Google and Microsoft are fighting for a leading position in the field of artificial intelligence

Google and Microsoft are in a fierce battle for leadership in artificial intelligence (AI) technologies, and with the recent update to Google's Bard chatbot, the market has begun to see the Mountain View company in a completely different way. Until now, it was believed that it lags behind Microsoft, but it may have actually taken the lead in the AI technology race. It is worth watching not only the battle for artificial intelligence between the two companies, which will be of immortal importance. Individual currents of opinion on AI technology and what we can expect in terms of regulation should also be analysed.

The race for leadership in artificial intelligence will have immortal consequences

After Meta's defeat with Metaverse it should be clear by now that Google and Microsoft are the giants fighting for leading in the field of artificial intelligence. Amazon has awkwardly lagged behind and lost its appeal among investors after failing to invest during the pandemic and betting on the development of technology in the field of voice assistants. Apple, on the other hand, is conspicuously absent from the AI race and is focused on other business, such as software for cars and health services related to the Apple Watch. The AI race gained momentum when, on January 23, 2023,

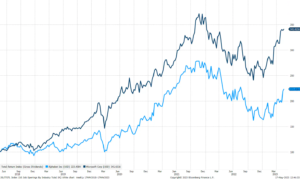

Microsoft has announced an investment of USD 10 billion, after investments in 2019 and 2021, which is the company's third and largest investment in OpenAI. Many considered the investment too much for the new technology, which was easy to lose, but after OpenAI upgraded the core GPT system for Chat GPT the situation changed quickly, and within the first two months of launching the company has gained as many as 100 million users, which was the fastest ever product deployment. Since Microsoft's $521 billion investment, the company's market value has increased by $XNUMX billion, reflecting high market expectations for the development of AI technology.

Has Google been the leader all this time?

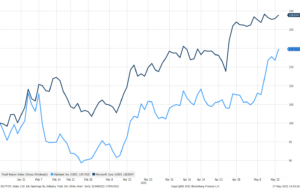

The price chart from January 23, 2023 also shows that Alphabet (Google) stock fell significantly after Google's AI chatbot Bard made a factual error in its first demo. Investors were immediately alienated from Alphabet's shares, recognizing that the company lags behind OpenAI and will lose the artificial intelligence race. Google has been researching AI technology intensively for years and released a ChatGPT-like technology called LaMDA two years ago. Mountain View Company chose a cautious approach to AI technology due to its internal ethics boards and guidelines, however, after implementing ChatGPT, it had no choice but to follow suit. Over the years, Google's London-based subsidiary DeepMind has achieved groundbreaking results in games such as Go (Chinese chess) and Stratego, as well as the problem of protein folding, and most recently in controlling fusion plasma in a tokamak with magnets.

Taking into account all the results achieved over the years, it could be argued that Google has been in the lead all along, and the recent outstanding results of the updated Bard chatbot have caused investors to rethink their expectations for Google in the race of artificial intelligence. Maybe Google has been the leader all this time? Alphabet's latest move was to merge its Brain AI research group with DeepMind, creating a combined AI research unit of 1 scientists. This is a powerful force in AI research, and in particular DeepMind's advantage in many practical applications such as protein folding, data center energy optimization and tokamak fusion control lead us to believe that Google has an advantage in this area.

One of the deciding factors in the AI race is whether the driving force behind this trend will be businesses or consumers. Microsoft has an advantage in distribution and enterprise software, so it will win the AI race economically if this trend is driven by enterprises. If it turns out to be a consumer trend, Google will win with its many consumer apps including email, search, maps, etc. According to a recent study by Critical Mass, consumers of all ages believe that Google leads the race.

