The increase in the price of natural gas was the main factor behind the squeeze on the uranium market

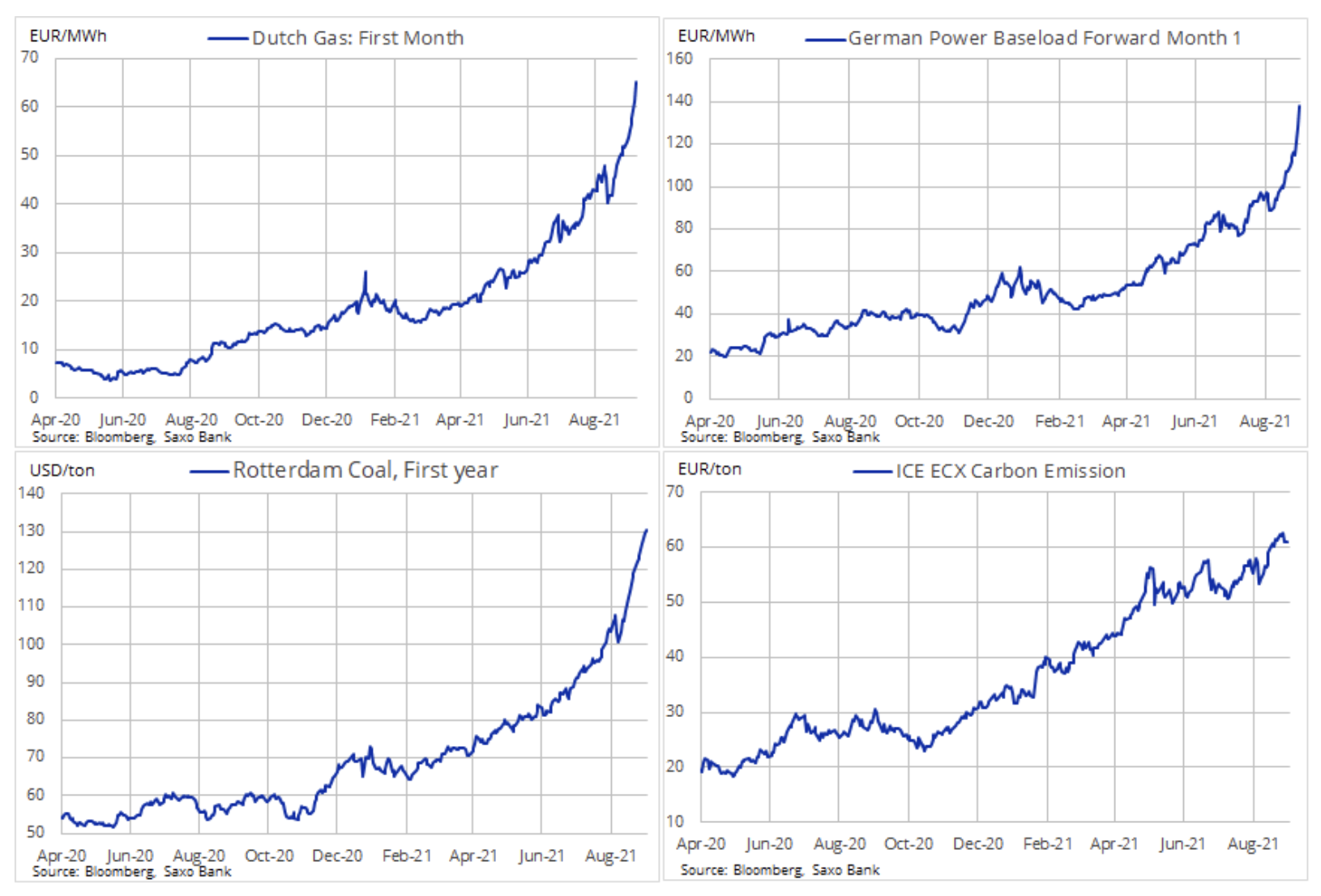

Global gas market and energy is still on fire, and limited supply and concerns about winter supplies are pushing gas prices in Europe to new all-time highs every day. This increase, in turn, is driving a strong demand for coal and emissions to offset the use of more polluting fuel. The end result is an above-average increase in electricity prices on the European continent, increasingly noticed by consumers and governments, and politicians are starting to worry about its potential impact on support for green transformation.

The vigorous drive to decarbonise the European energy market has stalled as wind and solar cannot supply the minimum quantities needed. If we add to this the prospect of limited supplies, with the lowest stock levels in many years on the eve of winter, we get a veritable perfect storm driving prices up.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The old saying that the best medicine for high prices is high price may hold true to some extent under the present circumstances. Not only is there a risk that certain industries may be forced to cut their electricity consumption this winter, but the recent record price hike in Europe has caught gas prices catching up with Asian prices, potentially opening up prospects for LNG supplies to Europe.

However, the very active hurricane season in the United States caused supply disruptions in America as well, and contributed to the growth of gas futures contracts with Henry Hub to their highest level in 7,5 years, ie $ 5,24 / MMBtu. However, from a supply point of view in Europe, the very active hurricane season in the United States, with the last, Hurricane Nicholas, arriving in Texas, runs the risk of disrupting liquefied natural gas installations on the Gulf Coast.

Putting the current high prices in Europe in perspective: the price of the Dutch TTF gas contract with the nearest expiry date has risen to almost EUR 66 / MWh, more than four times the average of the last five years and is equivalent to over USD 130 per barrel of oil. Energy prices in Germany, with an execution deadline in 2022, increased to EUR 102,25 / MWh, which is 2,7 times the five-year average. The limited supply of gas forced energy producers to return to coal, which not only increased the prices of coal for delivery in Rotterdam to long-term highs, but also increased demand for CO emission allowances2 under the EU Emissions Trading System.

