The vaccine and the weather support the raw materials

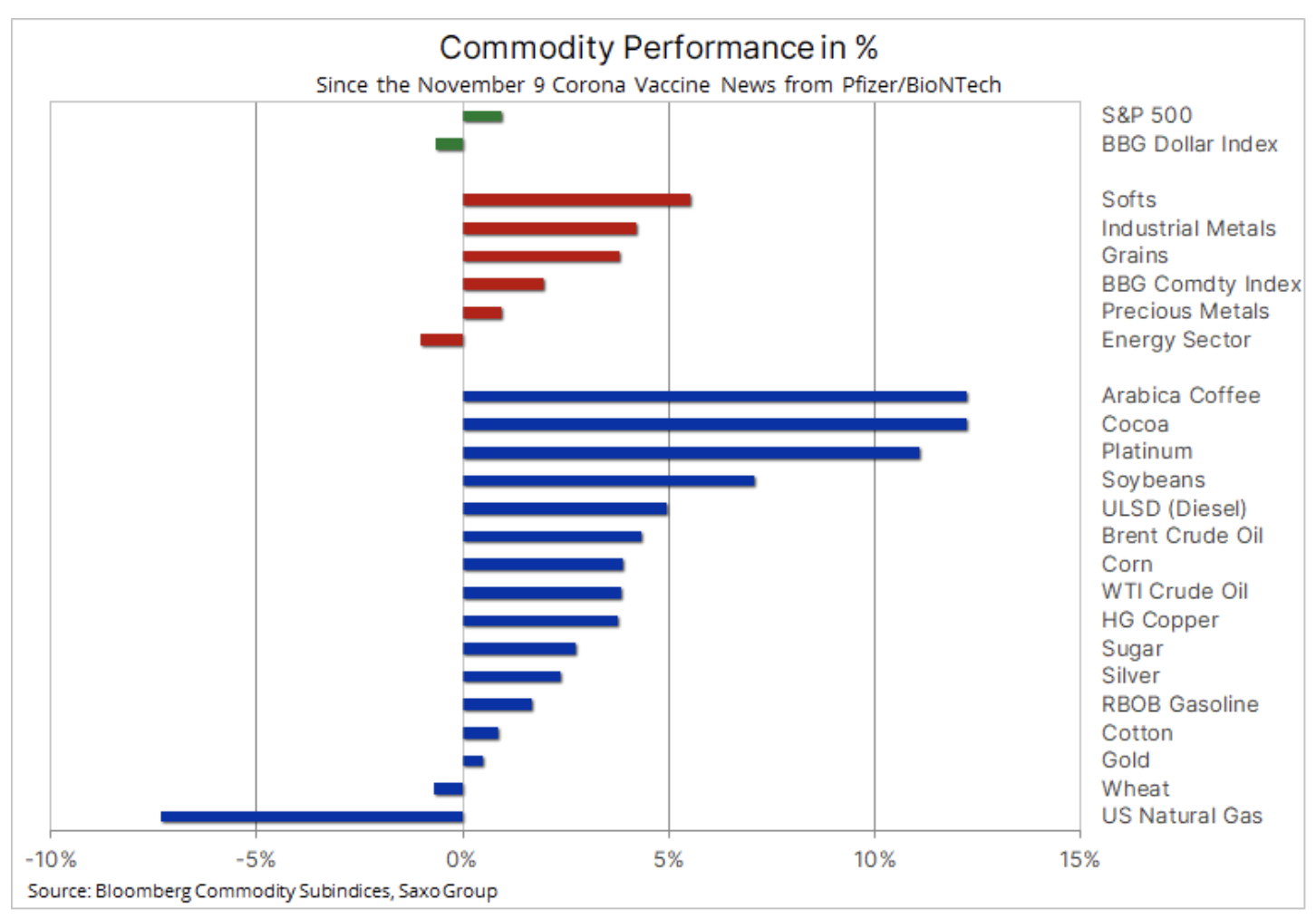

At the same time, global markets suffer from the negative impact of the increase in the number of coronavirus infections and the positive impact of the possibility of making the vaccine available next year. From November 9, that is, from the announcement of the introduction of the vaccine to the market by the companies Pfizer / BioNTech, as well as after similar information from the Moderna concern, the markets tried to focus on the prospects of recovery. However, these prospects are still associated with considerable uncertainty as it is not yet known when exactly vaccines will have a significant impact on the global community. This is particularly true when a further increase in the number of coronavirus cases around the world will lead to new lockdowns and reduce mobility.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In part, it also explains why the commodities sector has "only" gained 9% since the announcement of the Covid-19 vaccine launch on November 2. While energy and industrial metals prices, which will benefit most from increased mobility and economic recovery, have risen, the agricultural sector will, to some extent, see the greatest gains.

