Cryptocurrency mining in the spotlight in times of chip shortage

The Covid-19 pandemic has disrupted the semiconductor chip markets, affecting industrial production lines that rely heavily on them. The limited supply of semiconductor circuits is struggling to keep up with the increase in demand and has led to a global shortage. The automotive industry was particularly hard hit: General Motors reduced production at many factories, and overall it is estimated that the chip shortage caused car sales to drop by more than $ 60 billion. This shortage also affected many other sectors, such as gaming consoles, smartphones and other high-end electronic devices. Many chip suppliers now have orders that exceed their capacity, and the waiting times for purchasing capacity expansion machines seem long.

About the author

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Increasingly profitable cryptocurrency mining

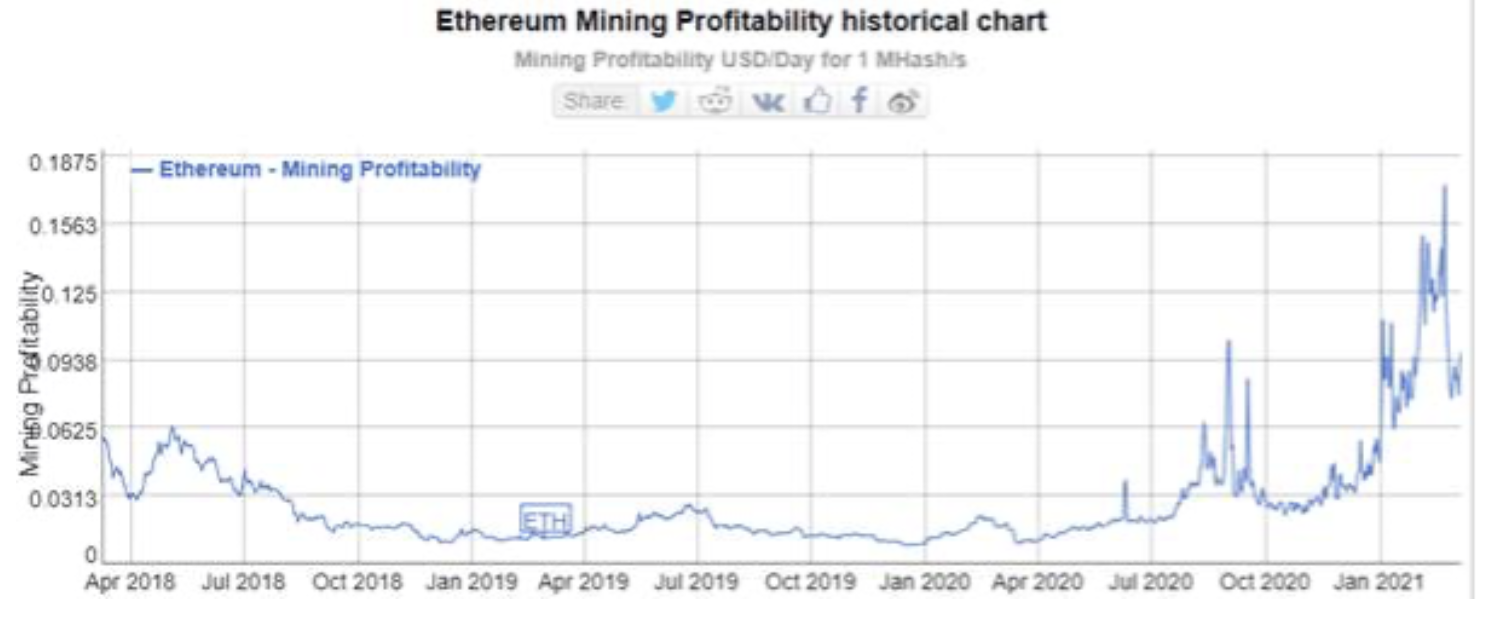

One of the major semiconductor chip consumers is the cryptocurrency mining industry. The boom in the cryptocurrency market that started in the fall of last year made the cryptocurrency mining industry much more profitable due to the increased activity in the crypto area (see Figure 1).

The increase in activity translated into an increased interest in purchasing cryptocurrency mining equipment. For example, an anonymous miner from Russia recently imported the largest mining infrastructure Bitcoinas ever seen in this country. Alternative ways to set up cryptocurrency mining farms are also offered - Chinese miners buy laptops for mining Ethereumas the current laptop and energy prices in China make it profitable. This, of course, limits the offer for those who need laptops for basic applications.

The global chip shortage has caused the price of cryptocurrency mining hardware to rise significantly, which could force some smaller players to pull out of the game. As the number of active miners decreases, the network becomes less decentralized, with fewer entities to verify transactions. Given the current state of the industry, we do not see any signs of this as yet, as current miners may not have the short-term need to replace their existing equipment. If the chip shortage continues for an extended period of time, it can ultimately mean an increased risk to network security.

