For raw materials, QXNUMX will be a challenge

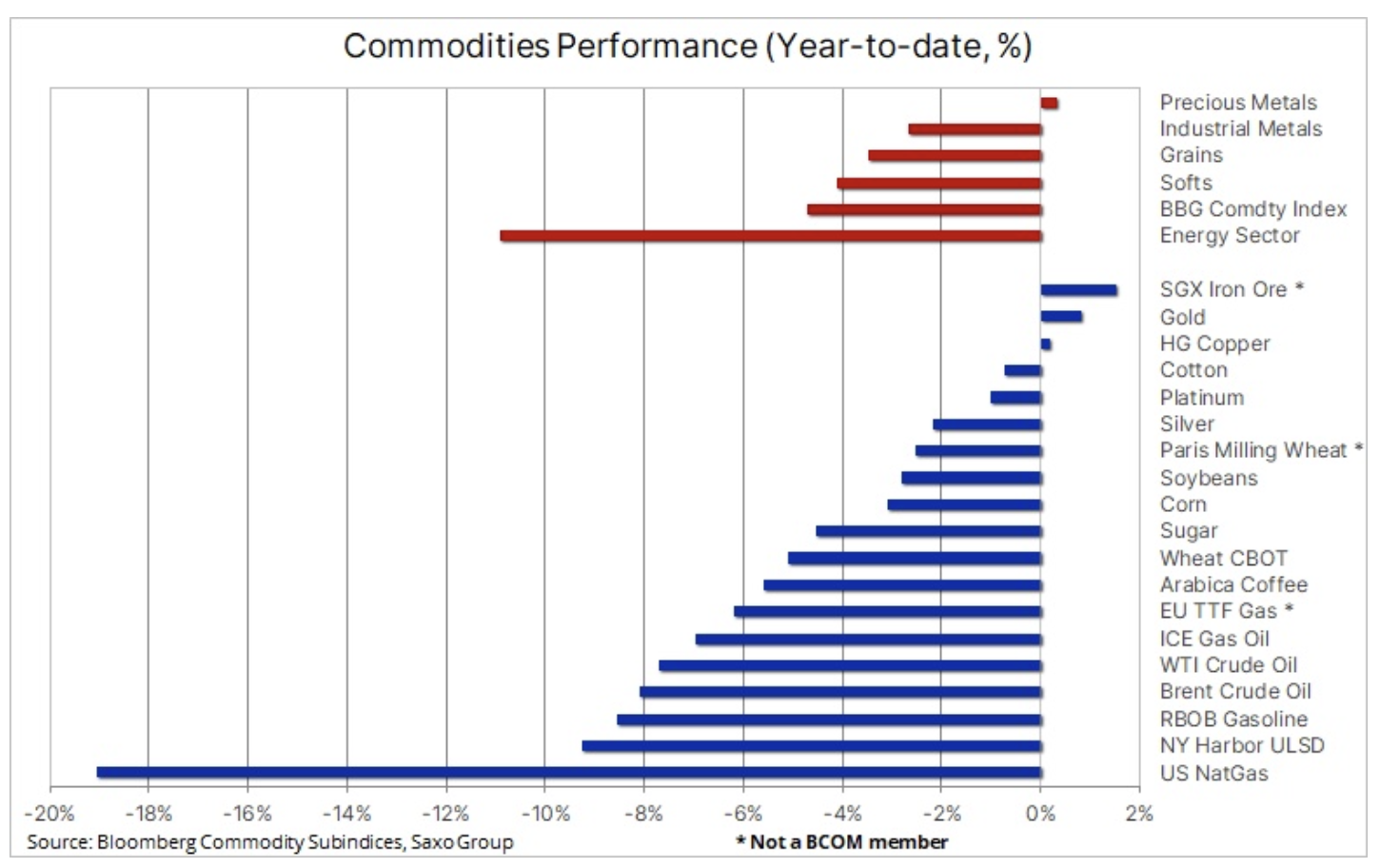

Cautious and defensive is the best way to describe commodity price action in early 2023. This year will hopefully be less dramatic and volatile than last year, when the Bloomberg Commodity Index Total Return) surged 38% in the first quarter, then drifted down for the rest of the year, only to record an annual growth of 11% for the second year in a row – a solid return given the negative impact of a stronger dollar and heavy losses in the stock and bond markets.

Many issues remain unresolved and it is their resolution that will determine what the coming year will be like. The top questions asked by traders and investors in the commodity markets are China's chaotic departure from its long-standing zero-Covid policy and what the recovery of the Chinese economy will look like. In addition, the actions of central banks to fight inflation and the scale of the economic slowdown, and perhaps even recession, which they will lead to in many regions, is another significant factor of volatility and uncertainty.

Meanwhile, inflation has peaked. Lower commodity prices contributed to this, and after reaching the highest level of inflation in decades in 2022, the key question for 2023 remains the possibility of a return to around 2,5% - a level that is currently included in valuations as medium and long-term inflation target in the United States. Finally, Russia's attempt to suppress a sovereign nation and the Western world's response to Putin's aggression remains a depressing and still unresolved situation that continues to translate into chaos in global supply chains of key raw materials, from oil, fuels and gas to industrial metals and major agricultural products.

