Turbocharged resources expect even more in 2021.

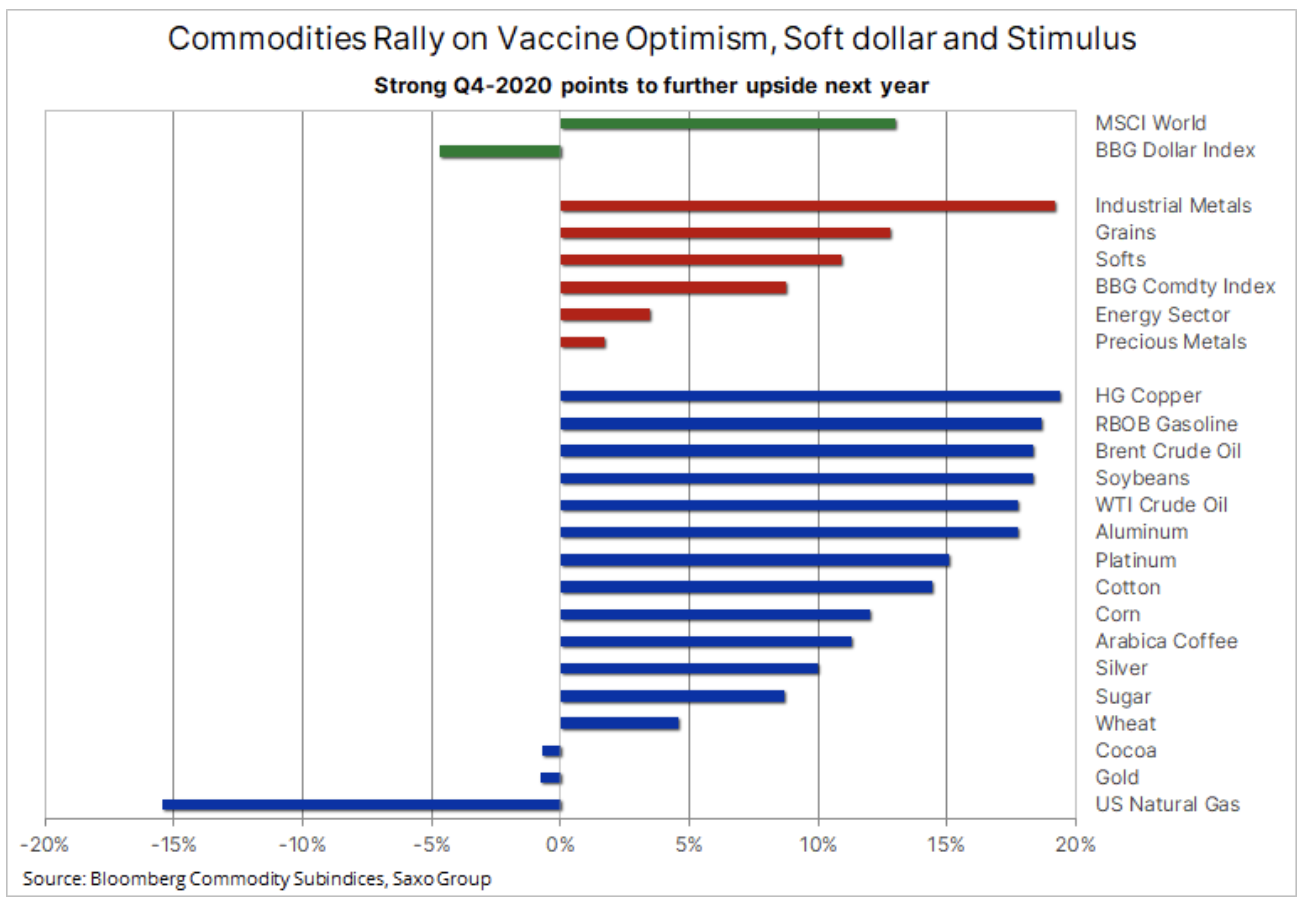

Commodities markets maintained a strong momentum before the end of the year as the so-called "overall" boom continues to be fueled by positive news. In addition to a weaker dollar and vaccine optimism that positively impacts the outlook for 2021, speculation about further stimulus from governments and central banks in the short term is also benefiting the market.

