The boom on the energy market diverts attention from declines in other sectors

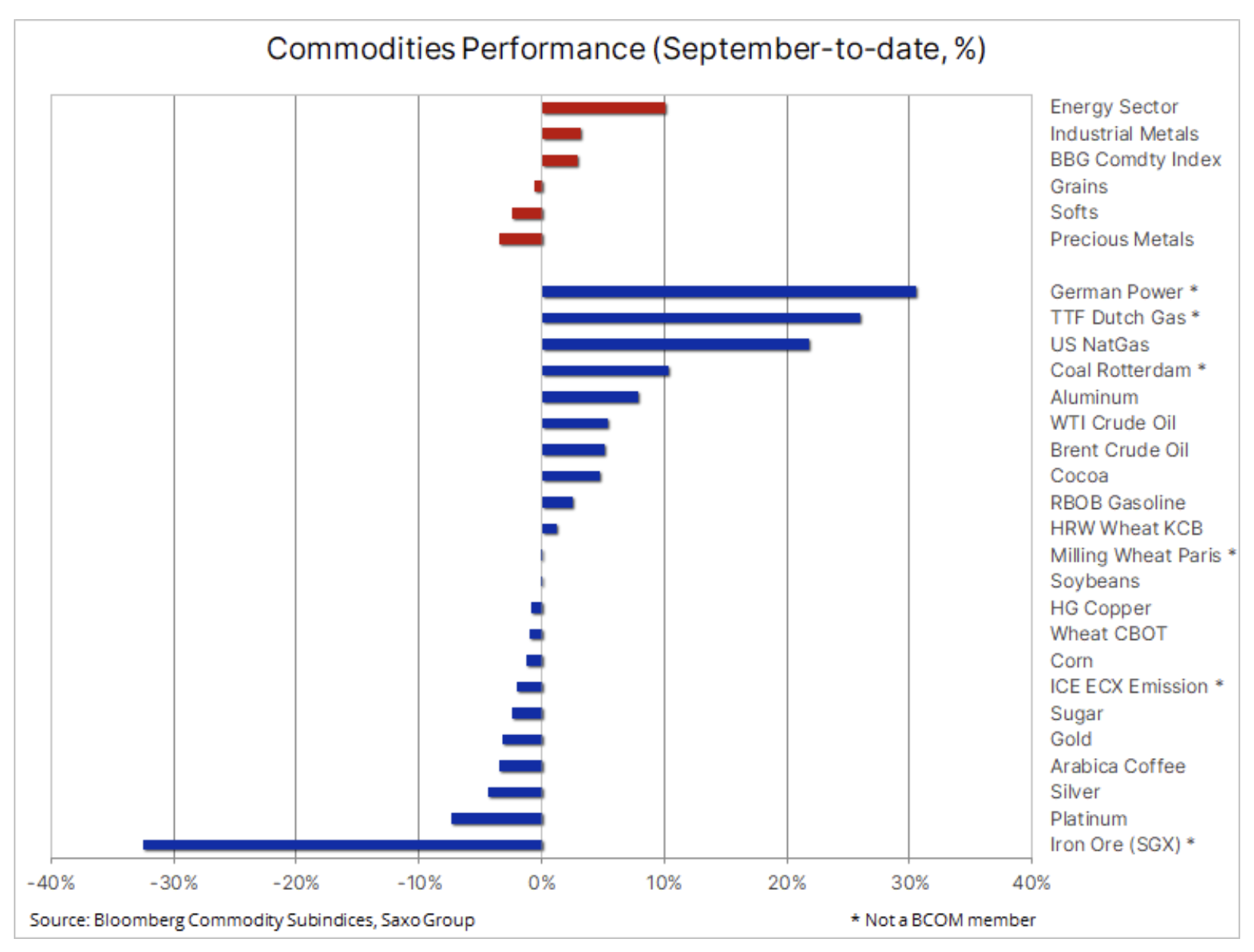

The commodity bull market continues with the Bloomberg spot commodity index recently hitting its ten-year high. It is worth noting, however, that the discrepancies between individual sectors have started to deepen and the results have become much less synchronized than in the first half of 2021. The weakest sector - both now and for most of 2021 - remains the precious metals sector, for which there is no justification against the stock market boom and concerns over inflation, counterbalanced by the prospect of a reduction in fiscal stimulus by central banks, which would lead to an increase in government bond yields and a potential dollar appreciation.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The dollar is another key factor in guiding the direction of commodity markets. It is still strong, which hinders the situation of raw materials most sensitive to the US currency exchange rate, such as investment metals or key agricultural products. Better-than-expected US retail sales data provided additional support to the dollar, coupled with demand for safe investment as the crisis of the Evergrande company, the most indebted developer not only in China but also in the world, continues to deepen. If the government fails to tackle this situation, there is a risk that the crisis will spill over to competing companies and the entire Chinese economy.

