Copper and cotton in disarray due to fears of a galloping recession

The month-long boom in commodities markets in late June faced a major hurdle as the risk of recession continues to paralyze investors. The sale was driven by the need to reduce exposure ahead of the holiday season in major trading centers and by the actions of macro funds which were buying during the boom but now have doubts as the risk of an economic downturn is increasing. The main victims of this weakening were copper and cotton, two recession-sensitive commodities from different sectors.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

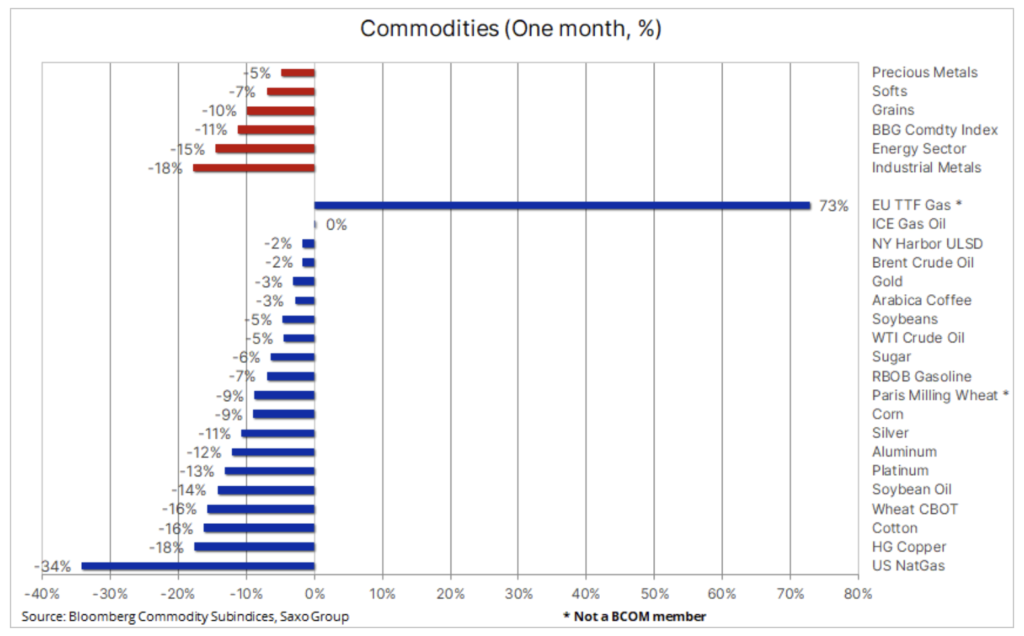

The Bloomberg commodity index has plunged 12% over the past month, losing almost half of the gains it made since last December. As can be seen in the table below, there were strong declines in all three sectors: energy, mainly natural gas, metals and agricultural products. At this point, it is not known what the level of potential demand destruction will be. There is no doubt, however, that some of the last purchases are currently being removed from the market. This is in part due to the actions of macroeconomic funds, which purchased commodities during a boom period, but are now beginning to have doubts as the risk of an economic slowdown is increasing.

What happened in June that would justify such a significant market reversal in the short or even medium term? It all started with a higher-than-expected inflation reading in the United States on June 10, which led to the first 75bp rate hike in several decades. Due to further planned Fed rate hikes, the market is becoming increasingly concerned that central banks around the world will continue to raise interest rates. This will continue until inflation is brought under control or something goes wrong - in the latter case, there is a risk that economies will buckle under pressure with a consequent recession. For now, at least one element of inflation, ie rising production costs due to higher commodity prices, has started to weaken, supporting a fall in two-year inflation expectations by 1,1% to 3,6% in just the past two weeks.

A series of weaker-than-expected economic data from the United States and signals that consumers have begun to curb consumption made the GDPNow model adopted by the Federal Reserve Bank in Atlanta indicate a contraction of the economy by 1,0% in QXNUMX, which would mean a "technical" recession in the United States, i.e. two consecutive quarters of negative real GDP growth. Even so, we do not believe the US is headed towards a broader recession, even if the Fed is likely to continue to pursue inflation.

