The path to a bull market in the bond market is clear, although not without challenges

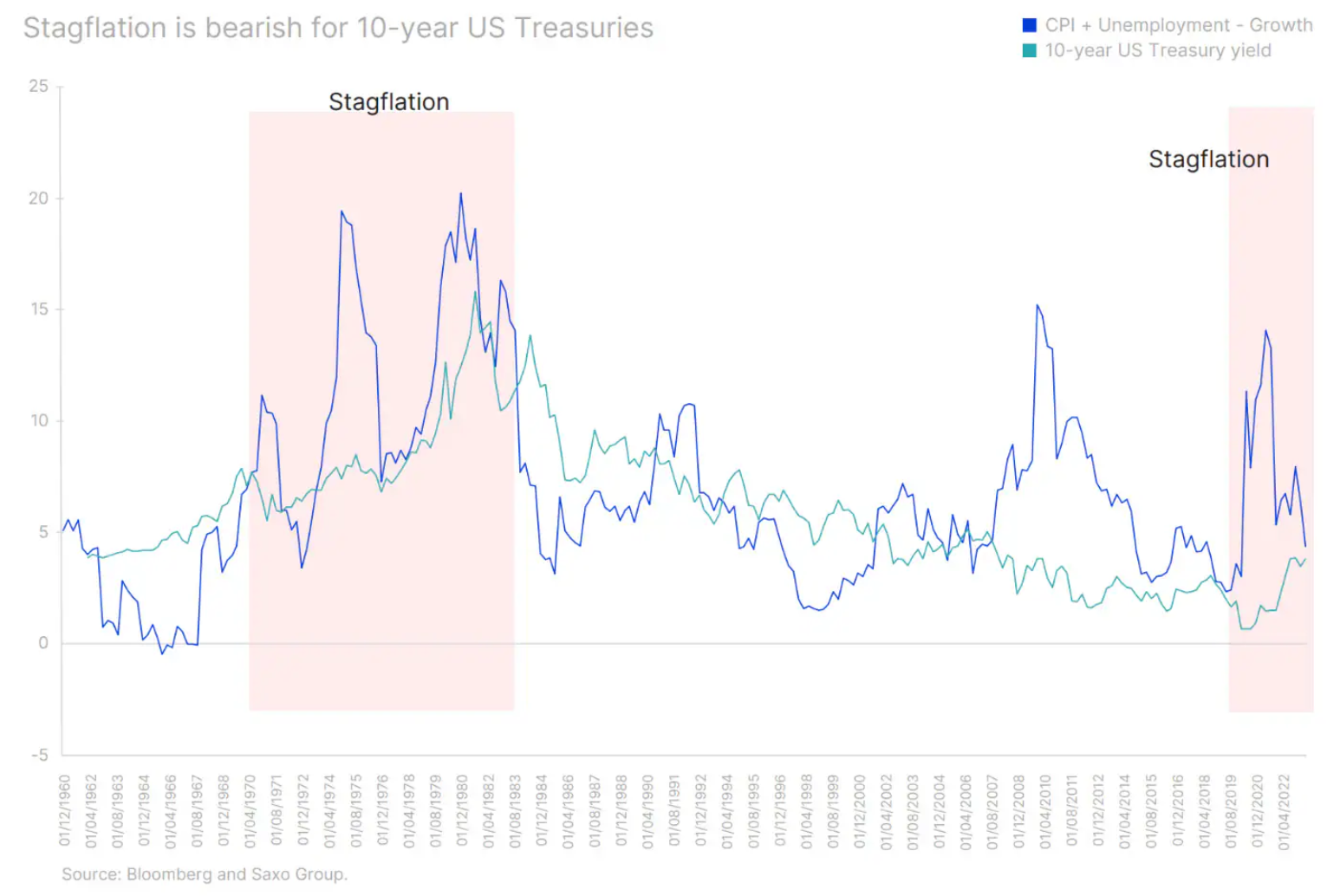

In the last quarter of this year stagflation will deepen on both sides of the Atlantic. The recession that started in Germany and the Netherlands will spread to other European countries, and economic growth in the United States will decline significantly. Still, inflation will remain high for the rest of the year and into next year, forcing central banks to maintain hawkish policies.

