The EU plans to contain soaring electricity prices

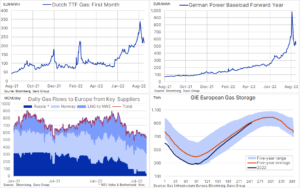

Following Monday's strong surge as markets reacted to Russia's latest attack on Europe in the form of the Nord Stream 1 shutdown, gas and electricity prices in the European Union fell on Tuesday. According to Russian commentators, the gas supply will not be fully resumed until the "collective West" lifts sanctions against Moscow for its invasion of Ukraine.

However, the fact that gas and electricity prices are respectively 35% and 52% below the peaks of the panic period following the maintenance announcement of Nord Stream 1 on August 26 proves that markets expect solutions to be presented at Friday's EU summit. answers on how Europe can mitigate the immediate threat to supply.

Nord Stream 1 will remain closed

After Monday's strong rise as a result of Gazprom's information published on Friday that the Nord Stream 1 gas pipeline will remain closed indefinitely after three days of maintenance, gas and electricity prices in the European Union fell on Tuesday. Although the oil leak in the last working compressor was cited as an explanation, the surprising decision of the Russian company was made shortly after the announcement of a plan to reduce Russian oil prices by G7 members. Thus, the energy war has further escalated and Europe may lose around 30 mcm / d, or 4% of its existing gas supplies.

While stock levels in the euro area have risen sharply in recent weeks due to increasing LNG imports, the prospect of rationing and further initiatives to curb gas demand and electricity prices will become a major topic for politicians across the region. The aim is to mitigate the destructive economic impact of dynamically rising prices before the peak of winter demand.

However, the fact that gas and electricity prices are respectively 35% and 52% below the peaks of the panic period following the maintenance announcement of Nord Stream 1 proves that markets expect politicians to implement measures to alleviate fears in Europe.

EU leaders will meet on Friday to discuss historic intervention in the energy marketwhich may lead to price caps and other measures to limit distortions to consumers and industry due to soaring prices and the lack of liquidity in the markets. However, given the current capacity constraints, largely due to Russia cutting off gas supplies, a sort of energy resource rationing plan may also prove necessary.

What is included in the EU project?

The draft presented by the Czech Presidency of the EU, which has already been covered by several news outlets, focuses on five key areas:

- eliminating / limiting the influence of gas on the price of electricity

- increasing liquidity in the market

- coordinated actions to reduce the demand for electricity

- reducing the revenues of electricity producers from sources other than gas (e.g. wind, solar and coal)

- the impact of the EU Emissions Trading System (EU ETS)

The electricity price structure in the EU is at the heart of the problem.

Raw materials market

Commodity markets tend to price with a margin; the same is with electricity. This system essentially means that gas-fired power plants often dictate the wholesale price of electricity for the rest of the market, even though renewable energy, and more recently coal, can be produced cheaper. It is this market structure, along with rising gas prices, that has contributed to the rise in electricity prices to previously unimaginable levels in recent months; the peak value was reached last Monday when the German electricity futures contract price for a year ahead for a short time exceeded EUR 1 / MWh, ie the equivalent of USD 000 per barrel of crude oil.

The decoupling of electricity prices from soaring gas prices has already been implemented in Spain and Portugal, two countries with limited energy connections to the rest of Europe, and also in Greece. Across Europe, such a system would work by charging non-gas electricity producers the difference between the agreed price cap and the actual market price - currently inflated due to high gas prices - that they receive for their energy. The increased revenues from this mark-up should be shared among consumers while supporting power generators forced to produce a marginal megawatt hour at a loss.

Other sources of energy

In the period 1990-2019, i.e. to the year preceding the global pandemic, which was followed by additional challenges related to gas supplies from Russia, the share of gas in relation to other energy sources in Europe increased from around 20% to 25%. At present high gas prices, this part of the European energy mix sets the overall price of electricity, hence discussions about the transition to a weighted average or weighted average energy price, which would ultimately drive down prices for consumers.

However, in this Twitter discussions my colleague Peter Garnry lists the reasons why a change to the benchmark energy price will not reduce overall costs, but merely redistribute them from consumers to utility service providers who will need government support to avoid bankruptcy.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

More analyzes of commodity markets are available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)