The increase in fuel prices raises inflation and threatens to reduce the demand

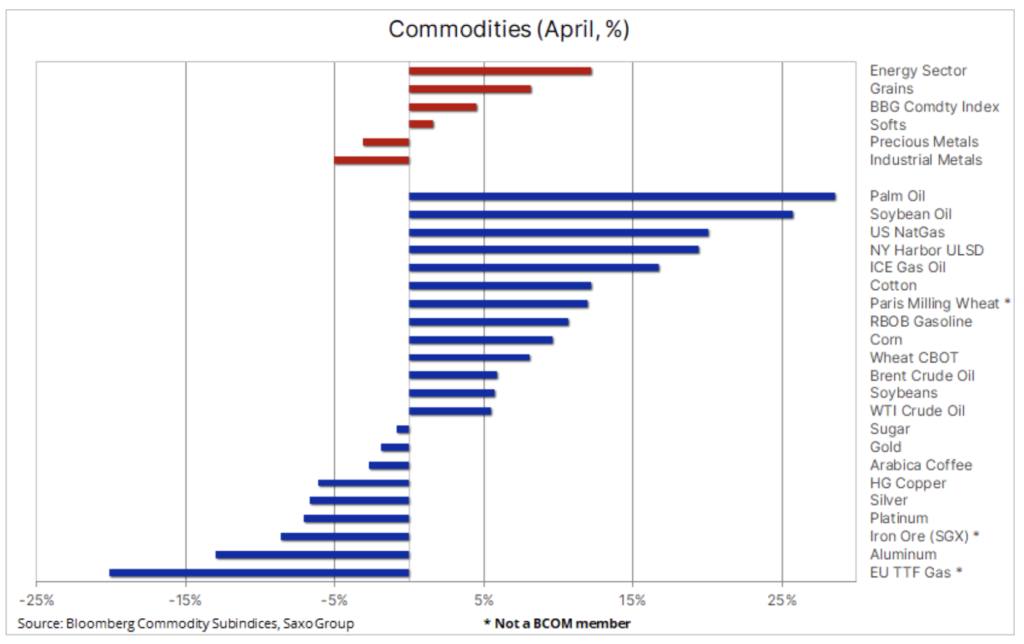

The commodities sector posted its fifth consecutive month of growth in April, but compared to the overall increase in March, gains were concentrated in the agricultural products and energy sectors, with cooking oils, heating oils and diesel oil in the lead. Precious and industrial metals have suffered in reaction to protracted Covid-19 lockdowns in China, fears that a rapid series of interest rate hikes in the United States will hurt the already weak economic outlook, as well as the dollar's dynamic strengthening.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Raw materials in an upward trend

In April, the commodities sector recorded another monthly increase, and the Bloomberg spot index, which monitors 23 of the most important commodity futures, appreciated for the fifth consecutive month to a new record high. However, gains were concentrated in the agricultural commodities and energy sectors, and precious and industrial metals suffered in response to the sustained Covid-19 lockdowns in China, negatively impacting economic growth and demand, as well as concerns that a rapid series of interest rate hikes in China would suffer. The United States will hurt the already weak economic outlook. In addition, the dollar has hit multi-year highs against several currencies, notably a twenty-year high against the Japanese yen and a five-year high against the euro.

One of the biggest investors in Hong Kong described the current situation in China as the worst in 30 yearsbecause Beijing's increasingly restrictive zero-Covid policy slows economic growth while causing discontent among the population. As a result, the threat to global supply chains has re-emerged and congestion in Chinese ports has started to increase, while demand for key commodities, from crude oil to industrial metals, has declined markedly. The Political Bureau of China responded to growing civil unrest without going into detail by announcing the implementation of economic stimulus to stimulate growth. Earlier last week, President Xi stressed that the main focus was on investment in infrastructure, the potential of which would become a key source of additional demand for industrial metals - which is why we hold the view that minimum prices will be reached soon after the recent weakness.

As part of my last webinar and in the podcast on the portal MACROVoices I recently listed the reasons why we believe the commodity boom still has considerable room for maneuver and why prices may rise even if demand comes to a halt due to slower economic growth.

