Core inflation has unofficially become history

Central banks entered the inflation game very late because they underestimated the effects of the economic recovery during the pandemic. They expected supply chains and the supply side of the economy in general to normalize much faster than they did. Our main thesis is that if central banks focus too much on core inflation, they can make a big mistake. Food and energy will be crucial in times of crisis, and climate change and the green transformation will translate into inflation in the years to come. Investors should invest more in the material world to offset this inflation risk.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Everything will be driven by the energy crisis

About 30 central banks around the world have adopted a headline inflation targeting strategy; in the United States, this is it Personal Consumption Expenditures Index, officially announced in January 2012. Although the target is officially based on headline inflation indicators, many central banks and economists place greater emphasis on core inflation indicators. These indices eliminate energy and food from the price index. It is probably because of this practice that central banks react more slowly to the current inflation impulse; remember that a year ago in Jackson Hole, Jerome Powell said:

"We have a lot of work to do to achieve maximum employment, and only time will tell if 2% inflation is sustainable."

American CPI readings and core CPI were then at the level of 5,4% y / y and 4,3% y / y, respectively

Energy and food items are removed from core inflation indices because they are viewed as volatile and not driven essentially by changes in trends in overall prices; it is also key to assume that there are temporary factors behind them, which will later reverse (see the following quote Federal Reserve Bank of San FranciscoThe same argument was used for disrupted supply chains, although in reality the process turned out to be much longer than anticipated.

“However, while the prices of these commodities can often rise or fall rapidly, the price disturbance may not be linked to a trend shift in the overall price level in the economy. Often times, food and energy price developments are more related to temporary factors that may reverse at a later date. '

Food and energy will increase inflation in the future

Our analytical team spent a lot of time discussing the physical world, and we recently introduced indexes industry groups based on tangible and intangible goods and services. We have repeatedly demonstrated how much underinvested the global energy and mining industry is and why it will affect us for many years to come. Food and energy are also inextricably linked, as we saw yesterday when Yara International reduced its European ammonia production to just 35% of its potential production due to the increased prices of natural gas. A decrease in ammonia production will lead to a reduction in the amount of fertilizer for farmers, and thus a reduction in food production, which in turn may lead to an increase in food prices.

