War and sanctions are turbocharging the already limited commodity markets

The prospect of a long-term raw material price growth cycle, first described by us in early 2021, continues to develop. Last quarter, the war in Ukraine and sanctions against Russia helped turbocharging the sector, who has already struggled with forecasts of supply constraint. Before government support and central banks lowering rates to zero led to the post -andemic overstimulation of the world economy, long years of plentiful supply and stable prices limited investment in new production, keeping producers unprepared for the surge in demand.

In the face of already shrinking supply, the commodity sector was extremely unprepared for the situation in which President Putin ordered an attack on Ukraine, which caused the market to shift from fears of low supply to passively watching its disappearance. Due to the fact that both Russia and, to some extent, Ukraine are the main suppliers of raw materials for the world economy, we are now witnessing historic changes, as the increasing isolation of Russia and the imposition of sanctions on itself by the international community cuts an important line of energy supply, metals and agricultural products.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The Bloomberg spot commodity index, which already shows gains close to those of 2021 - the best year for commodity gains since 2000 - is likely to consolidate over QXNUMX, focusing on four key drivers that could potentially shape market:

- on Russia's readiness to end the war, thereby embarking on the long road to the normalization of raw material supply chains;

- the slowdown in economic growth in China in the context of its ability to stimulate the world's largest consumer of raw materials;

- on the strength and pace of interest rate increases in the United States and their impact on inflation and economic growth; and

- whether commodity prices, in particular in the energy sector and to some extent in the industrial metals sector, have reached levels that will destroy demand.

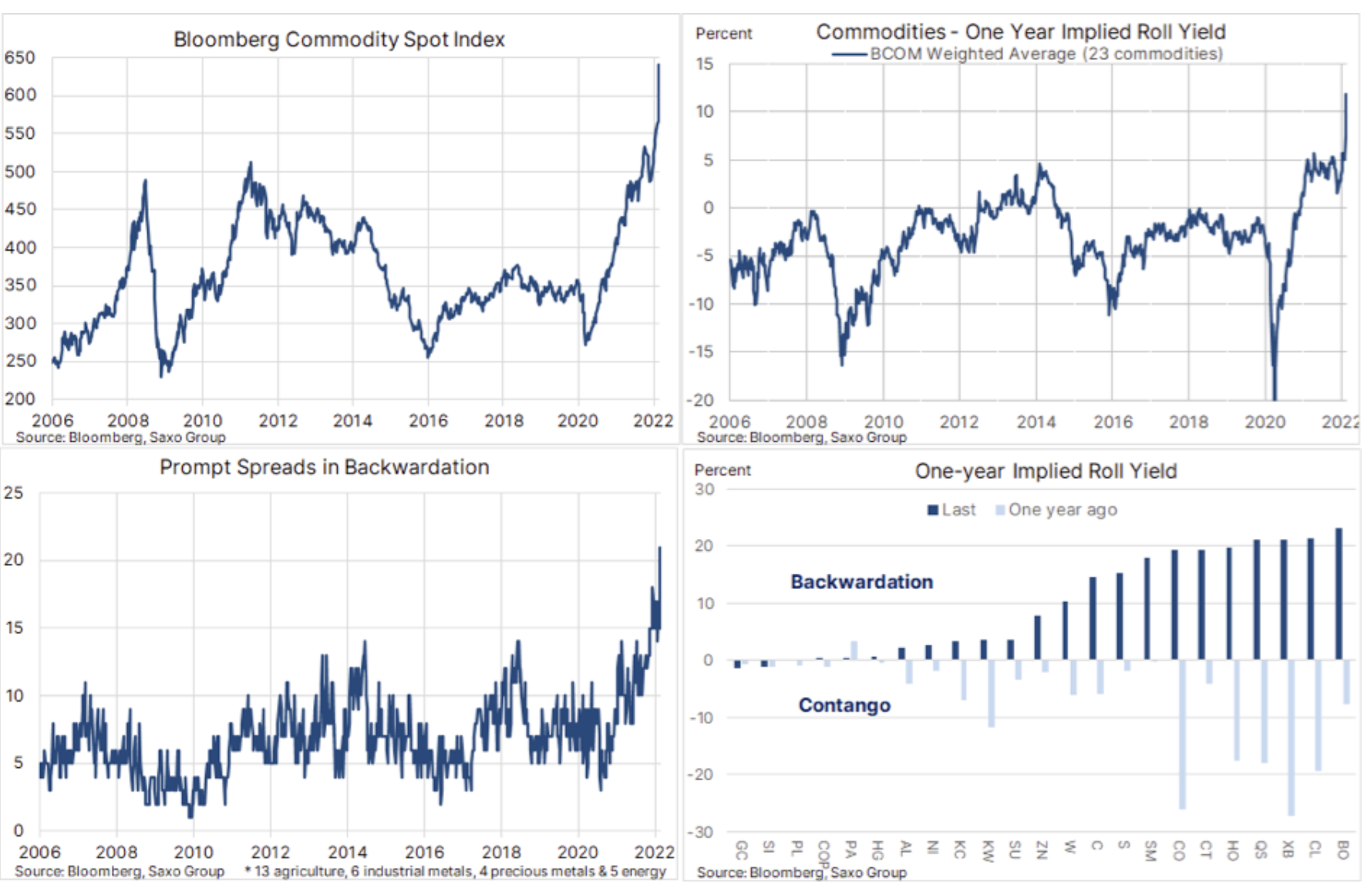

Supply constraint forecasts that have emerged on global commodity markets over the past year, caused prices to rise sharplywhich was then turbocharged in the form of unexpected disruptions in the flow of raw materials from Russia and Ukraine. As a result, the Bloomberg spot commodity index, which monitors a basket of 24 key commodities evenly spread across energy, metals and agricultural products, hit a record high on March 8, posting a staggering and in the short term unsustainable 38% yoy. Such a pace and scale of growth, driving up input costs in the entire global economy, carries the risk of slowing economic growth and the demand for many key raw materials.

