Weekly Commodities Review: The Green Transition Problem

Financial markets were relieved last week after Fed Chairman Powell clearly suggested that the Federal Reserve had ended its interest rate increases. Despite cautious rhetoric not ruling out another rate hike, Powell, by focusing on the significant decline in inflation rather than the recent strengthening of the economy, allowed the market to conclude that Federal Reserve really doesn't want to raise rates again unless forced to do so by worse-than-expected economic data. The dollar depreciated against other currencies and the yields of US treasury bonds fell significantly, which improved the mood in markets recently dominated by concerns about the geopolitical situation and a sharp increase in treasury bond yields, increasing the risk of economic weakening and mixed company results.

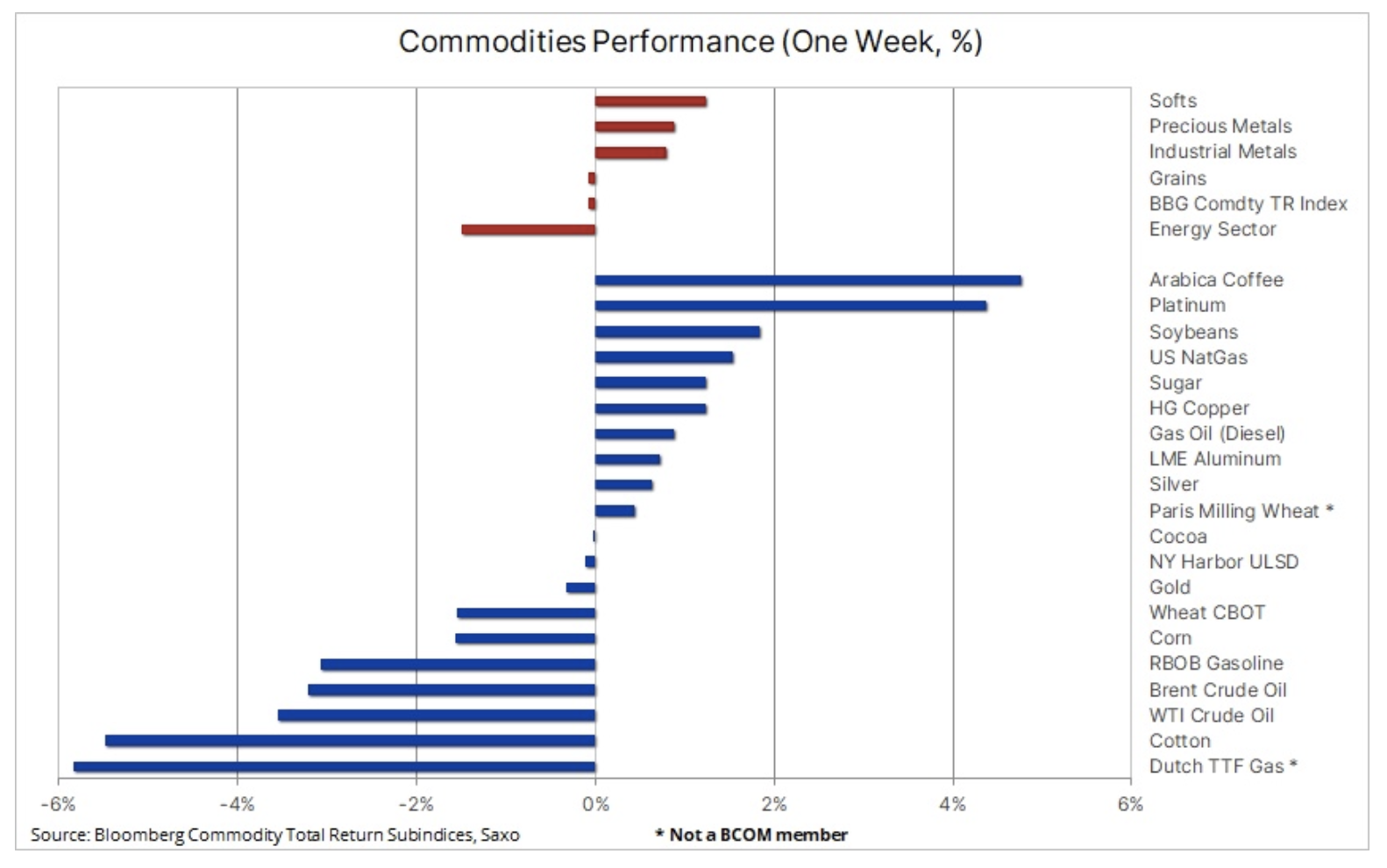

The situation on commodity markets was varied: growth was recorded in the so-called soft products, primarily coffee after inventories in stock exchange-monitored warehouses fell to the lowest level in 24 years, as well as industrial metals, in which copper took the lead, also due to the decline in inventories and the weaker dollar. The precious metals sector saw growth, primarily in relation to platinum i silver, which were catching up after the recent strengthening of gold. These gains were offset by losses in the energy sector, where oil declined for a second straight week as the war between Israel and the Gaza Strip failed to spread to neighboring countries while demand weakened. As the grain sector also declined slightly, led by corn and wheat, the Bloomberg Commodity Index, which tracks a basket of 24 major commodity futures contracts spread evenly among energy, metals and agricultural products, ended the week unchanged.