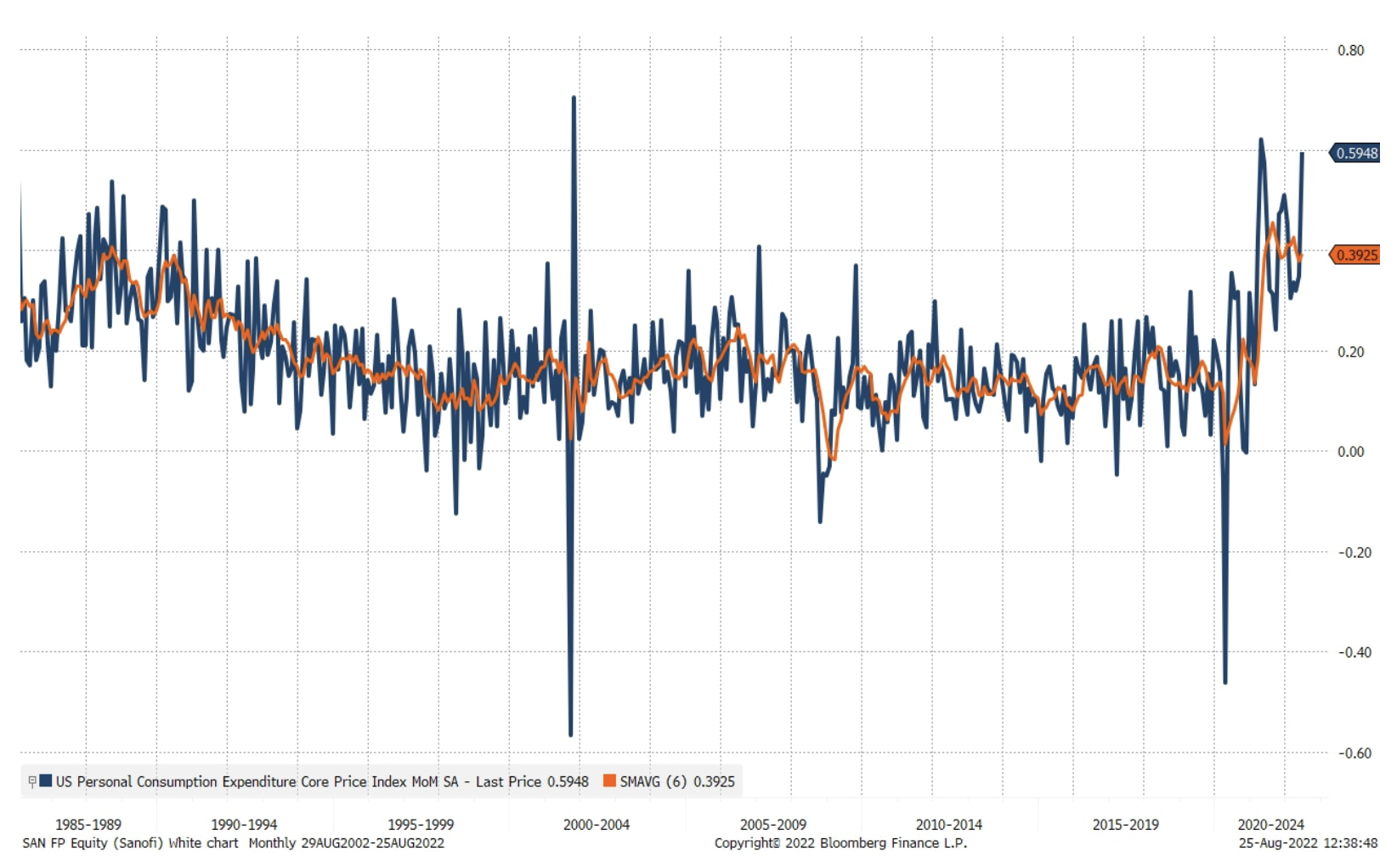

By this point, it should be clear that omitting food and energy could be a serious mistake on the part of central banks. Due to climate change, world food production will become more volatile, prices will go up, and due to the green transformation, energy prices will remain high for years. Our main thesis is that the coming decade will in many ways be a repeat of the 70s, as politicians will intervene in the economy to ease the pain of rising prices, but such decisions will only sustain the rapid growth of the nominal economy and thus both inflation and inflation. and corrections will take longer. The Fed's core inflation measure measured over six months now stands at 0,4% MoM, which suggests that the annualized core inflation is around 5%, which in turn means that short-term interest rates must be much higher for inflation to reach under control. Headline inflation is now twice as high as core inflation.