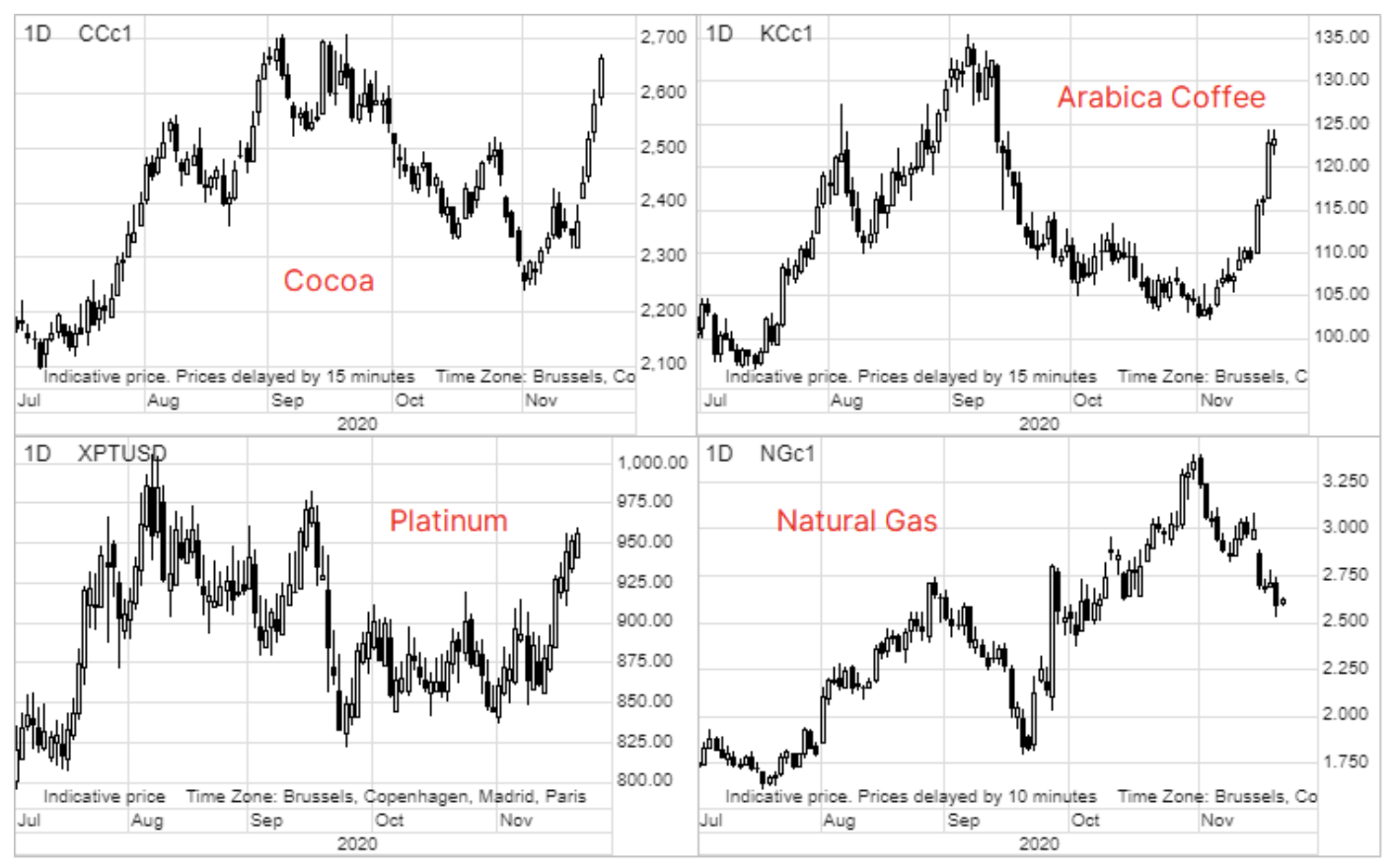

Cocoa, coffee and platinum have taken the lead in recent days, while natural gas, silver and gold have hit bottom due to political events, weather conditions and vaccine reports. Cocoa listed on the New York Stock Exchange gained 12% after Hershey, one of the main producers of chocolate in the United States, took unprecedented steps to source significant amounts of cocoa from the futures market rather than the physical market as West African countries threw in a high premium on their grains.

Coffee

Coffee rose by 10% after Brazil recorded its driest trimester in forty years, while platinum appreciated on a projected drop in supply, as well as with information on the vaccine that made precious metals move in the opposite direction. In turn, natural gas lost 12% after the US meteorological agency NOAA forecast that a warming will be unfavorable to demand in early December.

Cocoa

As we already mentioned, Kakao came up after Hershey, reported by Bloomberg, entered and acquired a significant number of cocoa futures with a December maturity date. As a result, the December price of another futures contract compared to the March price increased from zero to a record level of USD 250. To understand why a significant chocolate buyer unexpectedly increases the supply price by more than $ 250, it is important to look at the alternative.

This year, Côte d'Ivoire and Ghana, in order to support local farmers, decided to add a significant premium of $ 400 / t for deliveries in the 2020-2021 season, which started in October. However, due to reduced demand as a result of lockdowns, buyers were reluctant to pay bonuses in a period of weakening demand. As a result, the price of contracts rose sharply, while West African countries still have a significant amount of cocoa from their current crops that they should sell.

Platinum

Platinum saw its best week in four months: the price of this metal surpassed $ 900 / oz. This was remarkable in that both silver and gold went in the opposite direction in response to the profit taking generated by the information on the vaccine. The momentum of this growth increased even more after being in yours quarterly report The World Platinum Investment Council (WPIC) raised its projected supply deficit for 2020 to 1,2 million ounces, with a deficit for 2021 of 0,2 million ounces. This was due to a strong recovery in car demand and continued solid investor demand for precious metals, including platinum.

