Will Institutions Save Cryptocurrencies Before Retail Disappears?

December 16, 2008, in progress Great Recession, American Federal Reserve (Fed) with the stroke of a pen she cut the interest rate to near zero. It was the first time in history that the Fed brought the interest rate below 1%. To get the economy back on its feet, in March 2009 the Federal Reserve began implementing an extensive policy of quantitative easing to dump the economy with fresh money and liquidity. Barring a few minor hikes and cuts, the Fed kept its interest rate low throughout 2010, while other central banks set down rates that were actually negative. Simply put, it created an almost perfect environment for speculative assets, which enjoyed exceptional popularity over the years.

It is a special circumstance that just two weeks after the Fed first cut interest rates to zero, the most speculative asset of the era, bitcoin, entered the market as a result of the mining of the first block on January 3, 2009. This was largely case that the date of extraction of the first block Bitcoin almost coincided with the Fed setting zero rates and starting quantitative easing. However, these conditions were of great importance, because it was thanks to them that first bitcoin, and then cryptocurrencies as such, slowly but surely gained popularity among retail investors.

Dominance of retail investors

In the first decade of its existence, apart from individual strong supporters, cryptocurrencies were of interest to few, if any, institutional investors and financial intermediaries. While the financial establishment gave cryptocurrencies a wide berth, retail engagement grew exponentially, making it a key trading area for retail investors, along with meme stocks and other preferred investments r / wallstreetbets. Near zero or even negative interest rates in some countries have drawn them to investment assets, including highly speculative markets such as cryptocurrencies, to perhaps achieve some return on capital at a time when interest rates did not generate any returns.

The absence of institutions and the frequent fear of missing something (the so-called fear-of-missing-out, FOMO) led to excessive volatility and various speculative bubbles, including in 2017 and 2021, causing the prices of subsequent cryptocurrencies to skyrocket without any justification, followed by a collapse. This volatility has probably made institutions even more convinced that you should stay away from cryptocurrencies.