Nominal wages will keep inflation going for much longer

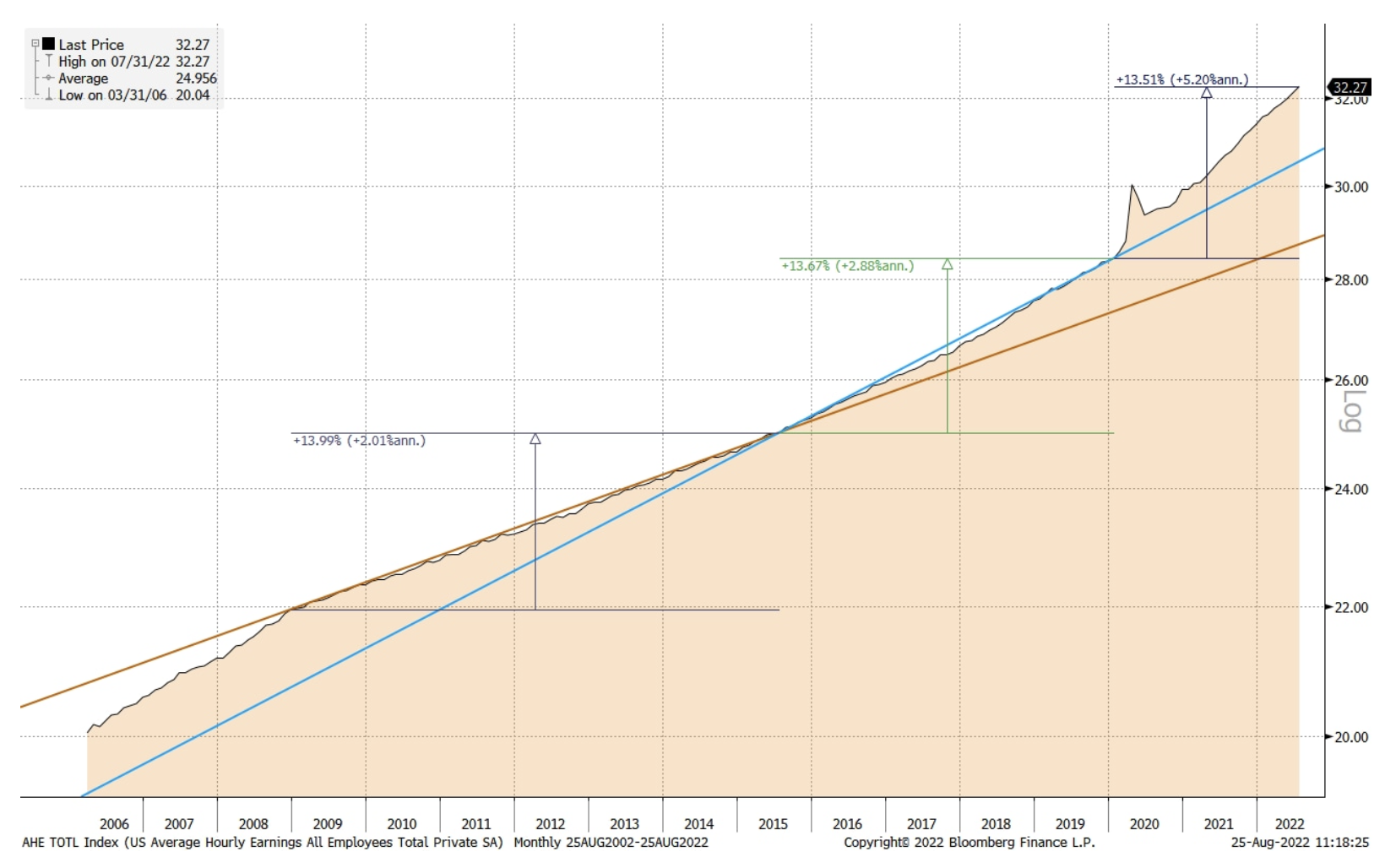

Authors ECB studies of August 2002 state that when monitoring inflation, central banks should give significant weight to increases in nominal wages. If we take into account the increase in nominal wages in the United States, the chart below shows the three-stage acceleration we have observed in the US economy since 2009. In the first phase - in 2009-2015 - wage growth was only 2% y / y as the it suffered from low demand in the years following the global financial crisis. The second phase covers the period from 2015 to the beginning of 2020, when years of loose monetary policy and slowly recovering economies led to an increase in nominal wage growth in the United States to 2,9% per annum.

The third phase runs from early 2020 to today and is driven by the extraordinary monetary and fiscal stimulus that was introduced after the outbreak of the global Covid pandemic. The total value of these incentives was equal to the value of measures implemented after World War II and they were introduced in a global economy that, as we know today, was much closer to the hard physical limit of supply than assumed at the time. As a result, the demand was much stronger than the upward trend, thus the increase in nominal wages accelerated to 5,2% annually. In fact, it looks like we have a serious problem with inflation that has receded from the 2% mark.