Natural gas

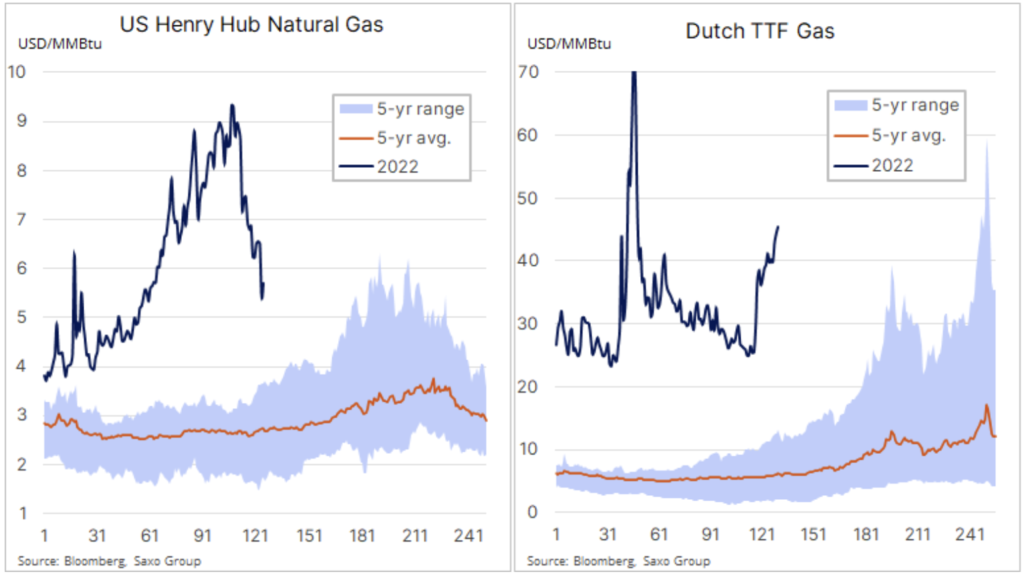

The two most important cases of performance deviation in the past month concern natural gas in the United States and in Europe. In the US, the price of the Henry Hub natural gas contract fell 34% to $ 5,7 / MMBtu as the protracted closure of the Freeport LNG export terminal leaves more gas in the country, resulting in a faster than expected increase in inventory levels ahead of the winter peak in demand.

The latest twist came after a federal agency statement that the terminal, which accounts for around 20% of US exports, could not be restarted without the written approval of the Biden administration. Last week, some 82 billion cubic feet of gas were pumped into underground tanks, compared with an estimated 75 billion cubic feet.

The restriction of US export opportunities could not have come at a worse time for Europe, where the reduction of gas flow from the NordStream 1 pipeline further disrupted the market and pushed prices up to a level destructive to demand, just below EUR 150 / MWh (USD 46,5 / MMBtu) , which is about ten times higher than in the period preceding last year's growth. The economic impact of the fact that European utilities do not receive the gas they have purchased under long-term contracts with Gazprom at significantly lower prices are now most felt in Germany, a country whose failed strategy of relying almost entirely on Russian gas has put it at risk many industries that consume significant amounts of energy.

Last week, Uniper, a large energy company, was the first to turn to the state for aid after receiving only 16% of the contracted gas volume from Gazprom after June 40. In order to make up for the shortages, it was forced to buy gas on the spot market at the very high prices mentioned above. With winter gas costs approaching EUR 150 / MWh and sluggish stockpiling in warehouses, only aggressive demand restraint, both on a voluntary basis and through government intervention, can prevent the risk of a power outage in the coming winter.

Petroleum

Petroleum and fuel products remain within the range and after the first, albeit small, monthly loss since last November, there are doubts about the sector's ability to withstand the additional wave of sales due to the recession. We continue to believe - and fear - that anxiety about the destruction of demand will be more than offset by supply constraints. There was a meeting last week OPEC + and another small increase in production was agreed; the group is already lagging behind its production target by 2,7 million barrels per day. After the production cuts made at the start of the 2020 pandemic have fully equalized, the market will be focused on the future, but given that most producers are close to peak production, we are unlikely to see an unexpected response in the form of additional supply.

Weekly American Report Energy Information Agency (EIA) on inventories found US crude oil stocks, despite large injections from Strategic Crude Oil Reserves (SPR), have fallen to their lowest seasonal level since 2014, while stocks in Cushing, an important center of supply for futures for WTI crude oil, fell to 21,3 million barrels, also the lowest since 2014. However, data on the supply of finished motor gasoline, showing an anti-season decline in US gasoline demand, had a negative impact on the market, which means that it is more affected by record high gasoline prices.

In the short term, there will be a battle between macro-economic traders selling "paper" oil through futures and other financial products as hedge against recession, and the physical market, which is still limited in supply to support prices. As a result of this battle, both now and during the impending holiday peak, when liquidity wears off, Brent crude oil could be traded in a fixed range of $ 100-125.

Gold and silver

For the first time in six weeks the price of gold dropped below $ 1 and is now focusing on key support around $ 800. This decline is due to the strengthening of the dollar, the market's valuation of lower future inflation as a result of rate hikes, fears of a recession lowering the overall appetite for commodity exposure, and the increase in import taxes by India, the world's second largest consumer of gold. Additionally silver price fell below $ 20 as a result of continued weakness in industrial metals, notably copper. Faced with these numerous setbacks, investors reduce their exposure to exchange funds, and speculative investors add short positions in futures. The reasons for holding gold, such as hedging against stagflation, geopolitical risk and financial market risk, have not gone away, but for now, with the looming holiday season and low liquidity, investors are tightening rather than increasing their exposure.

Copper and cotton scattered

They are behind the aforementioned sharp fall in the price of US natural gas copper i Cotton as the biggest losers in June. These two commodities from different sectors are often used as barometers of the health of the global economy. The level of demand for copper, due to its use in electrical conductors, and cotton for the production of clothing, are two key ingredients driving global growth, and with growing fears of a global recession, both of these commodities have fallen victim to sellers, both long and long-hauled. and entering short positions to hedge against further macroeconomic deterioration. While the copper price fell below levels not recorded since early 2021, the cotton price hit a nine-month low of about 32% below its May peak, reflecting lower demand in China as a result of the Covid pandemic. In the face of these challenging demand conditions, the supply outlook also worsened as the percentage of crops in the United States rated as good or excellent fell to just 37%, compared with 52% in the same period last year.

Once the dust settles, copper is likely to attract fresh demand, not least because China is making more attempts to lift lockdowns, and stock levels in warehouses monitored by the two major exchanges in London and Shanghai are almost at their lowest in decades. This is not a healthy starting point for any signs of a rebound in demand.

Copper HG extended its fall after the recent break below the support at $ 3,95 / lb, now focusing on the next key support level of $ 3,50 / lb.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response