Commodity Markets Weekly Review: Trouble with China and the FOMC

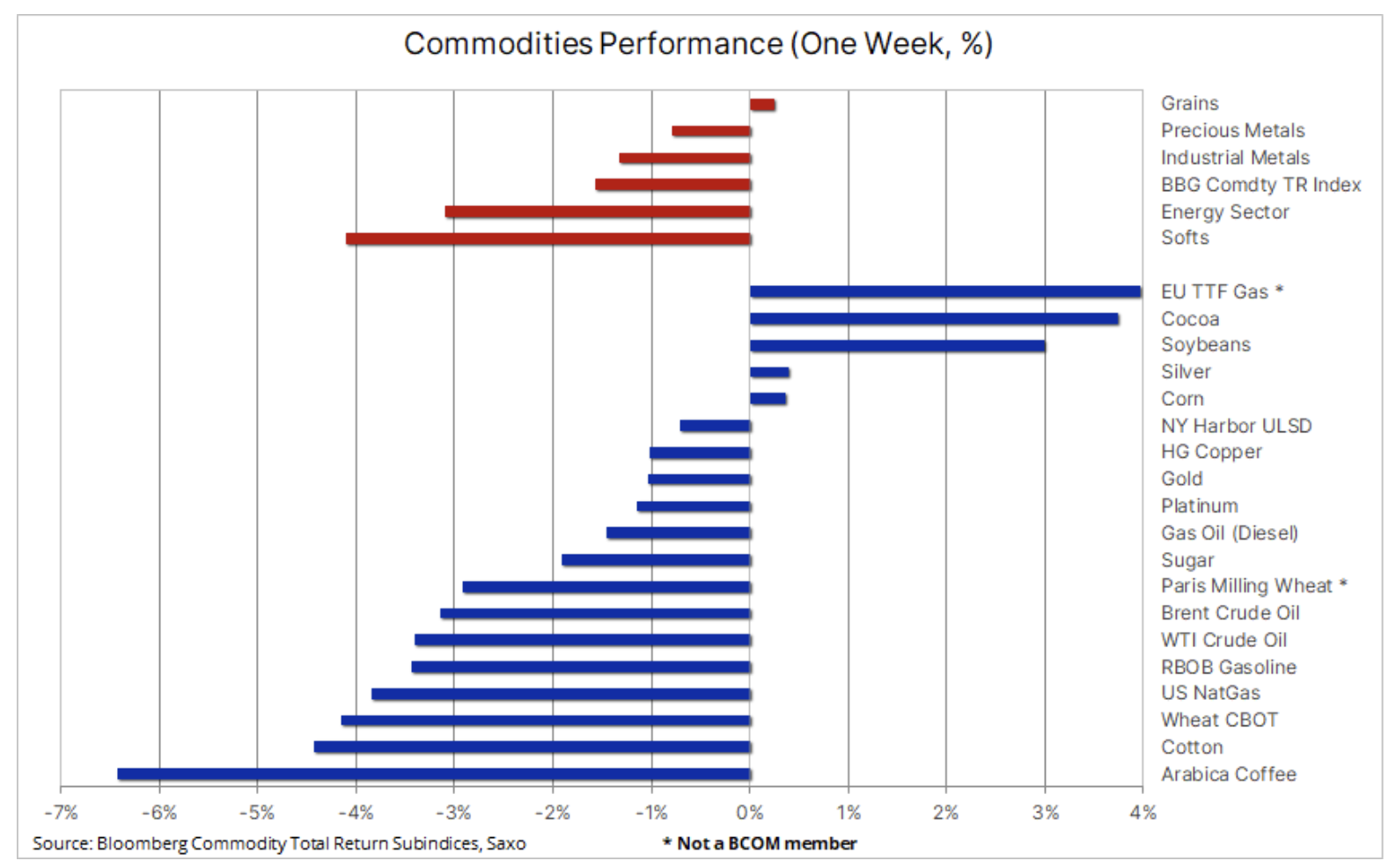

The commodity sector declined for the second week, but June was the first month to end in profit since November last year, mainly due to very strong increases in the first half of the month. The Bloomberg Commodity Total Return Index, which tracks the performance of 24 major commodity futures, including energy, metals and agricultural commodities, headed for a monthly gain of 3%, just below the MSCI World index. The gains were led by the grain sector, which at one point recorded a 20% increase before ending the month with a 7,5% gain, amid deteriorating crop conditions on the one hand and favorable rains on the other, taking into account the impact of speculation.

Sentiment in the financial and commodity markets took a turn for the worse last week after traders and investors reacted negatively to the minutes of the last meeting FOMC suggesting that Federal Reserve has not yet taken sufficient steps to combat persistent inflation. In addition, the Chinese economy, which has been struggling to recover for months following the end of last year's strict pandemic restrictions, continues to show signs of weakening as fears of another slowdown in the real estate sector, which has so far accounted for more than a quarter of the country's economic activity, continue to show signs of weakening. measure. The sell-off of commodities related to China has begun after the exchange rate of the yuan offshore dropped to near multi-year lows before major state-owned banks and the People's Bank of China (PBOC) stepped up efforts to stem the decline.