The green transition suffers from higher costs and a focus on wind and solar energy

It was also a week of mixed signals on the green transition theme, as the wind and solar industries face increasing challenges from rising costs, while the nuclear sector attracts increasing attention. Additionally, mining of green metals, particularly copper, has been in doubt after Panamanian lawmakers voted to rescind a new contract with Canadian company First Quantum Minerals, raising uncertainty about the future of the giant Cobra copper mine, Panama's second-largest source of revenue. employing 49 people directly and indirectly.

In his latest stock market analysis, my colleague Peter Garny wrote:

“October was another unfavorable month for our three green transition thematic baskets (renewable energy, energy storage and green transition), increasing this year's losses to between -27% and -32%. As we have written many times this year, the green transformation requires significant amounts of capital and raw materials, so this market segment has been hit hard by rising bond yields and higher raw material prices. “In addition, overvalued equity valuations across all industries related to the green transition in 2021 have also contributed to the current ‘hangover’ in this segment of the equity market.”

There is a growing discrepancy between the results of companies operating primarily in the wind and solar energy industry and companies dealing with it nuclear energy, is absolutely stunning. Year-to-date (YTD) the Global X Uranium ETF (market capitalization: USD 2,3 billion) gained as much as 36,5%, while the iShares Global Clean Energy fund (market capitalization: USD 2,7 billion) lost almost 33% . Recent developments in all three areas highlight the need to increase the share of nuclear energy in the decarbonization of the economy. At the beginning of last week, Cameco, one of the world's largest uranium producers, presented sensational third-quarter results that caused a sharp increase in the company's share prices, showing that the forecasts for demand for nuclear energy are getting better from quarter to quarter.

Short-term cyclical weakness vs. long-term structural growth

Returning to the broader view of commodity markets, Sax maintains the view that key commodities are entering a multi-year bull market driven by a shortfall in capital spending due to rising financing costs, lower investment appetite and credit constraints. The green transition is generating 'green inflation' through increased demand for industrial metals due to the shift towards 'new' energy at a time when mining companies are struggling with rising costs, deteriorating ore grades, growing social and environmental scrutiny and, in some cases, nationalism raw materials.

Moreover, we are observing increasing fragmentation, causing an increase in demand and prices of key raw materials. The agricultural sector will likely have to deal with increasing weather variability and price spikes. In principle, these supply and demand imbalances could take years to correct, ultimately supporting structural inflation above 3%, which is likely to increase investment demand for property, plant and equipment such as raw materials.

