What happens when the tightening cycle ends before inflation is brought under control?

The tightening cycle by central banks has de facto reversed as a function of lower expectations for future rate hikes. This cycle ended with a sudden collapse and official intervention over two consecutive weekends to avoid systemic risks from actual or potential bank failures in the case of Silicon Valley Bank and Credit Suisse, respectively. These circumstances happened so quickly and with such force that we witnessed some of the sharpest moves in US interest rates on the short end of the yield curve in market history. Indeed, the tightening cycle by central banks has finally broken something. Unfortunately for policy makers, that something was niches in the banking system, not inflation. While bank funding problems could precipitate a recession, inflation is likely to bottom out at very high levels, posing the biggest possible challenge for central banks.

In retrospect, the tightening cycle that started in late 2021 but only gained momentum last summer was too intense and too fast for the weakest links in the global financial system, even if the real economy was doing very well. these difficulties (and in addition, a number of extraordinary support measures, in particular in Europe, helped to sustain inflation). However, these new cracks in the system come at an inconvenient moment for central banks that are far from putting the inflation genie back in the bottle. Economies continue to absorb the monetary and fiscal excesses caused by the pandemic, and new imperatives on industrial policy and national security spending as a result of the "game of fragmentation" that is the focus of this forecast could drive inflation even higher. Due to the departure from the fiscal austerity policy, not only due to the aforementioned imperatives, but also due to the automatic inflation indexation of transfer payments, inflation permanently returned to a higher, though probably much more volatile, level.

While central bank tightening may be coming to an end, we are unlikely to see the widespread celebration in risky assets seen in previous easing cycles. First, persistent inflation is likely to make it more difficult for central banks to ease policy on a scale similar to that of previous cycles once actual policy easing occurs. Second, market awareness that central banks will fail to outpace inflation, and the resulting increase in long-term inflation expectations, is likely to mean that long-term yields will remain uncomfortably high, even as the economy starts to slow due to the credit crisis. This is the worst of the worlds for central banks, which will be forced to navigate between inflation and the need for governments to continue to support the economy with deficit-enhancing fiscal spending. what will they do?

Ultimately, everyone will follow in Japan's footsteps

Let us examine the potential for another slowdown in the economy, possibly caused by a weakening credit cycle, but with expensive financing due to still high inflation: ultimately too expensive for governments to issue debt on the scale necessary to meet spending needs without destabilizing bond markets (see a clear reaction to the Truss and Kwartenga bonds). In every crisis, the state must be financed, and therefore the state will be financed. And if bond markets start to sound the alarm, central banks will have to step in and eventually implement yield curve control in bond markets (yield curve control, YCC) in the style of the Bank of Japan, as they will become reduced to mere associates or even state aides. At first, this move may not be obvious, but de facto it will be. This means that we are entering a new era in which central banks will lose their independence.

Yield curve control yield levels will be nothing like the Bank of Japan's -0,10% and 0,50-year cap of 0,25% (compared to 3% in the years prior to this policy) - they will be much much higher. However, they will still be below average inflation, whether that means an interest rate of 6% with inflation at 4%, or 7% and 2%, or even 4% and XNUMX%. All sovereign governments will be forced to deleverage either themselves (US, UK, parts of Europe, Japan) or their economies (everyone else) or both (France!), and the only way to do that is by insolvency ( unacceptable), impressive economic growth (impossible) or debt devaluation through inflation (bingo).

In other words, central banks should not be expected to be able to raise interest rates to significant positive levels, or to tolerate high long-term rates that constrain spending and nominal growth. Ultimately, this means that yield curve control must be put in place to keep the fiscal side funded and real interest rates negative. Negative real interest rates at the level of -2-3% over several decades may make it possible to bring the debt to a sustainable level. It will be crucial for FX investors to identify which currencies will be able to offer the least unfavorable negative real rates and which assets will be able to maintain the highest real returns (hard assets and companies with the ability to increase prices in line with inflation or more) and which economies will offer the most of these assets in a world consumed by the game of fragmentation.