These developments contributed to the overall strengthening of the dollar, while bond yields approached the levels last seen before the financial crisis. Rising yields hurt the outlook for investment metals, with gold dipping below $1, while industrial metals, led by copper, took most of their directional inspiration from the yuan's volatility. The energy sector lost momentum after a two-month rally, but the current forecast of limited supply, supported by OPEC+ production cuts, will prevent a deeper correction at this stage.

At the same time, the agricultural sector has stabilized after weeks of weakness, although deliveries from the Black Sea remain a concern. In the United States, heat expectations in late August may still affect the final outcome of the harvest. In addition, restrictions on exports of rice and sugar from India - the largest supplier of these two important foodstuffs - continue to support price increases despite a slight decline last week.

Short-Term Outlook: Jackson Hole

The Federal Reserve Economic Policy Symposium in Jackson Hole, Wyoming, is scheduled for August 24-26. This year's theme is "Structural Changes in the Global Economy," and Fed Chairman Jerome Powell is scheduled to speak at 25 a.m. EST on August 10. Other central bankers will also take the floor, and recent comments indicate that central banks will maintain flexibility in terms of further rate hikes, while clearly avoiding a commitment to lower them in the near future. However, reflections on economic dynamics, in particular current adversities, may prove crucial, and the growing credit risk may justify a relatively soft stance.

Essentially, the Bloomberg Commodities Index of Overall Return (Commodity Total Return) fell for the third week in a row, erasing more than a third of the strong gains made after the low in early June. Most of the most important commodities and all sectors showed declines, led by the so-called soft products. Coffee prices fell sharply amid increased selling pressure from Brazilian producers as the harvest neared, easing fears of shortages that have helped keep the price high in recent months. Cotton prices also fell amid concerns about demand, despite a much lower US cotton harvest forecast due to record high temperatures in the southern states.

For the second week at the top of the table are EU TTF gas futures, which are not included in the Bloomberg Commodity Index. Their price remains buoyed by concerns about a strike in Australia's three most important LNG export hubs, which could affect 10% of global LNG shipments and thus increase competition from Asian buyers of gas destined for Europe, a region that has become more dependent on LNG imports after a sharp decline in supplies from Russia. The recent strong increase underscores the risk of another volatile winter given the uncertainty surrounding the weather and renewable production.

Crude oil: scarce supply versus macroeconomic headwinds

Energy trade fell for the first time in eight weeks as investors focused on consolidation after overall risk appetite was subdued amid intensifying macroeconomic headwinds from China's economic growth and rising interest rate concerns. China - the world's largest importer oil – remain a key piece of the oil puzzle, especially given that most of this year's forecasts of solid demand growth are based on demand from the Middle Kingdom, according to the IEA. With regard to current developments in the oil market, therefore, it is particularly important to focus on China for demand and Saudi Arabia for supply, with a voluntary 1m bpd production cut likely to strengthen the market and prevent a deeper correction at this stage.

On the other hand, growing production reserves at manufacturers OPEC as a result of supply constraints, coupled with rising exports from countries like Iran and Venezuela that are not quota bound, and the aforementioned demand concerns, we believe they are the forces that will hold back a sustained move above $90.

Earlier in the week, Brent and WTI oil prices fell below their 81,75-day moving averages, signaling a pause in the strong price rally that began in early July following Saudi production cuts. With a loss of risk appetite from the continued rise in bond yields and broad declines in equity markets, investors focused on consolidation, but as long as Brent crude remains above $78 and WTI above $XNUMX, the risk of another round of long liquidations items by funds remains limited.