Petroleum

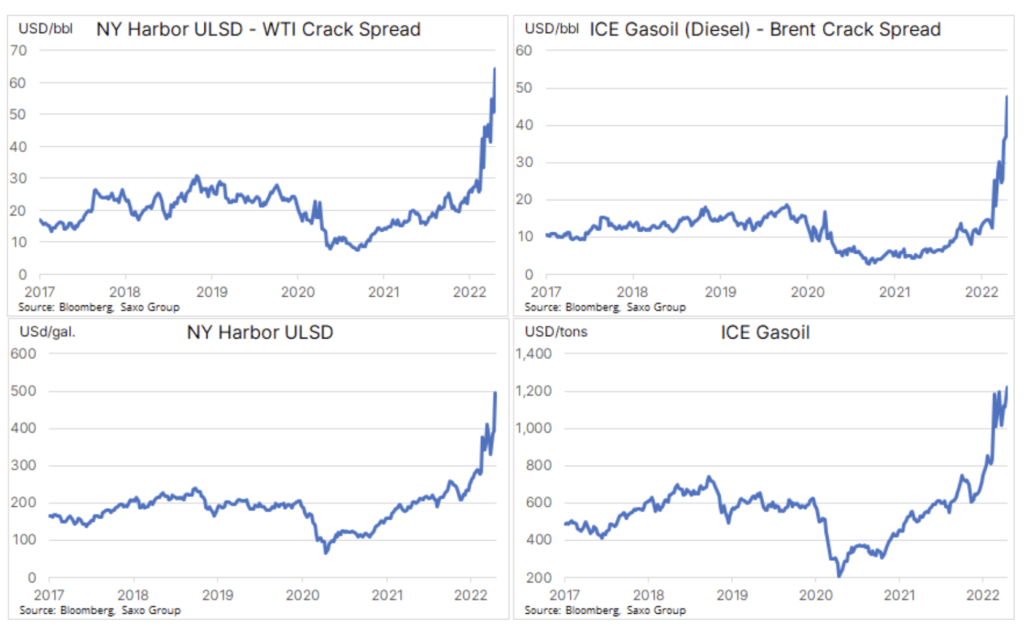

Crude oil remains in an increasingly narrower range, with Brent crude oil currently hovering between $ 98 and $ 110 per barrel. However, this did not prevent the sharp increase in the cost of fuel products. Diesel, the engine of the global economy, saw strong growth as supply decreased in the New York City area, which pushed prices to historic highs. The war in Ukraine, followed by the sanctions imposed on Russia, disrupted global supply chains, causing significant tensions in the physical market, in particular in Europe, where Russia has been the most important supplier of fuel products for years.

To fill this gap and take advantage of soaring prices, US Gulf Coast refineries increased supplies to Europe and Latin America at the expense of the US East Coast, where inventories have fallen to their lowest levels since 1996. As New York Harbor is the delivery point for futures contracts for ultra-low sulfur diesel fuel, the limited supply in this area has a particularly large impact on the visible prices.

These events highlight the importance of focusing on the cost of fuel products, not crude oil, when trying to identify the level of prices at which higher prices will begin to negatively affect demand. As a result, refineries are earning exceptionally high earnings with margins hitting record levels in both the US and Europe. The charts below present the refining margin. crack spread), i.e. the margin on the production of diesel oil from WTI crude oil in the United States and Brent crude oil in Europe.

Given the ongoing war and the risk of additional sanctions or actions by Russia, the risk of a decline in oil prices remains limited in our opinion. In our recently published quarterly forecast We identified the reasons why crude oil may be in the $ 90-120 range this quarter and structural issues, notably the persistent level of underinvestment, will continue to support prices in the coming years.

In the light of the lack of investment, which currently raises concerns about future supply levels, this week we will be closely monitoring the earnings of leading European oil companies such as Shell, Enel, BP and Equinor. Moreover, given the aforementioned increase in refining margins, Valero's results.

Gold and copper

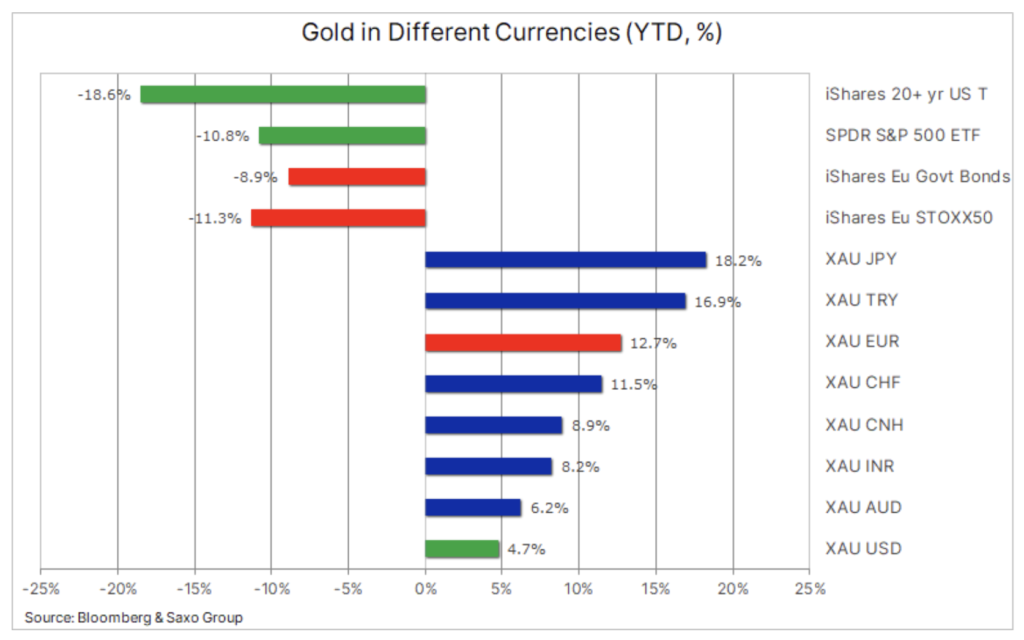

Gold was heading for the first month-to-month loss in three months, with the two main factors in this regard being the expected acceleration in the pace of monetary policy tightening by the US Federal Reserve and the mentioned strengthening of the dollar. Silver depreciated the most; its price fell to its lowest level in two and a half months, around USD 23 per ounce as a result of the weakening of the industrial metals sector due to the situation in China. As a result, the XAU / XAG ratio broke above the resistance of 80 ounces of silver to one ounce of gold. A renewed interest in Chinese economic stimulus initiatives, as mentioned above, would allow a floor to be set up for silver, thus reducing its recent negative impact on gold.

