Grain prices are falling, industrial metals are gaining, waiting for an impulse from China

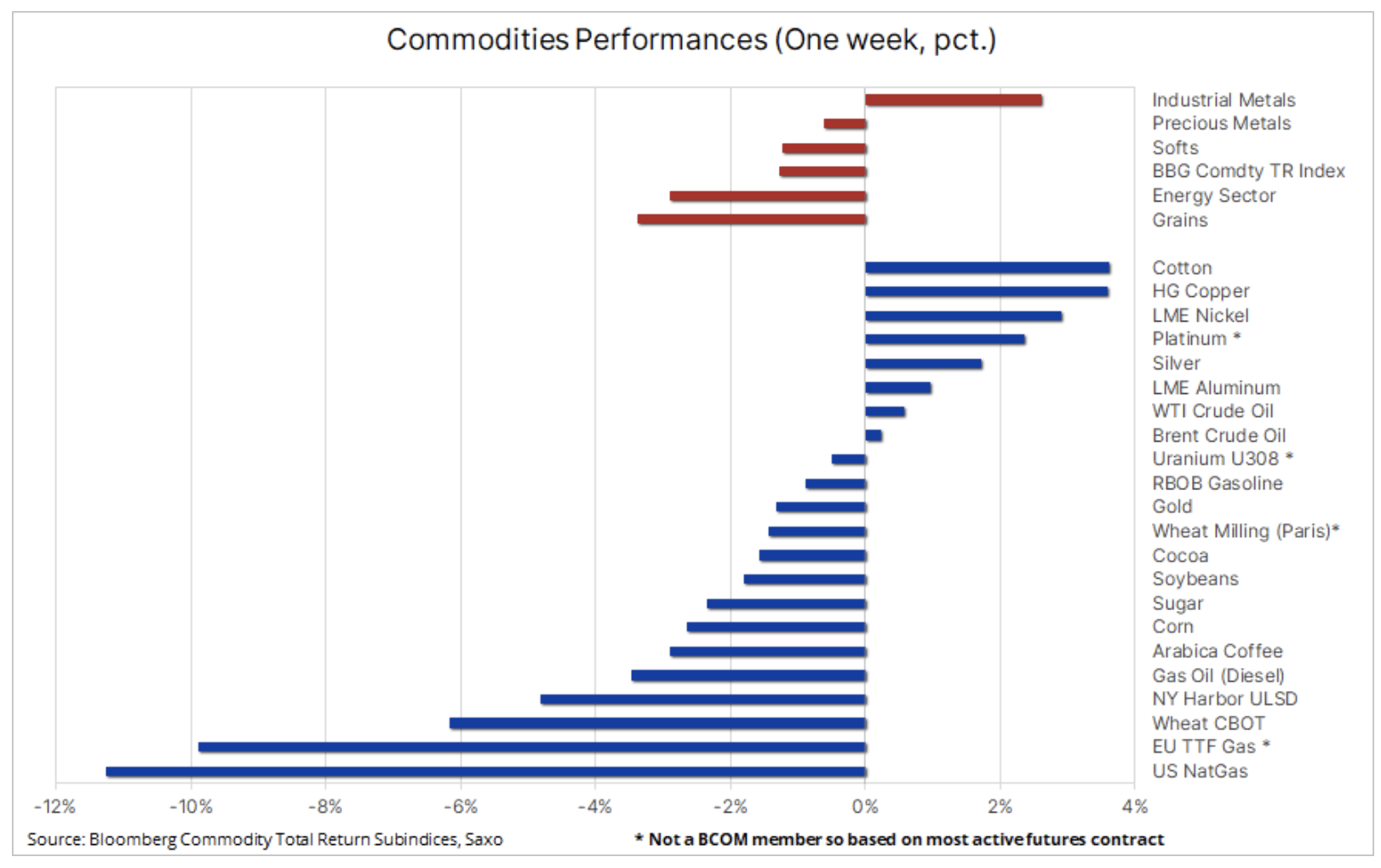

Commodity markets fell again last week, with all sectors except industrial metals losing value on ample supply, moderate temperatures and lower risk appetite after traders priced in a further delay in the first U.S. interest rate cut . Overall, the Bloomberg Commodity Total Return Index, which has remained within a relatively narrow range over the past two months, declined by approximately 1,3% and year-over-year losses widened to 2,4%. %. However, this does not apply to those under pressure natural gas, whose annual quotations remained almost unchanged.