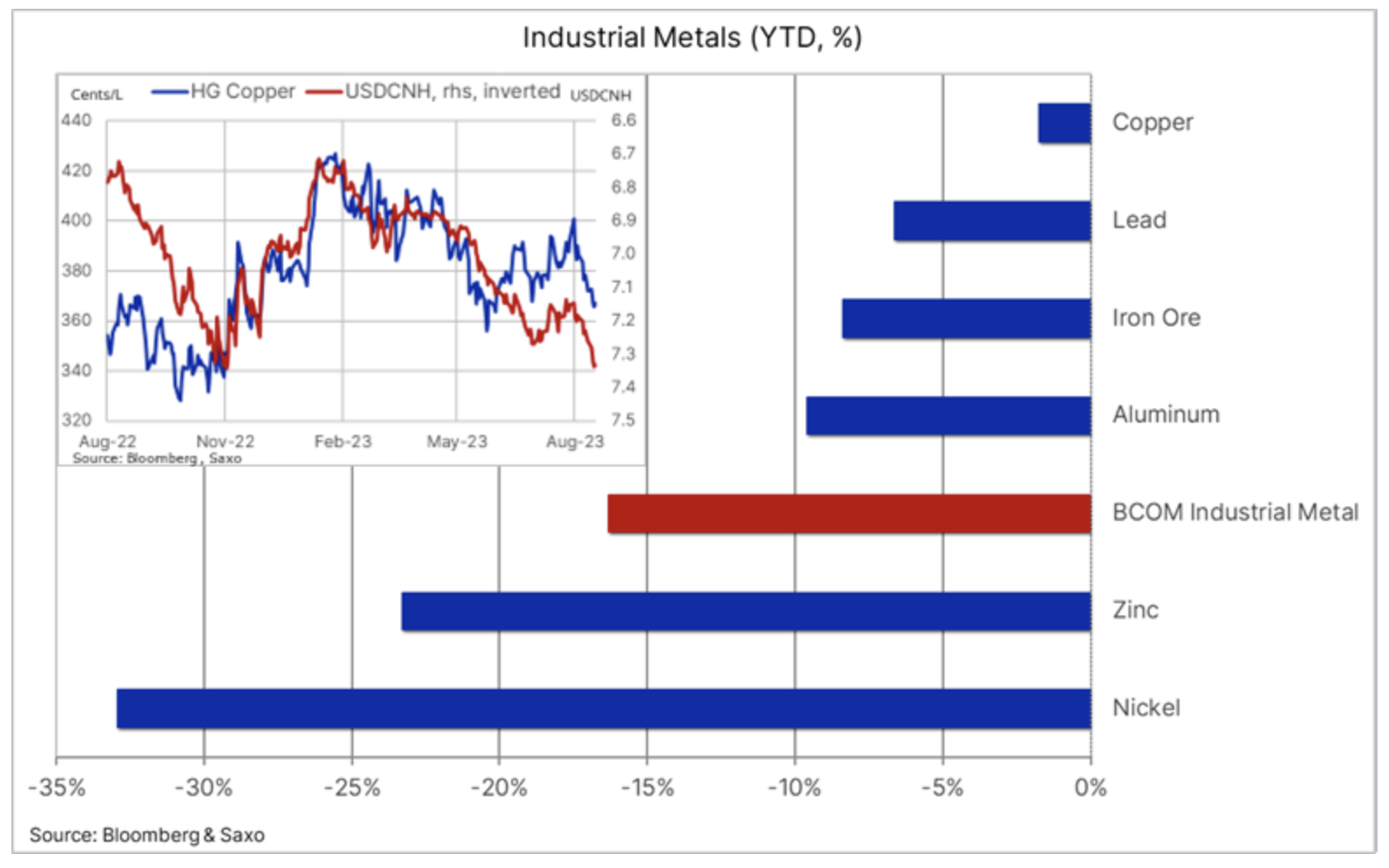

Copper: yuan watch

Copper futures traded on the London and New York Stock Exchanges continue to defy gravity, trending sideways for months, while the rest of the industrial metals sector has seen steep declines amid concerns over economic growth. Bloomberg Industrial Metals Index, monitoring performance copper (with a weight of 35,9%), aluminum (27,4%), zinc (16,1%), nickel (14,2%) and lead (6,4%), decreased by 16,4% year-on-year and is close to last year's low, when the prolonged lockdown in China negatively affected the sentiment and, above all, the demand from the world's largest copper consumer.

While the weakness in industrial metals prices, led by nickel and zinc, has created a tough environment for investors, copper remains resilient and despite stagnating PMIs in the manufacturing sector – usually well correlated with copper demand – Chinese demand remains surprisingly strong. He contributed to this strong and government-supported green transition demand for batteries, electric traction motors, energy storage and grid upgrades.

In addition to the aforementioned weakening in China and the global PMIs in the manufacturing sector affecting prices, the very strong correlation of copper with the Chinese renminbi continues to challenge the metal's short-term direction after the recent PBOC rate cuts brought down the Chinese currency offshore to its lowest level against the dollar since November last year before a slight rebound followed by government intervention and with it some recovery in the copper market.

While low stock levels continue to provide some support, long-term investors continue to point to the lack of major mining projects to ensure a steady stream of future supplies. This confirms our structural long-term constructive outlook as green transition metals demand grows and mining companies face rising input costs due to higher diesel and labor costs, ore grade deterioration, rising regulatory costs and interventions as well as climate change causing disruptions ranging from floods to droughts.

Gold: bulls need to be patient

Gold prices remain in a descending channel, dropping for the fourth consecutive week as yields rise and the dollar strengthens amid speculation that FOMC may be forced to raise interest rates further as incoming economic data indicate continued price pressure. As long as this aspect remains in the spotlight, little interest from asset managers and other large investors is to be expected given the current high opportunity/financial cost of holding gold relative to short-term money market products.

The holding cost or opportunity cost of holding a gold position is equal to the holding cost and interest income that an investor can earn from a short-term interest rate instrument such as treasury bills or money market products. So whether you hold physical gold or hold and roll a futures position, there is a cost to doing so, either from not receiving +5% via a short-term interest rate instrument or due to rollover to a higher price on the futures market.

While we maintain our optimistic outlook for gold, these developments also highlight the risk that gold may continue to struggle to attract investor demand until there is some breakthrough in the form of a credit event, a depreciating dollar, or the belief that the FOMC has shifted its stance towards lowering interest rates. Technical traders are unlikely to provide significant support until the downtrend is broken, and until then we may be at risk of extending gold's move towards $1.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)