Towards another crisis in the eurozone?

Every day someone asks us: "Will there be a recession, won't there be a recession?". This is not a binary situation where recession is bad and no recession is a green light for risk. We will face much lower economic growth than many assumed, especially in 2023, whether technically there will be a recession or not. A significant slowdown in growth is visible in all the latest statistics. The euro area is certainly worse off than the US or China. Monetary policy makers in the euro area, in particular the dovish majority of the Governing Council European Central Bank (ECB)have taken too long to admit that inflation is not as temporary as previously thought. I remember the brief but instructive discussion I had with a member of the Governing Council from one of the "small" countries of the euro area in October 2021. During this time, we have warned our customers for months that high inflation would continue. My interlocutor was a rational man and agreed that there was more and more evidence that inflation would not go away and the ECB's central scenario was too optimistic. However, he belonged to a minority in the Council and had little clout to push the rest of the members in the right direction. Several months have passed since then and I believe there is now a broad consensus that inflation will remain our headache for years to come.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Inflation is structural

The main problem is supply-side inflation. This applies to production inputs (labor, fuels, raw materials such as agricultural products or electricity), activity and transport. Activities can be shocked and resume fairly quickly. We experienced this in Europe during the pandemic. Transport can also be jolted due to a strike, blockages or lack of containers (which is a major problem now). However, this problem can be resolved over time. We anticipate that the arrival of new containers from 2023 will help to unblock transport bottlenecks. All these phenomena can be considered temporary. However, the supply shock affecting production inputs is certainly much more permanent.

Let's take a look at the raw materials. Despite all the communication efforts on the green transition, Europe remains heavily dependent on fossil fuels (oil, natural gas and coal). Due to the war in Ukraine, we are shaking the Russian supply of fossil fuels - the very ones we use. With demand rising and supply shaken, prices rise - these are the foundations of the economy. Logically, one would expect investments to increase dynamically in order to lower prices. However, there are two problems. First, we do not use crude oil as such, but only a refined part of it. Europe has all the infrastructure for refining Russian oil, but we are no longer able to use it. We have to replace it, but building a new infrastructure from scratch is a task for years. Meanwhile, costs will continue to rise. Second, the European Union is imposing regulations on the green transition, i.e. away from the use of fossil fuels. Europe has always acted through regulation. However, the regulation of green transition has redirected the necessary investment in fossil fuel infrastructure to renewable energy, without first ensuring that green energy can provide Europeans with a steady energy supply. Ultimately, this means higher energy costs in the coming years. Inflation is structural.

There is, however, another factor that to some extent contributes to the increase in inflation - fiscal policy. European governments have taken extraordinary measures to counter inflation - for example, lowering the value added tax (VAT) on energy and extending the benefits of the 'social tariff' to electricity and natural gas for the poorest households in Belgium, and raising the minimum wage to 12 EUR per hour from October next year and an additional aid of EUR 100 for the worst-off households in Germany. As the fiscal potential in Europe is much greater than in many other parts of the world, it is to be expected that these one-off measures will prove to be more durable, with more subsidies soon to follow.

When risk becomes reality

Economic history teaches us that the only way to lower inflation is to raise interest rates. Many other central banks have done so since recovering from the last global lockdown in spring 2021. After a long period of hesitation, the ECB is finally joining the rest. At its July meeting, the central bank will raise rates by 25 basis points ("gradual" tightening) - for the first time since 2011. It would be too easy for the ECB to be able to normalize its monetary policy by focusing solely on inflation and economic growth. However, there is one more issue that is as important as high inflation - financial fragmentation.

