The best month in over a year for commodities

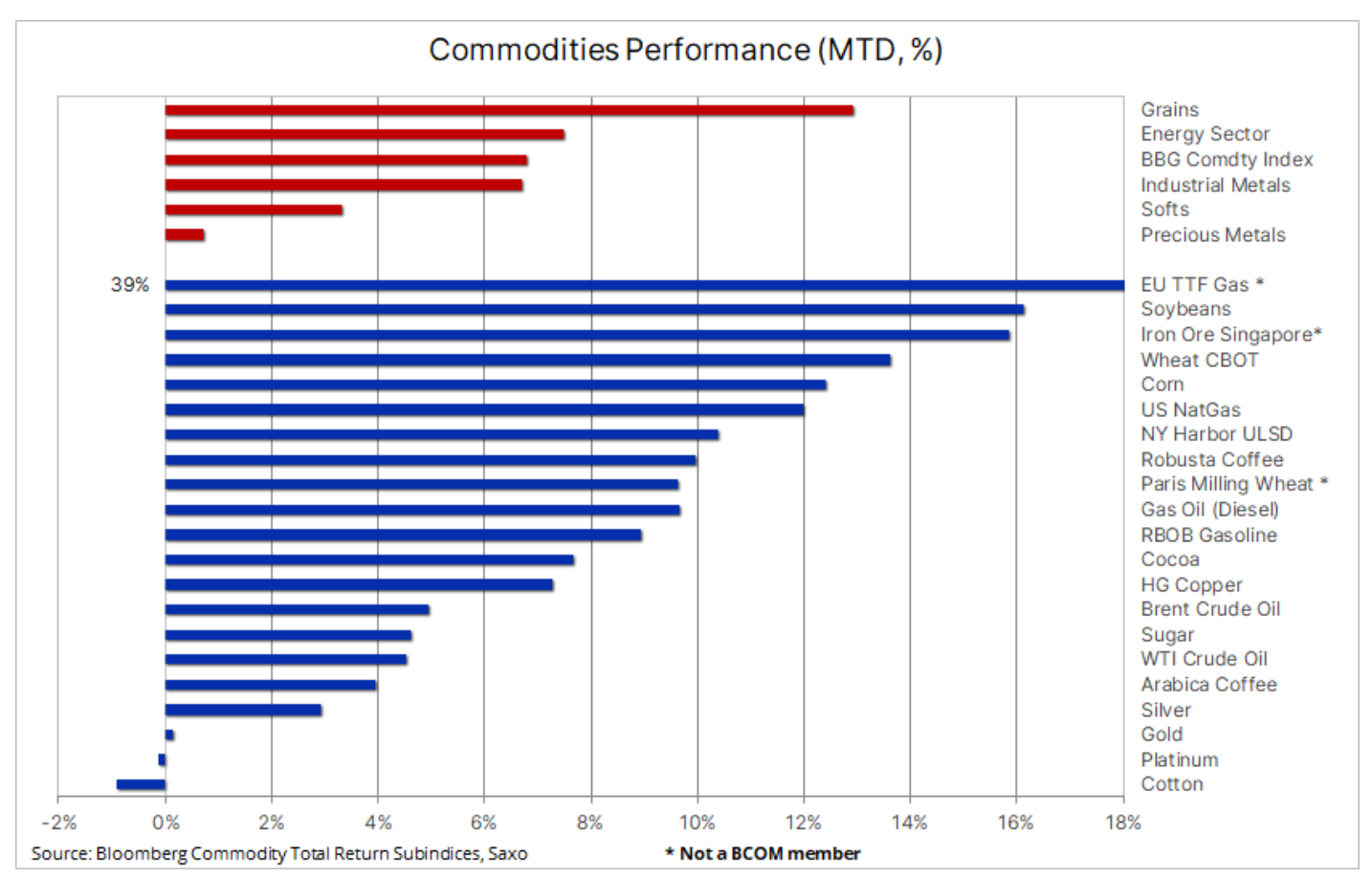

Halfway through the month, the commodities sector continues to do well: the Bloomberg Commodities Overall Return Index is up 6,8% to a seven-week high and is now on track to reach its best performance in 15 months. The index, which monitors the performance of key commodities in a roughly equal split between energy, metals and agricultural products, has seen gains across all sectors this month, most notably grains (13%), as well as energy (8%) and industrial metals ( 7%).

