War and sanctions shake global commodity markets

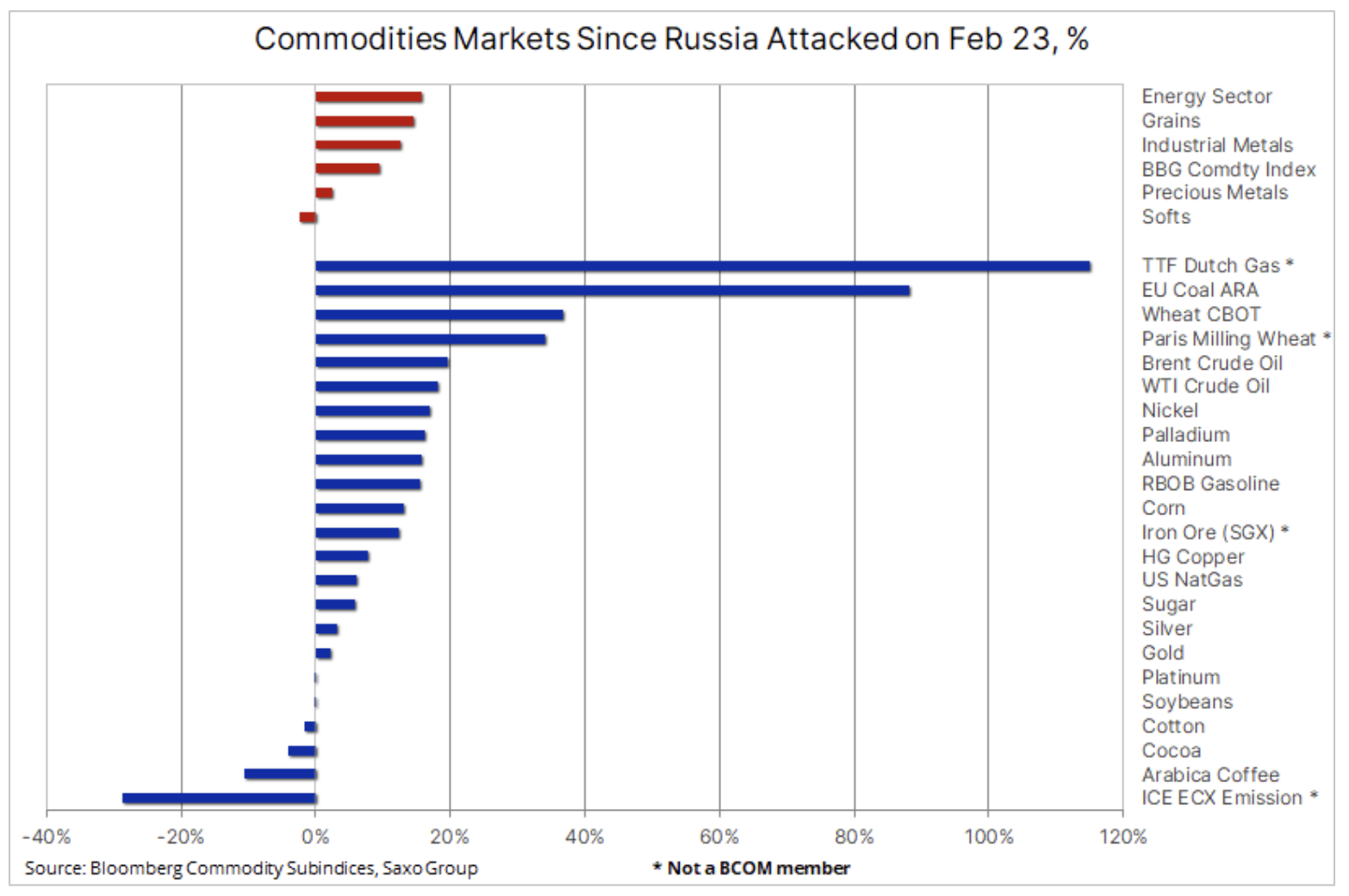

Raw materials, with a few exceptions, have experienced strong growth since President Putin ordered his attack on Ukraine, with market fears of limited supply turning into real supply shortages. Due to the fact that both Russia and, to some extent, Ukraine are the main suppliers of raw materials for the world economy, we are currently witnessing historic changes, as the increasing isolation of Russia and the imposition of sanctions on itself by the international community cuts off the main energy supply line, metals and agricultural products.

