Commodity prices are falling as growth forecasts worsen

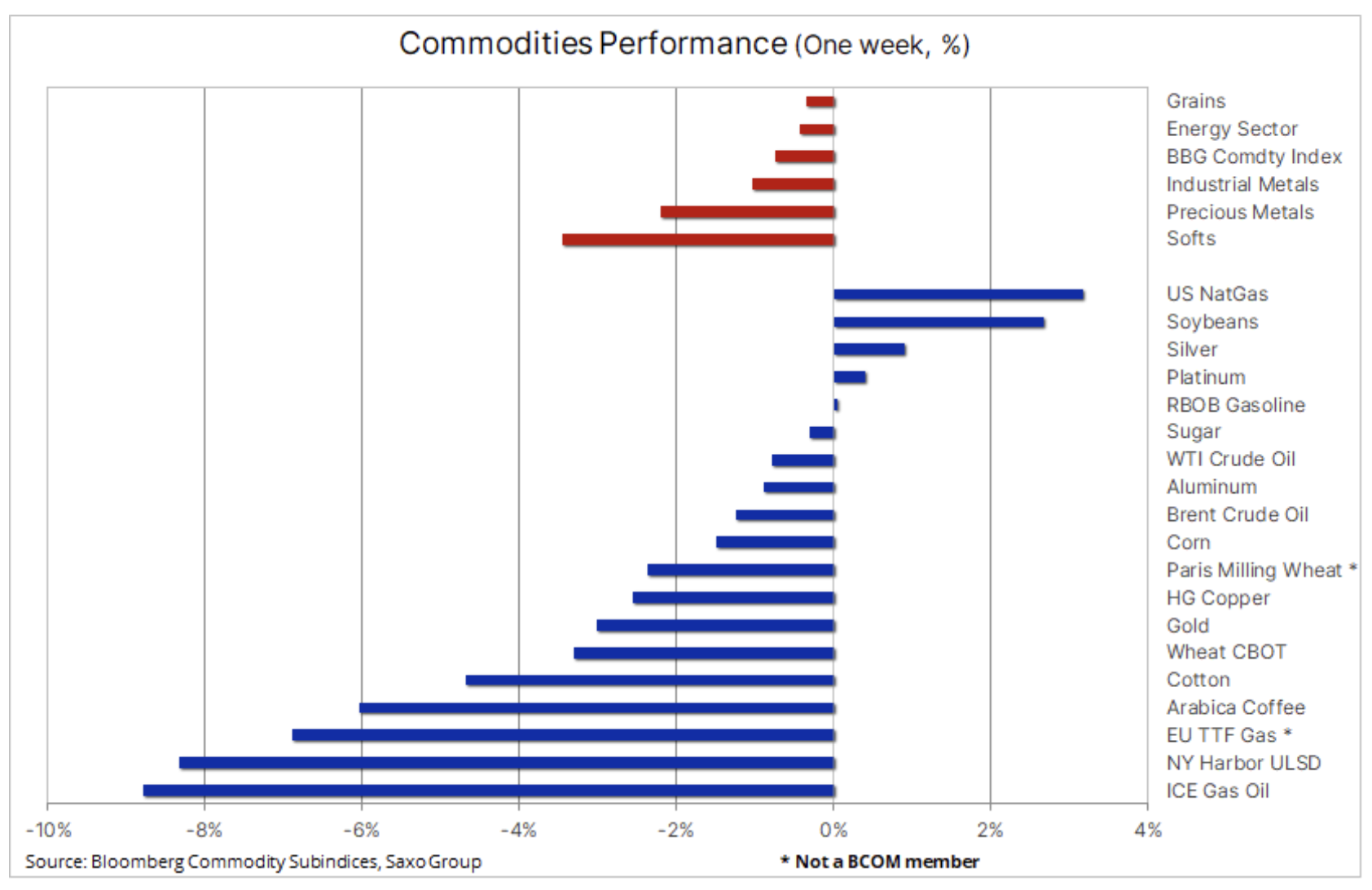

The commodity sector saw a decline for the third consecutive week; the main topic was the risk of an economic slowdown due to soaring inflation and the intensification of central banks' efforts to contain it. As a result, a stronger dollar and rising yields negatively impacted the prices of investment metals such as gold, while weakening commodities dependent on economic growth, such as Petroleum. The cereals sector was healthy amid supply concerns and the La Ninã phenomenon, while gas prices in Europe fell further.