Despite the growing fears of a recession in the United States, causing some - favorable for commodities - weakening of the dollar, there is more and more speculation that the Chinese government may increase support for the economy; there are also some signs of continued demand. Conversely, hot and dry weather conditions raise concerns in the agricultural products sector, as well as increasing demand for natural gas from power generators due to cooling demand. Despite continued concerns about demand, the energy sector is holding firm - supported by Saudi Arabia's unilateral output cut and the prospect of tighter supply and demand in the second half of the year. Finally, in the data-driven precious metals market, the situation is mixed as capacity is being questioned by the market FOMC to raise interest rates further before recession concerns are in the spotlight.

Given recent price performance across sectors, we may be witnessing the first signs of bottoming out in the markets, with current price levels already taking into account some of the worst-case scenarios for growth. However, the potential for further growth will depend primarily on China's ability to provide additional stimulus to support demand for key commodities, from crude oil to copper and iron ore. The development of the weather situation in the coming weeks in the northern hemisphere and its impact on crops will also be of key importance.

As we mentioned, the commodity sector received some overall support from the weaker dollar; depreciation affected almost all currencies except the Japanese yen after the Bank of Japan maintained its super-loose policy, thus strengthening its status as an individualist among global central banks where interest rate hikes are the dominant trend. This followed the ECB's hawkish rate hike this week, which gave the euro an upside boost, while the FOMC left rates unchanged saying it might raise rates further in the coming months unless the economic data backed it up. At the same time, the Australian dollar strengthened against the US dollar after the Australian central bank surprised the market with its hawkish stance for the second time, as well as due to the expected stimulated increase in demand for commodities from China.