These developments highlight the current challenges where markets are pricing a better tomorrow, while many countries continue to face a pandemic, particularly in the winter of the northern hemisphere regions, and prospects for improvement - with vaccines or other reasons - until warming occurs in March and April.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

With the global market flooding with cash, triggering wild speculation in all markets, and the possibility of another commodity supercycle, primarily driven by China and its indomitable appetite for commodities, the Bloomberg commodity index gained nearly 9% this quarter . Although the index continues to lose track on an annualized basis, mainly as a result of strong declines in the energy market in the first stages of the pandemic, the outlook for 2021 looks better and better.

This was due to the green transformation, increasing demand for key industrial metals, including silver, a weaker dollar, growing demand for hedging against inflation, an increase in fuel demand as global mobility revives, and demand outside China due to increased spending by governments, to support employment. Add to this the risk of rising food prices as the weather becomes more volatile.

Precious metals

Last week, the continuation of the "overall" boom was particularly pronounced in the case of metals. Industrial metals took the lead: copper HG reached USD 3,6 / lb, while LME copper reached USD 8 / t for the first time in seven years. This strengthening also included semi-precious metals: silver gained 7% on a weekly basis after breaking key technical levels, both against the dollar and against gold.

Growth in demand, especially in China, appears to continue into 2021 as the black clouds related to Covid-19 blow over the rest of the world, raising concerns about available supply after years of under-investment. The 2020 metal boom is the largest in a decade, and Goldman Sachs likens it to the boom of the early XNUMXs, when Chinese demand kicked off a nearly ten-year supercycle.

