Three Custom AT Indicators - Practice Test [Week 1]

according to with our announcements two weeks ago, we started the Forex strategy test based on three custom technical analysis indicators on MT4. Can this form of investing be effective? The first week of competition is behind us. Check how it went :-).

Non-standard indicators - test assumptions

Recall - the test takes place on a real account with a deposit of $ 1000 and will last 5 weeks. During its duration, we will check the "combat" effectiveness of the three indicators that we previously reviewed on our website. These are:

- Multi trend signal,

- CCI and CCI Divergence (in one window),

- 3D Oscillator.

A dynamic start

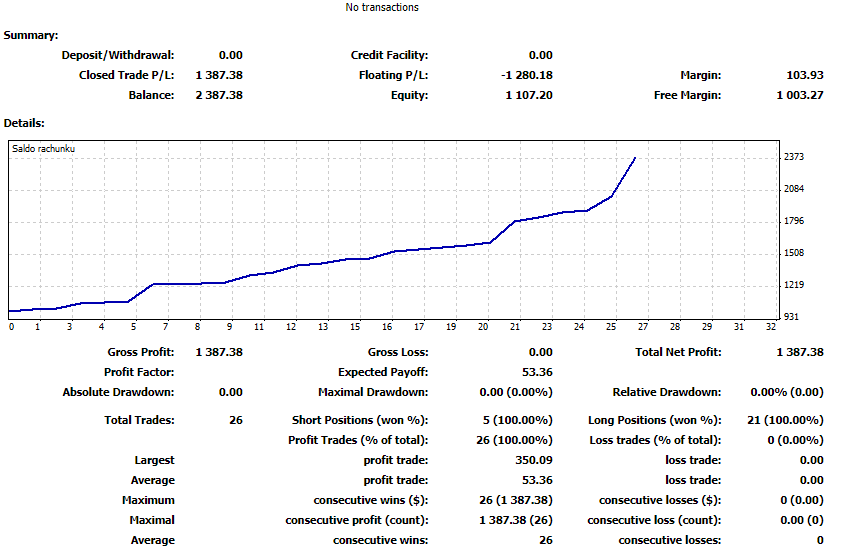

26 items have been closed. They were all made on gold. Two positions are currently open:

- 0.30 buy,

- 0.30 sell.

Long is a blocking position due to the strong trend and left open short game, which is on the downside.

Capital curve, real account. Source: MT4, IC Markets.

Account balance after the first week of trading:

- 26 items - all profitable,

- Total profit of USD 1387,38, which gives a rate of return of +138%,

- 2 active items with a balance sheet -1280,18 USD (long position is on the plus around 80 USD),

- Looking at Equity, our balance sheet is + 10 %.

Summation

It is far too early to draw conclusions as to the whole of this set of indicators. However, we can present our first observations.

The indicators generate a large number of signals. After a more careful analysis based on the trend line or the support and resistance line, we can choose even more convenient conditions to take a position. As you can see we have a position that has already generated a significant minus but we have an opposing position and a margin level of over 1000% and nearly $ 1000 free funds to play. Time will tell if our indicator trio will effectively get out of this situation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Three Custom AT Indicators - Practice Test [Week 1] 3 custom pointers](https://forexclub.pl/wp-content/uploads/2020/06/3-niestandardowe-wskazniki.jpg?v=1592897382)

![Three Custom AT Indicators - Practice Test [Week 3] indicators at forex](https://forexclub.pl/wp-content/uploads/2020/07/wskazniki-at-forex-300x200.jpg?v=1594031122)

![Three Custom AT Indicators - Practice Test [Week 1]](https://forexclub.pl/wp-content/uploads/2020/06/trybunal-niemiec-102x65.jpg?v=1592896114)

![Three Custom AT Indicators - Practice Test [Week 1] Do markets disregard the second wave](https://forexclub.pl/wp-content/uploads/2020/06/Czy-rynki-lekcewaza-druga-fale-102x65.jpg?v=1592904300)