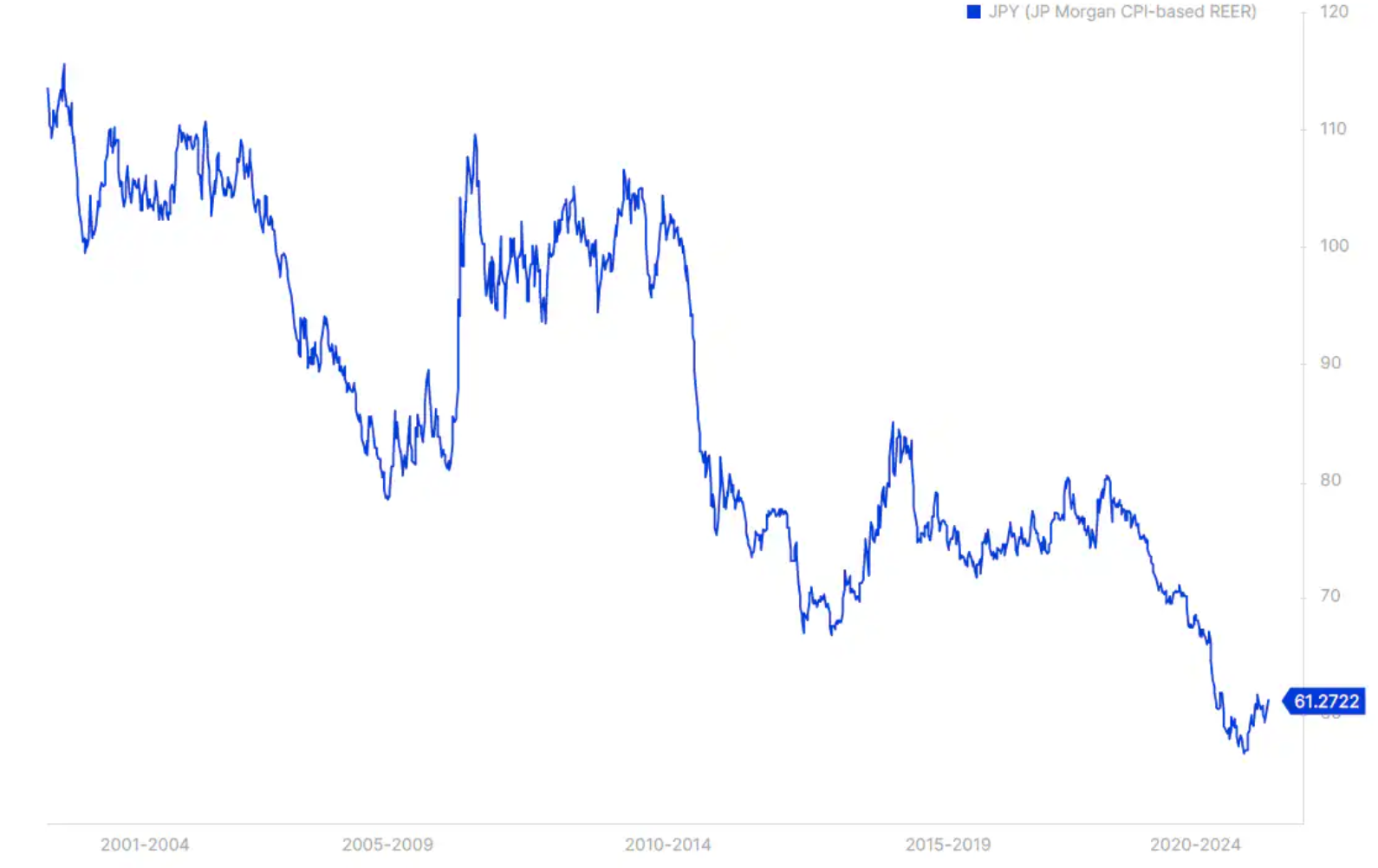

Chart: JPY Heading to Recovery?

QXNUMX marks the beginning of a new era for the Japanese yen, and not just because the CEO Bank of Japan Haruhiko Kuroda is due to leave office in April after ten years on the job, but also because we're probably heading towards a situation where other central banks will necessarily start to follow the Bank of Japan's policies, even at different nominal yield levels. In that case, it could ease some of the pressure on the JPY if expectations of lower and even negative long-term real (not nominal!) yields become more prevalent as we predict. Japanese investors may move some of their huge savings back to the Land of the Rising Sun if real yields in other countries become unsatisfactory. This could allow the JPY to strengthen significantly over the next few years, perhaps by 10-15%, as seen in the CPI-adjusted Japanese Yen Real Effective Rate Index below.

What will this mean for each currency?

