Bonds on everyone's lips - Saxo Bank forecasts for Q1

Markets are expected to experience volatility in 2024 due to weakening economic growth, falling inflation and geopolitical tensions. Central banks will likely be hesitant to aggressively cut interest rates, leading to uncertainty in bond markets. Investors should focus on high-quality government bonds, although selective investment in corporate bonds may be considered.

Declining economic growth, inflation and an unstable geopolitical environment

Markets should be ready for another bumpy ride in 2024. While slow economic growth and falling inflation have provided the basis for lower interest rates, monetary policy uncertainty and geopolitical tensions will remain.

As central banks began to aggressively raise interest rates, the likelihood of a recession increased among leading economists, and bond futures prematurely began to price in an impending cycle of cuts. However, central banks stuck to their "higher for longer" narrative, worrying markets throughout 2023. Interest rates then rose to the highest level in over fifteen years. Despite economic problems, policymakers do not expect to aggressively cut interest rates in 2024. However, recession in the U.S. economy could change that quickly.

An unstable geopolitical landscape will increase market volatility. The United States faces geopolitical tensions in Ukraine, Israel and Taiwan. As Americans head to the polls in November, the political situation in 2024 will likely turn to gridlock, lowering fiscal impulse and increasing uncertainty about economic growth.

The above requires central banks to be cautious about further tightening their policies or loosening them too quickly, which implies greater volatility in bond markets.

The bond market offers attractive prospects for investors

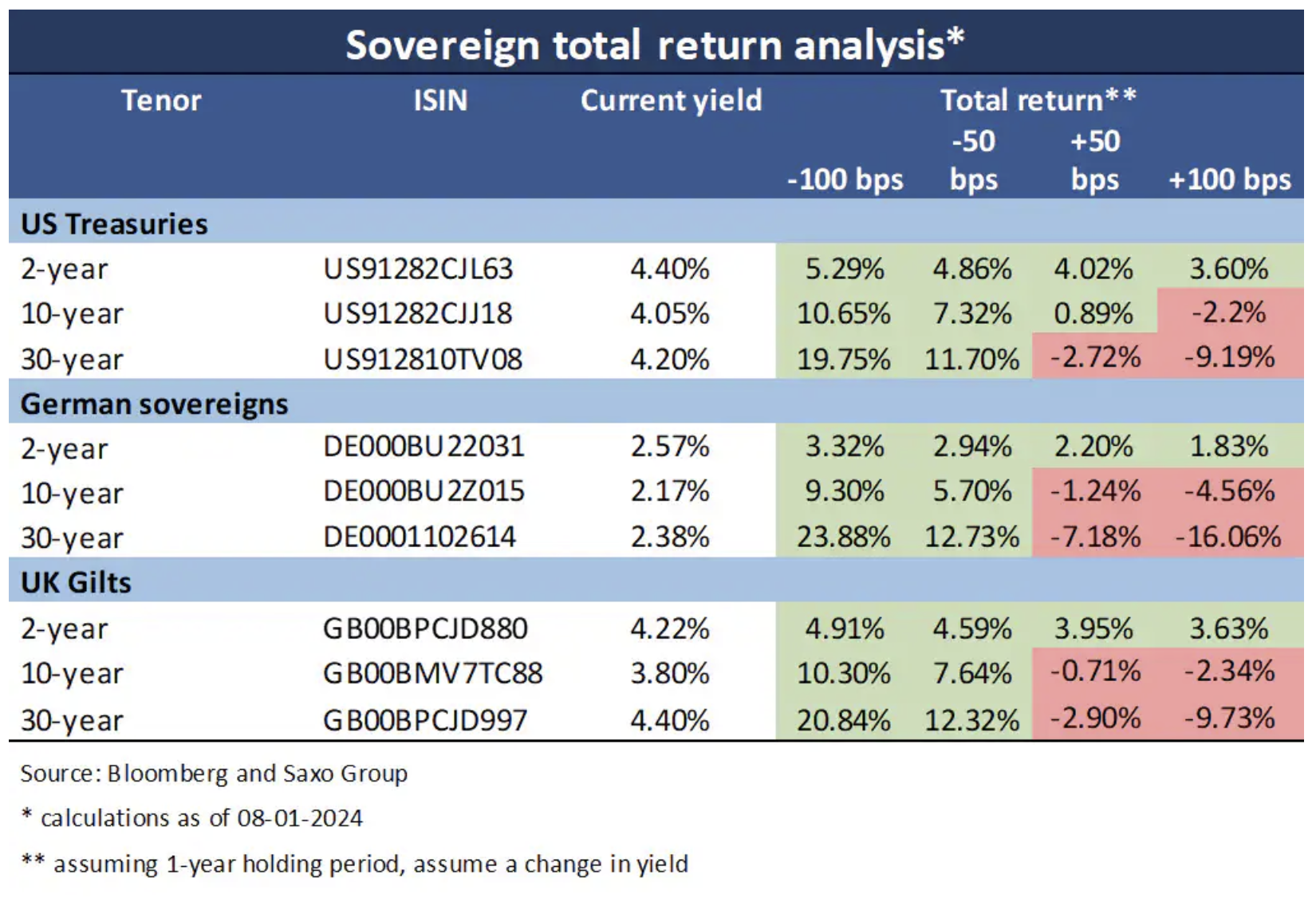

Bond investors have the opportunity to achieve one of the highest rates of return in over a decade. Higher yields not only mean higher yields, but also less likely that bonds will experience negative returns even if yields rise slightly again.