Last week, data on August inflation in the United States surprised the market, showing a slight increase instead of the expected decline, while core inflation - which excludes food and energy - rose by as much as 0,6% month-on-month. This highlights the difficult task facing central banks to contain inflation without damaging economic forecasts.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The inflation reading triggered another increase in expectations regarding interest rate hikes by FOMC; the Fed funds end rate is projected to peak at around 4,5% in the next six months - about two percent above today's level; in the last few weeks alone, the rate has risen by almost one percent. As a result, the dollar strengthened to a new record high against the basket of 11 major currencies, while two-year US bond yields rose to the highest level in 15 years to around 4%. Combined with the ongoing energy crisis in Europe, a slowdown in China due to protracted lockdowns and the crisis in the real estate sector, the outlook for the demand for key commodities is now questionable.

While the sell-off mainly affected fuel products, such as gasoline and diesel, as well as raw materials dependent on the situation in China - from copper to cotton, the biggest attention was paid to gold's fall below the support of $ 1 to its lowest level in 680 years . At the other end of the table is soybean, which is struggling with the decline in forecast US stocks and concerns about the "triple" La Ninã in the coming months. US natural gas prices rose after a stormy week amid the prospect of hot September weather, while European Union gas prices fell as the European Commission sought consensus on a plan to ensure consumers and industry survive the winter safely.

FedEx's warning and falling container rates point to a slowdown

FedEx, the global courier and logistics company, lost more than 20% last week after finding a significant discrepancy between estimated and actual profits and after the company withdrew its forecasts for 2023. The FedEx chairman said that "global volumes have declined due to significant deterioration in both global and US macroeconomic trends at the end of the quarter ”. The company expects its operations to deteriorate further in the current quarter. At the same time, declines in global container freight rates have accelerated, and Drewry's benchmark composite container freight rate fell 8% this week to 4,9k. USD for a forty-foot container. This indicator has already fallen by more than 50% from the record level from the same period last year, but still about three and a half times the average value before the pandemic. All major trade routes from China to the United States and the European Union saw declines. Logistics companies such as Maersk, one of the world's largest container shipping companies, had a negative impact, with share prices plunging more than 40% from a recent peak to a 15-month low.

Gold goes below key support

Gold, which has been on the defensive over the past five weeks in response to persistently high inflation in the US driving the dollar and US government bond yields, fell below the support that became a drag at $ 1 as the market was overwhelmed with momentum and technical support. sales related to the risk of a 680% hike in US interest rates this week. Moreover, the market continues to raise its expectations regarding the amount of the Fed funds rate hike in the coming months.

Gold, almost at the two-and-a-half-year minimum, has struggled to find a defense against the aggressive stance of the FOMC and along with other investment metals such as silver and - to a lesser extent - platinum, may continue to grapple with this problem until some of the growth factors are strengthened. The focus is on the rate hike by the FOMC, not the increasingly inevitable economic consequences - a risk that has been highlighted by FedEx and a sharp decline in freight shipping costs around the world. In our opinion, the recent CPI readings may indicate some difficulties in bringing inflation in the United States below 5-6%. If the market draws the same conclusion, we are likely to see a sharp upward correction - ensuring zloty support - with inflation swap valuations still accounting for a decline to around 3%.

In our opinion, the reasons for keeping gold as a hedge against policy error have only strengthened as a result of recent events. There is a growing risk that the FOMC will plunge the US economy into recession before it can contain inflation, and when that happens, the dollar is likely to weaken strongly, thus supporting new demand for investment metals. Before that happens, however, gold may continue to struggle with a deterioration in the technical outlook, with a week close below $ 1 potentially causing the market to target a 680% retraction from the 50-2018 growth line of $ 2020.