Although investor attention has focused on crude oil because of its global importance as a factor of production for the wider economy, other markets, such as European gas and coal, have surged unprecedentedly, while the market has struggled to price a potential supply shortfall. . From a global food security perspective, record wheat prices in Europe and the highest prices in the United States since 2008 also raise a lot of concern.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The strong and unprecedented reaction to Russia's attack on Ukraine made itself felt quickly, not least in Russia, where the economy is slowly declining - before the cessation of trading on the stock exchange, the stocks of the largest domestic companies depreciated over 90% and the Russian ruble hit the lowest price in the twenty-year history of President Putin's leadership. Worldwide, as a result of outrage and self-sanctioning, flows of oil, coal and many other commodities from Russia have slowed down, and buyers increasingly perceive the products produced and mined in the country as toxic.

These phenomena underline the threats to the global economy, in particular in the event of a long-term conflict. Under such a scenario, the prices of an insufficient supply of commodities would most likely increase to a level where a negative impact on demand would begin, thus supporting a return to greater equilibrium in the market. At this point, having observed these historical movements, it should be clearly emphasized that we are dealing with a situation whose outcome may be binary. Any sudden resolution that would justify the lifting of the sanctions could result in a significant adjustment for many key raw materials, potentially offsetting the strong gains shown in the table above.

Traders are fully aware of this, and in the short term, this would create even more volatility as investors' liquidity and confidence would drop. One way to measure volatility is through the average true price spread. average true range) with a 6,5-day observation period; in simple terms, it tells what kind of daily price range can be expected for a given stock or commodity, so the greater the volatility and uncertainty, the greater the price range. Using the ATR, it can be seen that the expected daily price range for Brent crude oil is $ 2 / tonne versus $ 24 / tonne in recent months, for wheat listed on the Paris Stock Exchange - EUR 6 / tonne versus EUR 32 / tonne. and for gas in the EU - EUR 7,5 / MWh compared to EUR XNUMX / MWh.

Global commodity markets are shrinking as the Bloomberg spot commodity index continues to hit another record highs. The impressive 9,4% increase last week is the largest since 1974, when the oil embargo imposed by OPEC triggered an oil shock in 1973-1974. By observing the futures curves, you can see that most major commodity futures are showing an increasing deportation - an indicator that helps measure market concerns about shortages and the higher price buyers are willing to pay for immediate delivery versus later delivery.

In addition to the spike in the Bloomberg spot commodity index, the above charts also show a variety of ways to measure the deportation, which is currently the widest and highest in recent history. If we measure the spread between the first and second months of futures, it turns out that 15 of the 28 major commodities futures contracts are now deported, while another measure shows that the annual rollover gain from the weighted average of the Bloomberg commodity index components hit a record 12%, with what is currently the responsibility of the energy sector, cotton and grains.

Copper market

Copper, which remained within the range for the last year, surged up last week and almost reached the record level from last May of USD 4,89 / lb. Since then, it has shown a sideways trend, underperforming the Bloomberg industrial metals index by nearly 25%. At the same time, other metals such as aluminum have reached record highs, the price of zinc is at its highest since 2007 and nickel has reached its 2011 high. high energy prices limited production, thus exacerbating severe supply constraints in the region. Russia is one of the world's largest producers of copper, and while price increases have been limited for months due to concerns about Chinese demand, market attention is now focused on the further decline in supply caused by the sanctions, and therefore on the prospect of reaching a new record rather sooner than later.