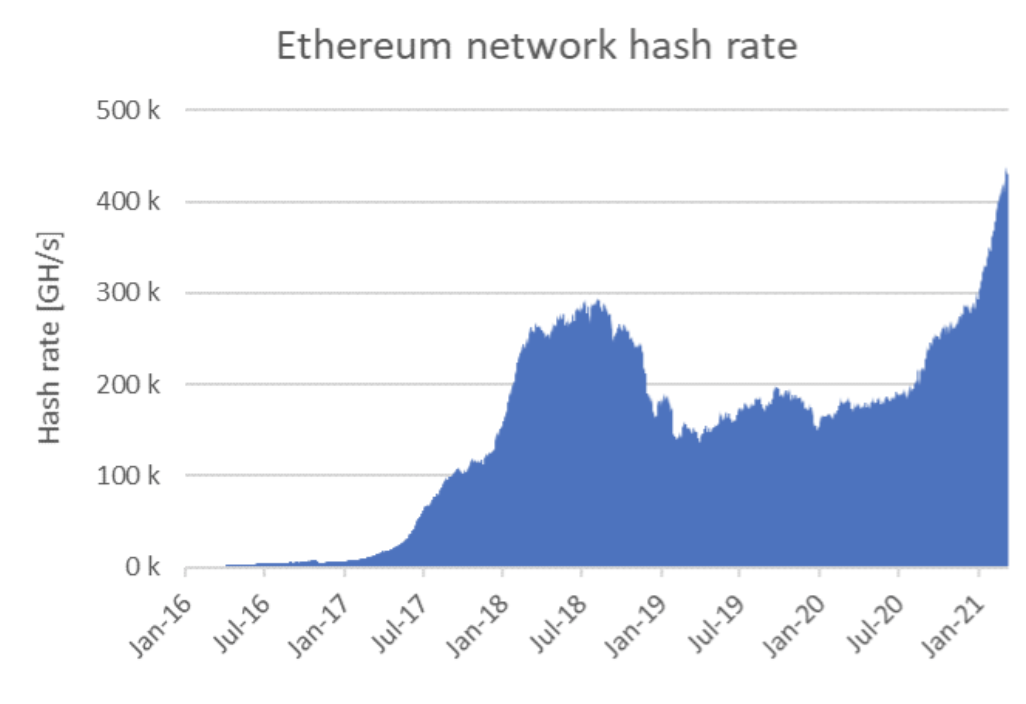

The total computing power that is used to extract and process transactions is measured by the so-called hash rate, including blockchain based on the so-called proof of work performance (proof of work) - in other words, when mining is used to validate a transaction. The current hashing rate for bitcoin is at a high level and is hitting a record for ethereum (see Figure 2). Mining ethereum is currently the most profitable of all currencies mined using GPUs, which is why it is gaining popularity among miners.

Figure 2. The hash rate is a measure of the total computing power used to mine and process transactions in a Proof of Work blockchain. Source: Etherscan.io

Cryptocurrency mining conditions will soon deteriorate

The Ethereum network is being updated to version 2.0. Verification of the transaction will move away from energy-intensive mining to the so-called proof of bid (Proof Of Stake), in which Ethereum holders could approve transactions with a portion of their shares. After full implementation, upgrading to Ethereum 2.0 will completely eliminate the concept of mining, so you may wonder why cryptocurrency miners are so eager to move to this network. Full transition is predicted in 2022 and this is influenced by the decisions of the Ethereum development team. Such a long time horizon can encourage miners to choose short-term profits, especially those miners who are able to extract significant amounts of ETH, which in turn will be able to use to win prizes on the new stake-based Ethereum 2.0 network.

Even before Ethereum version 2.0, another update is being prepared. EIP 1559 will transform the way miners pay to validate transactions. The revision is planned for July this year to ensure greater predictability and lower fees, as well as keeping Ethereum inflation to a minimum by burning some of the mining fees. The upgrade seems to be beneficial for Ethereum as a whole network, however miners are not happy with this initiative. In addition, more and more attention is paid to environmental issues related to the mining of cryptocurrencies. One example is the proposal to close one of the largest cryptocurrency mining centers in China - Inner Mongolia - due to energy conservation regulations.

Will we have a hangover in 2021?

In the semiconductor chip industry, concerns remain "Cryptocurrency hangover". The last one took place after the cryptocurrency boom in 2017, which caused a drastic increase in the demand for GPUs for cryptocurrency mining. This started a period when GPU vendors struggled to deliver hardware to their long-standing customer base, while declining interest in cryptocurrencies made mining less profitable, leaving miners uninterested in replenishing hardware. Companies such as Nvidia are now taking new initiatives to avoid overlapping interests in the functionality of their equipment. The company has launched specialized cryptocurrency mining equipment, as well as developing a dedicated card for players that will slow down the computer if used for mining, although implementing this in a way that will prevent skilled miners from circumventing security seems to be a big challenge.

In the long run, energy-intensive verification of cryptocurrency transactions through mining seems to be a thing of the past. It is not suitable for deployment on a scalable transactional infrastructure and does not meet the growing global power consumption requirements. Even though bitcoin uses mining for validation, it seems to have a special status due to its long history. As bitcoin is considered more of a store of value in the crypto area (despite its high volatility), it can stay at the forefront of the next generation of cryptocurrencies when the vast majority of cryptocurrencies will use Proof Of Stake or a similar approach to approving transactions - mining cryptocurrencies will be a thing of the past. In the short term, the continuation of the cryptocurrency raid is likely to provide miners with even greater profitability, offering them considerable bargaining power to compete with other industries for a limited amount of chips. This could put other industries using chips at risk if they do not take proper precautions.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)