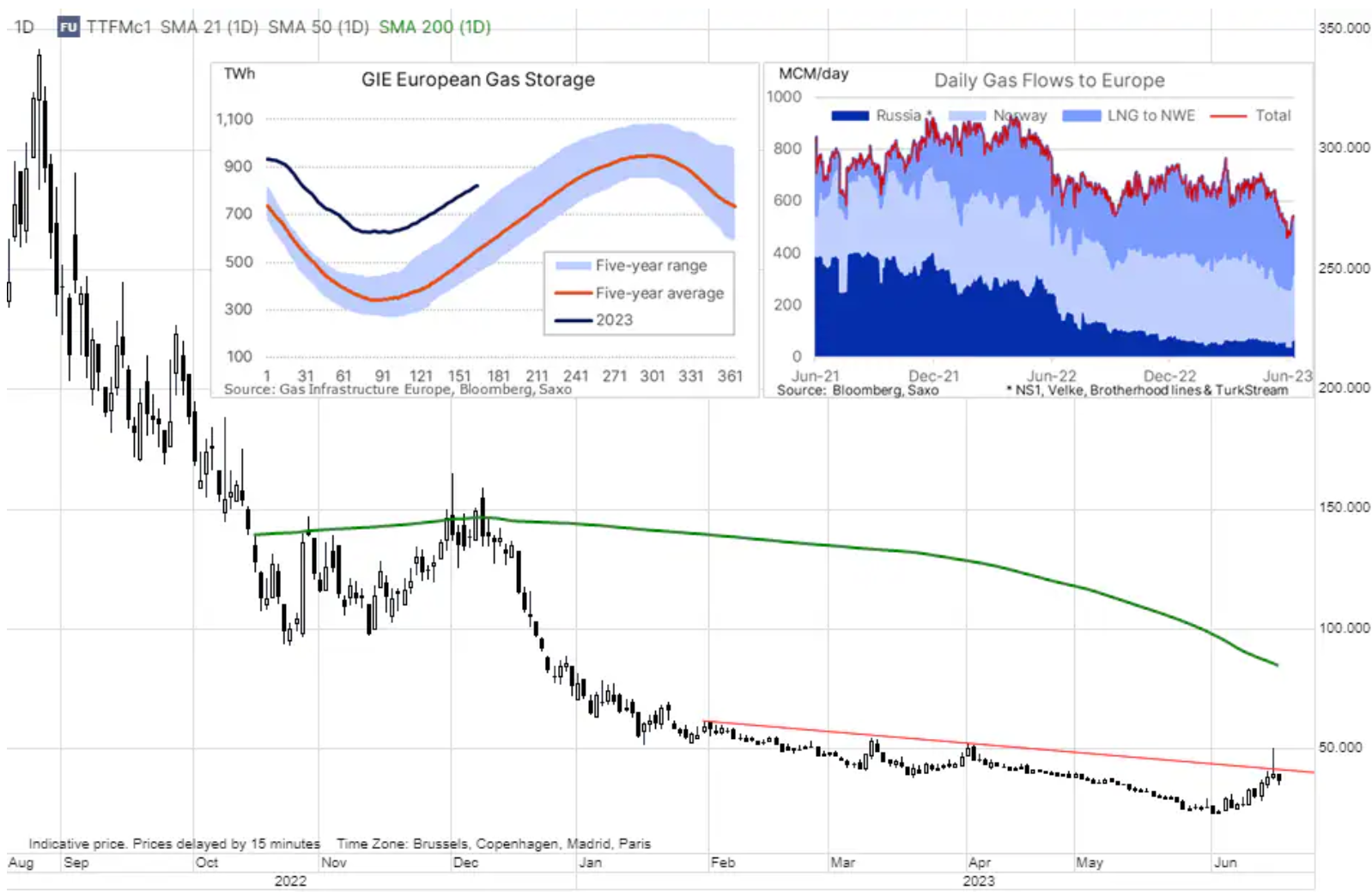

Proponents of short selling surprised by extreme volatility in the EU gas market

Natural gas prices in Europe skyrocketed during a week of extreme volatility driven by numerous supply concerns, some of which are temporary. They concern e.g. maintenance work at some large Norwegian hubs, and a heatwave in Asia, which increased competition for LNG at a time of limited supplies due to the repair season at some US LNG export terminals. After hitting a cycle low of €1/MWh ($23/MMBtu) on June 7,4, the market strengthened sharply, and on Thursday it briefly rose to €50/MWh ($16/MMBtu) after the Dutch government announced that in less than four months – in other words, before the onset of winter, when supply concerns will be at their peak – will permanently shut down one of Europe's largest gas fields. After this sharp increase, the price fell back to EUR 35/MWh, indicating that the move was largely due to squeeze short sellers. All these events somewhat dimmed the belief - but did not shake it - that the warehouses would be filled before the onset of winter.

Key crops benefit from growing concerns about the weather

The grain sector continues to grow amid concerns about the potentially damaging impact of drought in key production regions in the northern hemisphere. The Bloomberg Grain Index shows that after many months of low prices, the grain and variety gained about 13% this month. Soybeans recorded the largest increase (+16%) due to the fact that soybean oil went up by as much as 30%, while the prices of CBOT corn and wheat are higher by 12% and 14%. Weekly data shows US soybean crops in drought-affected areas have increased by 12% to 51%, and corn by 12% to 57%. Unless there is rainfall soon, this situation will negatively affect crops and raise concerns about the final result of production.