European gas and energy market

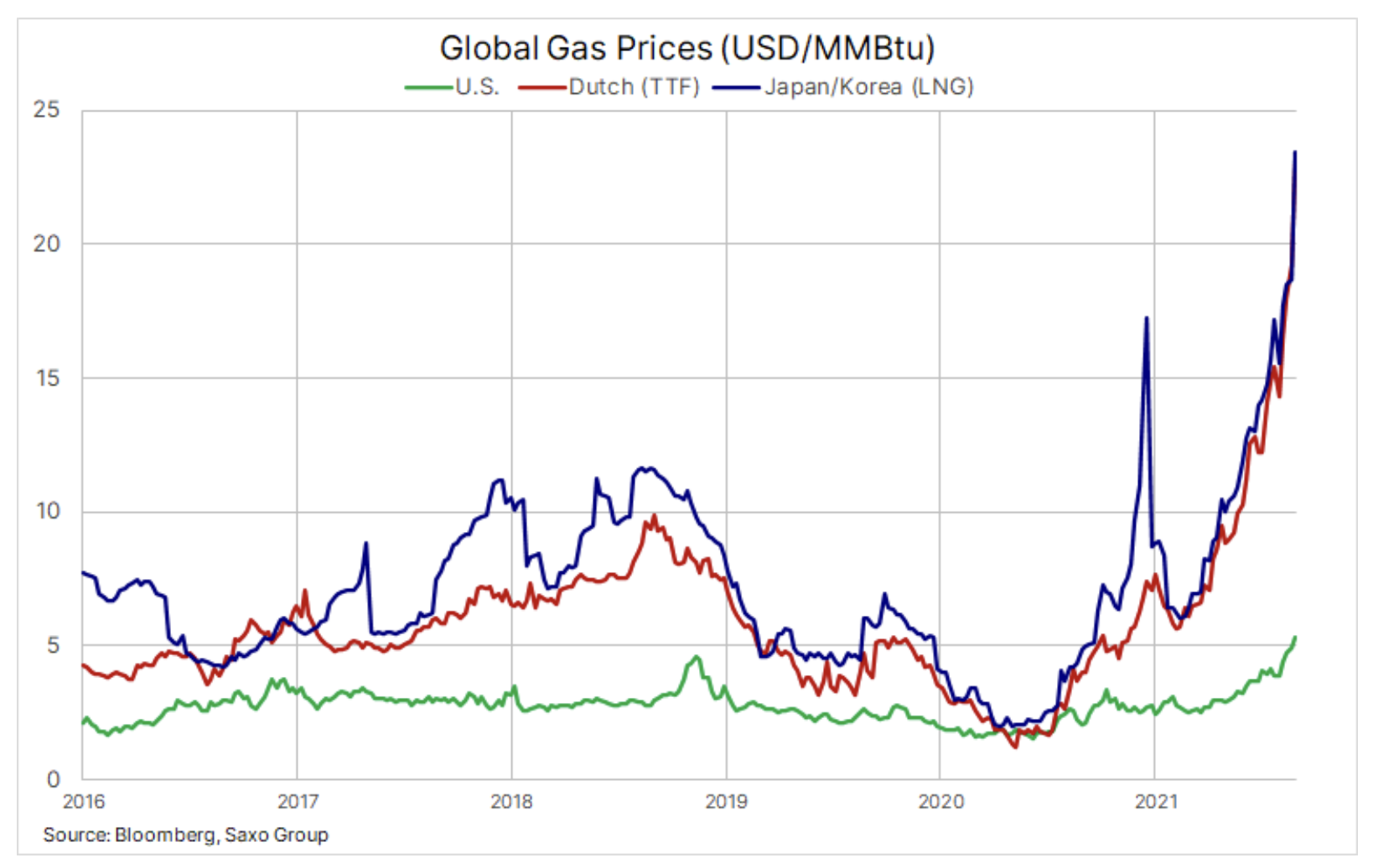

As in the previous two weeks, it is impossible not to mention the phenomenal jump in gas and electricity prices in Europe, which is increasingly being felt by energy-intensive industries, from chemicals and fertilizers to cement and even sugar producers. This year, there was an ideal storm in the form of price-beneficial phenomena that pushed gas prices to a record level: the price of the Dutch benchmark TTF gas contract with the nearest expiry date at some point reached EUR 76,5 / MWh or USD 26,8 / MMBtu, which is a record-high equivalent of USD 150 per barrel of oil. German basic energy prices with next year's delivery date reached EUR 108 / MWh, almost 2,5 times the five-year average for this period of the year. We are also concerned about UK consumers, who have found themselves in the most disadvantaged group, as the UK electricity grid has seen a sharp decline in energy from wind turbines. The British counterpart of the aforementioned Dutch TTF contract reached an unimaginable level of EUR 260 / MWh, after which it fell slightly.

