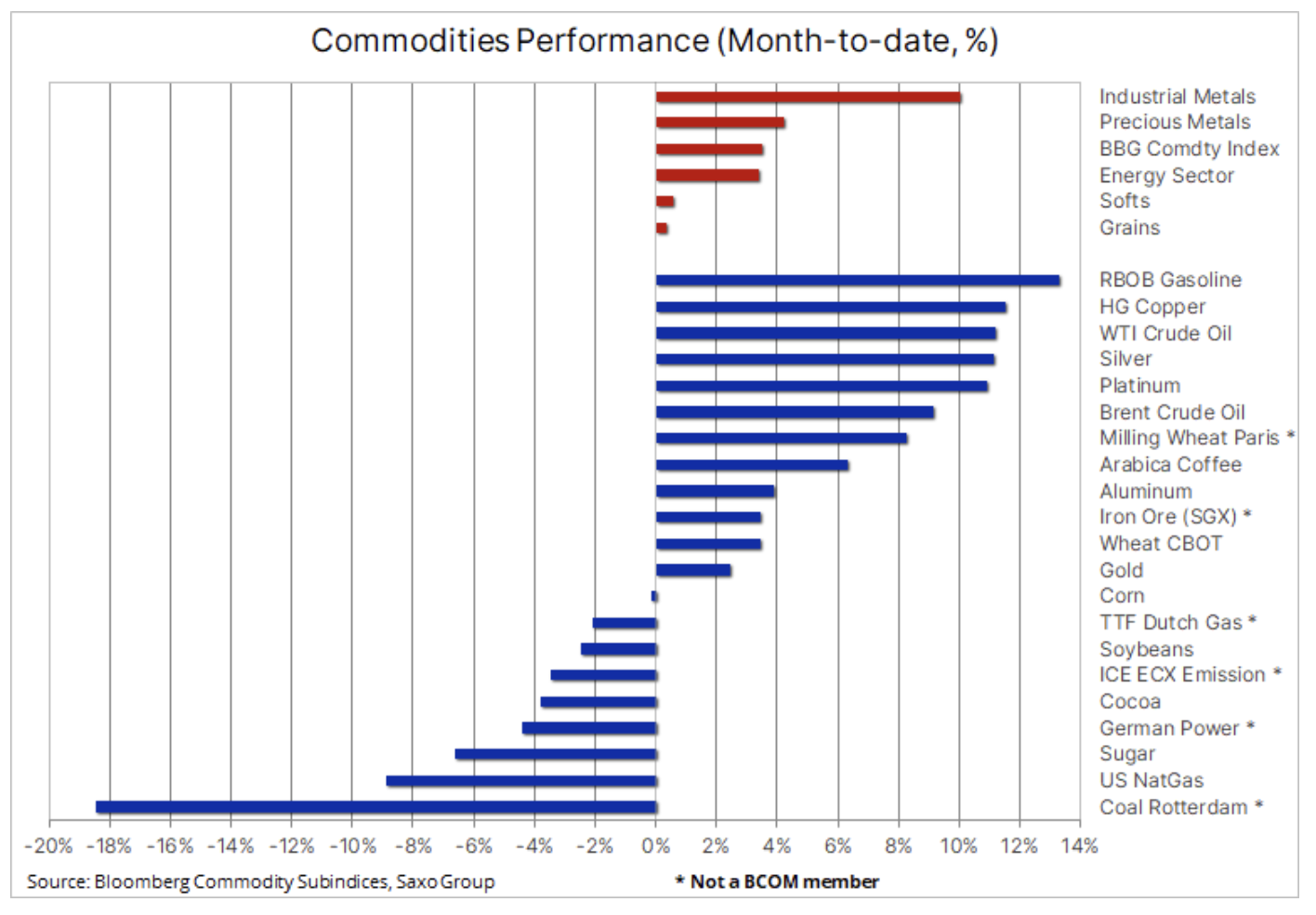

The energy crisis is driving the rise in commodity prices, despite concerns about economic growth