A great business to serve the retail segment

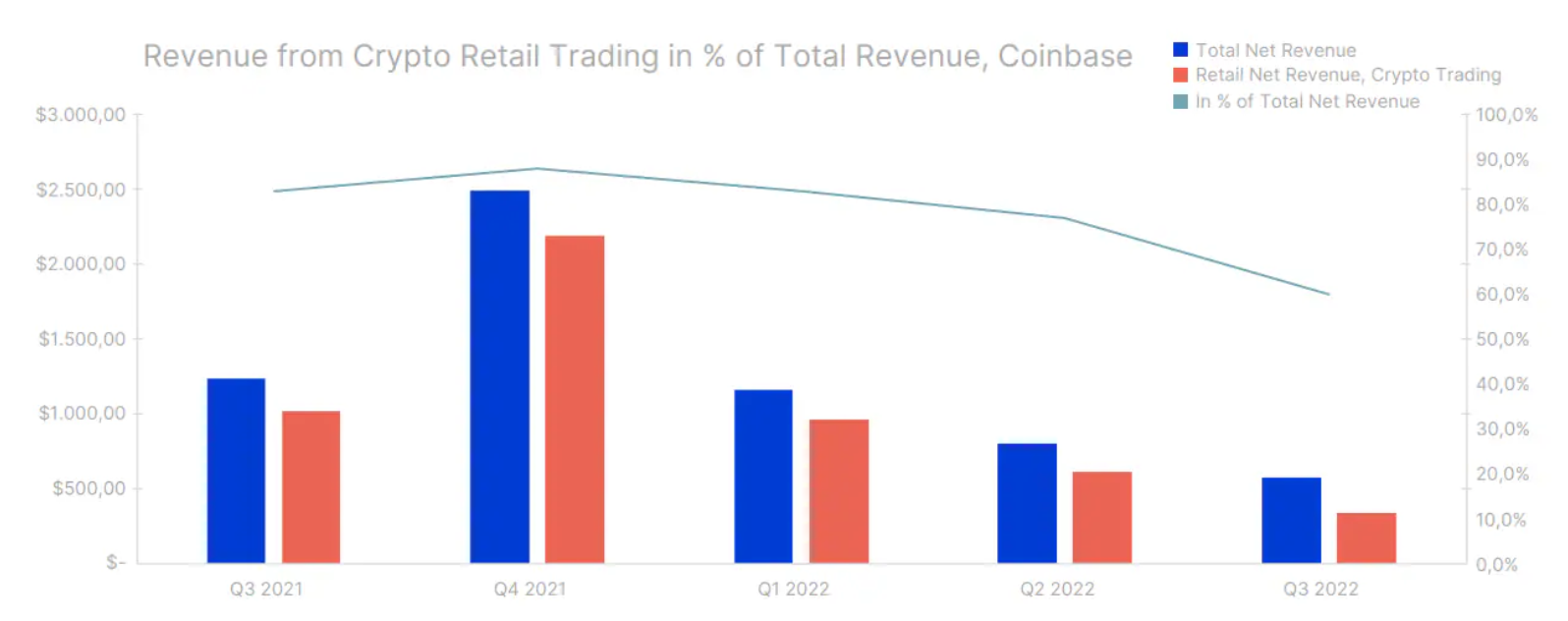

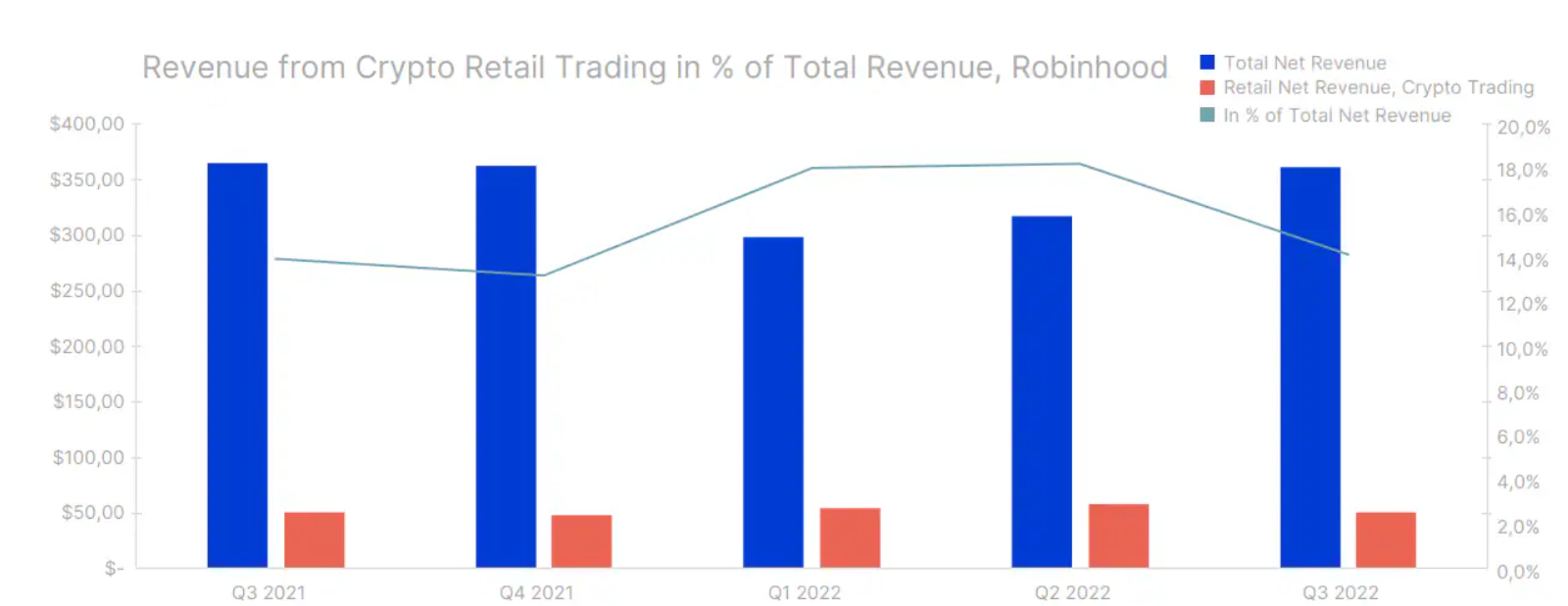

Serving the investment needs of retailers with cryptocurrencies was an extremely lucrative business for the exchanges that first started operating in this area. In fact, most of Coinbase's revenue is a product of retail trading, although the company has various other revenue streams such as staking, interest yields, trading gateway, developer tools, and institutional trading and trusteeship. In the case of a company Robinhood – broker with zero commission – retail cryptocurrency trading may not bring as much profit as in the case of Coinbase, but it is still a significant part of the company's revenue, especially considering that it also offers trading in other assets, such as shares or options . This underscores that retailers, not institutions, keep the crypto brokers afloat.

Source: Coinbase Global, Inc. and the Saxo capital group

Source: Robinhood Markets, Inc. and the Saxo capital group

Will retail trade survive the rise in interest rates and the end of liquidity?

In 2022, the macroeconomic environment rapidly transformed from a near-perfect environment for speculative assets thanks to the liquidity caused by the pandemic to its complete opposite. To curb soaring inflation, the Federal Reserve raised interest rates from near zero to over 4% in less than a year, and central banks around the world followed suit. To make matters worse, the Fed began quantitative tightening to reduce liquidity in the markets by reducing its balance sheet.

Rate hikes in 2022 reduced liquidity and further worsened the situation in the speculative markets, which enjoyed the greatest popularity in 2021. In retrospect, in early 2021, retail investors began to run out of new funds in the form of "free" fiscal stimulus from the pandemic period, which they could invest in cryptocurrencies. Note, for example, that bitcoin and other cryptocurrency assets first hit a significant peak within weeks of the payout of the last and largest US stimulus check, followed by an increase in volatility causing burnout among many cryptocurrency investors.

