The great revival of the euro and the problem with its turnover

Russia's invasion of Ukraine pulled the euro down shortly after the currency made a serious attempt to strengthen in anticipating a shift in monetary tightening by EBC at the meeting on March 10. Considering the uncertainty of the situation, the ECB made quite an aggressive change, but more important was the fact that Germany - just a few days after the invasion of Ukraine - they announced wide-ranging fiscal outlays to address weaknesses related to energy and defense. The European Union has joined Germany, which intends to finance new, large fiscal initiatives by means of joint debt issuance. All these fiscal measures will significantly deepen the EU's capital markets and could provide a long-term boost to the euro. If - hopefully - the terrifying fumes of war unfold soon, the conditions for the euro are promising and could lead to a significant upward revaluation of the euro.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

Euro

The fumes of war versus the promise of domestic investment and tightening of the ECB's policy

When analyzing the markets, it is important to always consider what is "in the price", which is what the market expects in the next 6-12 months, not just what is happening now. This is particularly important as we are on the threshold of the expected significant tightening of monetary policy in the United States and other countries. The forecasts for the future direction of the ECB's policy are similar, albeit less certain. This is mainly due to the fact that the euro area and its periphery are the economic areas most exposed to uncertainty and direct risk related to the possible further effects of the war in Ukraine. In the period from writing to the publication of this text, the situation may change drastically - for the better (to relax/ peace) or worse (complete cut off of energy supplies from Russia). This should mean that the potential price range for the euro will be very wide over the next quarter or two. However, the deep support for the euro is certain: wide-ranging new fiscal program initiated by Germany, which announces new spending of around 5% of GDP will be earmarked for energy, defense and other weaknesseswhich became painfully visible after Russia's invasion of Ukraine.

The most favorable combination for the currency is a tightening of monetary policy and a loosening of fiscal policy, and the euro area will move in the fiscal direction at least in the next year. The ECB's monetary policy can largely catch up as soon as - hopefully - the war in Ukraine has ceased and its impact has faded, even if difficult relations with Russia and problems with exporting Russian energy to Europe continue. At the March meeting, the ECB signaled a much faster than expected quantitative tightening schedule and the central bank is clearly ready to raise interest rates as soon as it finishes its balance sheet expansion scheduled for QXNUMX. If the war in Ukraine ends by then, we can expect a positive ECB interest rate by the end of the year. To highlight the differences in fiscal policy compared to other countries, let us compare the new fiscal abundance in the European Union with the fiscal cliff in the United States. Fiscal spending is likely frozen due to a political stalemate in the Democratic Party and is unlikely to improve after the mid-term elections in which one or both congress parties come under Republican control. This is why - although in the coming quarter a further significant drop in the euro exchange rate is certainly possible - if the effects of the war in Ukraine, which we saw in the first two weeks, come back and deepen, the foundations of the euro have definitely changed in favor. The existential risk for the European Union has definitely decreased as Russia's aggression has contributed to deepening fiscal integration. New EU fiscal expenditures, especially German ones, will deepen the capital markets in the EU, so that more capital will stay in place instead of being transferred abroad. The euro is poised for a strong recovery should the fumes of war dissipate soon.

Possible strengthening of the euro?

