Commodity prices are falling as the fight against inflation intensifies

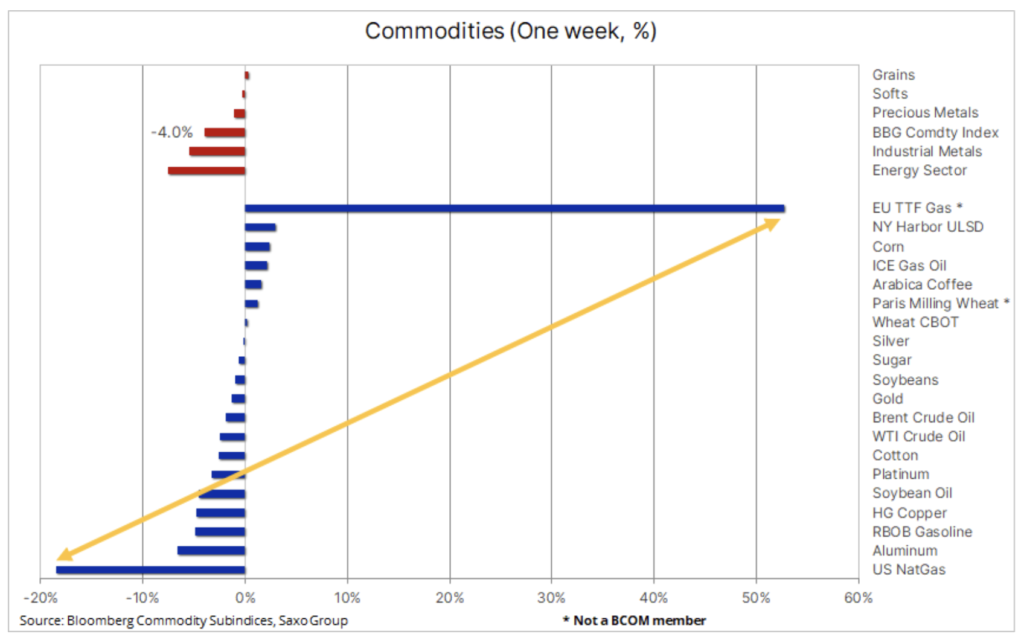

Commodities fell in a week when central banks came to the spotlight after announcing a series of interest rate hikes as part of an effort to contain soaring inflation. A 75bp rate hike by the US FOMC was particularly important - a strong move that increased the likelihood that these measures would negatively affect global economic growth, and hence the demand for raw materials. In response to these developments, the Bloomberg commodity index posted its biggest weekly loss in three months, with all sectors (except cereals) declining.

Central banks took the spotlight last week after announcing a series of interest rate hikes as part of their efforts to curb soaring inflation. Announced Wednesday by FOMC The rate hike by 75 basis points - as well as the announcements of further ones - contributed to further declines in the global equity and bond markets. In fact, global equities faced the biggest weekly decline in two years after hikes were joined by Swiss National Bank i Bank of Englandthereby increasing fears that a monetary tightening may dampen the global economic recovery from the Covid pandemic.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Recent price actions and changes in bond and stock prices have been historical in nature. One example is the S&P 500 index, where more than 90% of stocks have experienced losses in five of the last seven trading days. Such an overwhelming discount has not been seen since 1928 cryptocurrency and blockchain market it was indeed a week when investors struggled to find a safe area to invest; some raw materials were exceptions.

In response to concerns about global economic growth, the Bloomberg commodity index recorded its biggest weekly loss in three months, with all sectors (except cereals) declining. The most noticeable decline was seen in the energy sector after a prolonged downtime at a major LNG (liquefied natural gas) production hub caused US natural gas to sell off, and as a result, larger amounts of gas became available for domestic consumption. Disruptions in gas supplies from the United States to Europe and the shutdown by Russia of taps to Germany and Italy resulted in an increase in gas prices in Europe by over 50%. Combined with already record high diesel and gasoline prices, this once again means that Europe has become the epicenter of economic growth fears - primarily due to the Russian-induced war in Ukraine.