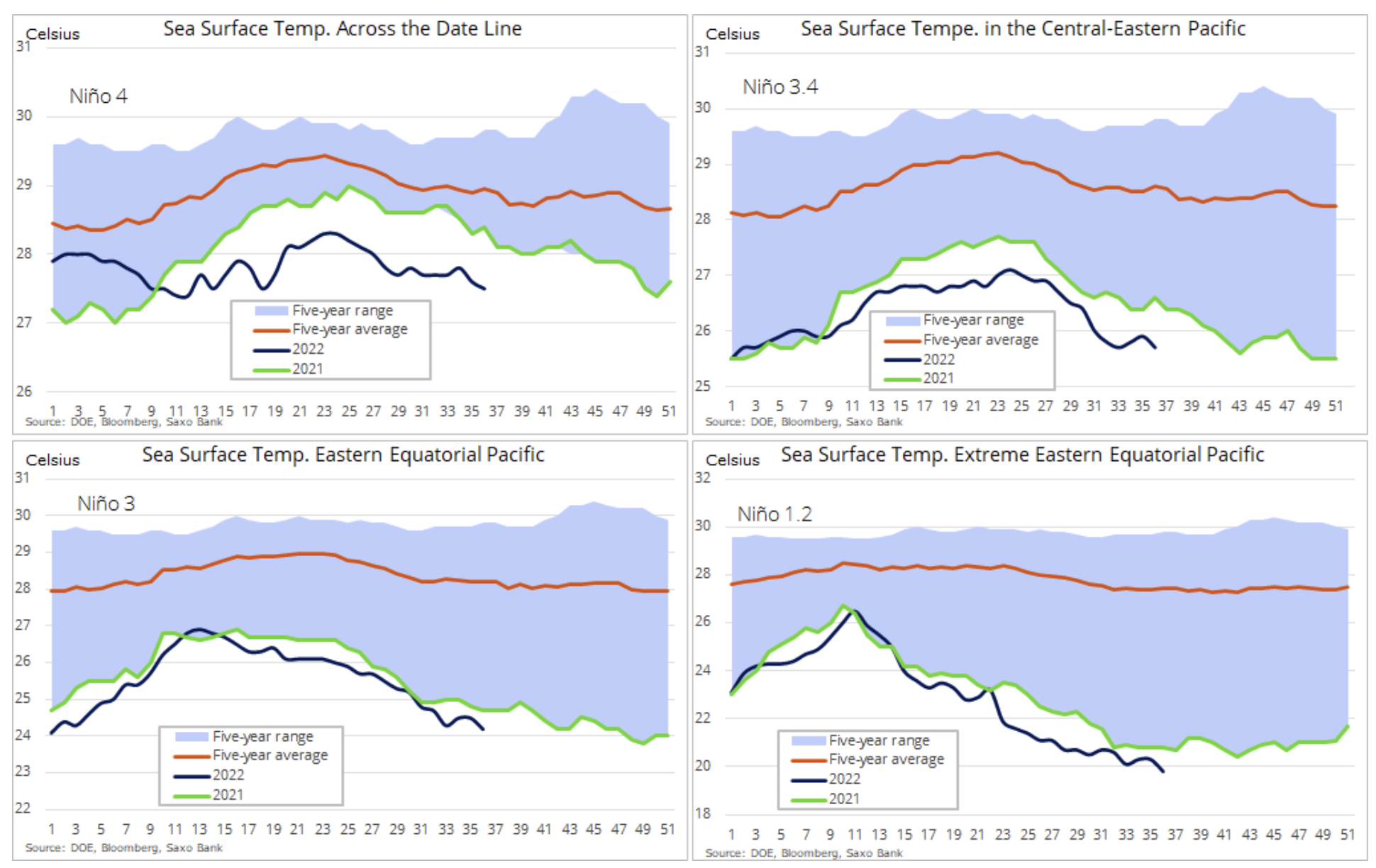

Food security may be at risk due to the rare 'triple' phenomenon of La Ninã

Major meteorological organizations warn of the risk of a triple La Ninã phenomenon spanning three winters in the Northern Hemisphere - a rare phenomenon that, according to the BBC, has only happened twice so far. Changing temperatures around the world has led to a range of climate hazards in 2022 including historic floods, above-average temperatures and droughts. World Meteorological Organization (World Meteorological Organization, WMO) predicts that the end of this year and the beginning of 2023 will be extreme weather conditions in some parts of the world due to the rare "La Niña triple phenomenon".