Petroleum

Clothing recorded a fourteen-year high on Thursday after Brent crude oil price nearly hit $ 120 / b, followed by a correction of $ 10 amid speculation that a nuclear deal with Iran could be reached over the weekend. World oil powers such as BP Plc, Shell Plc and Exxon Mobil Corp. are withdrawing from Russia, and buyers are avoiding the country's oil as they face financial penalties and soaring transport costs. As a result, the world market is currently in chaos, and Russia's unwanted varieties of crude oil are showing a significant discount to Brent crude oil.

After a record-breaking meeting on Wednesday, OPEC + decided to approve another unattainable increase in production of 400 b / d in April. As it turned out, this meeting was aimed at maintaining the stability of OPEC + rather than the oil market, as it did not deliberately raise the issue of the war in Ukraine or Russian sanctions. This underlines that the group is now treading very brittle ice, possibly also due to the fact that the available toolkit, or production reserves, is close to being exhausted. In the short term, with no solution on the horizon, the price could rise to a level that will kill demand. On the other hand, a peaceful deal could wipe out a significant portion of the gains over the past ten days.

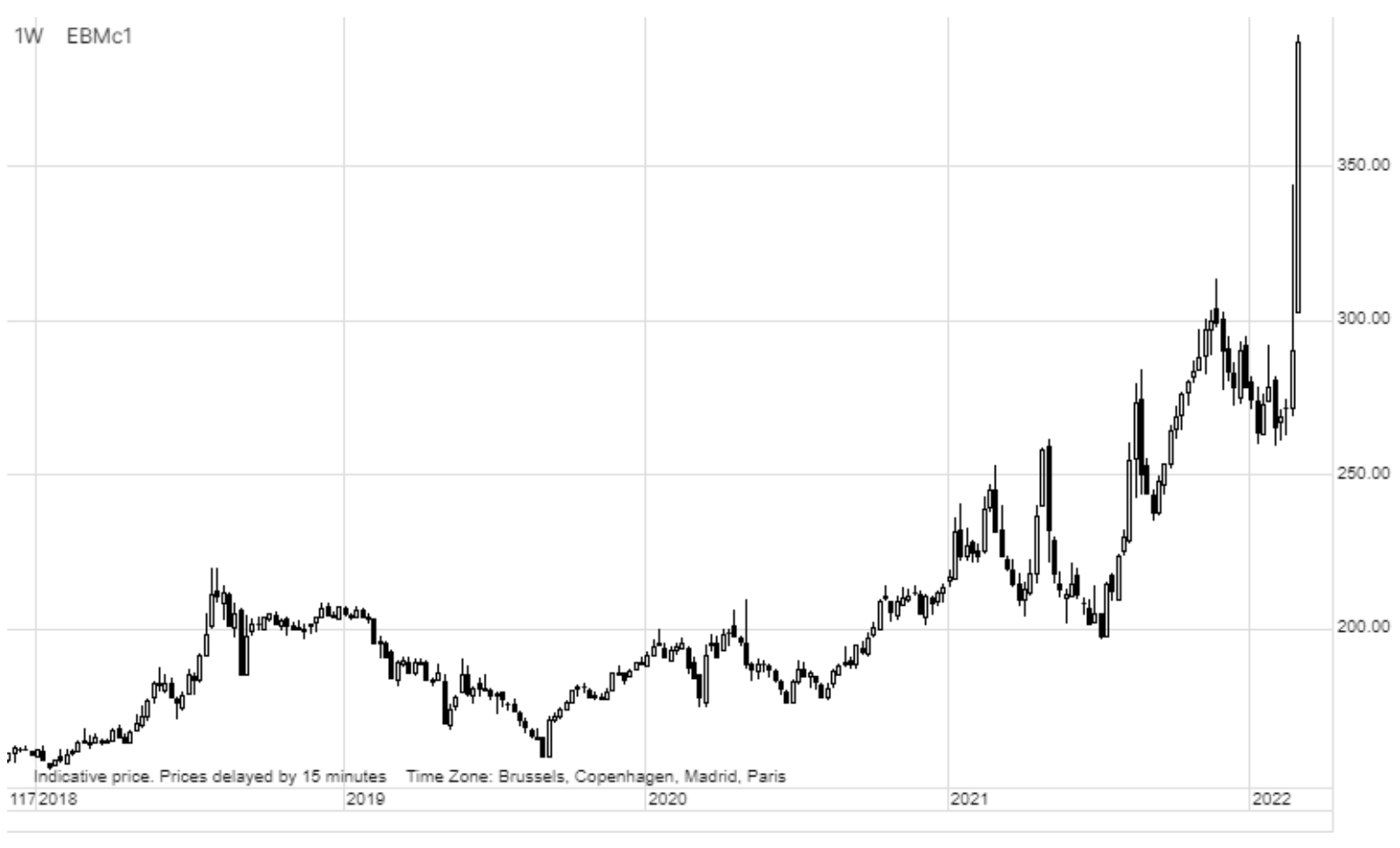

Natural gas

Gas price in Europe briefly rose to EUR 200 / MWh, and at current prices more than ten times its long-term average, it has reached a level that will trigger a fall in demand from the most energy-intensive industries, leading to a weakening of economic growth and an increase in inflation. The biggest victim of these circumstances was the futures contract on ICE carbon dioxide emissionswhich fell by a third from its February peak. Although the main stimulus was signals indicating a decline in demand for CO offsetting2, the pace and depth of sales were additionally driven by speculators fleeing from investment until recently considered safe, as prices continued to rise as EU politicians tightened their policies to combat climate change.

Coal

Coal prices has more than doubled since the beginning of the year as Europe, Japan and South Korea are looking for alternative suppliers to Russian coal and energy producers are looking for substitutes for Russian gas. In addition, coal production faces problems in other regions as well, such as lack of labor in China and Mongolia, floods in Australian mining regions, and the January export ban from Indonesia further contributes to supply constraints.

Wheat

