China's economic growth and inflation remain crucial

March got off to a solid start in commodity markets as data from China confirmed that activity in the world's largest consumer of commodities is gaining momentum.

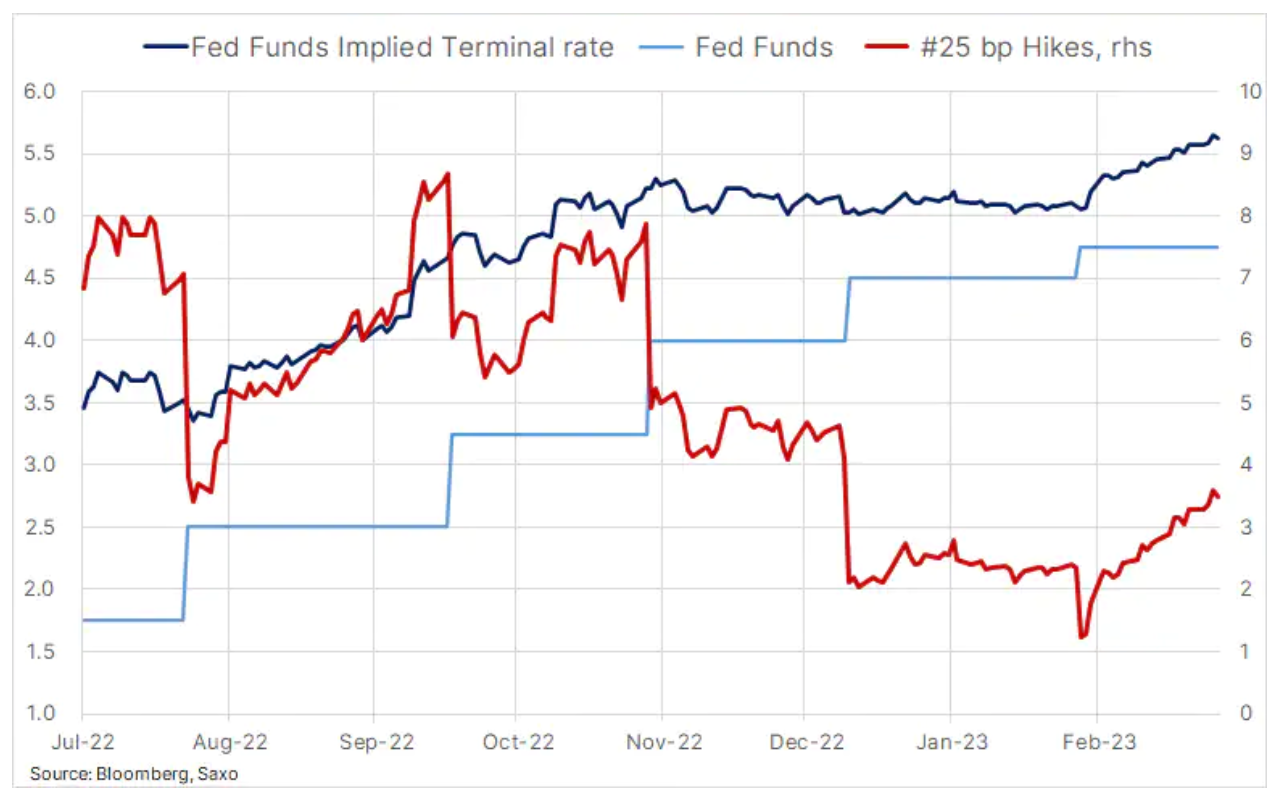

However, price increases are hampered by the prospect of sustained inflation in other countries, leading to higher interest rates and lower economic growth. Eurozone inflation rose by 8,5% yoy in February, unchanged from January and contrary to expectations for a decline, while price pressure reached a new record high of 5,6%. In the US, 4-year treasury bond yields exceeded XNUMX% for the first time since November in reaction to data indicating continued price pressure. This supports the view that the US Federal Reserve will continue to raise rates and then hold them for as long as necessary until inflation is brought under control.

The swap market is currently pricing in the maximum level of US interest rates until September at around 5,6%, while the futures market expects a cut of almost 75% over the next twelve months. In other words, incoming economic data will need to remain strong to support the over XNUMX basis point rate hike currently priced in. Any weakening could automatically lower expectations, while shortening the time interest rates remain at their peak. This increases concerns about economic growth, while supporting risk appetite due to the accompanying weakening of the dollar and declining bond yields.