The months-long rise in commodity prices shows no signs of slowing down, and its main driver remains the global energy crisis and its direct impact on all other sectors, not only the highly energy-intensive industrial metals sector. The shortage of fuels on the market, which led to their record high prices, has forced a reduction in metal production in many countries from China to European countries, which has contributed to the rise in the prices of several key metals, many of which are used in solutions to decarbonise economies around the world.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

However, the surge in prices has started to raise concerns about its impact on consumers and whether high prices will eventually weaken demand, thereby contributing to a more balanced markets. Global economic growth is already regularly showing signs of slowing down as rising energy prices act as a direct tax on consumers. Added to this is higher inflation and ineffectiveness in addressing supply problems worldwide, as well as the need for increased investment in healthcare to combat the virus pandemic, which has not yet been fully contained.

In addition to easing demand driven by rising prices due to inflation and the impact of higher energy costs on household disposable incomes, the slowdown in Chinese real estate and cuts in Chinese industrial output could be factors we believe could slow, though not completely, further rise in commodity prices in the coming months.

Inflation remains a hot topic, and after months of range trading, the gap between inflation-protected and regular bonds has started to widen. Break-even point breakeven yield), which reflects market expectations for US inflation over the next five years, hit 3 percent, surpassing the previous 2005 record. Increase of the 10-year break-even point to 2,70%. contributed to maintaining real profitability at around -1%, thus supporting the gold market, which is increasingly competing with cryptocurrencies, including after last week's launch ETF fund linked to Bitcoin futures.