Prices wheat Chicago has soared to a new 14-year high, while the Paris-based high-protein wheat mill contract sets daily records that culminated in Friday's jump to EUR 385 / t, around 30% above their 2008 record. Ukraine and Russia export 29 % of world wheat, mainly through the Black Sea - a route that was closed after attacks on cargo ships near Odessa. From the point of view of global food security, this is a very serious problem, as wheat and rice are the two most important food items. Among the top ten importers of wheat in the world are several developing countries, from Egypt and Turkey to Indonesia and Algeria, all countries where rising food costs will have extremely negative effects.

Precious metals

Gold and silver reached their highest weekly closing prices since November, and the demand for them was fueled by the demand for safe investments, not only due to the invasion of Russia, but also as a hedge against inflation, which accelerated significantly due to the rapidly rising commodity prices and the prospect of an upcoming deterioration economic situation. Federal Reserve Chairman Powell confirmed that the central bank intends to start a series of interest rate hikes this month to curb inflation, which is the highest since the 80s. The market, however, disregarded the news as Russian aggression could force the Fed to adopt a more cautious approach.

Real ten-year US bond yields fell to -0,9%, the lowest since early January, in response to rising inflation expectations and demand for safe investments, which at the same time lowered nominal yields.

In addition to the hard-to-estimate geopolitical risk premium on the market, we maintain a positive outlook that inflation will remain high and central banks may find it difficult to slow down sufficiently amid the risk of an economic slowdown. In our opinion, the Russian-Ukrainian crisis will continue to support the prospect of rising prices of precious metals, not only due to the potential short-term safe haven offer, which will change, but mainly due to what this tension will mean for inflation (increase), economic growth (decline) and expectations of rate hikes by central banks (lower frequency).

Coffee

Arabica coffee, which recently recorded an excellent performance, fell to its lowest level since November, and hedge funds have partially reorganized their portfolios in response to these disruptions in all markets. While the prospects for limited supply from Brazil have not improved, the outlook for demand has worsened as Brazilian exporters canceled contracts with Russia and Ukraine, increasing the availability of coffee in other countries. As a result, we are witnessing a slight increase in inventories monitored by ICE, which further - so far - alleviates concerns about the exhaustion of reserves.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)