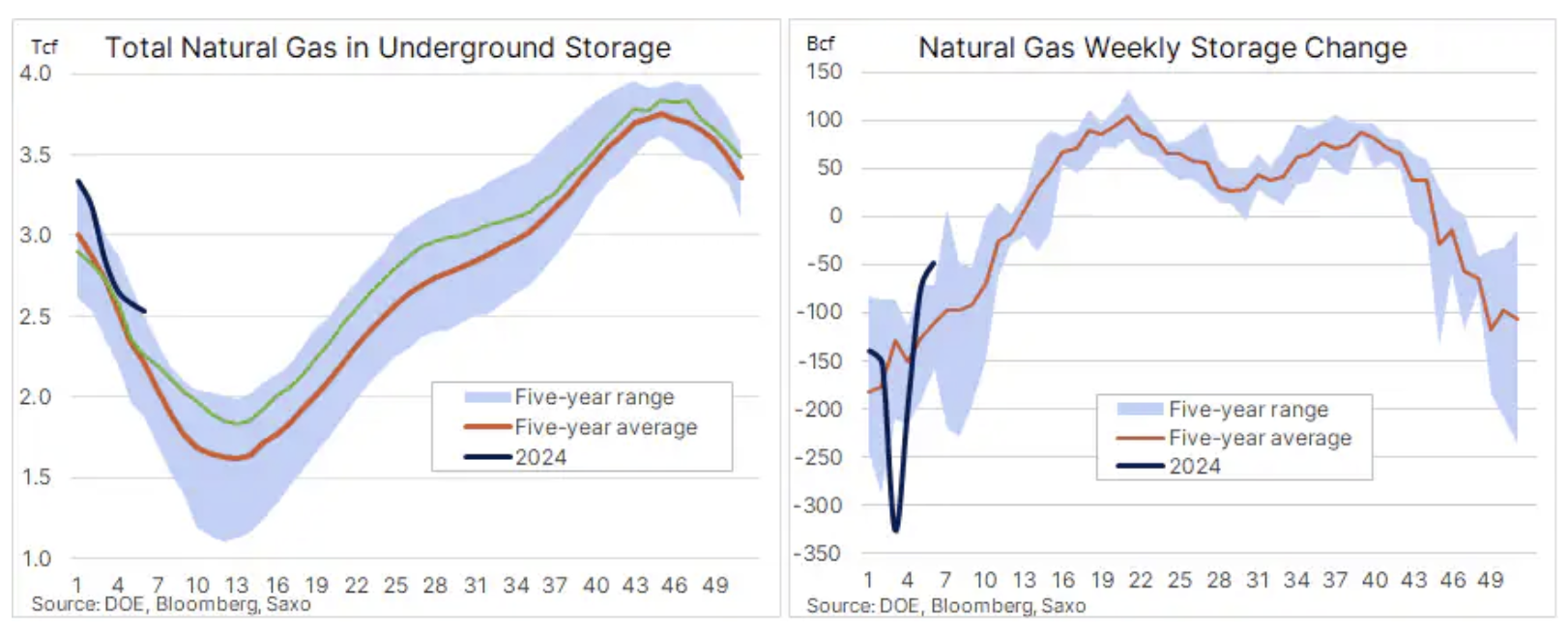

On an individual level, the mild winter in the Northern Hemisphere continues to depress natural gas prices, particularly in the United States, where the price of the Henry Hub gas futures contract last week fell more than 11% to levels last seen during the Covid shutdowns in 2020. This contract lost further value after the EIA reported that weekly inventory utilization was just 49 billion cubic feet, about 100 billion cubic feet less than the average over the last five years, and as winter demand slowed the surplus over the long-term average increased to 15,9%; as a result, there are still large reserves of gas in underground storage facilities before the filling season, which usually begins around April.

The main negative sector this year continues to be the grain sector, which has lost more than 22% over the past year, and last week corn and soybean prices fell to their lowest levels in three years, extending the decline after the US Department of Agriculture During the annual Forecasts Forum, he presented forecasts for US plantings in 2024 and stocks at the end of the 2024/25 season. Despite lower acreage allocations for corn and wheat, the report showed a sharp increase in ending stocks for all three major crops due to increased competition from South America for corn and soybean exports to China, as well as the forecast of exceptionally large wheat harvests in Russia and Europe in the upcoming season. U.S. soybean stocks are projected to increase 38% to a five-year high, corn stocks are expected to increase 16,6% to their highest level since 1988, and wheat stocks are expected to increase 16,9% to a four-year high. Overall, the Bloomberg Grains Index fell to its latest three-year low, with year-over-year losses of 32% for wheat, 26,5% for corn and 9% for soybeans.