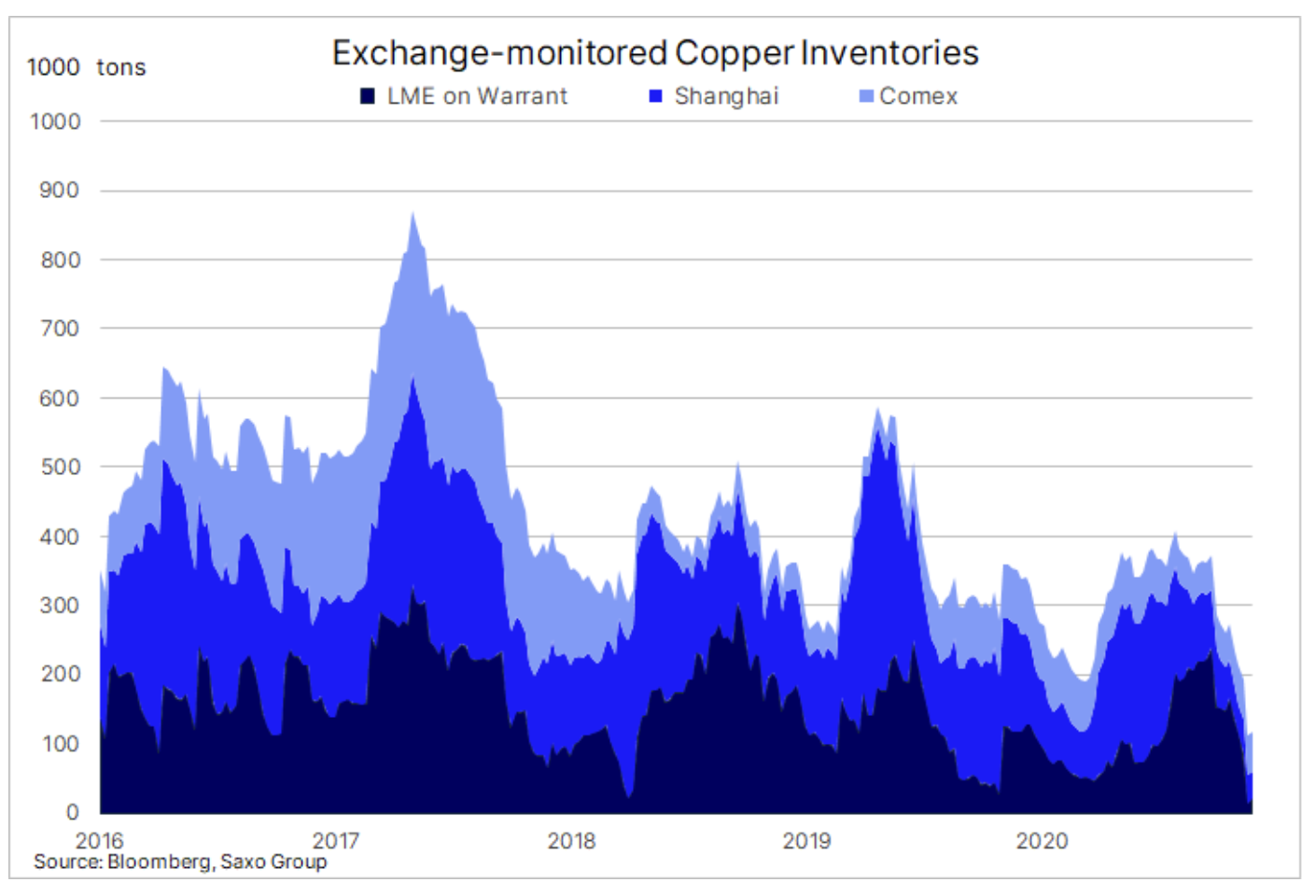

Industrial metals

Industrial metals saw their biggest gains so far this month due to the global energy crisis and the reduction in production by China, which is struggling with environmental pollution, with no signs of weakening demand. As China aims to curb high coal prices affecting the prices of energy-intensive metals such as aluminum material i cynkThe LME Metals index, which includes six metals, fell last week from a record high the week before. However, the most important event of the past week was recorded on copper market - The sharp reduction in available inventory in warehouses monitored by the LME has contributed to an unprecedented increase in the cost of metals available immediately.

While the benchmark three-month copper futures contract last Monday peaked at $ 10.450 / ton in the last five months, the spot price jumped to $ 1.100 / ton at one point. In recent weeks, the LME's physical copper inventories have fallen to their lowest level since 1974 - just 14.150 tonnes. At the same time, inventories monitored by the Shanghai Futures Exchange dropped to 40.000 tonnes, the lowest level since 2009.

Concerns about China's overall economic growth, and the health of the Chinese real estate market in particular, have kept copper in a relatively tight price range for several months, but the recent breakout amid declining stock market supply could lead to consolidation ahead of the record breaking highs in May. For high-quality copper, the rate is between $ 4,45 and $ 4,52 per pound.

Precious metals

The combination of rising industrial metals prices, a lower dollar exchange rate and projected rising inflation pushed silver prices up to a five-week high, while the gold-silver ratio fell to its previous level below 74 from above 80 at the beginning of the month. Despite the announcement of Fed representatives that there should be no hurry with interest rate hikes, gold did not manage to break above USD 1835.

The dollar, which was a strong drag in September, has stopped rising and, after weeks of speculative buying that lifted the US currency index against the IMM G7 basket of currencies to a two-year high, is showing signs of a reverse trend. If the trend proves true, an increase in the break-even point and deeply negative real yields should cause the bubble to burst.

Meanwhile, the appetite of long-term investors remains subdued, and the recent decline in stock market volatility has once again reduced the short-term need for diversification. The reduced demand for gold is best measured by looking at mining companies' data against the spot price of gold. When investors are more prone to speculation, they tend to rely on the performance of mining companies (such as the GDX ETF) to gain leverage. Otherwise, they prefer physical gold or ETFs that track gold spot prices. This indicator is now just 13% above the historic lows of 2015 and 87% below the peak of 2006.

Stagflation, which is a phenomenon of inflation combined with slowing economic growth, tends to increase the price of gold. It is noteworthy that during the previous two stagflation periods, gold prices rose while the Federal Funds Rate also increased. The upcoming monetary tightening may have a negative impact on gold prices.