While the prices of most commodities - with few exceptions - have since returned to the prevailing trends, the backward-supporting constraints in supply in the markets do not show any signs of weakening yet. By measuring the spread between the first and second months of futures, you can see that a record 21 of the 28 major commodity futures contracts are now shown by deport - an indicator that helps measure market concerns about shortages and the higher price buyers are willing to pay for immediate delivery compared to with delivery at a later date. Another measure shows that the annual rollover gain from the Bloomberg's weighted average commodity index components hit a record high of 12%, with the energy, cotton and grain sectors currently contributing to this appreciation.

Energy

After Russia's invasion of Ukraine Brent crude oil price rose to a level just a few percent away from the record high of 2008, while the prices of fuel products, especially diesel oil, reached new record highs. This was especially true in Europe, the headquarters of the most important buyers of Russian fuel products, where the 'self-sanctioning' of several commodity traders raised concerns about the availability of supplies. Within days, however, most of the gains were netted, and traders' attention focused on the renewed Covid lockdowns in China and the start of the long-awaited cycle of interest rate hikes by the US Federal Reserve.

With the usual channels of raw material supply from Russia disrupted, the end of the war in Ukraine is unlikely to mean a quick return to normalcy. It will most likely take a long time to repair the relationship and rebuild trust between Putin's Russia and the West.

Due to the broadly understood uncertainty, the price range will again be wide in Q90 - potentially USD 120-XNUMX per barrel. Ultimately, the market is expected to stabilize, with the risk of rising prices associated with reduced production reserves in key producers and further supply disruptions in the Russian context will be partially offset by a downturn in demand as the global economy is increasingly struggling with inflation and rising interest rates. If we add to this the temporary decline in Chinese demand due to Covid, a return to March's high seems unlikely.

The key events that could trigger additional uncertainty are still: the prospect of a nuclear agreement with Iran, Venezuela's permission to increase production and, above all, an increase in shale oil production in the United States, if producers manage to overcome the current problems related to the lack of manpower, fracturing lines, drilling rigs and sand.

Industrial metals

Aluminium, one of the most energy-consuming metals, hit a record high with nickel in March, while copper, with momentary resistance, reached an all-time high. The current supply disruption from Russia will support the sector until the end of 2022, in particular in the context of the continued drive to decarbonise. At the same time, increased defense budgets in response to the threat from Russia will keep demand high despite the current risk of an economic slowdown. In addition, the projected slowdown in capacity growth in China is favorable to the sector as the government increases efforts to combat environmental pollution and non-Chinese producers are, for the same reasons, very reluctant to invest in new capacity.

Despite the predictions that the energy transition towards less dependence on coal in the future will generate strong and steadily growing demand for many key metals, the outlook for China, in particular for copper, is currently the great unknown, as the real estate market is responsible for a significant part of Chinese demand. . However, given the small supply of mined metals, we believe that the current negative macroeconomic factors related to the slowdown in the real estate market in China will begin to weaken in early 2022. Furthermore, it should be taken into account that the People's Bank of China and the Chinese government, unlike the American Federal Reserve, is more likely to boost the economy, particularly in the context of green transition initiatives that require industrial metals.

While the war in Ukraine and Russian sanctions have turbo charged these metals, enabling them to hit new highs above all expectations, the outlook for most metals remains favorable as tight supply and an inelastic supply-side response are likely to push prices even further for the rest of this year.

Precious metals

In the first weeks of 2022, the strength of gold surprised the market, incl. due to the fact that the January boom was accompanied by a sharp increase in real yields in the United States. The outbreak of hostilities in Ukraine caused a short-term increase in the geopolitical risk premium, which brought gold to a level just a few dollars away from the record high in 2020.

We predict that in QXNUMX gold will finally adjust to the US interest rate hike cycle and the price of this metal will rise. Our positive outlook is based on the belief that inflation will remain high and that interest rate hikes will not help reduce the steadily rising costs of raw materials, wages and rents. We believe that gold is increasingly seen as a hedge against the current optimistic market view that central banks will manage to bring down inflation before slowing economic growth forces them to rethink the pace of rate hikes and the resulting final rate.

With gold hitting our target of $ 2 an ounce ahead of time, we predict the market will consolidate Q000 earnings to eventually hit a new record high in the second half of the year as economic growth slows and inflation remains high .

Agricultural products

The FAO world food price index hit a record high in February before the war in Ukraine worsened the situation, increasing the likelihood of an even more limited supply in key food markets, since wheat i corn to edible oils. Adverse weather conditions in 2021 have already depressed global stocks of key food products, ranging from soybeans to palm oil and corn. Moreover, rising fuel prices will not only increase the demand for biofuels, but also increase production costs through higher costs of diesel and fertilizers.

We see an increased risk of high food price inflation, the main factor being the weather phenomena and, above all, the duration of the war in Ukraine; the prolonged period of fighting may limit production in Ukraine, which is the world's main supplier of wheat. In its latest monthly report, the US Department of Agriculture lowered the estimates for exports from Russia and Ukraine by a total of 7 million tonnes to 52 million tonnes; however, these estimates remain highly uncertain and may rise sharply in the event of a prolonged war, thus keeping prices high.

All Saxo Bank's forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)