At this point, if retail investors continue to withdraw capital from brokerage companies, the cryptocurrency market is likely to be hit the hardest because cryptocurrencies have never functioned in such a macroeconomic environment and there is little involvement from professional and institutional investors. In our view, retail investors are unlikely to pull out of the market that quickly, given that the dominant younger generation of retail cryptocurrency investors must first shed their nearly fifteen-year-old belief that money is cheap. If liquidity remains limited due to central banks' struggle with inflation, both the model of retail investor domination keeping the cryptocurrency market afloat and the model of maximizing the economic situation by cryptocurrency brokers will collapse.

From detail to institution

For the last few years, cryptocurrency advocates have predicted that serious institutional investor involvement in this market is imminent. Despite the “don't touch!” attitude largely exhibited by institutional investors towards cryptocurrencies until 2020, some established institutions have decided to enter this area cautiously, trading cryptocurrencies themselves, offering them to clients and in some cases also performing various types of transactions directly on the chain. While this is a step in the right direction, institutional involvement in cryptocurrencies is relatively modest and still relatively few institutions are making such a move. Therefore, a massive influx of institutional investors is unlikely to compensate for the outflow of retail investors in the near future, especially in the case of smaller and less liquid cryptocurrencies.

Nevertheless, a decline in retail activity may lead the market to a less speculative but more robust and sustainable model in the long term, although most cryptocurrencies may not survive the purge of speculative activity. For such a sustainable model to emerge and for the market to thrive in the future, cryptocurrencies need to return to their roots offering unique decentralized use cases and mature into more economically sustainable assets. On the latter point, last year showed that cryptocurrencies can be economically sustainable assets by generating dividend-like returns after the network transition Ethereum from proof-of-work to proof-of-stake. In the course of this transformation, the network has drastically reduced its issuance of new Ether, now offering holders a reward of up to 7% per annum in exchange for verifying transactions, but without increasing supply as this reward is essentially funded by transaction fees. Hopefully other cryptocurrencies and tokens will follow the Ethereum network's lead in becoming more economically sustainable assets, making the whole area less speculative.

About the author

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)