Covid's Change of Inflation Narrative by Trump

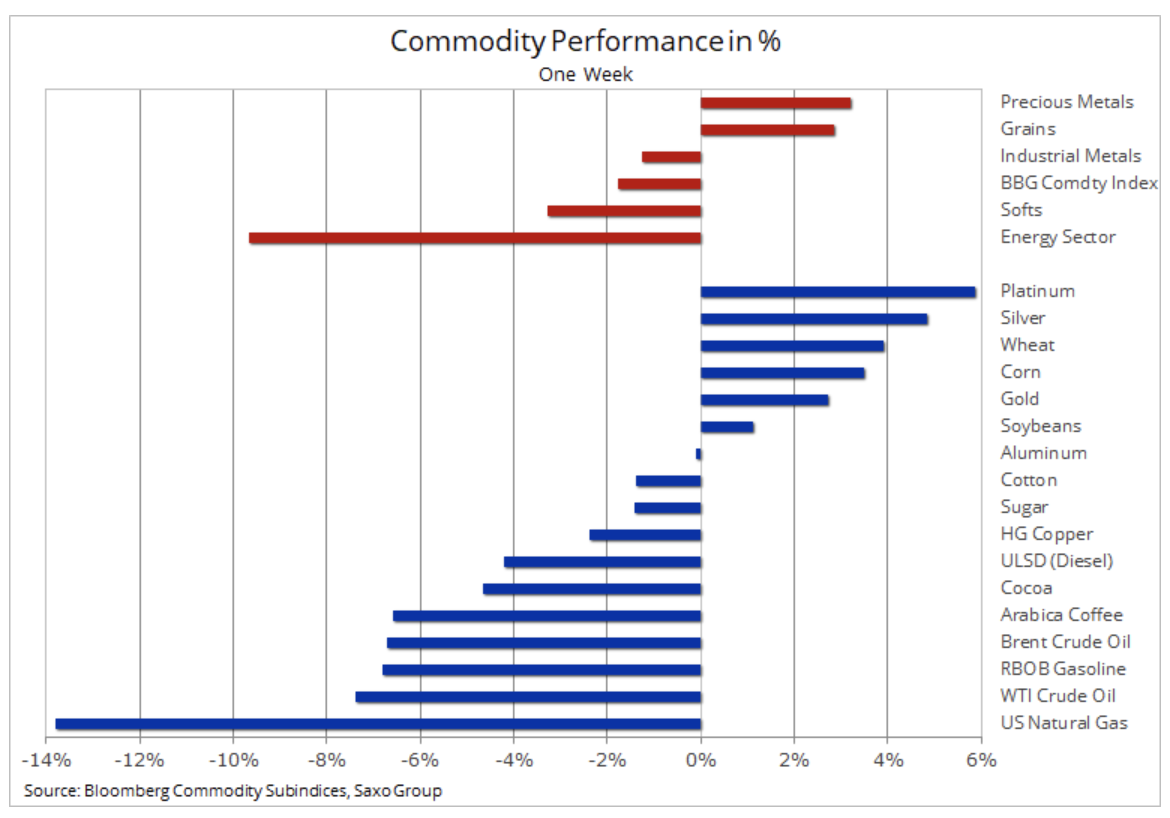

Commodity prices have declined for the second consecutive week as the Covid-19 pandemic continues to threaten global economic outlooks, and thus demand projections for a range of commodities dependent on economic growth, from crude oil to copper. Information given on Friday that President Donald Trump and his wife test positive for Covid, contributed to the strengthening of the movements started earlier in the week.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The situation on the commodity market

The positive result of the Trump test initially led to a decline in stock prices and a simultaneous strengthening of the price of gold and the US dollar. This is likely to bring even more attention to the way the president handled the pandemic in the context of the re-election fight against Joe Biden, who is currently polling. For now, the market has assumed that recent events could further weaken Trump's chances of re-election, which is seen as potentially negative for the dollar - hence the limited positive US response to this news.

Precious metals continued to appreciate after the recent correction, which, given the relatively long decline time, failed to change the positive outlook for this sector for the coming months. Silver i platinumthat suffered heavily during the relegation took the lead alternately.

He was in second place cereal sector, ending the third quarter with an increase of 12,3%, which was the best result in over five years. The most recent spike came after the US Department of Agriculture stock data showed that corn, soybeans, and wheat performed in line with analysts' average estimate. Intensive buying was an important factor variety i wheat by China, which was rebuilding its pigs after the African swine fever epidemic. In addition, estimated lower yields in the United States and dry air in South America could mean that the sector will begin to strengthen after years of oversupply.

It was a good quarter for broadly understood agricultural products: the sector ended it with nearly XNUMX% profit, and all three subgroups - cereals, "soft" agricultural products and livestock - surged. Due to the strong finish of the cereals sector, it is now expected that lower production in the United States due to unfavorable weather conditions in August and increasing concerns about La niña will continue to support this sector in the coming months.

Accordingly, in recent weeks more and more attention has been paid to the translation of inflation from commodity markets into the economy as a whole. If it did, it would be the worst type of inflation, however, as it would hit consumers, particularly in emerging markets that are least able to afford it. Concerns about reflation are offset by changes in raw materials dependent on economic growth, such as energy and industrial metals - crude oil and copper have declined in response to weakening fundamentals.

Petroleum

Price drop oil was prolonged due to concerns about the pace of recovery in world fuel demand and the ability of OPEC to keep production low. This is because the Libyan oil industry, de facto closed due to civil war since January, is starting to function again, which could lead to a rapid increase in production in the coming months.

The problem on the demand side, in turn, is the continued rise in Covid-19 infections leading to new lockdowns. Given that the timing of a commercially available vaccine is still uncertain, the CEOs of the three largest independent oil trading centers see no chance of significantly improving world oil demand for at least another 18 months.

After establishing resistance at $ 42,60 / b, Brent oil fell below the most recently identified support, falling to its lowest level since June. The market continues to see the next key level of support at the June 12 minimum at USD 37 / b. Due to the possibility of a further slowdown in production in the United States and the risk of additional actions from OPEC +, we do not expect the oil price to collapse similarly to April. But it is clear that improvement will not happen until the pandemic is under control or a vaccine is widely available.

The gold market

Gold It returned to a relatively safe level above $ 1 / oz after a recent correction, which was relatively weak from a technical perspective and within an established uptrend. Since the August high, gold-backed fund traders have shown exceptional resilience. Despite the downward revision of $ 900, the amount of gold held by these investors has not decreased. The current level of 226 million ounces is close to the last record volume.

We maintain a positive outlook for gold, and while we do not expect significant short-term changes in real yields and inflation, the uncertainty ahead of the US presidential election in November should be enough to discourage investors from taking a profit, before the dollar weakening we forecast and real yields decline. will lead to an increase in prices in 2021

Copper market

Copper, for which we have warned about the risk of a correction in recent weeks, it recorded the largest decline since March. This was in response to a weakening in fundamentals, reflecting the recent spike in inventory stocks monitored by the LME and the commencing slowdown in China as lending tightened. In addition, the recent appreciation of the dollar and the high speculative stance of funds have put price to a large extent to decline after six consecutive months of profits.

Technically, HG copper has already hit its first target of $ 2,84 / lb; the second key level will be the August low of $ 2,7850 / lb.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)