Below are the main reasons for the current price increase. While some may eventually change and lead to a decline, the prospect of another cold winter worries everyone, from consumers to industry and even politicians. The latter may fear power cuts, partly because of green transition initiatives that make it difficult to maintain the necessary baseload levels on the power grid.

- Uncertainty related to the launch of Nord Stream 2, a potential additional source of gas supply

- Problems with LNG supplies in the United States due to disruptions caused by Hurricane Ida

- Little wind power production in Europe, with Orsted, the leader in the Danish renewable energy market, announcing an "exceptionally weak wind quarter"

- Limited energy production from Norwegian hydropower plants

- Low gas stocks in more than ten years before the peak of winter demand.

Petroleum

Clothing saw the fourth consecutive week of growth, and the August price collapse caused by the Covid pandemic is long forgotten as both oil and natural gas prices continue to be impacted by Hurricane Ida. Producers of both commodities continue to struggle to resume production on platforms in the Gulf of Mexico, and the IEA, in its latest monthly oil market report, predicts a potential loss of over 30 million barrels. Due to the fact that refineries also have difficulties resuming operations, there has been a sharp decline in gasoline and diesel inventories, which had a positive impact on prices. Add to this the transfer of the aforementioned increase in world gas prices to the US market, as well as the IEA forecast assuming a strong increase in demand by the end of the year as the effects of the pandemic disappear again, and we will have a market where the bulls will take control again.

However, concerns about demand in China, a further recovery in production in the United States, and the prospect of releasing more oil from strategic reserves in both countries could limit further short-term gains above the multi-year trendline reaching the 2008 record high, now just below $ 77 .

Gold and silver

Metals continue to behave worryingly: they stabilize as profitability declines, then depreciate sharply as profitability rises slightly. This week was no exception - goldsilver, in particular, has been forgotten by investors following stronger-than-expected US retail sales growth. Higher yields led to a strengthening of the dollar as a result of speculation that fiscal stimulus may soon be contained. Gold fell below the support level, which became the resistance level ($ 1), while the price of silver fell to $ 780, the August low. The fund manager at BlackRock informed Bloomberg that it has reduced its gold exposure to near zero; a similar decision was made in recent months by other cash managers, focusing on economic recovery and normalization of real profitability.

Until the data show otherwise, the precious metal market will not be at the top of fund managers' purchasing lists, so despite continued strong demand from physical trading centers in India and China, as well as from central banks, the precious metal remains within limits. a wide range of $ 200 between $ 1 and $ 700. This week, investors' attention will focus on the FOMC meeting on September 1, during which the market will look for confirmation when the central bank starts reducing its wide-ranging bond purchase program. The size and pace of the reduction are likely to determine the short-term direction, and gold needs a solid breakout back above $ 900 to improve the outlook. Until that happens - and we still believe it will - there is no real reason to rush or open up new positions.

the iron ore

a key component of steel production and the largest export commodity Australia, has its longest streak of daily losses since 2018. China's steel production, which fell to its lowest level in 17 months in August, remains under pressure amid government clamps on polluting industries, but also signs of weakening real estate activity - a phenomenon that is currently attracting increased attention due to the aforementioned problems of Evergrande. The effects of this impacted the price of futures in Singapore, which fell from a record high in May of $ 230 / tonne on Friday to a double-digit level of $ 101,50 / ton.

Industrial metals

During the week, industrial metals slightly went down, but in monthly terms they still record an increase as a result of the recent strengthening of aluminum and nickel, the supply of which is decreasing, and the demand for them is growing, among others. due to the green transition and China's efforts to reduce emissions in the most energy-intensive industries. Copper - used for everything from cabling and electronics to electric vehicles - remains within the range, and a solid long-term outlook for demand is now threatened by concerns about growth in China's key source of demand.

In retrospect, we can see that copper, one of the pillars of the so-called The "green" transformation continues to show a downward trend, but at the same time managed to create a double bottom around $ 3,95 / lb. While waiting for a higher maximum, which will attract new buyers - above USD 4,63 / lb at the beginning - the risk of a deeper correction cannot be ruled out, but in our opinion copper remains a profitable investment amid new strengthening and possible additional weakening.

