Investors should not dream of an average stock market

For S&P 500 companies, net profit margins remain large, well above the historical average; Revenue growth has been equally strong recently. But what if the latest compression trajectory continues to push margins towards the historic S&P 500 average, and revenue growth also slows as nominal growth slows? CBA?

These are some of the scenarios we cover in today's analysis to calculate the sensitivity to ongoing margin compression, which will undoubtedly be the most important risk factor for stocks in the coming year.

The dynamics of margin compression next year will be crucial for the S&P 500 index

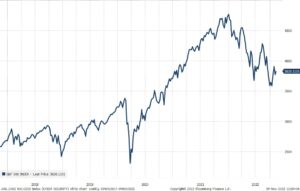

As he showed Disney's Earnings Report, all margins are dropping from their current high levels, as highlighted in our recent articles. The dynamics of margin compression has not been of interest so far, and the 500% drop in the S&P 20 index compared to the peak was mainly attributed to higher interest rates driving stock valuations down.

However, as we highlighted in a number of articles on the stock market, net profit margins have risen to record levels during the pandemic, and in the past five years, worldwide profit margins have been well above their historical average. Inflation, higher interest rates and wage pressures will continue to negatively impact margins in 2023. What will this impact on the S&P 500 index?

Ongoing 500-month rolling net profit margin of companies in the S&P 12,4 index is XNUMX% and is only 0,1% below the peak from a few quarters ago. Moving data is usually lagged with rapid changes, with Q11,8 net profit margin declining to 12,7% from XNUMX% in QXNUMX, a significant one-quarter decline.

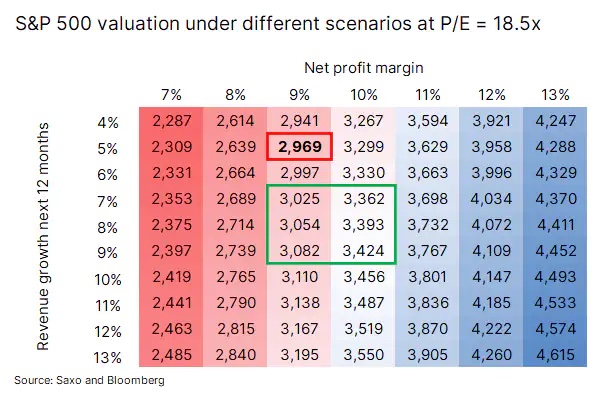

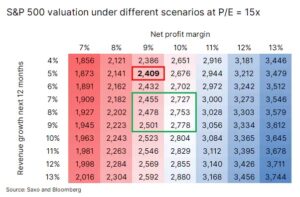

The 14-month rolling revenue growth is 2002% compared to the same period last year. Assuming that the net profit margin drops to the historical average since 9,3 of 7% and that revenue growth slows down to around 9-500%, which would correspond to a delay in nominal GDP growth, the S&P XNUMX could be in the price range marked with a green rectangle.

We assume that C / Z ratio will not change. The average value in the green rectangle is 3, which is not far from our target for the S&P 223 index of 500 and would be a 3% decrease from the current level. If the net profit margin of S&P 200 companies drops to a historical average of 16% and revenue growth also reaches the historical average of 500%, the valuation will be 9,3 assuming no change in P / E ratio.

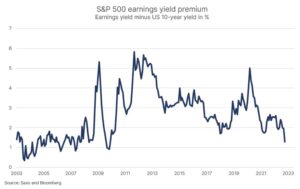

If we assume that lower margins will also coincide with an economic slowdown, the equity risk premium may increase - or so it has historically been - which in turn will lower the P / E ratio, unless interest rates drop significantly next year. Present the difference between the yield on US 500-year bonds and the yield on shares of companies from the S&P 1,3 index is XNUMX%, which is halfway in the post-2002 historical average. Assuming that next year the net profit margin drops to 9-10%, revenue growth will be in the order of 7-9% and the equity premium to US Treasury bonds will return to the average at the level of 2,6%, we will get a different valuation area than the one delineated by the green rectangle. The average price would then be 2 615, which is around 32% below the current level.

Assuming the most extreme scenario in the next 4-5 quarters, i.e. the stock market returning to the long-term average across all variables, the valuation would be 2 409. This value is so shocking that no one would want an average stock market - a rather more inflated - while we are floating on the wave of inflation.

Base scenario

What is our baseline scenario based on the current trajectory, assuming the recession will not be severe, but shallow, with nominal GDP being maintained so far? The net profit margin would then drop to 10% (and therefore stay above average), while the revenue growth would be around 8-9%, with the P / E ratio falling from the current multiplier of 18,5x to around 17x, which would be around 3 130 on the S&P 500 index, which is slightly below the target level of 3 we set as the moment when the market reaches the bottom.

However, like everything else in life, circumstances change all the time and many things can affect our predictions, including the war in Ukraine, China's successes in easing covid restrictions, inflation and wage dynamics, as well as the situation on the energy market.

How to protect your wallet against margin compression?

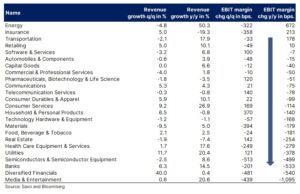

Last year, pressure on margins affected major industries such as media and entertainment, finance, banks, semiconductors, utilities, real estate and medical equipment. On the other hand, industries such as energy, insurance, transportation, retail, software and pharmaceuticals have managed to maintain or even increase their margins.

Based on the expected margin compression dynamics in 2023, we recommend investors to balance their portfolios, excluding industries that experience the largest declines, as the situation may worsen further. This concept is in line with our thesis, the physical world versus the digital world. Another way to reduce risk when compressing margins is to hedge your portfolio with instruments that appreciate when the S&P 500 or another stock index goes down.

With regard to the shares of individual companies, the following the list lists the largest companies in each of the categories listed as having maintained or expanded their operating margins. This list is provided for inspiration only and should not be construed as an investment recommendation.

- Exxon Mobil

- Chevron

- Shell

- Allianz

- Chubb

- UPS

- Union Pacific

- Microsoft

- Visa

- Oracle

- Johnson & Johnson

- Eli Lilly

- Roche

More Saxo analyzes are available here.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)