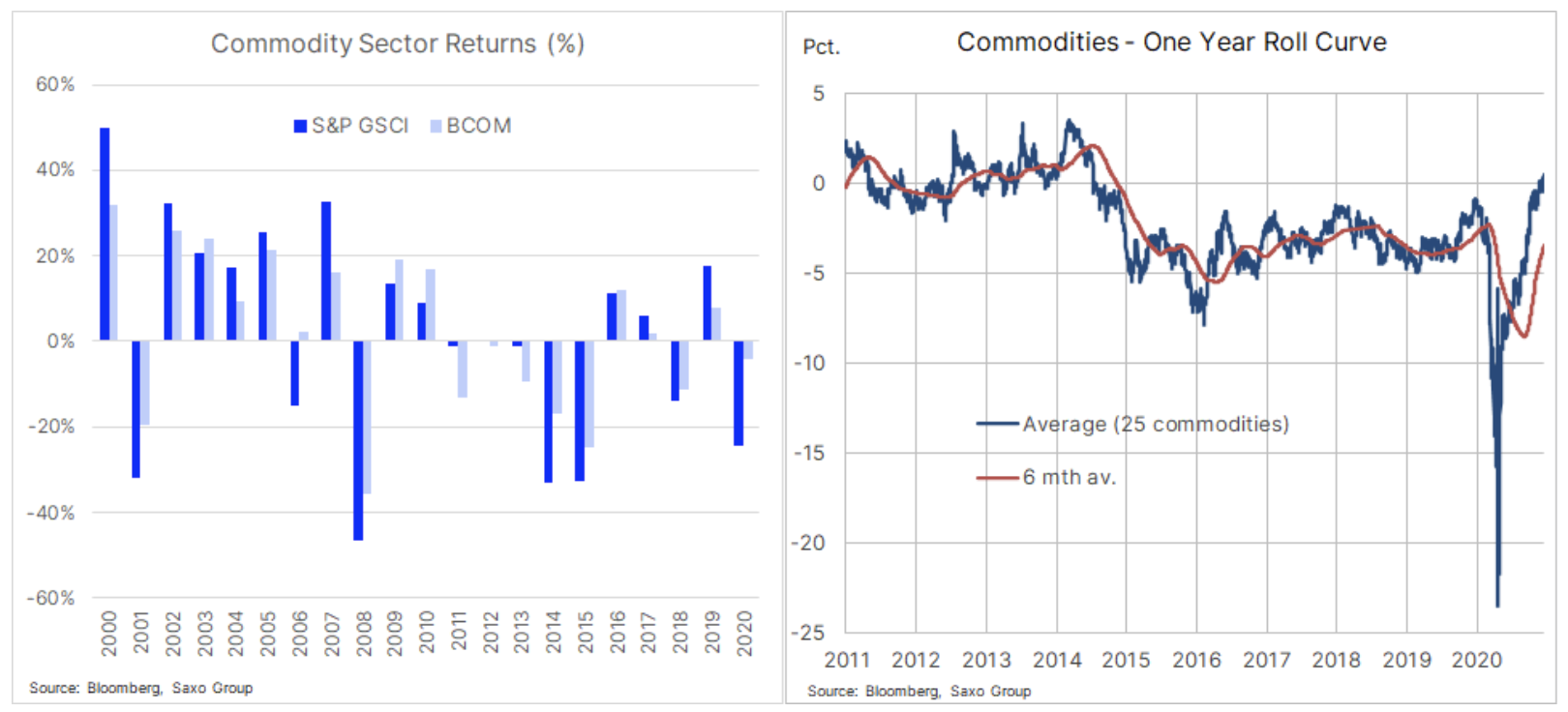

One of the biggest obstacles to the boom in commodity markets in the last decade has been the widespread availability of raw materials. Oversupply during this period, and in particular over the past six years, kept the raw materials sector in a contango state where the immediate price, due to the widespread availability of goods, was below strike prices. The impact of this situation on passive investments is presented in the chart below.

From 2014, the profit on rollover of the portfolio of 24 key raw materials, which was sometimes as high as 5% on an annual basis, was negative. From an investment perspective, this handicap, coupled with the generally strong dollar and low inflation, made the sector less attractive. However, in recent months, the profit from rolling has turned positive, especially in the agricultural sector, where key crops experienced a strong boom in response to the decline in production and an increase in demand.

This sector appears to be experiencing an expected increase in demand and reflation in 2021, particularly in markets where supply may not match demand. This applies to copper, platinum or soybeans.

Nothing is ever simple, especially when it comes to raw materials. Therefore, although the forecasts for 2021 are getting better, it should be taken into account that the boom in the last few months was fueled by very optimistic outlooks for the vaccine, which translated into a weakening of the dollar and gains in the stock markets.

Against this background, we have reached levels that raise some doubts as we approach 2021. This is especially true of the crude oil market: the price of Brent crude has exceeded $ 50 / b for the first time since March. This happened in a period where the only positive developments were strong Chinese and Indian demand as in the rest of the world demand for fuel was still weak due to lockdowns. In the latest reports on the oil market, OPEC, the MAE and EIA warned that rebalancing the global oil market may take longer than originally assumed. After a decline in demand by 9,2 million barrels a day in 2020, all three entities are now forecasting an increase of 2021 million barrels a day in 5,8, with the IEA predicting that oversupply will continue until the end of 2021.

After an uninterrupted boom since the beginning of November, when the vaccine was announced, Brent crude oil has already recovered 61,8% of the losses incurred in the period January-April. Given the short-term demand and supply forecast, the bull market is likely to slow down around $ 50 / b until the actual increase in demand becomes more pronounced.

Gold, and above all silver, a major winner last week, saw a further improvement in risk appetite as the dollar weakened, progressed in the US on a fiscal stimulus agreement and the FOMC confirmed its intention to support the recovery. Silver, which gained 7% on a weekly basis, was supported by a further boom in the industrial metals sector. After breaking the downward trend from the August high, the metal strengthened to reach another resistance level of $ 26 / b. At the same time, gold, which has been on its way to its highest annual profit in ten years, has slowed down with the closest important level to be broken at $ 1 / oz.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)