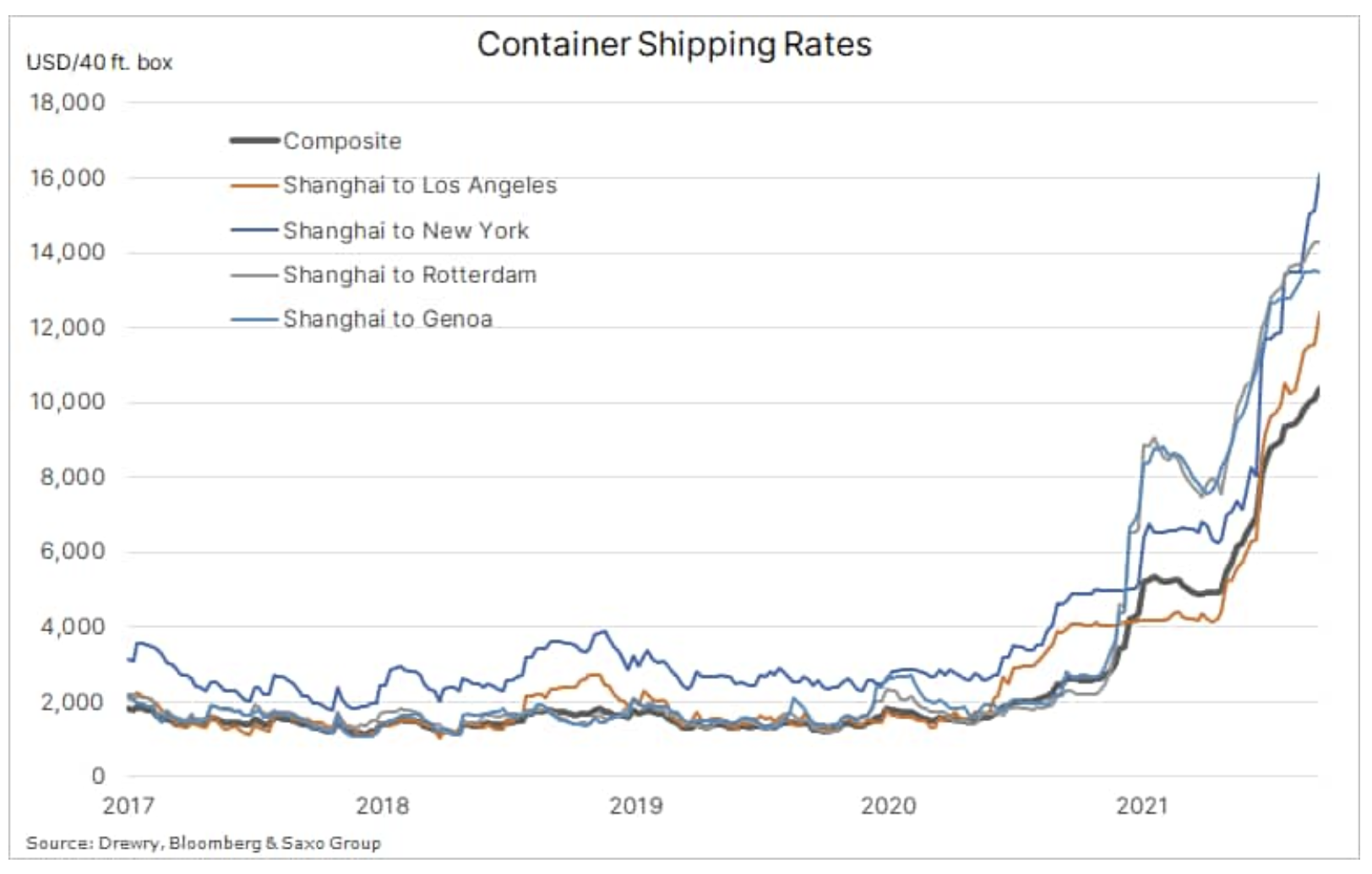

Increase in rates for container freight

Another factor influencing the costs and possibilities of global transport of raw materials is the continued dynamic growth of global container freight rates. Last week, Danish company Maersk, one of the largest container ship owners in the world, raised its profit forecast for 2021 for the third time, citing the unique market situation. The increase in freight rates is a result of the persistent congestion and bottlenecks in global supply chains that are lagging behind the demand for goods and struggling with the disruption of work caused by the coronavirus outbreaks. These inflationary forces are not expected to reverse any time soon, and high rates may persist until 2023.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)