This does not mean, however, that there will be no further increases in interest rates. The increases in increases have already become smaller, and some central banks have even suspended increases at recent meetings. This means that we are nearing the end of the interest rate hike cycle, or that it may have already ended. This will be followed by fine-tuning of monetary policy to maintain a hawkish stance as inflation remains above central bank targets. However, there will be dark clouds on the horizon in the form of a slowdown in economic activity and geopolitical risk, which will create conditions for a bull market in the bond market.

Against this backdrop, a steepening of yield curves on both sides of the Atlantic is expected in the last quarter of this year as markets consider how long interest rates can be maintained at current levels before entering a downward cycle. While rate cuts themselves are beneficial for short- and long-term bonds, the period leading up to them may not be so for long-term bonds. That's exactly what we've seen recently with developed market yield curves bearishly sloping and US 4,36-year Treasury yields hitting 2007% in August, the highest level since XNUMX.

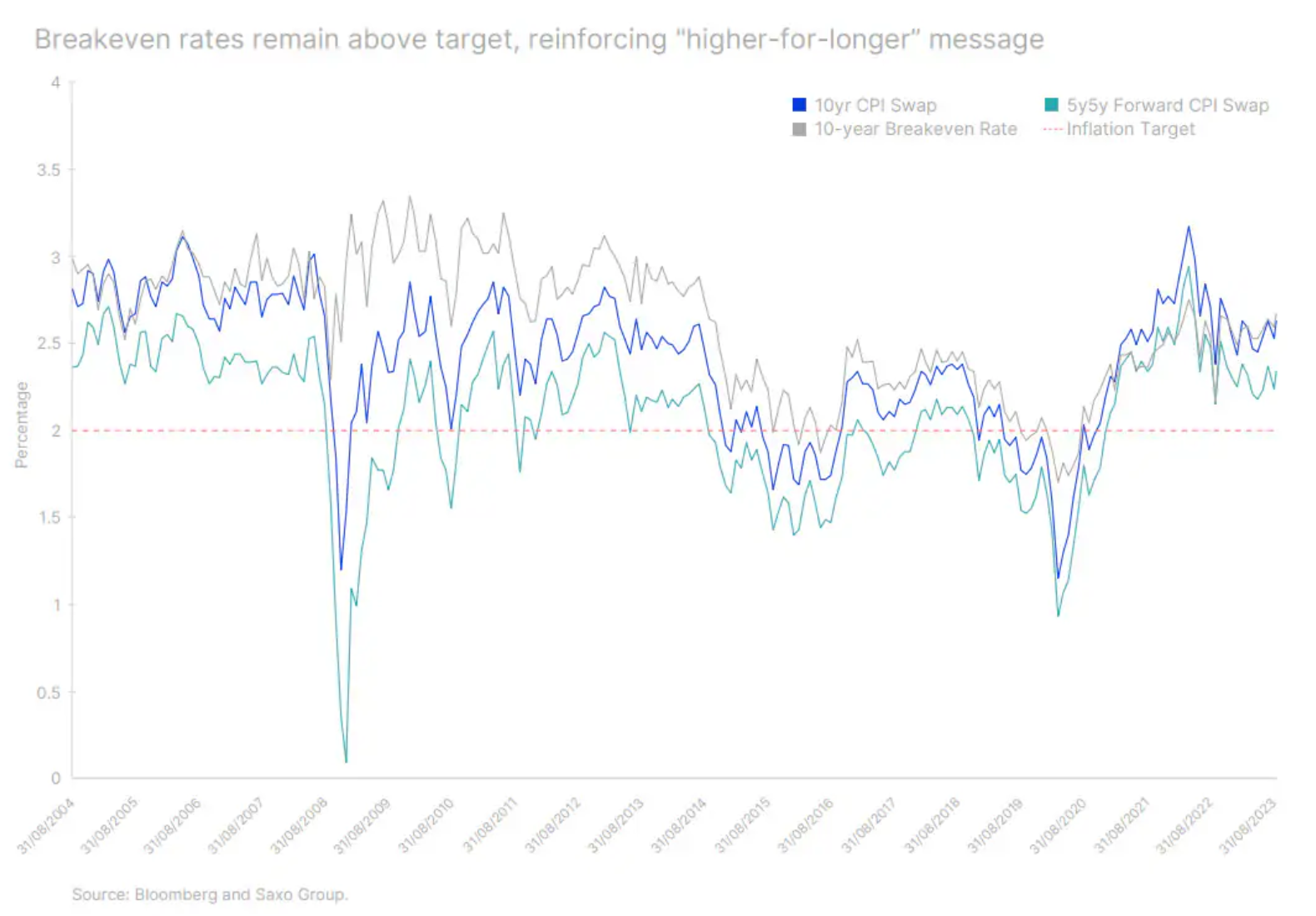

The “higher rates for longer” message reflects above-break-even yields. Despite a downward revision in inflation expectations from the 2022 peak, they have stabilized slightly above target Federal Reserve amounting to 2%. This means that the central bank may have no incentive to further increase interest rates, but it also has no incentive to lower them.