In Australia, the recognized Meteorological Bureau announced that the La Ninã phenomenon is ongoing, and communities in eastern Australia should be prepared for above-average rainfall that could lead to flooding in the coming months. Moreover, in South America and equatorial Africa, droughts recorded in the last few years may repeat themselves. This situation may exacerbate concerns about the global food crisis as stocks of a number of key food products have dropped to multi-year lows.

Chilling in your veins information Bloomberg examines in detail the increasing risk of La Ninã, a meteorological phenomenon that makes the waters of the eastern tropical Pacific cooler and the waters of the western tropical Pacific warmer than usual. This combination affects the direction of the winds, cloud cover and atmospheric pressure over the Pacific Ocean. When this atmospheric change is combined with changes in ocean temperature, it can affect global weather patterns and the climate.

Recent events have added to nervousness in the cereals market, which is the best performing sector this month, and prices for all three major crops - maize, soybeans and wheat - are increasing. In a recent report on world supply and demand, the US Department of Agriculture cut estimated closing stocks of US corn and soybeans to their lowest levels in ten and nine years, respectively. Wheat remains backed by Putin's threat to revise some aspects of the Ukrainian 'grain deal', which has resumed agricultural exports by sea, albeit at a much slower pace than pre-war levels.

Fuel products lead the decline in the oil market

During the week, crude oil prices plunged, in part due to losses in markets for fuel products such as gasoline and diesel, but remained within a recently lowered range, with demand concerns again at the center, more than counterbalancing potential supply challenges in the coming months. Concerns about growth and demand remain in the spotlight, as well as a stronger dollar that is pushing the cost of fuel globally higher as the market prepares for another growth-dampening interest rate hike by the US FOMC.

In addition, demand in China continues to slow down after the IEA said the world's largest importer of oil was headed for the largest annual decline in demand in more than thirty years. At the same time, the US Department of Energy withdrew its stance on replenishing strategic reserves, arguing that it did not include the strike price (which was supposed to be around $ 80 per barrel), and it is unlikely to happen before the start of fiscal 2023.

In Europe, and increasingly also in Asia, high gas and electricity prices continue to drive substitute demand for fuel products such as diesel and heating oil. In addition, the supply side will closely monitor the impact of the EU embargo on Russian oil, which will begin to affect supply from December. In its last monthly report on the oil market, the IEA emphasized that the embargo was the reason for lowering forecasts for supplies from Russia in early 2023 by 1,9 million barrels a day - unless a peace agreement is reached or other political events take place in Moscow , such a development of the situation may cause the supply on the market to start shrinking again. In addition, the current stagnation in demand from China may change after lockdowns are lifted, and coupled with the risk of limited supply, we expect a potential weakening in QXNUMX to be replaced by a strengthening again next year.