Recently, I was asked why gold is performing so weakly when inflation is at its highest level in several decades. My answer continues as follows: gold is doing very well and is responding to the expectations of a diversified investor.

We tend to focus primarily on dollar-denominated gold, and as you can see in the table below, the XAU / USD ratio has bounced "just" around 5,5% this year so far. However, if we add the results to this the S&P 500 index and long-term US bonds, things are starting to look much better. Gold priced in dollars so far this year has outperformed both of these key investment sectors - by 15% and 23% respectively. For gold traded in other currencies, the results look much better due to the influence of the strong dollar.

European investors looking to hedge against rising inflation and the sharp worsening economic outlook improved gold returns - 24% and + 21% respectively - compared to the Euro Stoxx 50 benchmark and euro-denominated government bonds. We maintain a positive outlook for gold due to the need for diversification in contrast to volatile equities and bonds, increasingly grounded inflation and persistent geopolitical problems. After finding support at $ 1 last week, a close above $ 875 could mark a renewed growth potential fueled by new momentum and technical buy orders.

Copper it broke the upward trend from the 2020 low, which led to a decline to a nearly three-month low of USD 4,40 per pound, before the improvement in sentiment was not influenced by China's announcement that it would maintain its target economic growth at 5,5%; the Chinese economy is now well below this level. While the short-term outlook for demand has deteriorated and stocks in the stock exchange-monitored warehouses have increased over the past four weeks, we believe the outlook continues to be favorable for prices. The need to act to isolate Russia by reducing dependence on Russian oil and gas is likely to accelerate global electrification, which will require significant amounts of copper.

Moreover, Chile, a supplier of 25% of the world's copper, has experienced a slowdown in production in recent months, and in the face of rising "anti-mining" sentiment in the newly elected government, the prospect of maintaining or even increasing production seems doubtful. In addition, in Chile, drought has been going on for 13 years, and water shortages have a significant impact on the water-consuming process of copper production. In addition, the government presented a bill aimed at prioritizing water consumption by people; if it is passed, it may not only delay investment decisions, but also force mining companies to invest in desalination plants, which will further increase production costs.

Agricultural products

Soybean oil futures traded on the Chicago Stock Exchange hit record prices as Indonesia's palm oil export ban and sunflower oil rationing in European supermarkets further reduced the world's edible oil supply. Export restrictions on palm oil used for everything from cooking to cosmetics and fuel will remain in place until domestic prices fall, and with Indonesia consuming only a third of its production, exports are expected to resume as soon as stocks are rebuilt and stabilized prices. The edible oil sector, which has grown 56% over the last year according to the UN Food Price Index, has suffered the most from weather conditions and war in Ukraine, the world's largest exporter of sunflower oil, leading to food protectionism by producers, and this is railways may cause prices to rise further.

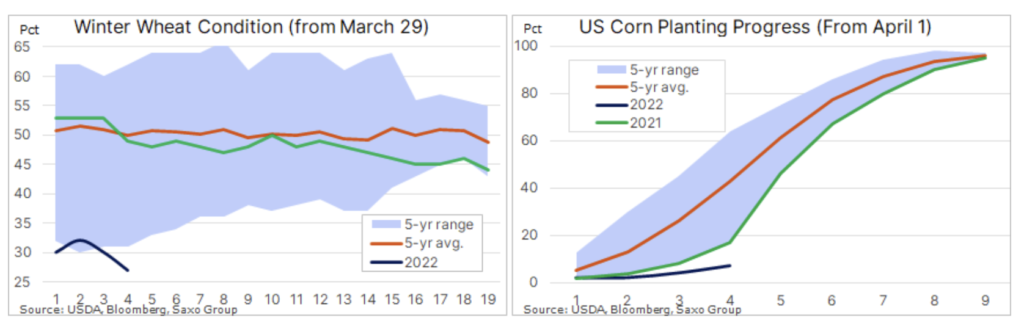

Speculative investors have recently increased their involvement in US grain futures to record levels as slow seeding progress and deteriorating growing conditions pose a challenge and provide price support. In a recent weekly report, the US Department of Agriculture said maize sowing progressed by 3% and overall seeding was 7% achieved, the slowest rate in nearly a decade and lagging behind last year's rate of 17%. Good / Excellent quality winter wheat fell by 3% to 27%, which was almost the worst result ever. Sowing delays and conditions were the result of either too cold or too humid weather conditions, or a combination of both. A large grain harvest in North America is essential this year after Russia's invasion of Ukraine limited supplies from the Black Sea region, where 25% of world wheat exports come from, while raising doubts about Ukraine's grain production this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)