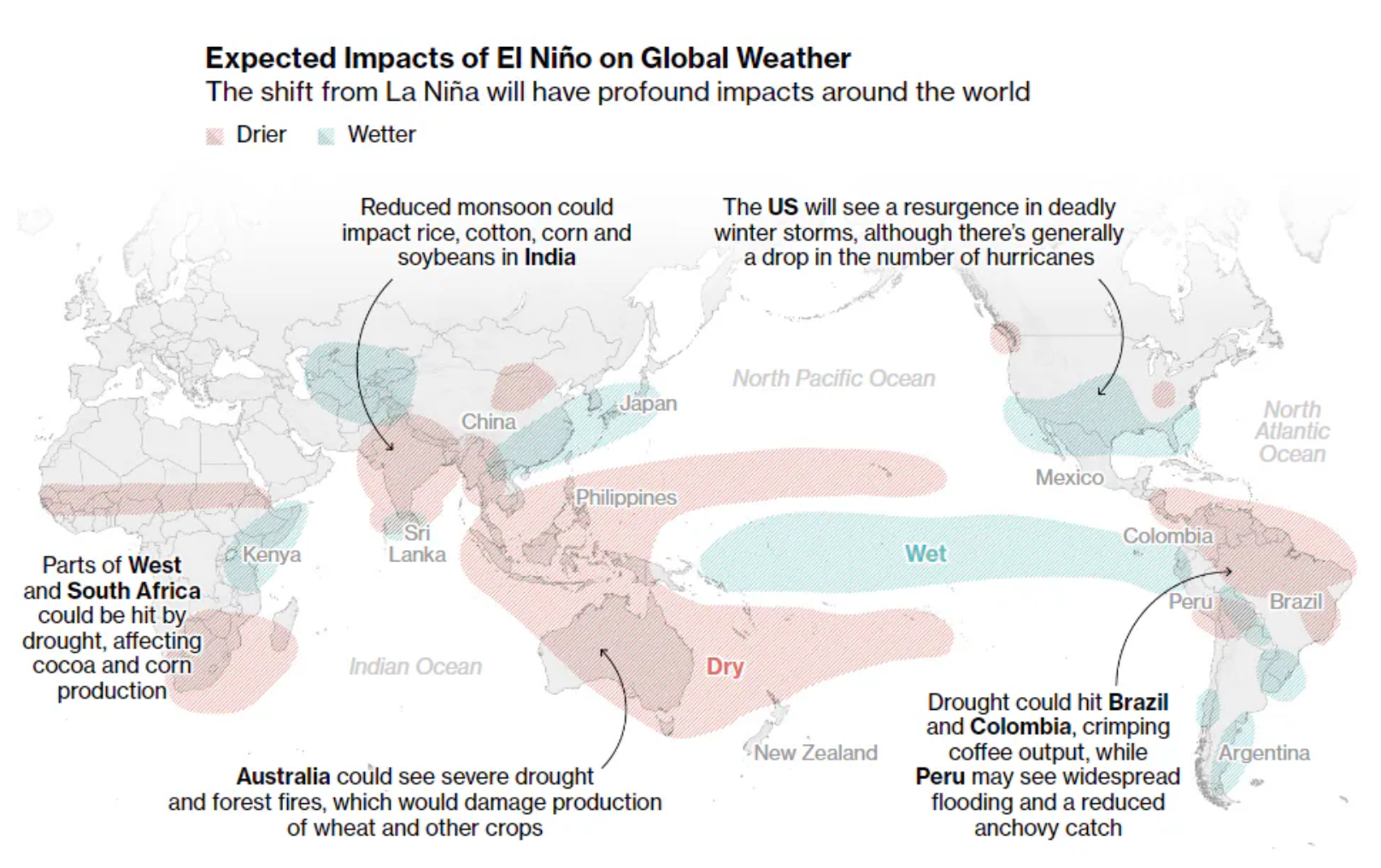

At the same time, markets are on high alert for the potential impact of a returning El Niño, with the US National Oceanic and Atmospheric Administration (NOAA) recently reporting the arrival of this phenomenon. According to the director of the NOAA El Niño/La Niña forecast office, the El Niño formed a month or two earlier than usual, which would give it room to grow, increasing the chance of a strong event to 56%, with a 25% probability that El Niño Niño will grow to enormous size. El Niño affects the weather conditions in Australia, bringing it into a zone of higher temperatures and more drought, while the northern countries of South America - Brazil, Colombia and Venezuela - tend to be drier, and south-eastern Argentina and parts of Chile are wetter. India and Indonesia also tend to experience drought in August during El Niño.