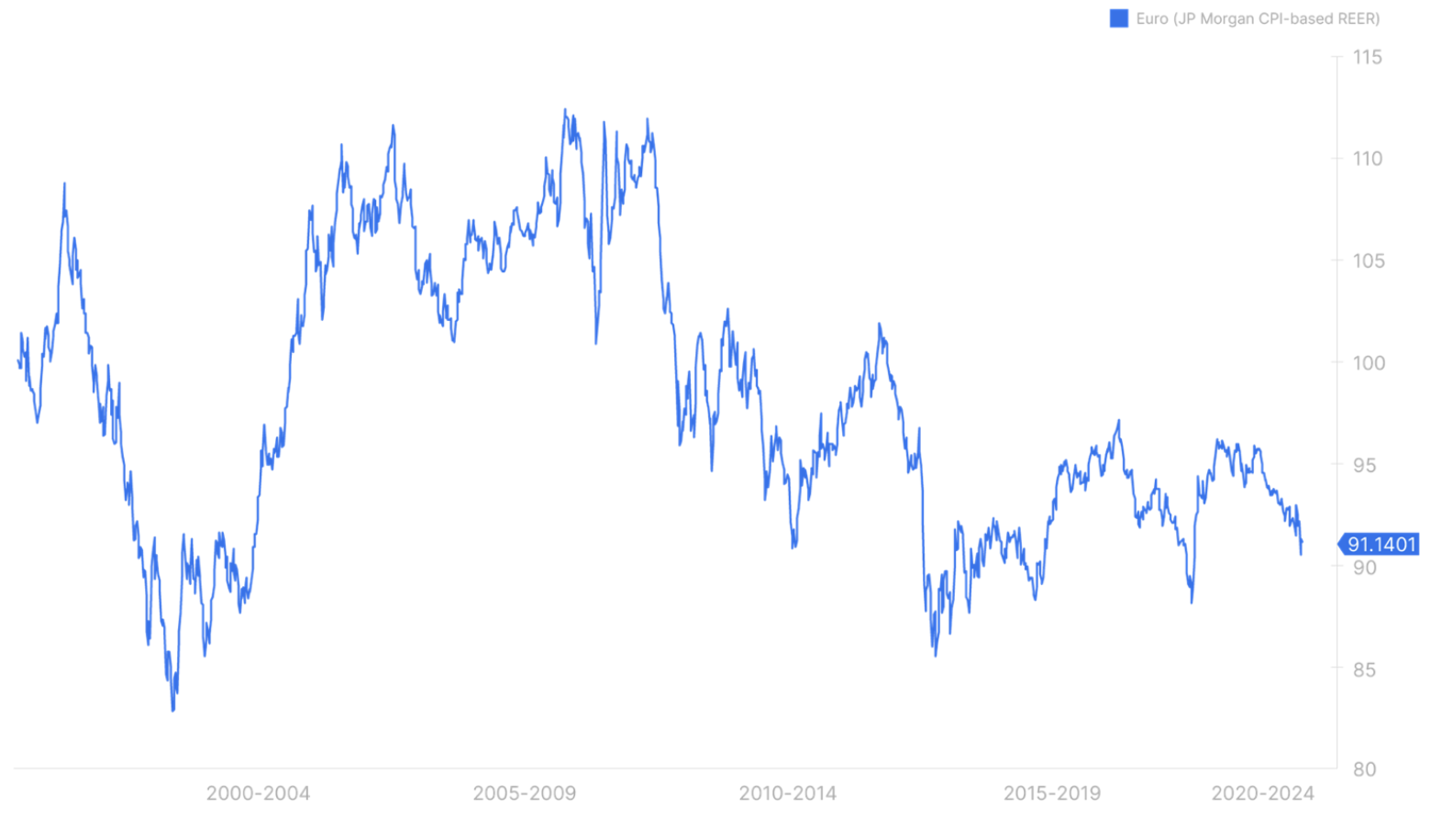

Since the beginning of the 2010st century, the euro has only been weaker twice than right after this year's Russian invasion of Ukraine - and surprisingly, the EU sovereign debt crisis in 2012-2015 was not such a situation! The first such case was the episode that started in XNUMX, when there was a significant policy discrepancy between tightening policy Federal Reserve and the ECB, led by Draghi, who was late in implementing quantitative easing. The second case was a momentary achievement of a new minimum when a pandemic broke out. From this point of view, our forecast is much more constructive to the potential of the euro, especially in the context of divergence in fiscal policy. The EU is taking aggressive measures on the fiscal front, introducing new energy and defense spending priorities in the wake of Russia's invasion of Ukraine, while, for example, the United States and the United Kingdom will see a significant fiscal deficit. The chart shows the real effective exchange rate of the euro, according to JP Morgan, adjusted for the CPI.

USD

End of reserve currency status and related aspects

Many have suggested that the coordinated sanctions on Russian central bank assets following Russia's invasion of Ukraine are a historic event that happens once in a generation, perhaps comparable to Nixon's closing the "golden window", which effectively ended the system in 1971. from Bretton Woods. Surely any nation that accumulates significant reserves and believes it is willing to risk the collapse of its Western alliances will find it unacceptable that its financial system and economy could prove to be as vulnerable as in the case of Russia.

In particular China, as the holder of the largest foreign exchange reserves in the world and an increasing rival of the United States, is likely to see the actions directed against the Russian central bank as a serious warning signal that will induce it to become independent from the US dollar as soon as possible. In addition, with soaring commodity prices and a lack of fiscal discipline in the United States, all significant holders of dollar and other fiat money reserves may choose to diversify their negative return currency assets and invest in commodities and other hard assets and capacities instead. productive, even if they are not directly threatened with sanctions.

Such processes take time, and the US dollar will retain its advantage as the world's most liquid currency as we follow this bumpy road. Markets will have to get used to higher inflation and a much tighter monetary policy, however the US dollar will face a major downward correction in the coming yearsas the main exporting countries will no longer consider it a means of storing value. They will look to transfer their surpluses elsewhere, making the United States increasingly difficult to finance its enormous double deficit.