Will China's 'double session' add momentum to China's recovery?

After expectations of an economic recovery in China from the Covid pandemic faded into the background in February, they are now back in the spotlight as the manufacturing economic activity index (PMI) rose to its highest level since 2012. According to another report Residential property sales in China rose for the first time in 20 months after authorities stepped up support for the struggling sector. According to report, the strength of the current economic recovery surprised the Chinese authorities, suggesting that the government will be restrained in introducing new stimulus this year.

As a result, investors are now focused on the Chinese government and what measures it will take to further support the economic recovery. The first session of the 14th National Committee of the China People's Political Consultative Conference will begin on March 4, followed by the 14th China National People's Congress on the following day. During the so-calleddouble sessionThe Chinese authorities will present a list of social and economic development goals, as well as an official forecast of economic growth and various policy measures to achieve these goals.

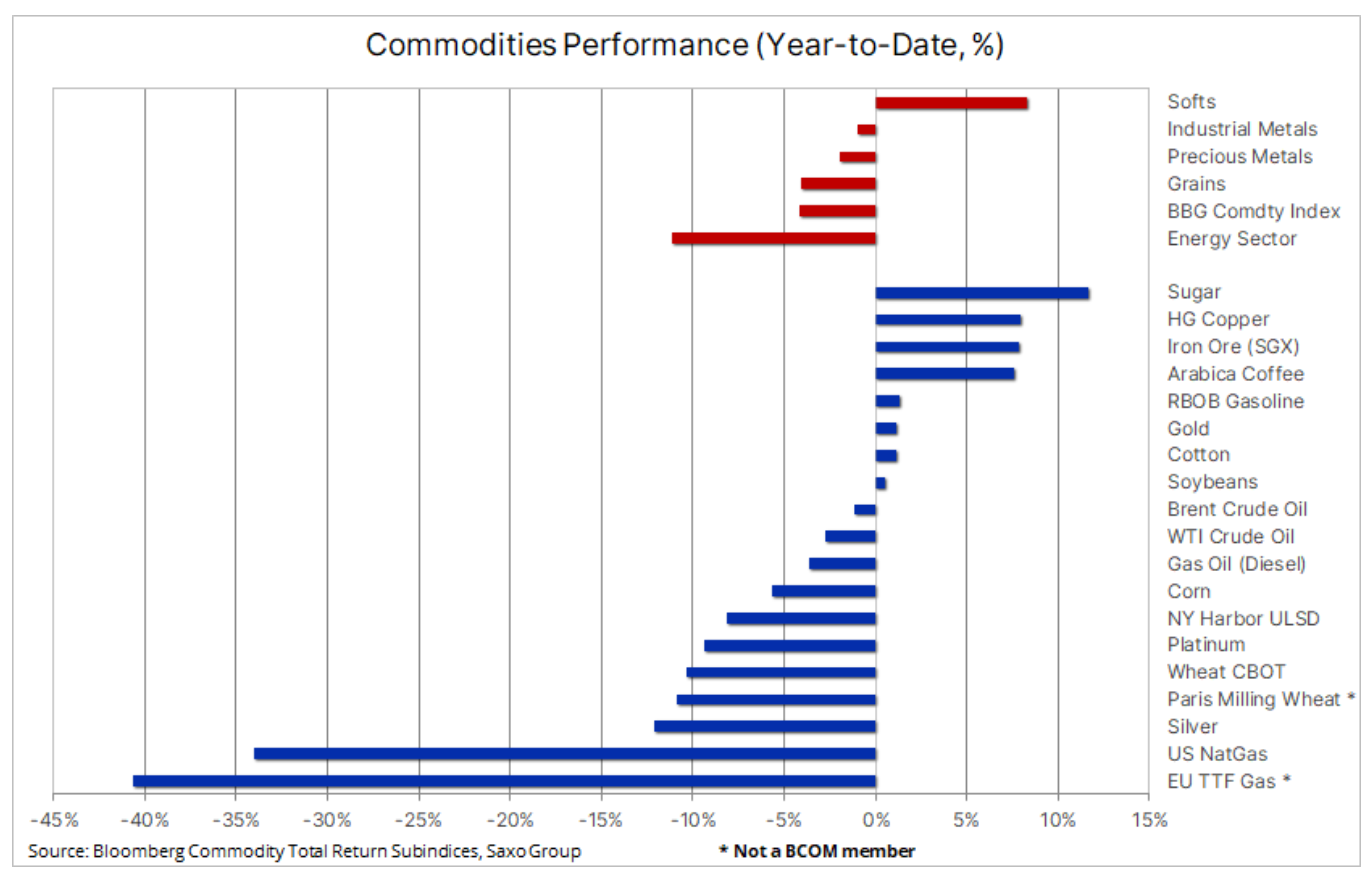

Raw materials are recovering after a hard February

Commodities remained in the background for most of February, with losses across all key commodities, from energy to industrial metals and precious metals. These losses were primarily the result of still strong US economic data, including inflation, which forced the Fed to tighten its hawkish rhetoric, while at the same time causing bond yields to rise and the dollar to strengthen, which worsened risk appetite in stock and commodity markets. However, while some of these fears have been offset by the above-mentioned solid data from China, the short-term outlook remains balanced, with no clear factor yet to emerge that could significantly impact the stalemate between bulls and bears. This is most evident in the energy market, where crude oil has remained within the range since the end of November.

The Bloomberg Commodity Index, which monitors a basket of 24 major commodity futures with an almost even split between energy, metals and agricultural commodities, fell 4,2% year-on-year after a 4,7% drop last month offset January's gain , In