Therefore, long-term interest rates may continue to rise as the following factors put upward pressure on yields:

- Central banks repeat the mantra firmly "higher rates for a longer period of time". This means that while short-term rates remain anchored, the long portion of the yield curve is free to rise.

- Bank of Japan intends to abandon the policy of yield curve control. This means that Japanese investors will gradually return to domestic assets as Japanese bond yields rise.

- Quantitative tightening (quantitative tightening, QT). All central banks in developed markets have policies aimed at reducing their enormous balance sheets by not reinvesting some or all of their redemptions.

- Central bank expectations regarding the end of the interest rate hike cycle will motivate investors to engage in transactions to take advantage of the phenomenon steepening of the yield curve. This means that investors will buy bonds at the front end of the yield curve and sell securities at the long end, putting further pressure on long-term yields.

Therefore, we may witness a last increase in interest rates before their final decline, as central banks prepare to lower rates. Therefore, we continue to favor short-term treasuries and see an opportunity to increase duration exposure towards the end of the year (duration) bonds.

The time to increase exposure to the duration of bonds is approaching

Inflation remains a significant risk for bond investors. If it rebounds after central banks reach a peak in interest rates, it may mean the need to continue tightening policy despite a deep recession. While the greatest impact of this decision will be felt at the front of the yield curve, it is important to remember that long-term yields will also increase. This is what happened in the 70s: yields rose regardless of maturity as stagflation deepened. However, much smaller movements in long-term bond yields will result in more severe losses.

Two years old US Treasury Bonds (US91282CHV63) currently offer a yield of 5% and have a modified duration of 1,5%, which means that if the yield unexpectedly increased by 100 bps, the investor would lose just 1,5%. On the other hand, the 91282-year US Treasury note (US18CHT8) has a modified duration of XNUMX%.

Therefore, with inflation forecasts still uncertain, short-term bonds are ideal for storing funds while waiting for a better investment environment. At the same time, long-term government bonds become more attractive when inflation has no chance of rebounding.

As the recession deepens, concerns about inflation will fade into the background. Better opportunities to add fixed-duration securities to your portfolio will arise towards the end of the year, when central banks may be forced to ease economic conditions.