Let us invest in the material world

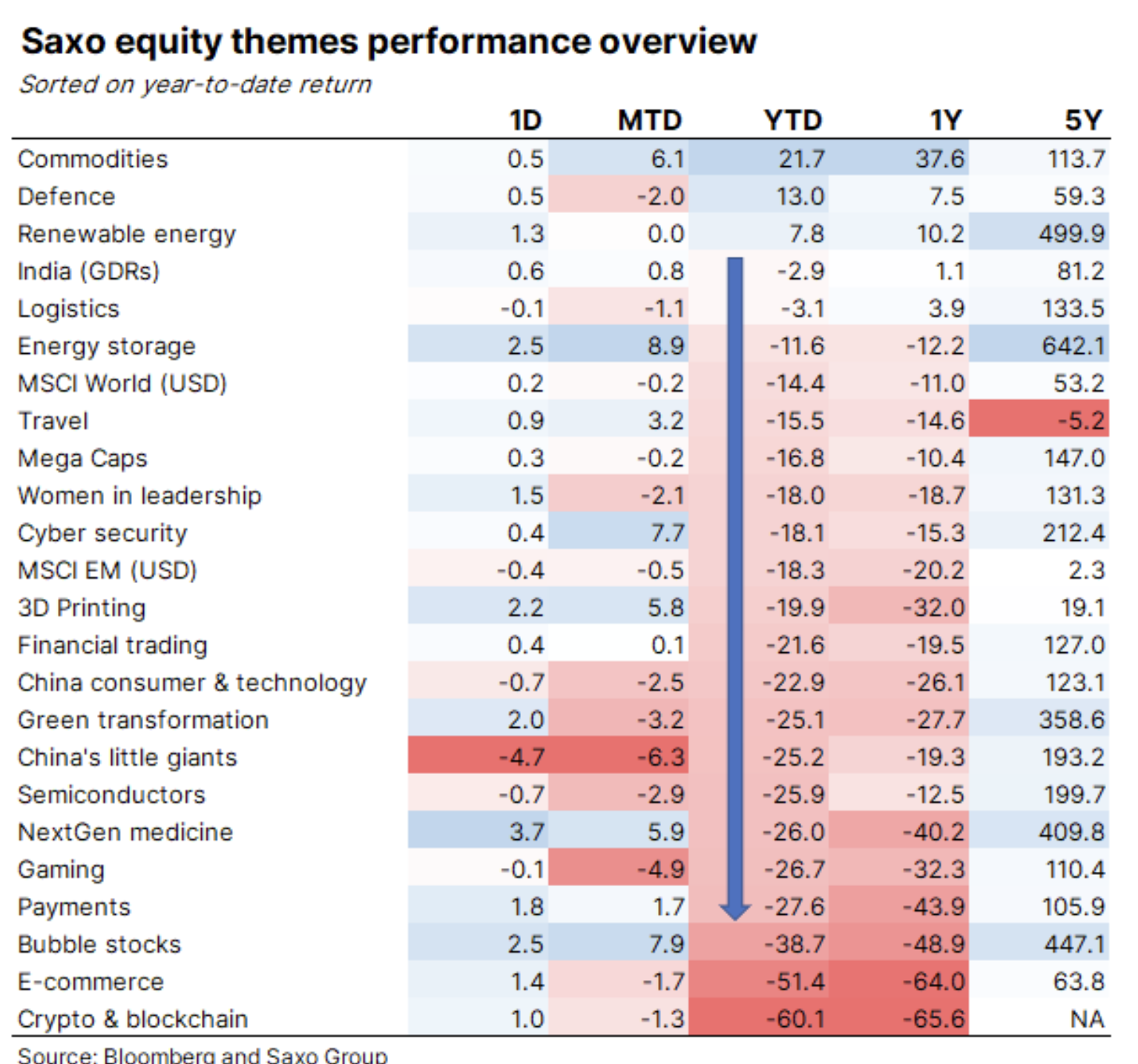

In an inflationary environment, the importance of the material world must grow rapidly, so you should invest in it to counterbalance the inflationary risk in order to protect your assets in real terms. In our last material, entitled "The material world returns to the game ", We list the industry groups that are part of the material world, but the overview of the results of our thematic basket also shows which material areas are doing well - this year this was for raw materials, defense, renewable energy, logistics and energy storage. Customers Saxo Bank can find these companies in any of the thematic baskets on our trading platforms.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)