The stars of the European stock market. Analysts are full of optimism

European equities have been the most important topic on the stock exchanges since the beginning of 2022, when the interest rate shock began and it turned out that inflation will remain high for longer. European equities not only outperform, but are also much more attractive in terms of valuation at P/E ratio at 13,2x compared to 18,5x for US equities. Estimated profits have also grown faster in Europe than in the US this year, despite the excitement surrounding AI. It is also worth paying attention to the shares of 20 European companies, which contributed the most to the spectacular results on this market this year.

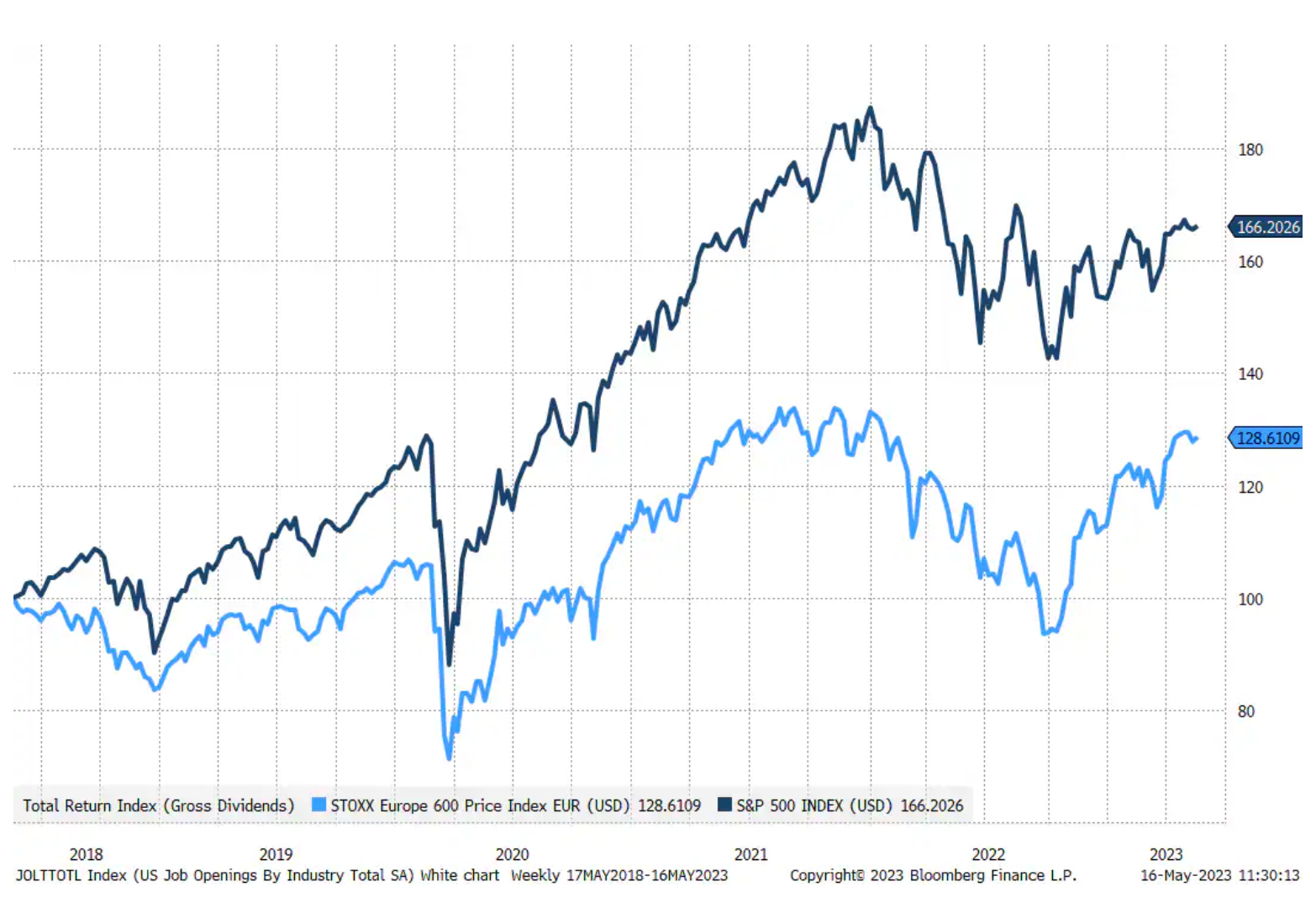

European stocks continue to dominate US stocks

European stocks are up 14% this year compared to 8,5% for US stocks. Were it not for the excitement of the artificial intelligence phenomenon, these data would be even more favorable for European equities. If we compare the change in prices this year with the actual change in core income, and more importantly, with the expected profits, we can see that the US stock market has become even more expensive than the European one. The valuation of the STOXX 600 index currently assumes a P/E leading ratio of 13,2x and a dividend yield of 3,5% versus 18,5x and 1,7%, respectively. The risk-reward ratio clearly favors European equities, and many overseas investors are looking to diversify their exposure to US equities by increasing their exposure to European and Japanese companies.

It is already clear that European stocks simply outperform in times of inflation. Since the Covid immunization announcement kicked off a return to the physical world and inflation, European stocks have returned 39% compared to 32% for US stocks. Since peaking at the end of 2021, US stocks have fallen 11%, while European stocks have fallen just 3%. Due to the ongoing debt ceiling debate in the US, which is likely to lead to a compromise to reduce the current deficit, government growth momentum in the US in 2023-2024 may be lower than in Europe. In other words, European stocks offer better projected returns and a much lower starting point in terms of valuation. What's not to like here?

The upward revision of profit estimates underscores the momentum in Europe