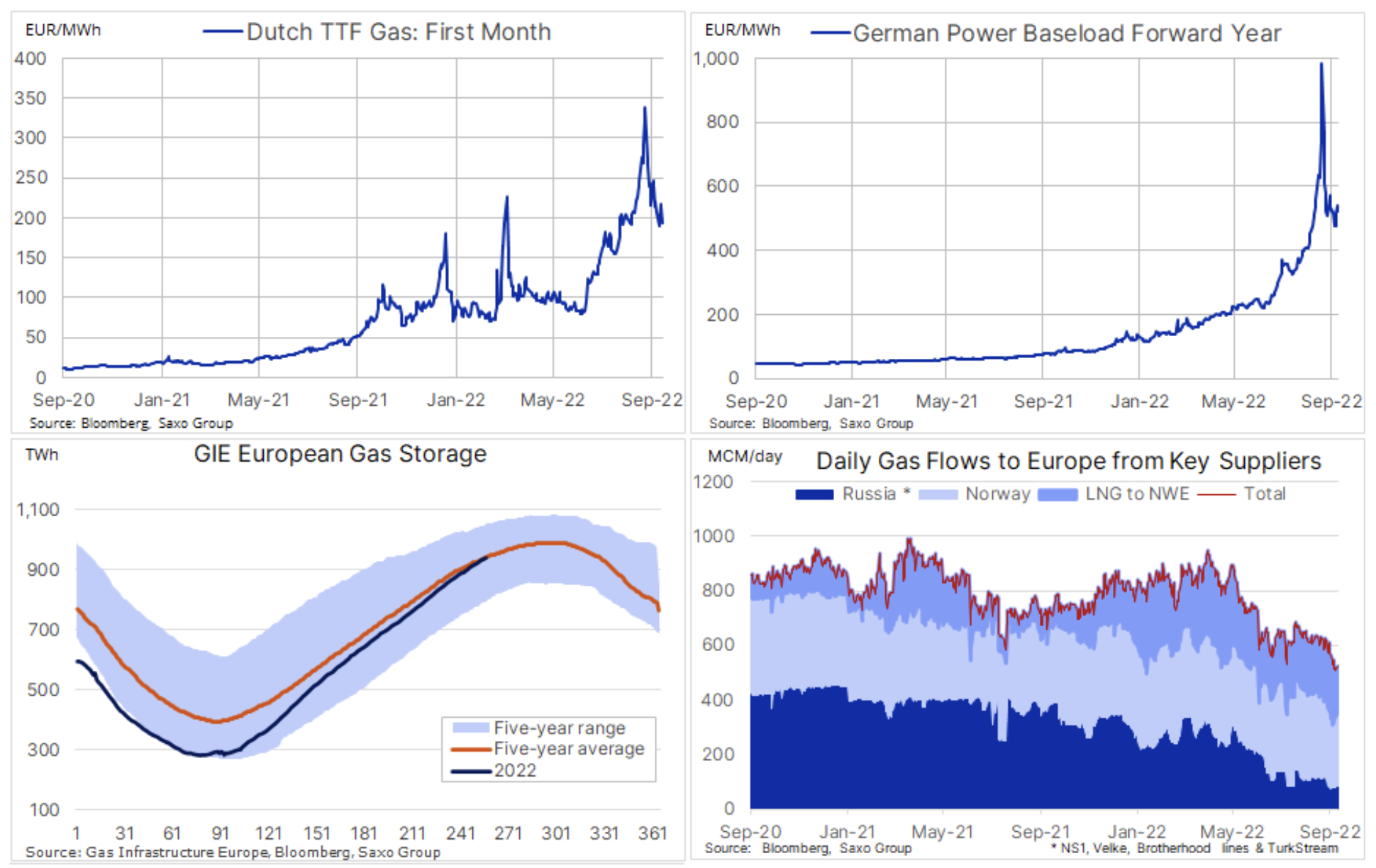

European gas prices continue to decline due to the EU's support plan

Dutch benchmark TTF contract (Transfer Title Facility) at natural gas it's been down for the third week in a row as the European Union continues to work on its plans to alleviate the worst energy crisis since the 70s. The good news is that the price has dropped 43% since the panic peak on August 26 ahead of Nord Stream 1 shutdown, the bad news is however, the fact that the price is still more than twelve times the long-run average.

Russian gas supplies to Europe via the remaining two of the five active pipelines fell by 80% in the last year, with a decrease of 285 million cubic meters having to be offset by increased imports from Norway and via LNG, and a decline in overall demand. Demand for gas has already fallen by 15% and looks set to decline further, both as a result of government interventions and voluntary reductions from consumers overwhelmed by current gas and electricity prices. In our opinion, assuming normal winter conditions, strong pressure to reduce demand and Russia maintain the remaining flow due to the lack of other opportunities to sell gas, we believe that Europe will survive the winter. For now, however, the price of gas must remain elevated to ensure a sufficient reduction in demand.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)