especially for precious and industrial metals. Primarily, the prices of soft products such as coffee, sugar and cotton, supported by the forecast of increasingly limited supply. The energy sector hit rock bottom, largely due to losses in the US natural gas market, which was oversupplied. As in Europe, the price of US natural gas fell sharply last month as a mild winter reduced heating demand, followed by an unexpected jump of almost 30% last week on signals that production could start to feel the effects of a downturn prices and increase in LNG exports to the level of the annual maximum.

Oil prices will not change in the short term

In the case of oil, there is a growing likelihood that the current year will be divided into two distinctly different halves. Oil prices will remain in the range for the first half, with concerns about global economic growth offsetting the impact of strong, rising demand from China and India. Later in the year, we see a substantial risk that market supply will become limited as recession in Europe and the US fails, turning market surplus into deficit. In addition, the protracted war in Ukraine makes it difficult for Russia to maintain the current level of production, primarily due to problems with the redirection of petroleum products from Europe. What's more, competition from refineries in the Middle East is growing - the newest refining center, whose production capacity will increase even more in the second half of the year.

Petroleum, which has been within the range since November, still has not received a directional impulse to break out of the established ranges - USD 80-89 for Brent oil, USD 73-83 for WTI oil. Strong economic data from China helped offset lingering concerns about the economic outlook in the US and Europe, where interest rates are likely to continue rising in the coming months. These developments, coupled with a weaker dollar and direct spreads pointing to a decline in supply, contributed to a modest weekly gain. For Brent, a weekly close above the 83,75-day moving average of $XNUMX could signal additional upside momentum, but we generally don't expect a breakout from these ranges anytime soon.

