Nuclear energy - an exchange sector worth watching

Nuclear energy is of great interest as an energy alternative in the global drive to secure key energy supplies, given that shortages will emerge in some countries towards the end of 2022 and 2023. Demand for nuclear power has soared as it is the second largest source of zero-carbon electricity, behind hydropower. Alternative clean energy companies also generated some of the highest shareholder returns in global markets in 2022. So today we are taking a closer look at this sector to see what could happen, which countries could become leaders in nuclear power development and which companies are involved in it. Before considering this sector as an investment and / or trading opportunity, it is important to analyze the fundamentals of the industry and make decisions based on it.

Nuclear energy currently supplies 10% of the world's energy demand, but is expected to play an important role in the supply of electricity in the future. As nuclear energy has a zero carbon footprint, its production is cost-competitive and requires limited resources. Still, the world is desperately looking for alternatives to paying record gas, oil and coal prices or the higher cost of renewable green energy projects. Regardless of the scenario, according to the World Nuclear Association, uranium supply will have to double by the end of 2040 to meet growing demand. This is good news for uranium prices and uranium companies.

So why is nuclear energy gaining in popularity?

- Nuclear energy is zero carbon. It produces energy through a process called fission, in which uranium atoms are split to produce energy. As a result of the heat released, steam is produced which rotates a turbine that produces electricity. All this is done without the use of fossil fuels, which means it does not affect air quality.

- Nuclear energy requires fewer resources than wind or solar energy. An average nuclear power plant with a capacity of 1 MW requires an area of 000 m to operate2; for wind farms, it is 360 times more, and around 430 wind turbines are needed to generate the same amount of electricity. Solar panels require 75 times as much space, and to produce the same amount of energy as the average commercial nuclear reactor, the number of panels should be around 3 million.

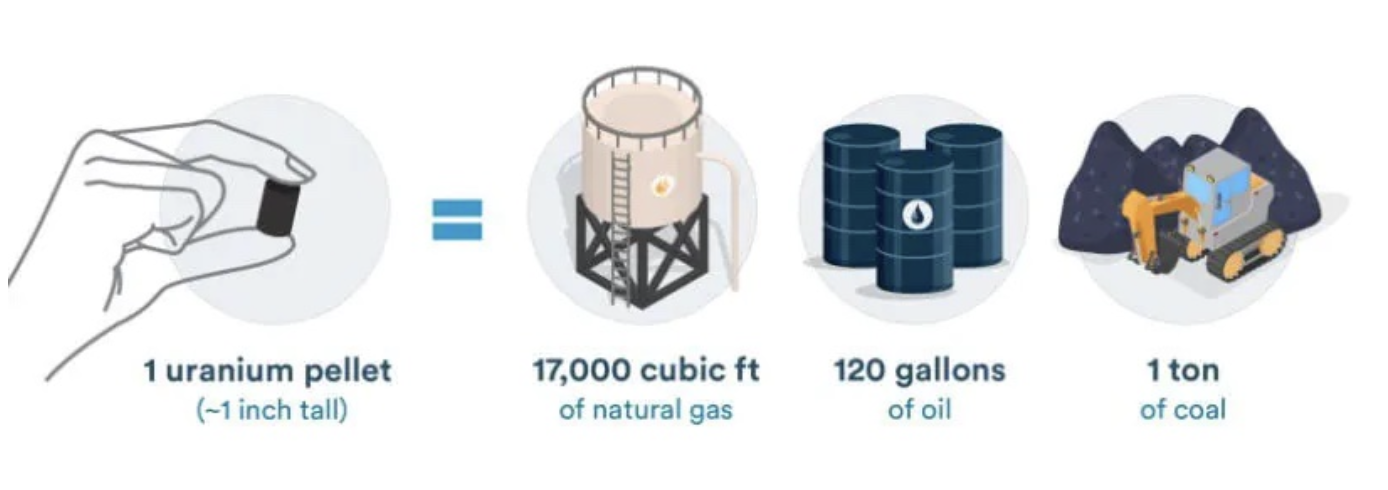

- Nuclear fuel is extremely dense. Its density is approximately one million times greater than that of conventional energy sources. For example, one pellet of nuclear fuel only 2,5 cm (1 inch) in diameter provides the same amount of energy as 2,8 barrels of oil (120 gallons), 1 ton of coal, and 481 cubic meters (17 cubic feet) of natural gas. Nuclear energy also produces a minimal amount of waste, with some advanced nuclear reactors recycling the spent fuel, making the amount of waste zero. All the nuclear fuel consumed by the US nuclear energy industry in 000 years would fit on the surface of one soccer field 60 meters deep.

Nuclear fuel - the energy source with the highest density. Source: US Department of Energy (EIA) Energy Information Administration. Saxo.

What will be the next factors in the development of the nuclear sector?

First, the United States, Canada and Japan are world leaders in the drive to use nuclear energy as the primary source of clean energy. As part of a mass project Clean Energy Ministerial (CEM), these countries are focusing on the use of nuclear energy for full-scale electricity production. Proposals for the use of nuclear energy are to be submitted to the CEM by the United States in the coming winter, so much more news about nuclear energy and increased interest in this sector can be expected.