Stagflation argues for investing in inflation-linked securities

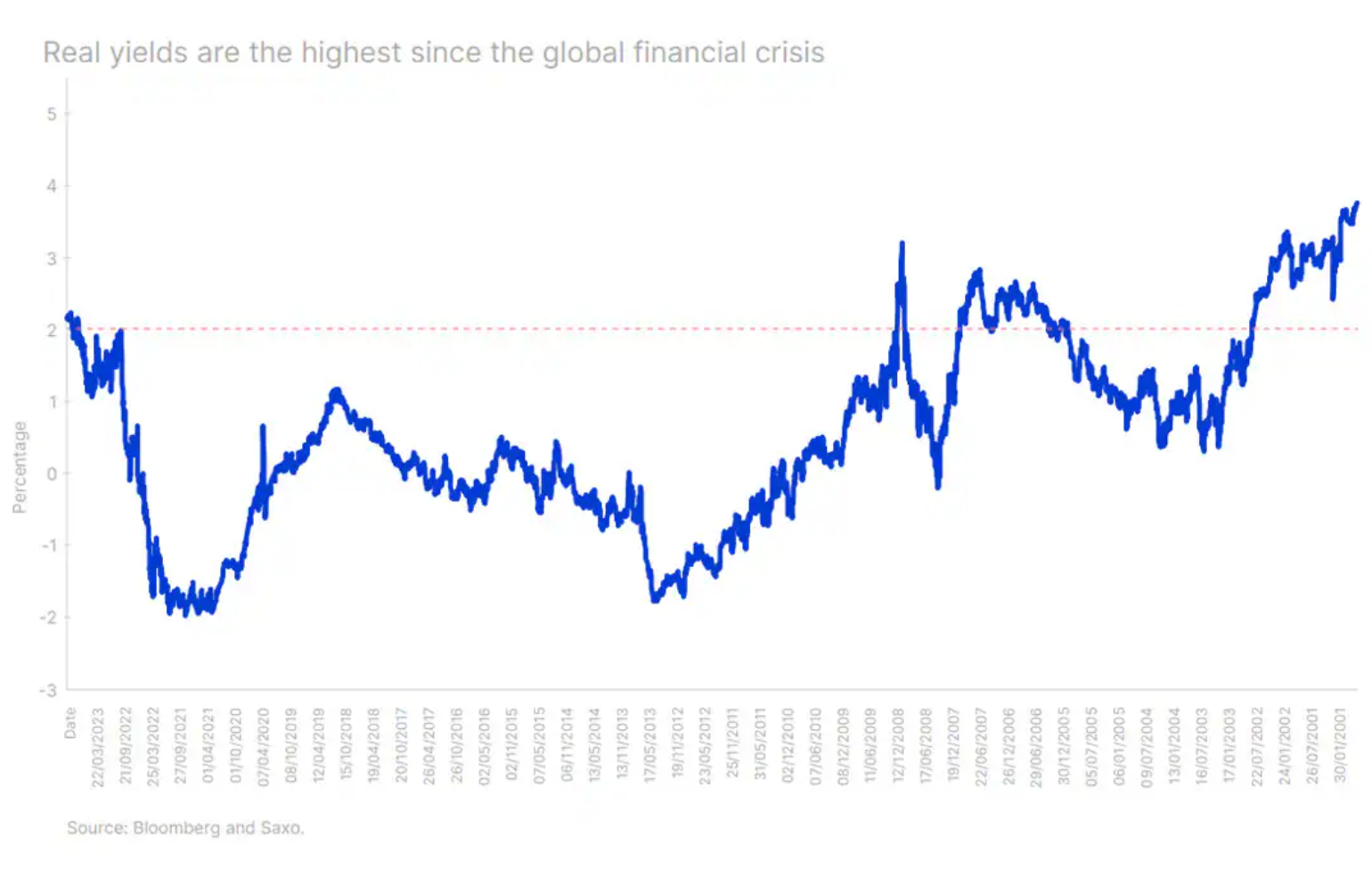

Inflation-linked bonds are a once-in-a-decade opportunity. A two-year US inflation-linked bond (US912810FR42) offers a yield of 3%. Ten years (US91282CHP95) and five-year (US91282CGW55) US inflation-linked bonds yield just above 2%, offering the highest yield since 2008 and contributing to the tightest conditions since the global financial crisis.

The beauty of inflation-linked bonds is that they provide dual exposure: to inflation and to interest rates. This means that if inflation increases, their nominal value and coupon will also increase. However, if inflation returns to its mean, inflation-linked bonds will benefit from falling interest rates despite lower coupons and face value at maturity.

Inflation is expected to remain high this year and next despite an aggressive rate hike cycle. We are therefore at a turning point where either interest rates will be too high or the market will not sufficiently take projected inflation into account in valuations. In both cases, inflation-linked bonds offer an excellent risk-reward ratio in an appropriately diversified portfolio.

Junk bond spreads will increase. The most important thing is quality.

While real interest rates of 2% represent a real opportunity for savers, they threaten borrowers and economic growth. The only period in which real rates remained above 2% were 2005-2007, preceding the global financial crisis. It would be naive to assume that real interest rates at historically high levels will not weaken high-risk assets.

As stagflation deepens and central banks maintain high interest rates, the credit foundations of enterprises will deteriorate. Companies will struggle with higher financing costs, and the ability to adapt to higher debt costs will depend on the credit quality of the company.

Today, the spread between junk and investment-grade corporate bonds is as tight as it was pre-pandemic, with junk bonds yielding an average of 270 bps more than investment-grade bonds. We therefore expect this spread to decompress and widen as defaults increase and pressure on interest coverage ratios increases.

We remain cautious and lean toward high-quality bonds over junk bonds. Investment grade corporate bonds are attractive, currently offering an average yield of 5,1%, near the highest level since 2008.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)