Crude oil, fuel

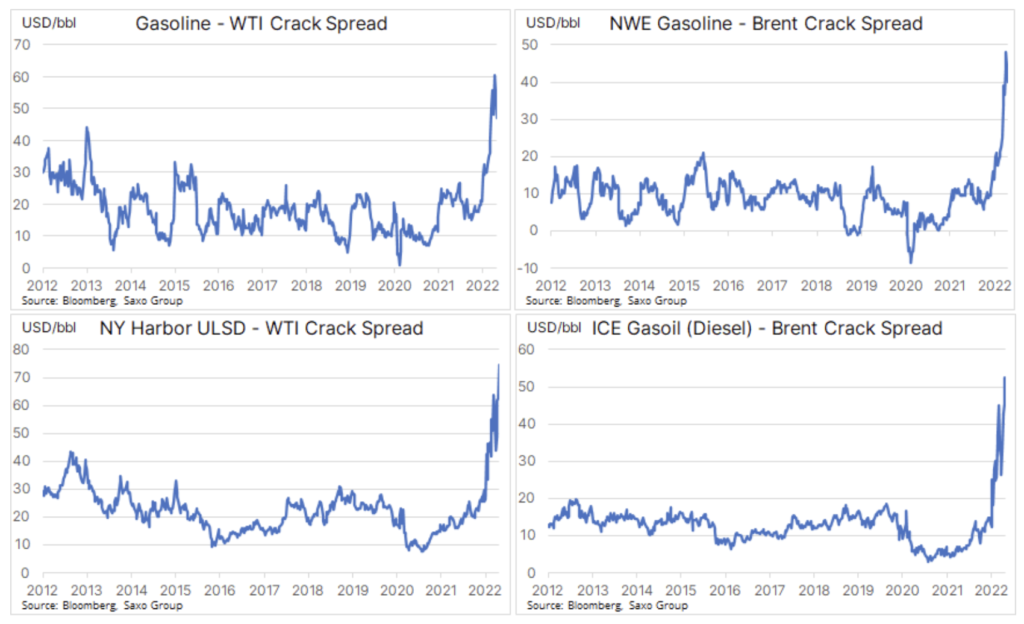

Simultaneously Petroleum and fuel products did not get caught up in the narrative of lower economic growth, which led to a reduction in demand and a drop in prices. The current supply constraint in the market as a result of supply problems is simply too big a factor to ignore. As a result, we expect fuel availability to be low at the peak of the summer demand. At the same time, we are witnessing a steady increase in the margins refineries obtain on fuel production, in particular diesel oil - the fuel that keeps the world and the economy moving.

As this is such an important factor for the global economy, the slight weekly loss to mounting concerns about economic growth due to aggressive central bank interest rate hikes highlights the current problem of limited supply, which is the result of years of underinvestment. This underinvestment was due to historically low rates of return, high volatility and uncertainty about future demand, ESG (environmental, social and governance issues) and green transition. A series of members OPEC +, for various reasons, including those mentioned above, it is close to running out of production capacity. With production reserves increasingly concentrated among a few Middle Eastern producers, the prospect of steady growth in demand in the coming years is uncertain.

Sanctions against Russia and numerous other disruptions saw OPEC + exceed its production target by more than 2,5 million barrels per day. The risk of even greater supply reduction, she emphasized International Energy Agency (IEA) in its monthly report, saying that in 2023 it will be extremely difficult to meet the world's demand for oil. The main reasons for this state of affairs are the recovery of the Chinese economy after the Covid pandemic and the tightening of sanctions against Russia. Despite clouds looming on the growth horizon, the Paris-based agency still expects demand to grow by 2,2m barrels / day to 101,6mnbbl / day, just 0,3mbbl. / Day above the level recently forecasted by the US Energy Information Administration (EIA).

After a series of unsuccessful attempts to break the resistance in the region of USD 125 a barrel, Brent oil began looking for support in the lower regions. However, once again the decline turned out to be very shallow and support was found above $ 115 - the earlier resistance level that became support.

Industrial metals

Industrial metals prices fell again after the Bloomberg industrial spot metal price index hit its lowest level this year, going down 28,5% from its record high in March. This peak was reached just before the emergence of new Covid-19 outbreaks in China (the world's largest metal consumer), contributing to a sharp reversal. From May to early June, the index underwent a slight recovery as China began lifting its Covid restrictions, which improved the outlook for new growth initiatives. However, further lockdowns in Shanghai, the prospect of lifting restrictions only next year, and a renewed focus on a central bank-driven reversal in global growth contributed to a sharp decline in the sector last week.

Aluminum price dropped to its eleven-month low as US data deepened fear of recession. At the same time, copper slipped towards key support in the region of $ 4 per pound ($ 8 per ton), creating the potential to attack a level that has bounced back repeatedly in the last fifteen months. As long as stock levels in warehouses monitored by exchanges continue to decline rather than rise given the current downturn, we maintain our long-term positive outlook for the sector.

Descent copper prices below these levels could trigger a temporary downturn which we believe, using Fibonacci retracements, could extend the downtrend to $ 3,86 or at worst drop by around 12% to $ 3,50.

Precious metals

In the last week of trading gold i silver were lower, although well above the levels that could be expected given the unfavorable movements in other markets - most of all the strengthening of the dollar and the rise in US Treasury yields in reaction to the FOMC interest rate hike by 75 basis points. But - as we highlighted in our last analysis - Gold is increasingly showing signs of disconnecting from the usual strong inverse correlation with real US yields. Given real ten-year bond yields of 0,65%, compared to -1% at the start of the year, some might say that the price of gold is about $ 300 too high.

While the appreciation of the dollar and the rise in bond yields in recent weeks have held back gold, contributing to the debate about its potential as a hedge against inflation, it is safe to say that other supportive factors are at play now. The most important of these is the risk of a hard landing by central bankers, in the sense that a recession in the United States may occur before inflation is brought under control, thereby ushering in a period of stagflation that has historically always been favorable to gold.

We believe that hedging against the rising risk of stagflation with gold, along with traders' response to the highest inflation in 40 years, and turbulence in the stocks and cryptocurrencies markets, are some of the reasons why the price of gold has not fallen at a pace dictated by rising real yields. Accordingly, we observe what investors actually do, in contrast to what they say, based on flows in exchange-traded funds. Recently, total gold-backed equity holdings have seen a slight decline of less than 0,25% - again pointing to investors' persistence of exposure to gold to offset the chaos in other markets and other sectors.

Last week's events strengthened our current positive outlook for gold and silver. We still see the potential for gold to reach a new record high in the second half of the year, when economic growth slows down and inflation remains high. The weekly chart shows that if the support at $ 1 is broken all the way to around $ 780, no strong support is seen, and a daily close above $ 1 would be needed to change the current sideways trend.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)