15 million unemployed in the US "covered" by the new Fed program

Last week in the United States, the number of newly registered unemployed reached over 6,6 million, which resulted in a total increase of 15 million unemployed in three weeks. The coronavirus pandemic, of course, is to blame, which, like in many other countries, has forced Americans to stay at home and has led to a sharp slowdown in demand for services and many goods.

US in the face of unemployment

A sharp jump, and basically the explosion of unemployment in the US, almost immediately translates into moods. In April, household sentiment, illustrated by changes in the University of Michigan index, was the worst since December 2011.

The US administration and the Fed continue to try to cushion this sudden shock in the economy, taking further steps to protect it from the effects of the coronavirus pandemic. Thursday Federal Reserve (Fed) has added one more thing to earlier actions. It launched a $ 2,3 trillion program to support local authorities and small and medium-sized enterprises. Through the banks, the Fed has made available 4-year loans to companies and will buy city and state bonds.

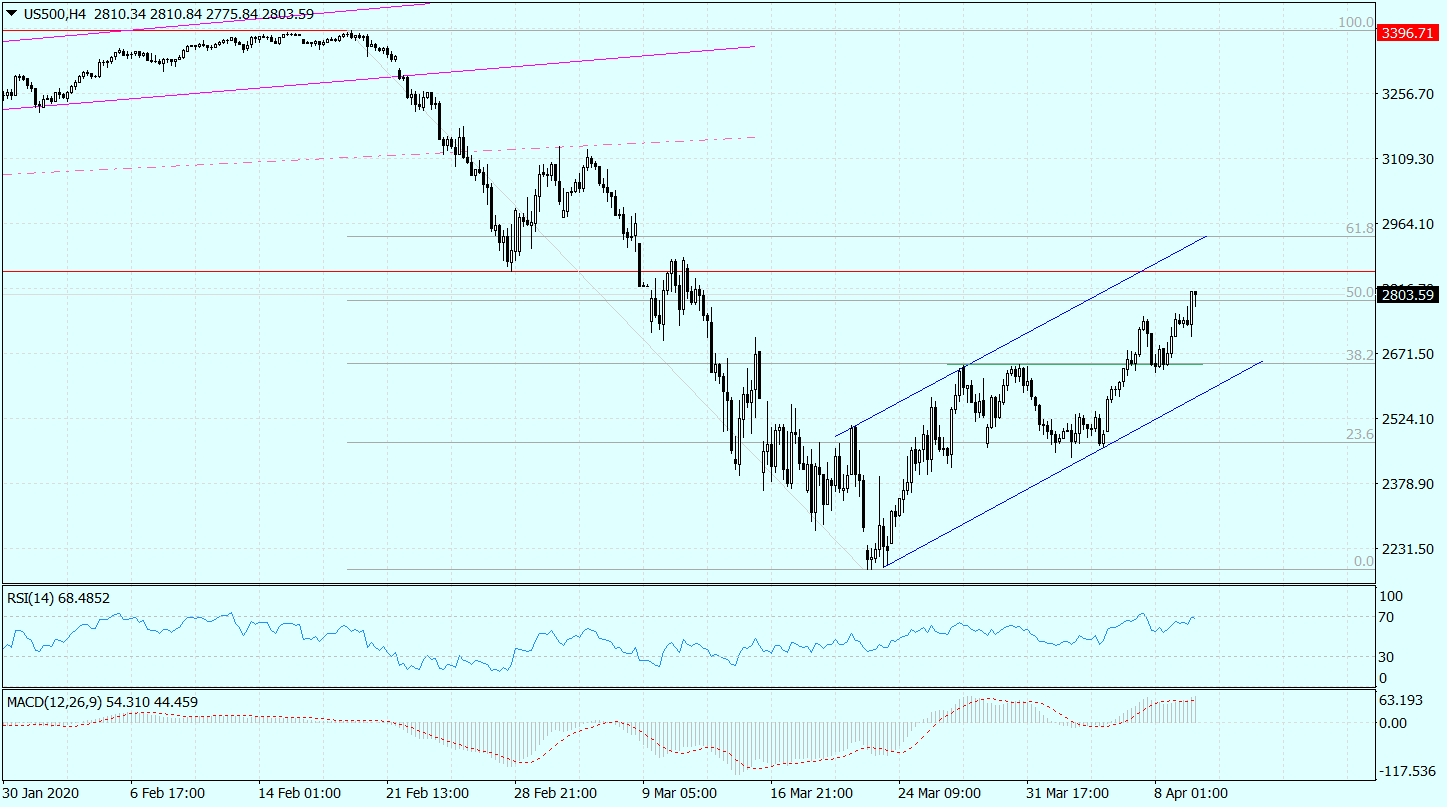

The Fed's efforts are seeing the financial markets. Thursday's session on Wall Street started with strong gains. The S & P500 index attacked the barrier of 2800 points, growing by 27,7%. from the March low of 2191,86 points

US500 chart (CFD per index S & P500), interval H4. Source: MT4 Tickmill.

The improvement in market sentiment and the associated increase in risk appetite, while the Fed is pumping money into the economy, pushes the EUR / USD exchange rate up, allowing it to continue its correction of falls at the turn of March and April. On the basis of technical analysis, this pair currently has an open path to at least 1,10.

Chart EUR / USD, H1 interval. Source: MT4 Tickmill.

Thursday is the last day of active trading on financial markets. On Friday many of them will already be closed. Similarly on Easter Monday. Normal activity will not return until Tuesday. Then investors will look again at the subject of coronavirus. And from all sides. A week after Christmas, the season of quarterly results will be launched by Wall Street companies. Data on the dynamics of Chinese GDP in the same period will be published. The March, i.e. already covering the time of the epidemic, macroeconomic data from Europe and the USA will begin to flow. Finally, the decisions of some European governments to loose some of the restrictions imposed in connection with the coronavirus epidemic will be closely monitored. It promises to be no less hot week than the last ones.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)