Natural gas

There must be a loser every week - this time it was a traditionally floating contract natural gas. Unusually high temperatures reduced the demand for heating, and thus increased the level of inventories, delaying the start of the winter season of using the inventories. Their condition recently increased by about 31 billion cubic feet, compared with an average decline of 24 billion cubic feet in the last five years.

Gold

It continued to lose momentum in response to recent information on the vaccine and its potential effectiveness in fighting the pandemic. This resulted in a minor exodus from funds listed on the stock exchange, the volume of which gold overall, it fell 1,75 million ounces to 109,3 million ounces, the lowest level in two and a half months.

As a result, the risk of a deeper correction has increased, but at the same time it is worth remembering that flows in funds are often delayed in relation to price action, rather than ahead of it. As we highlighted in previous articles, the vaccine may solve the virus problem, but not the gigantic debt built up over the course of the year. Central banks are projected to maintain ultra-loose monetary policy conditions, which could increase inflation risk due to the political fallacy of reacting too late to the final recovery.

In addition to the risk of higher inflation that would support gold in the medium term, another key factor for commodities in general, and for precious metals in particular, remains the negative correlation to the dollar. As reported Financial Times, analysts from major banks predict that the dollar could lose 20% of its value if the publicly available coronavirus vaccine leads to a recovery in the economy in 2021.

While short-term technical traders may look for short selling opportunities at the break below $ 1 / oz, long-term traders will be rather inclined - in our opinion - to take advantage of the opportunity to accumulate at lower levels.