Gold buyers doubt the FOMC rate hike projections

Gold prices fell to a three-month low after the US Federal Reserve kept interest rates unchanged but announced two more hikes before the end of the year. Fed Chairman Jerome Powell described the July meeting as "lively" in the context of interest rate hike discussions and said the FOMC would take decisions from meeting to meeting. So far, however, the market is challenging the hawkish statements, with less than one hike in the quoted time frame in pricing – and the risk of recession is forcing a shift in focus and direction. An inverted yield curve typically signals an impending and often gold-favorable economic recession, and in the week following the FOMC meeting, the US 94- and XNUMX-year spread inverted by XNUMX basis points, the most since the March banking crisis.

A further delay in the peak of interest rates, coupled with an increase in the equity market – reducing demand for alternative investments such as gold – has seen total shares in bullion-based exchange-traded funds fall continuously over the last 13 trading sessions. In that time, investors have reduced holdings by 18 tons to 2 tons, but the overall holding is still 913 tons above the three-year low in March, just before the banking crisis caused demand for the bullion to soar.

Gold managed to rebound flat on a weekly basis, and the lack of interest in selling below $1 gave traders enough confidence that the FOMC projection of two more rate hikes might not materialize in the context of the aforementioned recession. In addition, the dollar fell to a four-week low, providing an additional layer of support. Gold is currently trading back above its 935-day moving average and this could signal a new uptrend, confirmed by a break above $1, its recent high.

Copper goes up thanks to fiscal stimulus

Copper prices rose for the third week in a row, and the rally accelerated after breaking the resistance area around $3,82/lb. The recent increase was supported by speculation about fiscal stimulus and reports pointing to a weekly decline in stocks tracked by three major exchanges in New York, London and Shanghai to 265 tonnes, particularly in China, where a six-week drop brought stocks to an all-time low for six months.

Notwithstanding the implementation of any additional stimulus in China, we believe that the month-long price drop is corrective as the theme of the green transition will continue to provide strong support for copper, the best conductor of electricity, in the context of the green transition including batteries in the coming years, electric traction motors, renewable energy generation, energy storage and grid upgrades. In the coming years, the mining industry will face challenges related to the deterioration of ore grades, rising production costs and a post-pandemic lack of investment appetite as the focus on ESG has reduced the available investment pool offered by banks and funds.

Major mergers and acquisitions in the mining industry over the past few months are proof that mining companies are trying to prepare for a decade of strong demand in the face of growing interest in the green transition. Mining companies are increasingly seeing copper as a valuable resource and are seeking to include it in their product lines. A recent example is First Quantum Minerals Ltd., one of the few copper-only companies that recently declined an informal takeover bid by Barrick Gold Corp, the world's second-largest producer of precious metals. Earlier this year, BHP also offered a 49% bonus for the acquisition of OZ Minerals Ltd, a producer of gold and copper.

Having returned above the two-day moving average - most recently at $3,815 per pound - traders are now focusing on consolidation as the $3,95 resistance is unlikely to be broken until the market receives more information on China's stimulus and its potential impact on markets.

Crude oil within the range between opportunity for Chinese stimulus and risk of recession

Petroleum continues to trend sideways near the cycle low within the $71,50 range of $78,50-$XNUMX as investors continue to assess the impact of Saudi Arabia's decision to support prices on its own at the recent OPEC+ meeting and the prospect of stimulus implementation in China offsetting recession fears elsewhere countries.

This week, the International Energy Agency (IEA) joined OPEC in providing an optimistic assessment of the short-term demand forecast. In his monthly "Oil Market Reports" for June both OPEC, and MAE raised their global demand forecast for 2023 – with the IEA increasing its forecast by 0,2 million barrels per day to 2,4 million barrels per day, bringing total consumption to a record 102,3 million barrels per day. Both organizations expect the market to tighten somewhat in the coming months due to OPEC+ production cuts, but with almost half of this year's demand growth expected in the coming quarter, we may be in for a disappointment, potentially keeping prices from rising in the short term.

At the same time, OPEC's focus on supply management may argue for a soft bottom under the market, currently around $72 for Brent crude, while a break higher seems equally unlikely as long as the market is focused on a worsening economic outlook. From a technical perspective, the $80 Brent area is likely to provide significant resistance, and funds looking to move further down are unlikely to change their negative price view until there is a return above $80.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response