Minor currencies from the G10 group

Bumpy road ahead due to volatility in commodity prices and sentiment

In the first quarter, the five minor G10 currencies - three commodity dollars (AUD, CAD and NZD) and the Nordic currencies (NOK and SEK) - probably recorded historical discrepancies. For example, the Swedish krona has been doubly weak due to its traditional sensitivity to risk appetite, and also because the Swedish economy is seen as dependent on forecasts for the entire EU economy, which has been hit hard by the war in Ukraine. The more commodity-driven AUD rose as Australia's raw material export portfolio provides an almost perfect counterbalance to the war in Ukraine as Australia is an important exporter wheat and the world's largest exporter LNG. NOK gained from oil prices, CAD - to a lesser extent, and NZD as the main safe exporter of food and after maintaining last year's aggressive stance by RBNZ, unexpectedly gained. SEK has rebounded sharply since then and should perform well in an environment favorable to the euro, despite being sensitive to the volatility of high-risk assets. Petrocurrency could face a tough move later this year if the recession affects the damage caused by high energy prices. The AUD is still one of the currencies to watch for long-term growth potential if China introduces the right stimulus.

GBP

The tension has eased, but the fiscal situation is unfavorable

Bank of England started normalizing politics before the Fed did it, and certainly - before the ECB started it, but it is unlikely to match the pace of the Fed rate hikes. This is more likely to be the case The UK, and not its peers, will be heading towards recession this year due to the combination of the impact of severe supply constraints in the economy, soaring energy prices, and a heavy fiscal burden, especially when compared to the EU aggressively seeking expansion. It is worth observing the EUR / GBP pair as an important barometer for the pound sterling rate. On a positive note for the British currency, the EU's security weaknesses after Russia's invasion of Ukraine are likely to keep Brexit-related trade tensions to a minimum as the UK has the greatest military potential in Western Europe and is needed as a ally.

JPY and CHF

It goes to its own, as long as it's about profitability. End of the Japanese fiscal year!

Last quarter, I mentioned a return to the average for the Japanese yen way too early. The yen benefited only slightly from the deterioration in risk appetite in the early stages of the war in Ukraine before falling to new historic lows, partly due to sharp increases in commodity prices driven by Japan's scale of dependence on imported food and energy, and later due to on rising interest rates. In the first quarter Bank of Japan stepped up its yield curve control policy by defending a 0,25% cap on Japanese 31-year government bonds. Rising safe investment yields at the long end of the yield curve mean in theory that should global yields continue to rise, the burden of pressure will be on the yen should Japanese government bonds fail to meet it. However, the JPY is at historically low levels, and as we approach the recession, yield increases at the long end of the curve and commodity prices may slow down somewhat. The end of the Japanese fiscal year on March 2021 is often a turning point - as was the case in XNUMX, when JPY hit a bottom on that day and US bond yields peaked in the current cycle.

In the case of the Swiss franc, its strengthening following Russia's invasion of Ukraine was swiftly reversed when Switzerland joined the international community in sanctions against Russia, further weakening Switzerland's traditional special status as a safe haven for money of potentially dubious origins. Rising yields are also a relatively negative factor for the CHF, as the Swiss central bank always delays action until the situation clears up, even if Switzerland is still in a strong current account and stability standpoint.

Currencies of emerging markets and CNH

As I mentioned above, China will likely seek to break away from dependence on the US dollar and other foreign currencies as soon as possible. This task is difficult to implement in a situation where the country has a capital control system (CNY cannot be traded outside the country). There are technical options to circumvent this problem - CNH currency for foreign settlements with announcements of potential physical settlements by other methods, e.g. in gold or digital currency - but it takes time to build confidence in new solutions, so you should carefully monitor how China will achieve this goal .

Since the beginning of last year, China has already pursued a strong yuan policy to deleverage the real estate sector and limit the influence of the tech sector, as well as as a hedge against rising commodity prices. While these priorities are unlikely to change as long as commodity prices remain high, the pace of CNH's appreciation this year has greatly accelerated, which will jeopardize the competitiveness of Chinese exports. China has also set out monetary easing priorities to support a weakening national economy, which continues to be disrupted by Covid lockdowns - a phenomenon that does not currently occur in most countries. In the rest of the emerging markets, exchange rate developments were clearly related to commodities and the current account; this situation is likely to continue as long as volatility in commodities markets remains high. Turkey and India are at risk from exposure to raw materials, while South Africa and Brazil have benefited from this.

All Saxo Bank's forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)