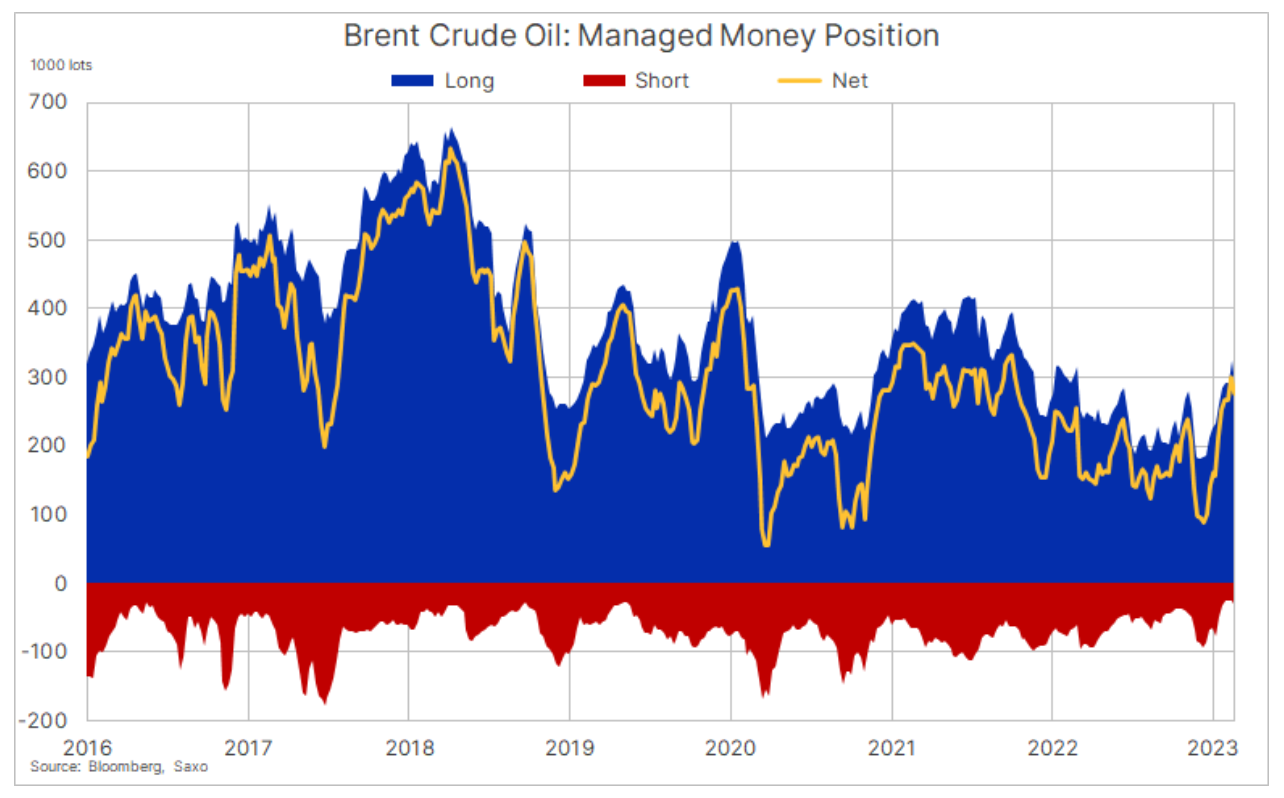

COT data indicate support for higher Brent oil prices

On Friday, February 24, the ICE Futures Europe exchange published Commitment of Traders (COT) data delayed by four weeks, updating its reporting in this regard after the January cyberattack on ION Trading UK, which caused delays in reporting trades. Meanwhile, the US Commodity Futures Trading Commission (CFTC) released one COT report for the week ending January 31; the data will probably not be updated for another three weeks. ICE Brent data showed unwavering support for higher prices, with the fund-managed or hedge-fund money category showing a net-long position of 277k. lots, the highest level in 16 months, and the lowest gross short position since 2011 at 28. flights.

Return of gold buyers amid persistent inflation

For gold it was the best week since mid-January after a hot inflation reading in the EU and strong economic data from China, which is the main buyer of this metal. As a result, the dollar depreciated and the price of gold soared, surpassing the 3-day moving average (currently $1) for the first time since Feb. 844. President at the beginning of the week Federal Reserve Bank in Atlanta, Raphael Bostic said that the Fed funds rate could go up to 5,25% and stay at that level until 2024, however, given that the market is already pricing in a terminal rate above 5,5%, the negative impact of this comment the price was limited.

It's also worth noting that the 10 basis point jump in US 1-year bond yields this week was primarily driven by yields rising above break-even (inflation), while real yields remained almost unchanged. This confirms our long-standing view that persistent inflation will force an upward revision of future inflation expectations over time. Combined with demand from central banks, gold's upside potential was unaffected by the recent correction. However, for the current recovery to attract support from technical buyers, gold and silver prices must at least break above the $864 and $22 levels respectively to signal the end of the current correction.

China's PMI provides a boost to industrial metals

Copper, aluminum, zinc and iron ore posted gains after the aforementioned series of economic data from China showed an increase in factory activity as well as an increase in residential property sales, raising expectations for a faster recovery in demand. The news added further momentum to an already bouncing copper market that recently retraced to a key area just below $4 and found support there. However, following the recent strong rise in stock-monitored stock levels in New York, London and most notably Shanghai to September 2021 highs, the immediate prospect of a strong rebound seems unlikely until the inventory overhang is offset by rising demand – a process that may take several months. Currently, investors' attention is focused on the Chinese "double session" and what actions the Chinese government will take to continue to support economic recovery after the end of lockdowns.

In general, we maintain our long-standing constructive opinion on industrial metals, especially copper. However, due to the aforementioned inventory overhang, another sustained upward move is unlikely to occur before Q3,95. This timing is to some extent dependent on economic outlook for the rest of the world and whether a recession can be avoided, which we believe is possible. For now, the market will focus on price action for clues, specifically traders' reaction to a retest of support at $4,24 or $XNUMX, February highs.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)