. Investments in India accelerated due to the country's attractiveness as a consumer market and favorable political stance. Apple has started manufacturing iPhone 14s in India and is expected to move a significant portion of its smartphone production to India by 2025. If this is successful and Apple is able to carry out the planned production, it will be a significant confirmation of India's production capabilities. However, starting in 2023, India's valuation became tight; in addition, there are other relatively cheaper markets that offer better value after deep declines last year. This means that India will have to prove its worth again by continuing its economic reforms to attract foreign investment.

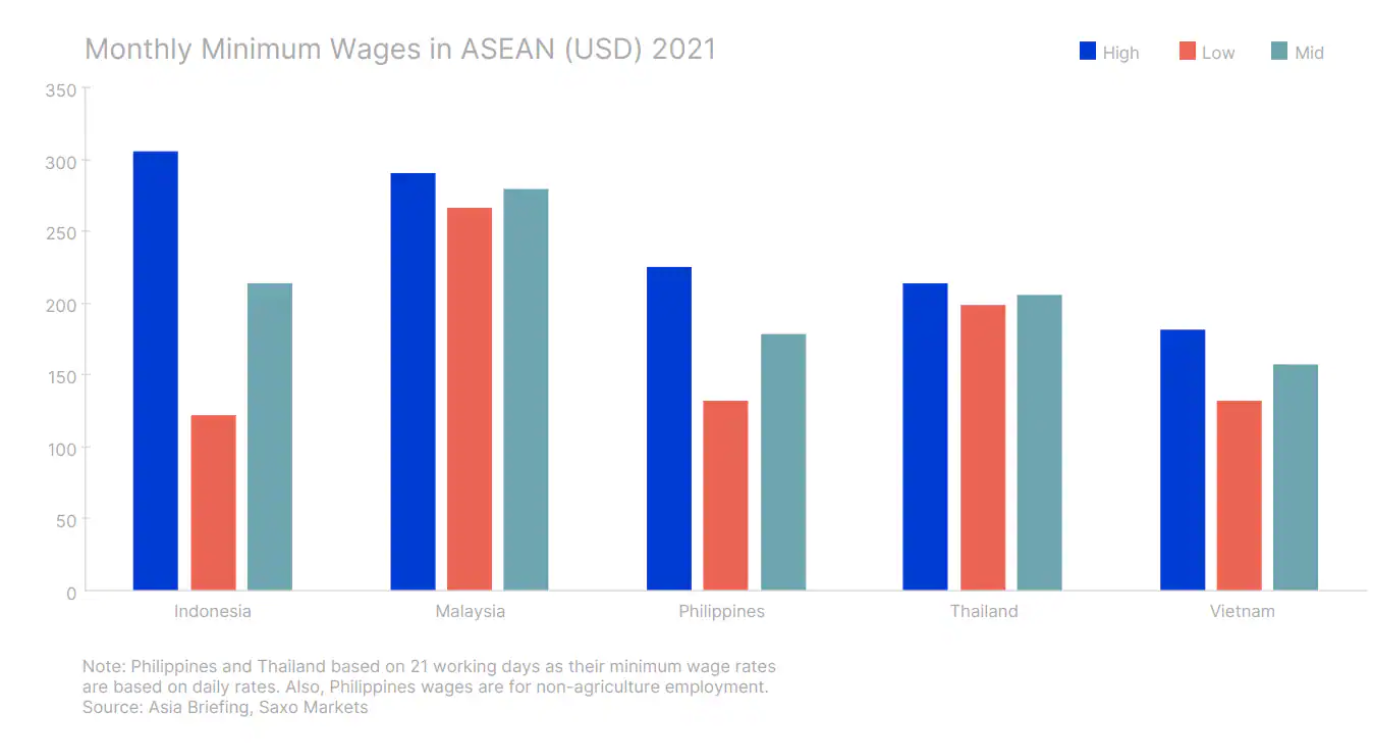

Another winner of the China+1 strategy is Vietnam, because he managed to attract a significant part of the production from the Middle Kingdom. In 2023, Vietnam continues to provide relative value as a global supplier of key components for broadcasting equipment, integrated circuits, telephones, textile footwear, clothing and furniture.

Another winner among Asian markets in 2022 was Indonesia due to high exposure to raw materials. With most countries struggling to secure baseload power supplies, demand for Indonesian coal in 2023 could be sustained. In addition, the return to green transformation plans will continue to increase demand for nickel and copper, Indonesia's key export metals.

Electric car manufacturers Tesla, are considering the possibility of establishing production facilities in Indonesia as part of reducing dependence on China, but also to locate production closer to the sources of raw materials to ensure supply chain resilience. However, towards the end of 2023, when the campaign for the 2024 presidential election begins, political uncertainty will start to negatively affect the forecasts.

Chip wars could move South Korea and Taiwan away from China

The Cold War between the US and China could take a strategic turn this year, and if the semiconductor sector restrictions continue, it could force major players in the semiconductor supply chain, such as Taiwan, Korea and Japan, to secede from China. Taiwan recently passed a law that will allow local semiconductor manufacturers to receive tax credits of up to 25% of their R&D spending. The United States and European countries may follow suit to attract more investment, which could mean that in 2023 the rating of the semiconductor sector may be revised.

Initial earnings reports from semiconductor companies pointed to dismal results and high inventories, which negatively affected market sentiment. However, there is potential for a recovery in demand from the reopening of the Chinese economy, recovery in the automotive sector and continued investment in data center expansion. Taiwan may be a victim of a "geopolitical discount" with the MSCI Taiwan Index trading well below its five-year average despite the recent strong rise in stock prices in the region. The opposite case is the MSCI Korea index, which just broke its five-year average as a result of an increase in early 2023, although it is still far from its 2020 highs.

ASEAN's potential to gain a privileged geopolitical position

While the world in 2023 will struggle with excessive dependence on China, China's trade with countries ASEAN will likely continue to grow, allowing for greater economic growth in the region. As supply chains move out of China, many manufacturers still need to source parts for assembly in this region. In addition, China is the main foreign investor in Southeast Asia, accounting for around 8% of total FDI flows to the region in 2016-2020, an increase of 65% over 2011-2015.

China's strategic policy shift to high-value-added manufacturing has also resulted in much low-value-added production moving to lower-wage neighboring countries. China's exports to Vietnam in 2019-2021 increased by 40%, with a significant part of it being inputs and components for Chinese factories in Vietnam, producing mainly for export purposes. The recovery in Chinese demand should also help rebuild damaged supply chains and boost demand for ASEAN exports. Demand for tourism services is also likely to increase as Chinese tourists return to Southeast Asia as borders reopen.

All in all, 2023 is a perfect set of positive developments for Asia. In the short term, the region will gain in importance as China reopens its borders. In the longer term, however, Asia will become a key element of global supply chains and enjoy a privileged geopolitical position that is vital to both China and the United States.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response