At the end of the year, the funds focused on raw materials

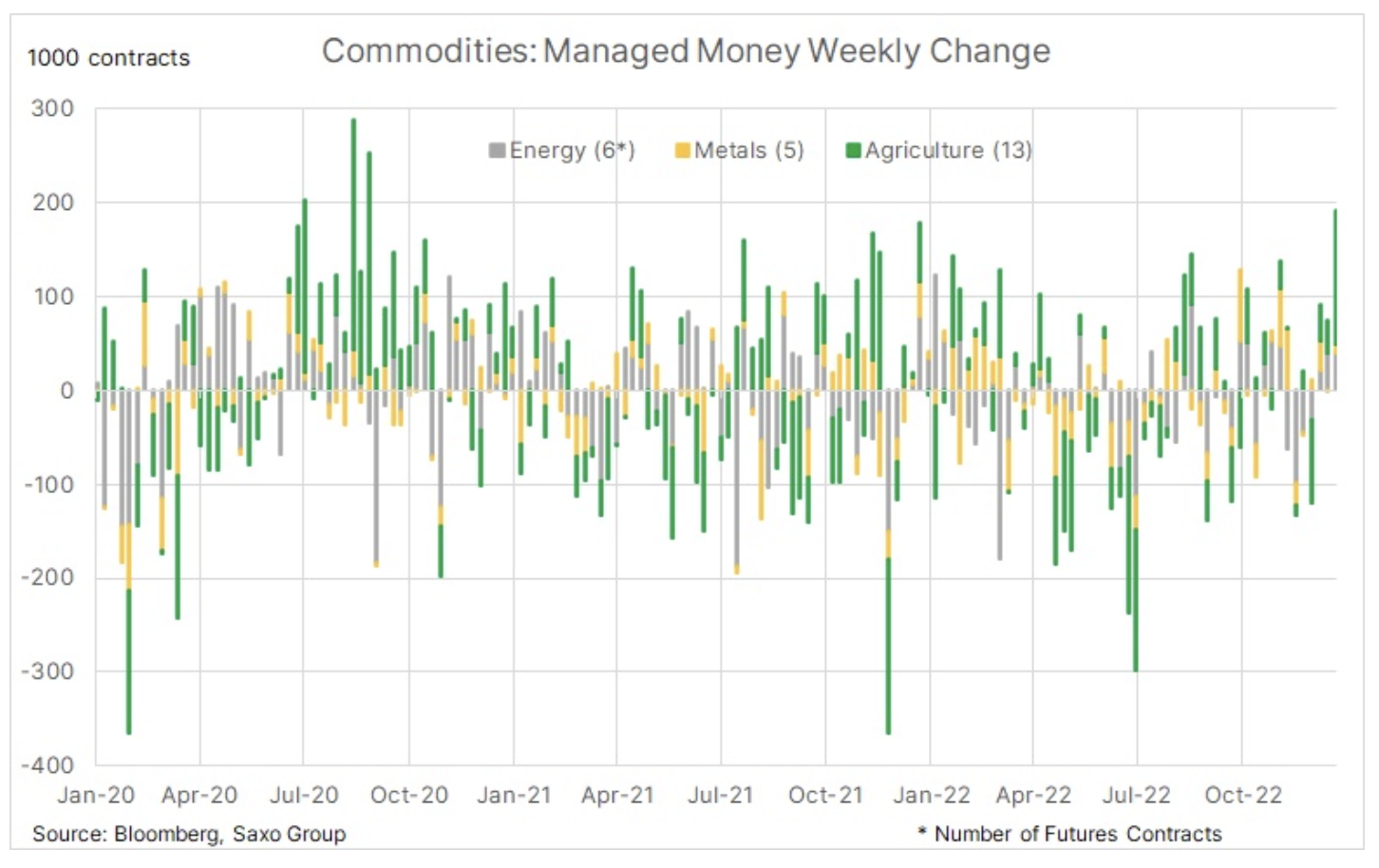

According to the report Commitment of Traders, in the week ending December 27, hedge funds showed strong interest in commodities. In our last analysis For this group of speculative traders or investors, we found that for all but one of the top 24 commodity futures covered by our report, they are net buyers. As a result, the total net long position increased by 16% to 1,4 million lots, a six-month high. Two-thirds of this increase was due to the addition of new longs, while the remaining one-third was due to investors reducing their shorts.

With all sectors except natural gas finding buyers, the reasons for these changes are to be found in general macroeconomic developments, primarily in the context of the weaker dollar and emerging optimism about the outlook for demand in China, which began to dominate the market just before the end of the year. year. This would also explain the partial weakness seen last week as traders cut back on recently created positions.

The attitude of investors at the beginning of a new financial year is always cautious for fear of making a mistake. At the same time, however, the fear of missing something (FOMO) can contribute to the dynamic building of positions that can be left in the event of a change of direction. In the short term, these mechanisms will affect price action in all markets; Take the movements in the gold and oil markets last week as an example.