Europe is shining today not only in terms of results. Looking at the 600-month earnings estimates, analysts are consistently more optimistic about European equity earnings. The 1,7-month STOXX XNUMX gain estimate is up XNUMX% this year, while the STOXX XNUMX gain estimate the S&P 500 index fell by 0,1% this year. One of the key drivers of this is that demand in the physical world is outstripping demand in the digital world, as the fragmentation of global supply chains is driving a significant amount of investment in both the US and Europe. However, a more impressive aspect of the performance of European companies is that they achieve it with less fiscal impulse compared to the US, where the fiscal deficit is around 7% of GDP, while in Europe it is closer to 3,5%. The war in Ukraine has accelerated two powerful developments in Europe: 1) the green transition, which is driving the most extensive electrification process in history, and 2) the doubling of military spending, which will have positive spillover effects on European industry.

The stars of the European stock market in 2023

While the technology and healthcare sectors drive the US stock market, the European stock market is more diversified, spanning the consumer goods, healthcare, financial and energy sectors. The table below shows the shares of the 20 European companies that contributed the most to this year's results. 5,75 percentage points of the 14% total return on the STOXX 600 index this year was generated by the stocks of the 20 companies we call Europe's stars.

Three of these companies belong to the dynamically developing segment of luxury goods, which we wrote about extensively throughout the year, and most recently in the analysis published last week entitled Stocks of luxury goods producers do not react to the state of the Chinese economy. Stocks of luxury goods producers, led by the French giant LVMH, are the preferred solution for investors positive about the reopening of the Chinese economy to the world. In addition to the luxury goods segment, three companies from the healthcare sector (Novo Nordisk, Novartis and AstraZeneca) also contributed to the increase in this index this year. Healthcare stocks have extremely high quality and defensive characteristics that are seen as extremely valuable in a context of economic and inflation uncertainty. The pro-cyclical boom in infrastructure, the green transition and the reduction of risk in supply chains have brought tangible benefits to industrial enterprises and semiconductor manufacturers such as ASML, Siemens and Schneider Electric.

European banks such as HSBC and UniCredit were also in the top XNUMX. Even a short-lived banking crisis caused by bankruptcy Silicon Valley Bank had no real impact on the European market, apart from the merger of UBS with Credit Suisse. European banks stood out positively this year with rising net interest income and lower than expected loan loss provisions. US banks performed significantly worse than European banks last year.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)