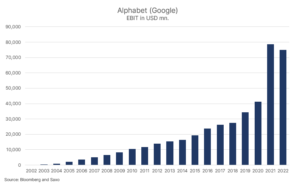

As we have already noted above, Alphabet (Google) and Microsoft are in a fierce AI race and every investor in the world must decide how to gain exposure to this technology. As we have already pointed out in several previous stock market analyses, in the context of AI, the equivalent of spades from the California Gold Rush period is Nvidia, but when it comes to the actual implementation of AI, the choice of investors is limited to Google or Microsoft. Both companies have economic potentialto compete and invest in artificial intelligence - Alphabet's last operating profit (EBIT) was $74,8 billion, while Microsoft's profit was $83,4 billion. Taking into account valuations, Microsoft's return on free cash flow is valued at 2,6%, while Alphabet - at 4,8%, suggesting that the market is betting on Microsoft for now. However, as recent price action has shown, the market is also aggressively overvaluing Alphabet's stock.

Three currents of opinion on artificial intelligence

There seem to be three competing ideas about AI with respect to what it means for our civilization. The first concept is the positive approach of a Silicon Valley optimist who believes that all technology is ultimately good for humanity and that AI will prove extremely positive for our society. Proponents of this thesis include Yoshua Bengio (professor and computer scientist) and Yann Le Cun (lead artificial intelligence scientist at Meta). Sam Altman, co-founder and CEO of OpenAI, the company behind ChatGPT, was initially part of this group as well, as evidenced by OpenAI's aggressive push to implement ChatGPT despite many ethical concerns related to this technology. Since then, Sam Altman has rebalanced his originally unilaterally positive attitude towards AI (see next section on AI regulation).

In the opposite camp, we have pessimists speculating that AI technology could lead to the demise of our species; the most famous proponents of this thesis are Max Tegmark (lecturer at MIT), and recently also Geoffrey Hinton, one of the first and most important contributors to the current field related to AI, who clearly negatively assessed the prospects of humanity in the context of AI and resigned from Google to shape public opinion on artificial intelligence.

The last group consists of scientists who are concerned about causality and argue that while current AI systems are impressive in many respects, they are still mere correlation machines and therefore unable to understand our world in terms of chains of cause and effect. Late last year, Microsoft researchers experimented with new artificial intelligence systems, recommending AI make a stable pile of a book, nine eggs, a laptop, a bottle and a nail, which task requires an understanding of our physical world. The answer was clever, and one researcher suggested that perhaps they were witnessing the birth of a new kind of intelligence. A group of AI skeptics slightly modified the same command and immediately noticed that the solution proposed by the AI showed that it did not understand the physical world.

Regulations on artificial intelligence are coming

Altman himself attended a hearing before the Senate Committee on Artificial Intelligence in recent days, discussing a wide range of AI-related topics, from regulation to copyright models. Altman said government regulation of AI is critical in preventing the technology from becoming a reality will get out of control; he is also a supporter of the government model of artificial intelligence licensing. He also said that OpenAI is not profitable and that every time someone uses ChatGPT, it means a loss of money. He added that he had some concerns about this technology, in particular regarding the potential negative impact on children.

After the hearing, Senator Blumenthal stated that Congress cannot be the guardian of AI regulation, the Federal Trade Commission (FTC) does not have the capacity to do so, and AI regulation should be part of a broader technology regulatory framework. There is no doubt that regulation of artificial intelligence is necessary to ensure that the technology is used in the right way and does not harm society, but with this type of regulation comes the possibility of so-called regulatory capture by big companies and limiting competition if not properly designed. Regulation means a potential benefit for companies involved in the field of artificial intelligence because raises the barrier to entry into the marketand thus contribute to improving profitability.

Altman himself also talked about generative AI products using the example of OpenAI's Dall-E 2 image generator, which is able to create images based on inputted text. There are two risks associated with generative AI. The first is the risk of copyright infringement and the lack of compensation for the artists, since their original works were clearly part of the training of the Dall-E 2 system. Sam Altman reported that OpenAI is working on a copyright system to ensure that artists are properly compensated. The second risk with generative AI is that it will flood the internet with AI-generated content that will dominate the training samples of future AI systems in the future. The question is whether this will naturally lead to a plateau in the development of this type of AI systems. One thing is certain: artificial intelligence will remain the hottest topic in 2023 both among regulators and investors.

More Saxo analyzes are available here.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)