The crisis of confidence deals a blow to commodity prices

The commodity sector is on the back burner this month as the market shifted from a commodity-friendly focus on reopening the Chinese economy to further concerns about growth and demand, including in the United States, where recent economic reports have shown continued labor market strength, while inflationary pressures have eased less than expected. Consistently strong data forced the Fed to sharpen its hawkish rhetoric, to which the market reacted by raising the expected final Fed funds rate while bond yields rose and the dollar strengthened, which worsened the risk appetite in the stock and commodity markets.

Meanwhile, geopolitical risks remain elevated, which could further accelerate the regionalization process after two decades of unrestricted globalization. Reshoring and friendshoring (relocating production back home or to countries with similar values, respectively) can push prices up, which supports our view that inflation is unlikely to fall to the levels targeted by central banks and currently reflected in market valuations .

Given the commodity-driven green transition and continued economic growth in China and India, we see limited scope for the sector to deteriorate beyond the current weakness, which is due more to a lack of market confidence than to an actual slowdown in demand.

One year after Russia invaded Ukraine

Last week also marked the tragic anniversary of Putin's so-called a special operation that was supposed to last only a few days. The attack on February 24 last year turned out to be a big mistake by Putin, as Russia suffered one military and economic defeat after another. This miscalculation was partly due to Putin's belief that the rest of the world would come to terms with this situation, as it did after the annexation of Crimea in 2014. However, an attack on a sovereign state with a democratically elected government right on Europe's doorstep could not be tolerated and In the following weeks and months, further sanctions were imposed on Russia.

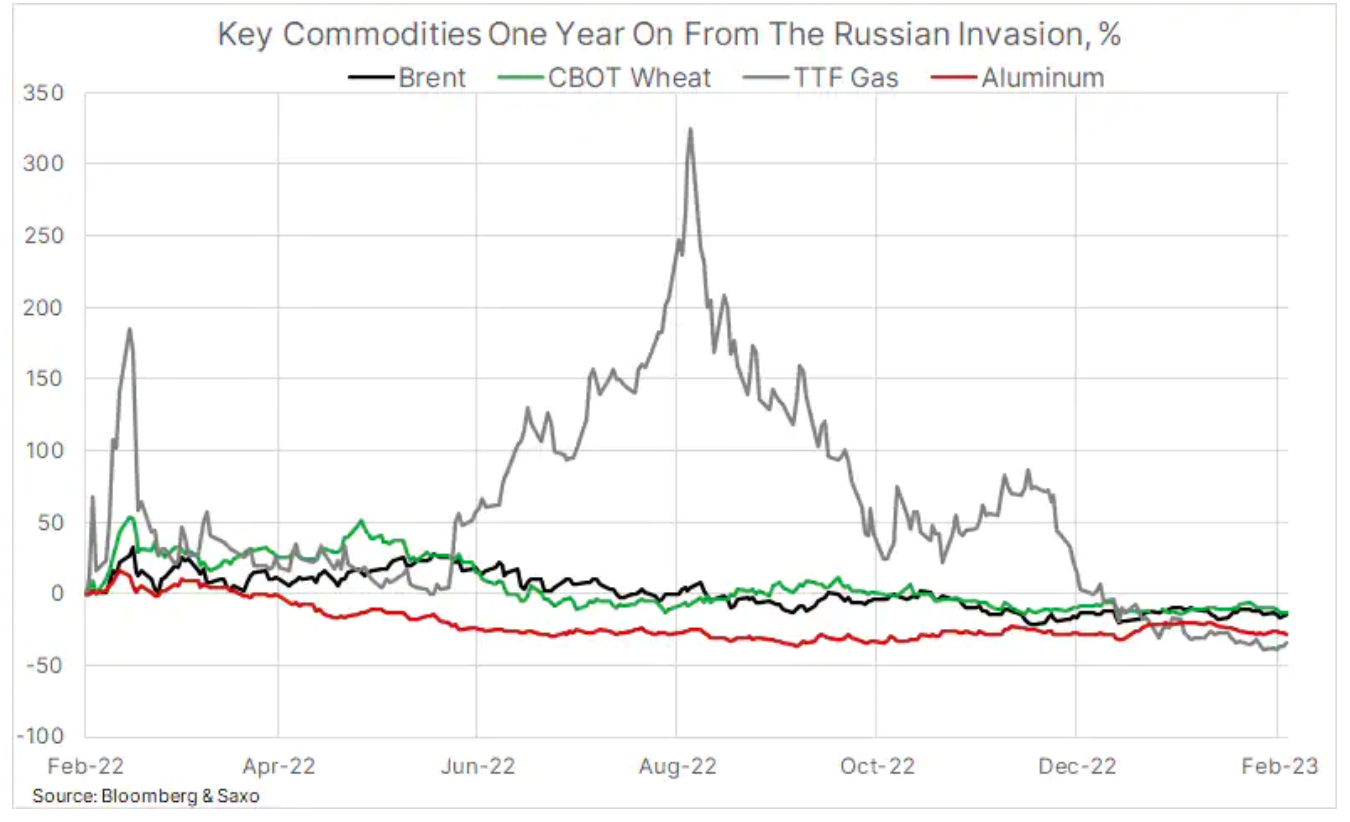

Russia and Ukraine are major suppliers of raw materials to the global economy and, faced with the risk of supply disruption, in the weeks following the invasion, a number of key commodities - from oil and natural gas to wheat and some industrial metals - surged in price. Ukraine, the world's main grain supplier, has experienced attacks on its supply lines and disruptions that briefly pushed Chicago-listed wheat futures prices to record highs in March last year before, after the opening of a UN-sponsored export corridor cereals - prices have fallen again.