Positive start to the year for gold

Gold struck out of range to start 2023 with strong growth as a result of carrying over the positive momentum from December. However, after a sudden breakout earlier in the week, the bulls in the gold market were definitely made aware on Thursday that we were dealing with a marathon, not a sprint. After solid ADP report On the US jobs report, risk appetite waned across all markets with yields and the dollar moving up, while gold fell heavily. The report also inadvertently contributed to reducing the negative impact on prices of another solid US employment report released on Friday.

The overall bullish attitude towards gold was unaffected by one report, but these events underscored the need to be patient until then Fed will continue to raise rates, and the peak of the Fed rate will remain unclear. Overall, we anticipate 2023 to be favorable for investment metal prices with recession and valuation risks, central bank interest rate peaks coupled with the prospect of a weaker dollar and mid-term inflation not returning to expected levels 2,5%, instead stabilizing around 4%.

In addition to the aforementioned supporting factors for gold this year, we anticipate continued strong demand from central banks providing a soft lower bound in the market. In the first three quarters of last year, the World Gold Council reported that the institutional sector purchased 673 tons of the metal, the largest amount since 1967 in full years. In part, this demand is driven by several central banks seeking to reduce exposure to the dollar. Such "de-dollarization" and general appetite for gold should make it another solid year for gold buying by the institutional sector.

In addition, we expect a more gold-friendly investment environment to offset last year's reduction in exchange-traded fund holdings of 120 tonnes, potentially resulting in an increase of at least 200 tonnes. At the same time, hedge funds have become net buyers since the beginning of November, when a triple bottom signaled a change in the then dominant strategy of selling gold at any sign of strengthening. As a result, from a net short position of 38k. contracts, the funds reached a net long position of PLN 27 as at December 67. contracts.

In the short term, gold could fall to $1, the 802-day moving average, while remaining in the uptrend that started in November. Gold's ability to hold that support amid better-than-expected economic data will give us a clearer indication of the strength of the market in terms of investors with potentially more long-term plans beyond short-term events.

Gas prices are falling sharply due to the mild winter and lower demand

Prices natural gas in the United States fell to a year-low of $3,55 on forecasts of milder weather in January after a period of frostbite that saw some states halt all activity towards the end of the year. With warming looming, the closely watched March-April spread - used as an indicator of market concerns about gas availability at the end of winter - fell to just 7 cents after hitting $1 in early December.

At the same time, in Europe, gas prices are falling sharply for the same reasons - over the last month, the price of the Dutch benchmark TTF gas contract has fallen sharply, at one point reaching the level of EUR 65/MWH (USD 20/MMBtu) - the lowest since October 2021. This decline was due to a mild winter and robust renewable energy production, as well as reduced industrial consumption, resulting in an unusual seasonal increase in inventories. Gas stocks in storage facilities across Europe are now 168 TWh above the five-year average and approaching the equivalent of a full month of peak winter demand.

With LNG imports still dynamic and demand falling by over 10%, the Old Continent found itself in a situation that was unthinkable just a few months ago - a situation where prices must remain low so that LNG shipments can be redirected to other parts of the world and overload local warehouses.

Copper and iron ore received an impetus from China's actions

Copper and iron ore managed to post modest gains in this challenging week, where China's chaotic departure from its long-standing "zero Covid" strategy led to a spike in infections across the country. While short-term demand forecasts are problematic, this change, in contrast to prolonged lockdowns, has accelerated the recovery in China, the world's largest commodity consumer. However, with the Chinese New Year festivities beginning on January 23 this year, the prospect of an improvement in demand is unlikely for now; perhaps the current situation will last even until spring.

HG copper endured a sell-off in the middle of last week after China, the metal's main consumer, announced further steps to support a struggling real estate sector. China-dependent commodities, including iron ore and the renminbi, surged after China's central bank and banking regulator jointly issued a directive allowing banks in cities where housing prices are falling to lower mortgage rates below the lower the limit specified in the existing guidelines.

HG Copper is stuck between the two moving averages, with resistance at the 3,8525-day average of $3,72 and support at the 4-day average of $XNUMX. A close above the first of these levels could signal a renewed attempt to challenge the key resistance around $XNUMX per pound, which we believe is very likely, but potentially not until later in the year.

QXNUMX will be a challenge for crude oil

Concerns about global growth and China (Covid-19), a strong US labor market pointing to further problems with interest rate hikes, as well as a mild winter in the northern hemisphere reducing demand for diesel and natural gas, contributed to a sharp fall in the index energy company Bloomberg in the first week of listing. Crude oil and fuel products lost around 8% last week due to continued concerns about the near-term demand outlook. These fears were reinforced by Saudi Arabia's decision to cut oil prices for Europe and Asia in February amid weak demand and competition from cheap Russian oil looking for buyers, particularly in Asia.

We maintain the view that oil A difficult Q80 awaits, with the Brent crude price likely to be below USD 90 most of the time, before finally rebounding to USD XNUMX as soon as the Covid clouds begin to dissipate over China and seasonal demand starts to pick up. In addition, we have strong doubts about the risk of a recession in the US economy and we expect demand from the world's largest consumers to support the price in a year where supply continues to be driven by OPEC + and US producers unable or unwilling to increase production.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)