Uranus triggers the nuclear option

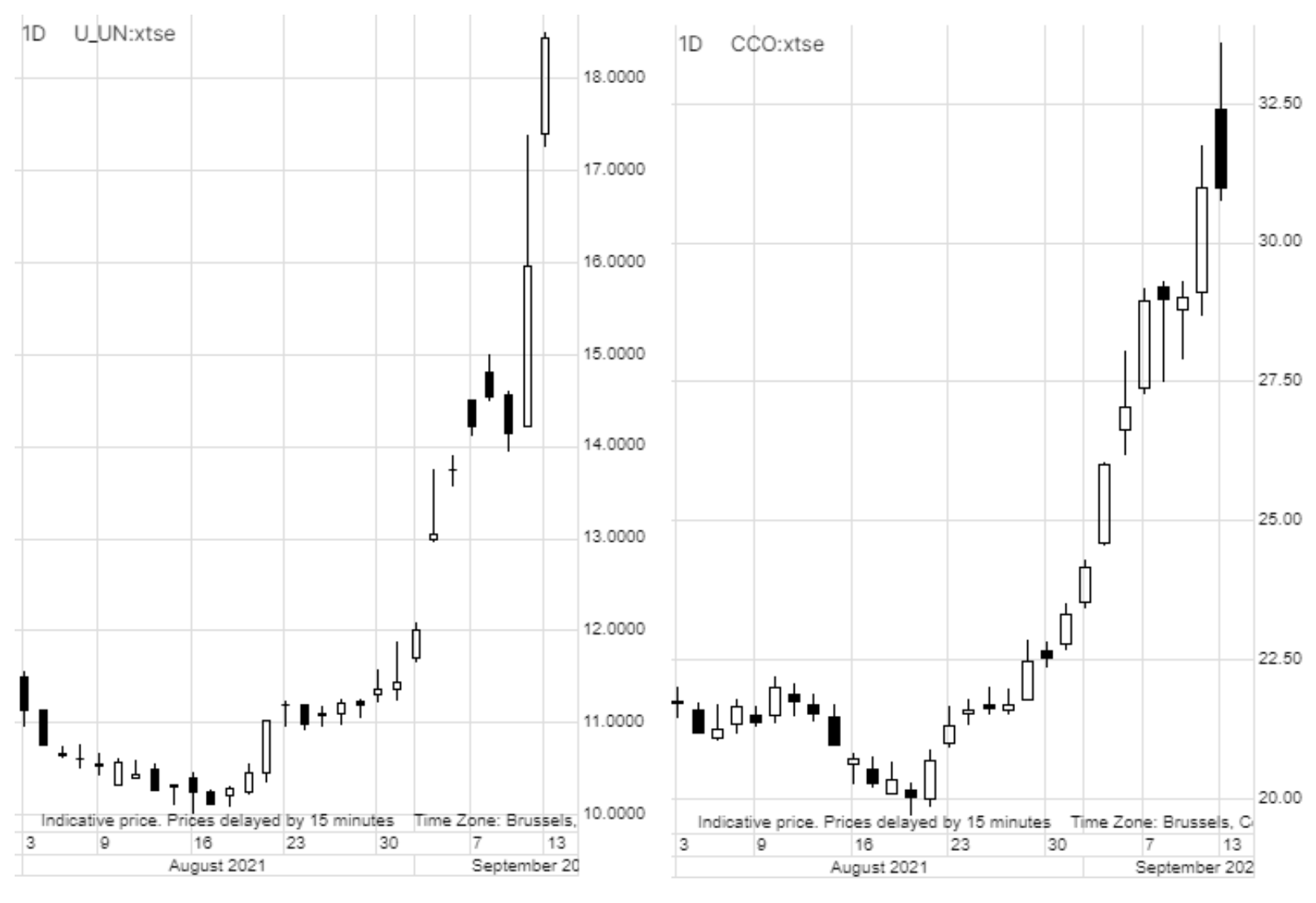

Another energy source that has come to the fore as a result of the drive for green transformation is the uranium mining sector (URA: arcx). However, after booming in the first part of 2021, the sector began to slow down as the price of U308 uranium stalled around $ 30 / lb. However, this stalemate has changed dramatically over the past month with the arrival of the Sprott Physical Uranium Trust (U_UN: xtse). His goal is to invest and hold most of the assets in the uranium, and in the past month he has amassed millions of pounds of physical raw material used to power nuclear reactors.

The removal of U308's physical uranium from the market pushed the price to $ 44 / lb and while Sprott Trust saw an 82% increase last month, Cameco Corp (CCO: xtse), one of the world's largest uranium producers, surged 55% . Like cryptocurrency investors, uranium investors are very vocal and are convincing with enormous commitment that prices will go up even more. Sprott Uranium Trust gave them a product that, as a result of the elimination of physical metals, can contribute to higher prices by increasingly limiting the supply on the market.

The long-term success of uranium as an investment will depend on governments around the world, particularly in Europe, recognizing that nuclear energy is the inevitable next step towards reducing the global carbon footprint. However, it is worth remembering that such an increase in demand may only take place in a few years, taking into account the construction time of a modern nuclear power plant.

Therefore, it should be borne in mind that while the current increase in gas and energy prices is associated with a change in the foundations of demand and supply, the uranium boom is driven solely by the actions of speculative investors; some of them count on short-term gains while others assume that the sector has a great future. Without the discovery of new energy sources or the development of nuclear energy, it will not be possible to reduce the levels of global CO emissions2. In this context, the nuclear sector has a bright future ahead of it, but needs to be backed up by increasingly constrained supply and demand foundations, rather than a metal pooling speculative fund that can easily re-enter the market when investors switch to other investments.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)