Energy carriers: oil and gas

Gas prices and energy in the EU, after their sharp increase in early October, remain in a horizontal trend, but are five times higher than the average seasonal gas price, which will cause economic difficulties in the entire region, and at the same time may inhibit economic growth due to the need to reduce production by energy-intensive industries. As temperatures drop in the Northern Hemisphere, the market is exposed to price spikes in the event of a colder winter. The 25% drop in coal prices after Chinese government intervention helped ease fears of soaring prices, at least temporarily.

With Chinese coal-fired power plants being incentivized to produce more energy, and China's energy crisis showing signs of easing, the prospect of increasing the supply of liquid natural gas to Europe has been raised. However, Europe will face a tough winter season, unless high prices will beat demand, winter will not be mild and windy and - most importantly - Russia will not decide to increase gas supplies. Unfortunately, the latter factor seems to be strongly related to whether Germany will agree to the construction of the controversial Nord Stream 2 gas pipeline. Therefore, global energy prices will remain high, and the substitution of gas with oil will additionally increase the prices of several fuel products from heating oil and diesel to propane.

The six-week rise in oil prices is showing signs of slowing in response to lower US gas prices and falling coal prices. From a technical point of view, the combination of a situation where Brent crude oil and WTI reached a large excess of demand and hedge funds became net sellers, helped to achieve long-awaited gains. According to the latest report Commitments of Traders for the week to October 12, hedge funds reduced their exposure to Brent crude oil, the global benchmark, by 10% to 300 million barrels, less than half of its record high of 632 million barrels in 2018, the last time it was above $ 80 / b.

Read: What are the CoT report and how to read them?

Meanwhile, the price WTI oil peaked since 2014, and inventories at Cushing, a major delivery point for WTI crude oil futures, plummeted to their lowest level since 2018 - well below average. As a result, the futures curve has shifted more into the backwardation - a phenomenon where the tightening of the market causes the spot price to be higher than the futures price. An example is the spread of $ 10,4 / b between the two closest December contracts recorded in 2013.

In our forecast for the fourth quarter of 2021, released on October 5, we raised our target range for Brent crude oil by $ 10 to the range of $ 75-85. As the upper end of this range has been reached, in view of the uncertain development of the situation with the approaching winter and the lack of additional OPEC + activities, the risk of an upward revision for our forecast remains real. However, continued sale by hedge funds should be approached with caution as it removes a key source of demand in the "paper" market.

Coffee

Price Arabica coffee stabilized at around $ 2 / lb, which is 75% above the five-year average. Growing global demand, a weaker harvest in Brazil due to unfavorable weather conditions and, equally important for the current market situation, disturbances in the supply chains have contributed to a significant increase in the prices of this commodity in recent months. September was the weakest month in four years for coffee exports from Brazil, and problems with the provision of containers and shipping vessels helped keep prices high while causing a decline in stocks monitored by ICE exchanges, especially in European warehouses, as supply shortages forced roasters to look for other sources of supply.

As traffic problems in global ports and container shortages are projected to continue until 2022, the short-term prospects for price developments will again depend on the weather situation in South America. Warnings of another weather anomaly called La Nina, such as the one that hit the continent last year, could provide a sufficient basis for maintaining, or even increasing, the current high prices.

Iron

Price iron ore, which halved between July and September, stabilized at around $ 120 / tonne. In the short term, given Chinese efforts to reduce environmental pollution by reducing steel production and concerns over the health of the real estate sector, prices are likely to remain low in the coming months. Faced with the weak prospects for high demand, the short term outlook will depend on supply from the top three manufacturers Vale, BHP and Rio Tinto, who together control about 60% of the maritime trade. So far, all three producers have reacted by lowering their supply forecasts, which should help avoid falling prices to cost levels that are currently just under $ 50 / tonne.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)