Energy resources

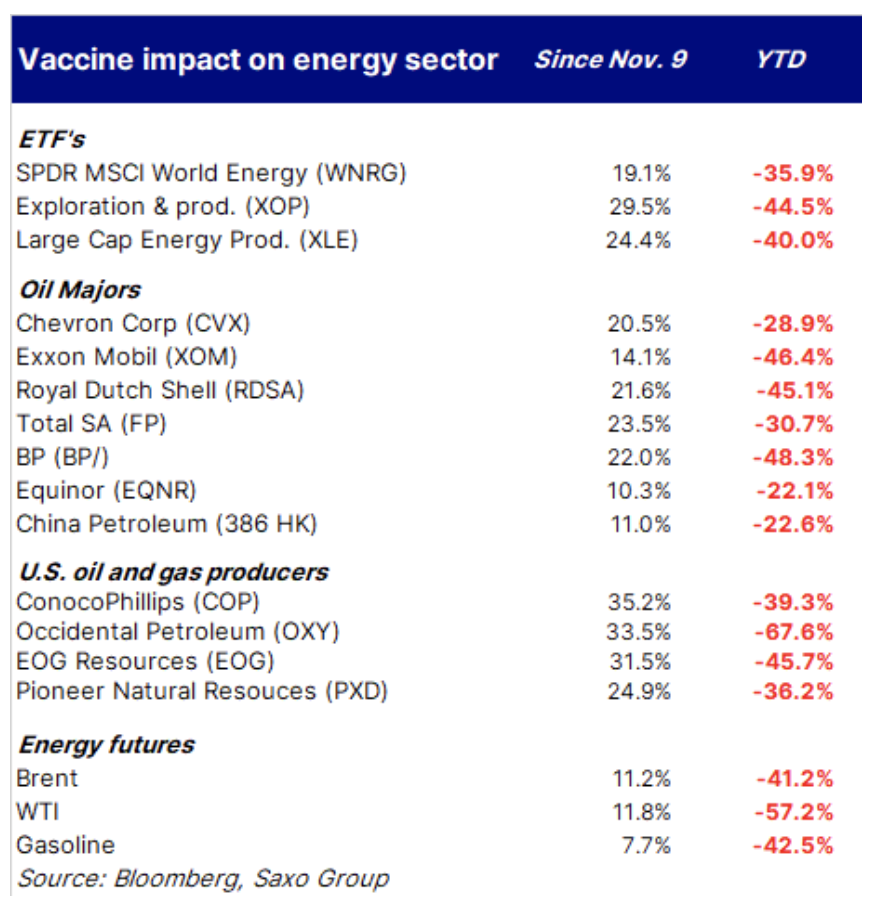

While energy futures may struggle to break higher until fundamentals show no real improvement, this does not apply to the equity market, which has a forward-looking approach. Since November 9, when the Pfizer / BioNTech concerns announced the launch of the vaccine on the market, the shares of major oil companies have gained a lot. The global MSCI energy index has since climbed 19%, while the XLE fund, which monitors America's largest energy producers, has appreciated almost a quarter.

Even after these strong gains, both MSCI and XLE in 2020 are down 35% and 40% respectively. At the same time, futures contracts on Brent crude oil and WTI recorded about half of the profits achieved at the company level.

Although in our opinion the energy sector will definitely return to the game eventually, at this point it is necessary to be patient with the futures market. While the vaccine will eventually normalize demand, it should not be forgotten that crude oil and commodities in general are not as comfortable as stocks are to allow for a rollover of forecasts as demand and supply should balance each day.

Taking this into account, we maintain the opinion that the immediate price of crude oil will not be able to break much higher in the near future. In the short term, however, the impact of the long-term contracts gaining in value and the purchase of speculative contracts with the shortest maturity may lead to an increase.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Commodity market for beginners [Download ebook] The Commodity Market in a Nutshell - Free Guide](https://forexclub.pl/wp-content/uploads/2022/07/Rynek-towarowy-w-pigulce-przewodnik-300x200.jpg?v=1658906549)