- USD “The Federal Reserve has been the most aggressive in tightening policy, and on the face of it, the USD may have the most to lose if expectations for future policy are lowered. However, the current chaos and the risk of a credit crunch has accelerated the eventual onset of a recession, and the US currency will continue to find strength as a safe investment during periods of market turmoil. The USD may only begin to depreciate more decisively once the policy response begins to catch up during the next recession, although the USD has probably already peaked last fall.

- EUR – In QXNUMX, the pressure to tighten ECB policy at the end of the cycle ended. Instead, the EU may be struggling with its giant banks and their funding/liabilities, with the risk that Member States' actions to remedy the situation will be taken at different paces. It seems that the EU always needs the right crisis to get a strong political response. Neutral position.

- JPY “Last year, the Bank of Japan paid a very high price for its yield curve control policy as it lost control of its balance sheet and the JPY depreciated. The Bank of Japan's yield curve control policy will still require an upward revision if inflation remains at current levels, even if other central banks "follow Japan's lead" as discussed above. JPY is expected to outperform USD in general and EUR in particular in the coming year.

- GBP – The UK will show greater agility in policy responses, as has already been seen after the sovereign bond/liability based investment (LDI) crisis that led to the abrupt collapse of the Truss and Kwarteng governments. Still, the structural background of the UK remains alarming, although it is difficult to determine how much of this has already translated into a low price.

- CHF – Arranged by Swiss National Bank the takeover of Credit Suisse by UBS put the balance sheet of the central bank on the line because of a number of guarantees. Fortunately for CHF, this balance is huge, but in connection with this decision and its consequences in the near future, the franc may show some weakness, also because the game of fragmentation may not be kind to the traditional, friendly towards all Swiss banking model, because the country will increasingly have to take sides, as was the case with Russia's invasion of Ukraine.

Commodity dollars

- AUD, CAD and NZD – On the positive side, all these countries can outdo each other in terms of the attractiveness of their exports of hard assets (commodities); on the negative side, we have a high level of private debt and the risk of a correction in the housing market, particularly in Canada and Australia.

Scandinavian currencies

- NOK and SEK – The most positive news for NOK and SEK may be the deepening of the local government bond market and the imposition by Norway and Sweden on banks and other institutions of the requirement to keep a larger part of savings in the country. Such a policy decision could have a positive impact on the Scandinavian currencies, outweighing the possible risk of downside resulting from typical weaknesses (deterioration of global liquidity in the event of an eventual economic slowdown). However, there is no guarantee that this will happen. Still, NOK seems particularly cheap. With unfavorable real interest rates, especially in Sweden, both countries should focus on the part of inflation that is driven by excessive currency weakness, even if they are exposed to systemic risk from an expansion of the housing bubble. This aspect may turn out to be especially important this year!

China

- CNH – One of the most anticipated events in the first quarter was the reopening of the Chinese economy to the world, which was supposed to take place in connection with the decision of the Chinese authorities to abruptly end the zero-tolerance policy towards Covid. In fact, many indicators of the Chinese economy show an impressive improvement in activity from very low levels. However, equities' strong gains had already lost momentum in early February, and around the same time, commodity funds that were expected to benefit from China's recovery also proved disappointing. The recovery of the Chinese economy has always been inconvenient in the context of the game of fragmentation, as other countries, in particular the United States and its security allies, including Europe, seek to diversify all key supply chains dependent on China. Stability will always be an imperative for Beijing, but the CNH is most likely at a very low ceiling because the Chinese currency is overvalued due to the fact that the monetary policy in the Middle Kingdom is unable to positively influence the exchange rate or "follow Japan's footsteps" to devalue debt resulting from malinvestments in recent years. The USD/CNH pair ended QXNUMX perfectly in the middle of the range and China will probably want to keep it there.

Currencies of emerging markets

- Emerging markets have too much going on to list here, but their currencies are unleveraged domestically, and negative real yields elsewhere are likely to avoid debt problems as inflation lowers their real value. This should mean that emerging economies that are able to keep interest rates significantly positive will likely be able to attract investment, even if they run current account deficits, offering attractive returns in the coming years once we get through the turmoil phase related to the eventual onset of recession in the current cycle (accelerated, as mentioned above, by the risks associated with the bank funding crisis). For example, the Mexican peso has broken out of line in the last cycle, partly on a wave of enthusiasm for less negative real rates, because the Mexican central bank has adjusted its reference rate to inflation, but also because the game of fragmentation has already begun there, as many investors see the huge potential of Mexico in terms of transferring production to politically stable countries (so-called friend shoring) by American companies, incl Tesla.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response