Other countries participating in CEM are the United Kingdom, Romania, Poland and Argentina, as well as the United Arab Emirates and Russia. By the deadline, many countries had already taken large-scale efforts to deploy or plan for the development of nuclear energy. In the face of soaring energy prices, Poland wants to buy "much" more nuclear energy from Ukraine. At the same time, the US Department of Energy (DoE) proposes that 80% of operating and decommissioned coal power plants should be converted into nuclear reactors, saving 35% of capital compared to building new reactors.

Second, the United States is accelerating its own initiatives in the area of nuclear energy as part of the anti-inflation law signed by President Biden on August 16. The law unlocks opportunities for nuclear power plants and profits for companies in the hydrogen industry, as nuclear power plants will receive a package of favorable tax solutions, including tax breaks, by providing electricity to hydrogen producers. Nuclear power producers will also receive a production tax credit.

Accordingly, a company worth watching might be Constellation Energy (CEG). Constellation is scheduled to begin hydrogen production this year, powered by the Constellation Nuclear Power Plant in New York City. Earlier, she received a grant from the US Department of Energy. Utilizing nuclear potential to produce pure hydrogen can increase Constellation Energy's profits. According to Morgan Stanley, this could increase Constellation Energy's profits by 10%. Due to the projected higher profits and news about the subsidy, Constellation Energy shares surged more than 15% on a year-to-day (YTD) basis as of the date of writing (September 100), placing the company in second place below relative to the results on the S&P 500 index on a year-to-day basis.

Third, in addition to the positive momentum for nuclear power, there are risks to be reckoned with and which could cause volatility. The Australian Government Low Carbon Technology Advisor and former Australian Chief Scientist reported that Australia does not need to include nuclear energy in its future energy mix. At the same time, the European Union wants to get $ 140 billion from cutting profits from renewable and nuclear electricity suppliers as well as taxing windfall profits from oil and gas companies to help consumers pay their energy bills.

Where are the largest uranium reserves in the world?

The world's largest uranium resources are in Australia. However, the largest world uranium production is in Kazakhstan, followed by Namibia, Canada and Uzbekistan, with these five countries accounting for the majority of the world's uranium production (World Atomic Energy Association). So what is stopping Australia from becoming the largest uranium producer in the world? The government of Western Australia has somewhat held back the approval of new uranium mining projects. Australia does not use nuclear energy and relies heavily on coal to cover 60% of its energy needs. Consequently, 100% of Australia's uranium production is exported, accounting for a quarter of total energy exports.

Most of Australia's uranium comes from the uranium crown jewel -Olympic Dam, the world's largest known single uranium deposit. It is owned by BHP, the world's largest mining company.

OHS operates one of Australia's five uranium mines. Many other Australian mines have been closed for environmental reasons, and the company's Rio Tinto mine, which is partially owned by the company, closed last January with plans to restore it to its original state. At the same time, the company Boss Energy bought the closed Australian uranium mine in 2015 and only recently - in 2022 - did it obtain approval for its opening. Boss Energy made the first of the planned 86 wells under the Honeymoon uranium project in South Australia in September 2022.

Companies involved in nuclear power that could benefit from this trend

For further inspiration related to nuclear energy, we have compiled a list of companies in the nuclear energy industry that conduct a significant part of their activities in the nuclear or uranium industry - from uranium mining and refining, to energy producers and nuclear power plant operators, to transmission companies energy, as well as suppliers of components and nuclear fuel. This list is provided below.

Alternatively, you can also consider publicly traded uranium funds, e.g. Uranium ETF (URA).

If you prefer to pick individual stocks, perhaps based on your own research or our list of inspiration, however, remember that a company's stock performance is essentially based on earnings growth and expectations for future earnings and cash flow growth. For example, taking into account the best results on the NYSE and ASX in 2022, we see that fossil fuel companies and other energy companies benefited the most. Against a backdrop of higher inflation and higher interest rates, consideration should also be given to which sectors and companies (equities) should be able to replicate this success and deliver the greatest gains in profits and revenues. We believe the energy sector will continue to perform best, so it is worth considering your exposure to the energy sector when reviewing the portfolio for this quarter.

|

Thematic area - nuclear energy |

|

|

Company |

Code |

|

Duke Energy Corp. |

FAQ |

|

Dominion Energy Inc |

D |

|

Electricite de France S.A |

EDF |

|

Exelon Corp |

EXC |

|

RWE-AG |

RWE |

|

CGN Power Co Ltd |

1816 |

|

Endesa S.A |

HE |

|

Cameco Corp. |

CCO |

|

Korea Electric Power Corp |

KEP |

|

Fortum Oh |

FORUM |

|

NAC Kazatomprom JSC |

KAP Assisted Psychotherapy |

|

Tokyo Electric Power Co. Holdings Inc |

9501 |

|

BWX Technologies Inc |

Bwxt |

|

NexGen Energy Ltd |

NXE |

|

Paladin Energy Ltd |

PDN |

|

Uranium Energy Corp. |

UEC |

|

Denison Mines Corp |

DNN |

|

CGN Mining Co Ltd |

1164 |

|

Energy Fuels Inc / Canada |

UUUU |

|

Yellow Cake PLC |

Y.C.A |

Author: Jessica Amir, market strategy specialist, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response