WisdomTree Grains, a UCITS-eligible exchange traded commodity (ETC) monitoring the Bloomberg Grains Subindex Total Return, broken down into soybean (36,5%), corn (35,2 %, CBT wheat (17,3%) and KCB wheat (11%).

The situation in the metals sector was mixed, with gold weakening on higher-than-expected US inflation readings, but strengthening somewhat after retail sales fell short of expectations. Meanwhile, silver achieved its best performance against gold since December, supported by a strong rebound in the industrial metals sector ahead of the reopening of markets in China following the extended Chinese New Year celebrations.

Excluding natural gas, the rest of the energy sector was mixed, with recent strong gains in refined fuel futures moderating slightly, while crude oil was almost flat on a weekly basis, but still positioned closer to the upper end of a relatively narrow range in which has remained so far this year. We maintain the view that the price of Brent crude oil is likely to remain within the range of around USD 80 per barrel, while the price of WTI crude oil will remain at around USD 76, assuming that the geopolitical risk premium does not increase in the conditions of limited risk of the current crisis spreading to other countries. Middle East to key production areas, while support will be provided by further OPEC+ production cuts and a general improvement in risk appetite as the US interest rate cycle approaches.

Despite the recent problems, our optimistic outlook for gold and silver remains unchanged

We maintain optimistic forecasts for gold i silver, however, as we have highlighted repeatedly in recent months, both metals are likely to remain flat until we have more knowledge about future interest rate cuts in the United States. Until the first cut, the market may be a bit too optimistic, increasing expectations regarding a rate cut to levels that expose prices to a correction. In this context, the near-term direction of gold and silver prices will continue to be dictated by incoming economic data and their impact on the dollar, yields, as well as expectations of interest rate cuts.

One key factor remains the short-term interest rate market, which has gone from pricing in more than six 25-basis-point cuts in US interest rates this year to fewer than four cuts, while the expected date of the first cut has moved to June, potentially leaving a very tight window window for rate cuts. This is based on the assumption that the FOMC is unlikely to cut rates around the November US presidential election to avoid accusations of favoritism towards the incumbent president.

Having moved below key support in the 2005-2010 USD area, the market is now engaged in a battle between selling in short-term momentum-based strategies and sustained physical demand - supporting a soft market bottom - from central banks and retail investors, primarily in the Middle East , in India, as well as in the form of the Chinese middle class trying to secure their fortunes, which are shrinking due to the real estate crisis and the stock market achieving one of the worst results in the world, as well as the weakening yuan. Ahead of this week's Chinese New Year celebrations World Gold Council reported that China's wholesale gold demand in January was the highest on record at 271 tonnes, while the People's Bank of China announced its 15th consecutive gold purchase in January, increasing gold reserves by 10 tonnes to a total of 2 tonnes.

The fact that silver outperformed gold in such a weak week highlights its dual role as both an investment and industrial metal. The strengthening of industrial metals not only helped prevent silver from falling below key support around $22 per ounce, but also supported a strong short-covering recovery that has seen the gold/silver ratio drop from a recent peak of around 92 ounces of silver to one ounce gold fell to its December low of approximately 87 ounces of silver to one ounce of gold.

In the short term, gold needs to re-establish support in the $2 area, while silver looks to next week's reopening of Chinese markets to see if the industrial metals sector can capitalize on recent gains to support silver's attempt to clear key resistance at 000. $23,32 - the late January peak - as well as a two-hundred-day moving average.

Industrial metals are counting on support after the reopening of the Chinese market

As we mentioned, the industrial metals sector saw a strong rebound in a week that saw the Bloomberg Industrial Metal Index initially fall to its September 2022 low before rising on growing optimism ahead of the reopening of Chinese markets following the extended celebrations. Chinese New Year. Construction in the world's largest metal consumer country is expected to pick up in the coming weeks and the seasonal winter slump will end. For now, the recovery has been largely the result of speculative investors covering their short positions, particularly in HG copper futures, where hedge funds and CTAs increased their net short position sixfold to 6 contracts in the week ending February 20.

Overall, copper remains range-bound, with growth concerns in China balanced by speculation that the Chinese government will take broader action to support its weakening economy, as well as the prospect of tighter market outlooks as the green transition continues to gain pace and mining companies lower production forecasts due to increasingly difficult to exploit deposits, rising costs, water restrictions and increased scrutiny of new permits.

At the current price of approximately $3,80, the futures contract for copper HG is near the midpoint of the range established between the July 2022 low of $3,13 per pound and the January 2023 high of $4,355 per pound. We expect this sideways trend to continue until the expected supply constraints become more apparent, particularly in the second half of the year.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)