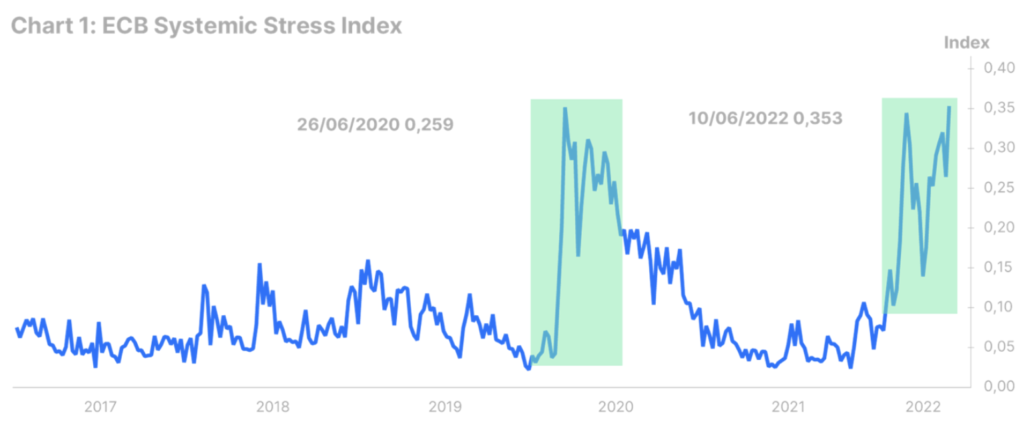

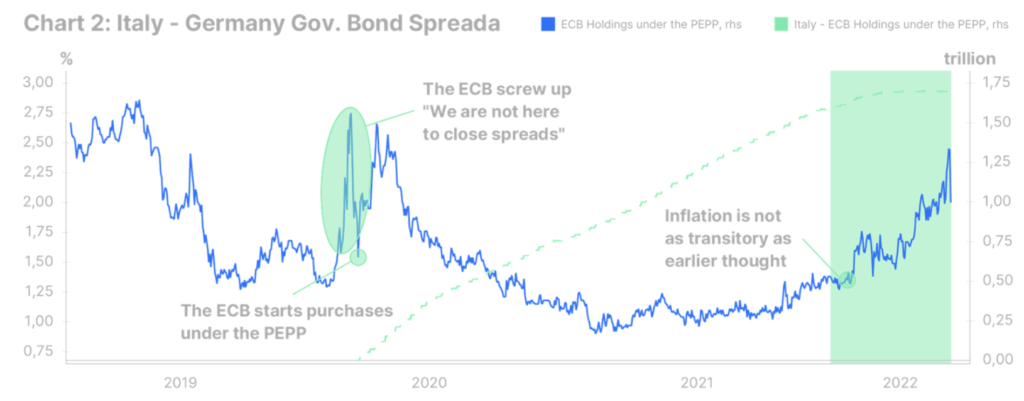

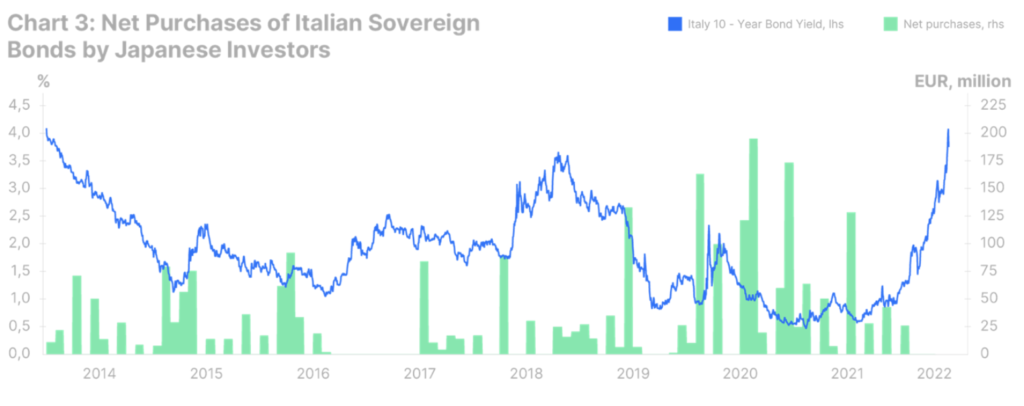

Bond market volatility is increasing everywhere, mainly due to the great global inflation shock that affects everyone. In the euro area, however, the situation is deteriorating at a faster pace. Worldwide risk reassessment without QE is a painful procedure. The ECB's systemic risk indicator (developed in 2012 and based on 15 measures of financial stress) has returned to levels not recorded since the outbreak of the pandemic in March 2020 (see Chart 1). For some countries, re-pricing is more painful than for others. Since the end of quantitative easing, borrowing costs in Italy have risen sharply. The yield on ten-year bonds is now almost three times higher than at the beginning of February. The yield spread against German bonds also increased, returning to the risk zone (see Figure 2). The most disturbing, however, is not so much the level of bond yields as the process itself. Volatility is increasing too fast, while at the same time liquidity conditions are deteriorating rapidly. Basically, foreigners just want to get away from the Italian bond market (see Chart 3).

There is no doubt that soon, perhaps even at the July meeting, the ECB will announce a new tool for managing government bond spreads. We don't know many details at this point. Based on recent comments from Isabel Schnabel, it can be assumed that this will be some version of a FTC program with light conditionality, a fixed term and a shorter maturity than the pandemic fallback buying program (perhaps two to five years). This should be enough to avoid a repeat of the 2012 crisis, but it is not certain. The ECB cannot hold back from raising interest rates. The more he resists, the more the situation will worsen and the more he will have to buy Eurozone government bonds. From an optimistic point of view, a repeat of the crisis in the euro area is not only a negative phenomenon. Since 2012, the previous crisis contributed to key institutional reforms that strengthened the framework of the euro area. The same may happen with a new crisis. However, the bond market situation in the euro area raises a serious question in the long term: can this go on forever? At some point, the southern euro area countries should be able to face the markets without extending the ECB's mandate to rescue them. Otherwise, the ECB could end up holding all the Italian debt.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)