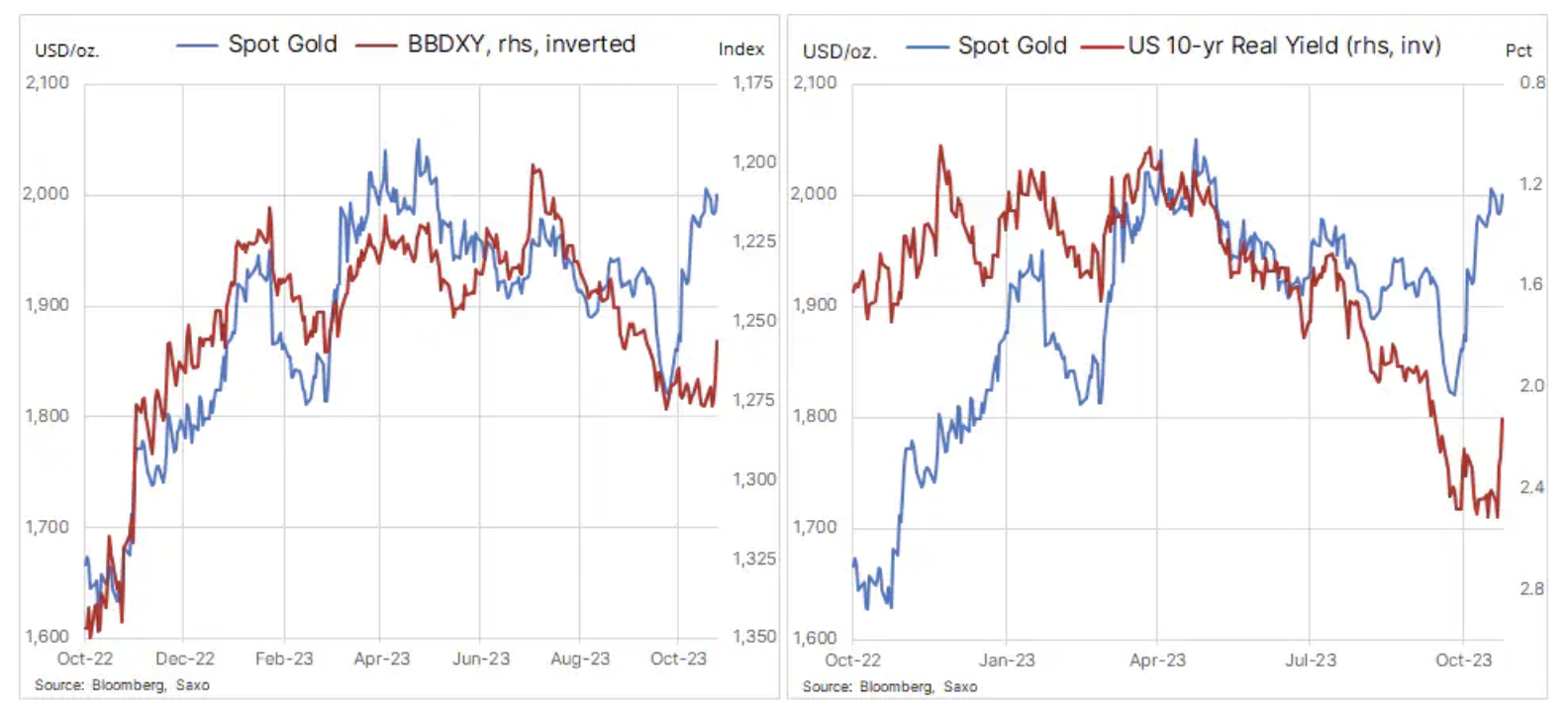

The gold rally is slowing down

The reason gold didn't shoot back above $2 after Powell's suggestion that FOMC ended with rate increases was the fact that the precious metal had already strengthened significantly over the last few weeks. While the initial rally was driven by unrest in the Middle East and the surprise of short-sellers in the futures market, we believe much of the near-$200 gain was the result of a steady rise in U.S. bond yields that has made traders and investors increasingly fearful about US fiscal policy, in particular whether the recent spike in both real and nominal yields will "break something." The emphasis on this issue led to an unusual situation in which rising bond yields and even a strengthening dollar ultimately supported gold.

As US Treasury yields show signs of stabilizing and potentially begin to weaken somewhat, we may see a normalization in the relationship between bullion and yields, and while peak interest rates will support gold in the coming months, the continued move towards higher prices will be hampered by typical periods of consolidation and corrections. . For now, however, while numerous areas of geopolitical uncertainty continue to provide relative support, we believe that any short-term corrections will be short-lived and shallow, thanks in part to continued and growing support from central banks, which continue to purchase bullion at record rates.

Strong demand from central banks for a second year in a row explains why gold has not behaved "normally", reaching near record highs at a time of rising real yields in the United States, higher costs of holding assets, a strong dollar and intense selling among ETF. A recent report by the World Gold Council showed that central banks, led by China, are likely to test last year's all-time high in gold purchases this year, with emerging markets leading the purchasers as they seek to reduce their dependence on the US dollar for maintaining reserves. According to World Gold Council, in the first nine months of this year, central banks purchased 800 tons of this metal, which is an increase of 14% year-on-year, and if the fourth quarter turns out to be equally strong, last year's record of over 1 tons may be broken.

Compared to the 800 tonnes purchased by central banks, the reduction in total ETF holdings year-to-date through Q183 was XNUMX tonnes, highlighting why the negative price impact of these sales was so limited. We believe that renewed interest in exchange-traded funds, similar to last week when the total gold ETF position increased for the first time since May, will be the stimulus that will ultimately drive gold prices higher. Such a change will only occur when we see a clear trend of lowering interest rates and/or an upward trend, forcing a reaction from investors investing real money for fear of missing an opportunity.

Gold has stalled after strengthening by almost $200 last month as profits were again taken above $2 an ounce. After such a strong rally in such a short period of time, the market needs consolidation, but so far the correction has been relatively shallow, with support emerging at $000, ahead of $1, the two-hundred-day moving average and the 953% rally line retracement. Given the length of the recent rally, gold could correct back below $1 without harming the bullish setup, while a new break above $933 could embolden traders enough to push the price towards $38,2.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

Leave a Response