As central banks are likely to slowly reduce interest rates, the delayed transmission of aggressive monetary policy from 2023 will continue to tighten financial conditions in the new year. This supports maturity and quality extensions in the medium term.

There are three possible scenarios for developed market government bonds in 2024:

- Soft landing scenario: the fight against inflation ended and a deep recession was avoided, causing central banks to lower interest rates slightly, but not aggressively. Yield curves would be steeper and 10-year bond yields would adjust moderately lower than current levels.

- Hard landing scenario: a deep recession forces central banks to aggressively reduce interest rates, which causes a deep steepening of yield curves. Interest rates would drop significantly depending on maturities.

- 70s scenario: inflation erupts again, forcing central banks to increase rates again. This would flatten yield curves and yields on shorter-dated bonds would rise significantly compared to longer-term yields.

Quality is king

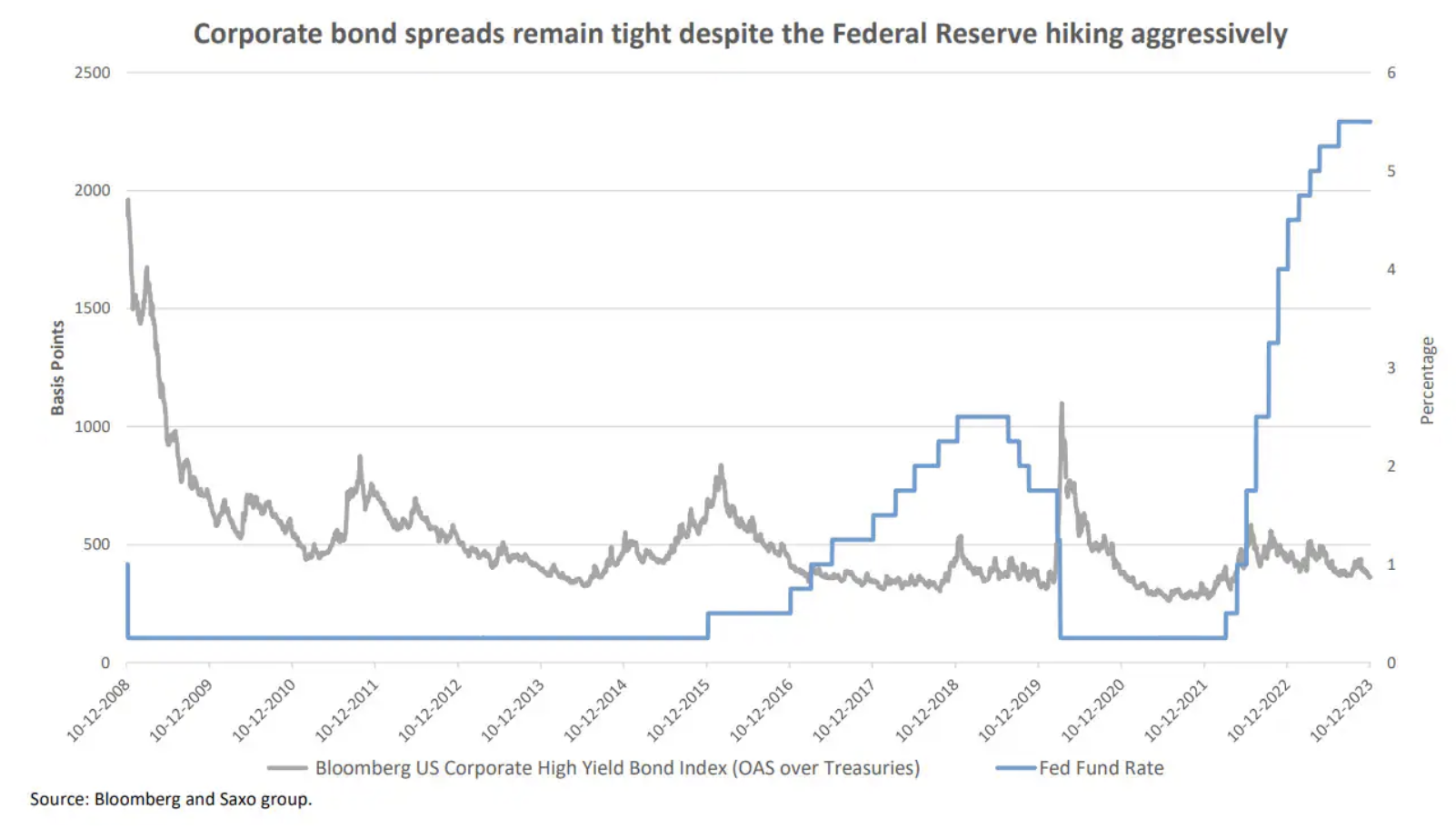

Deteriorating economic activity and high interest rates do not bode well for risky assets, which could lead to higher corporate bond spreads amid slowing revenues and squeezed margins.

While U.S. and European corporate bond yields have risen in line with Treasury yields, the growth in the value of investment-grade corporate bonds relative to their benchmarks is well below the 2010-2020 average.

Looking at “junk bonds,” the picture is even more depressing. High-yield USD bonds pay 260 basis points more than comparable investment-grade bonds, a level in line with pre-Covid valuations when Fed stimulated the economy through quantitative easing, and interest rates were less than half what they are today. In Europe, junk bonds pay 310 basis points higher than their high-quality counterparts, reflecting tougher macroeconomic conditions.

As a result, we see greater value in government bonds from developed markets, although a selective approach to corporate bonds remains attractive.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)

Leave a Response