Very severe sanctions were imposed on Russia, which led to a voluntary strike by buyers; as a result, the price of Brent crude oil skyrocketed, briefly reaching almost USD 140 per barrel, while the price of European diesel futures at one point reached USD 223 per barrel. At the same time, the London Metal Exchange index went up to a record high: they took the lead nickel i aluminum material – a metal with exceptionally energy-intensive production – the price of nitrogen fertilizers produced from natural gas has also increased.

An exciting year for natural gas prices

Putin's biggest economic mistake was trying to undermine the determination of Europeans by higher prices gas prices. Gas and electricity prices rose for the first time last summer, when Gazprom sequentially turned off the taps on three of the five most important gas pipelines to Europe, thereby reducing gas exports through these channels by about 75%. While this caused a market panic for a time, the timing of the reduction in flows during the summer low demand period gave Europe more time to source gas from other suppliers, as well as to implement initiatives to reduce demand during the winter period.

A year later, the price of the Dutch benchmark TTF gas contract is more than 40% below its pre-invasion level. This is due to both the mild winter and, in most cases, voluntary reductions in consumer and industry demand.

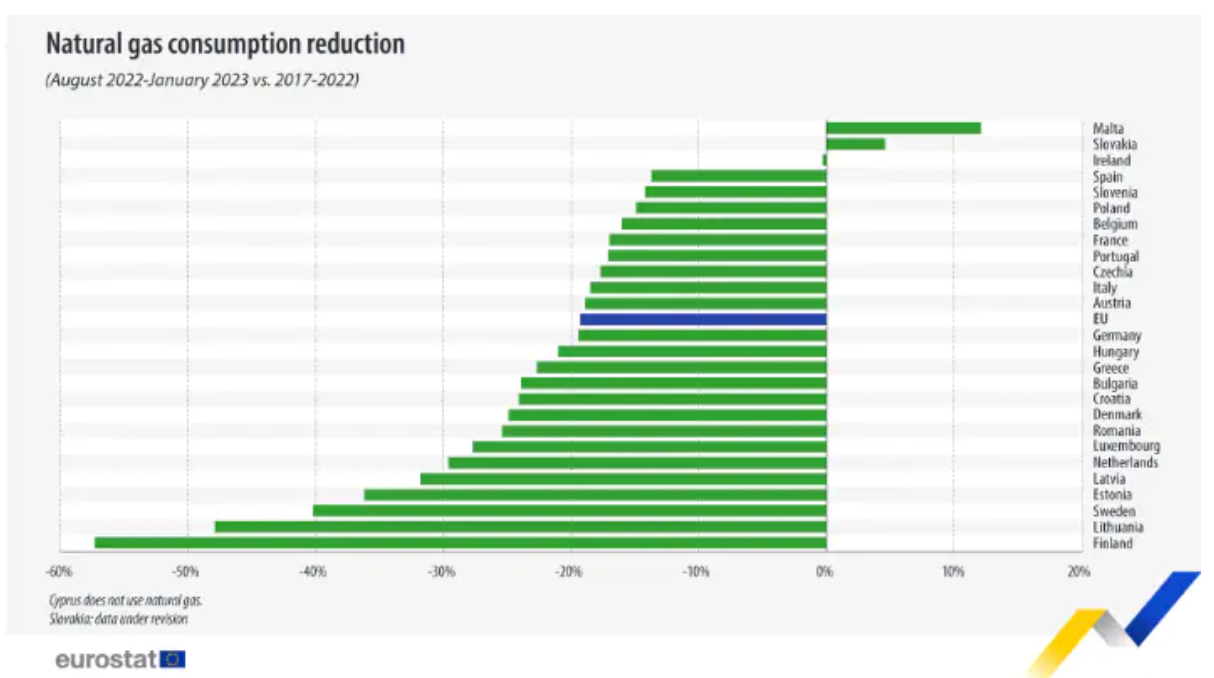

Earlier this week, Eurostat reported on its website, that between August and January, natural gas consumption in the EU fell by 19,3% compared to the five-year average consumption in the same period. Taking into account total gas flows in the form of growing LNG imports, stable supplies from Norway and a small inflow from Russia, the year-on-year decrease is 20%. This has allowed gas storage levels to be maintained to the extent that EU storage facilities are now 63% full compared to pre-invasion levels of 31%. Apart from the strong increase in demand for gas in China, these developments should ensure that Europe gets through another winter comfortably.

Crude oil remains within the range and around support

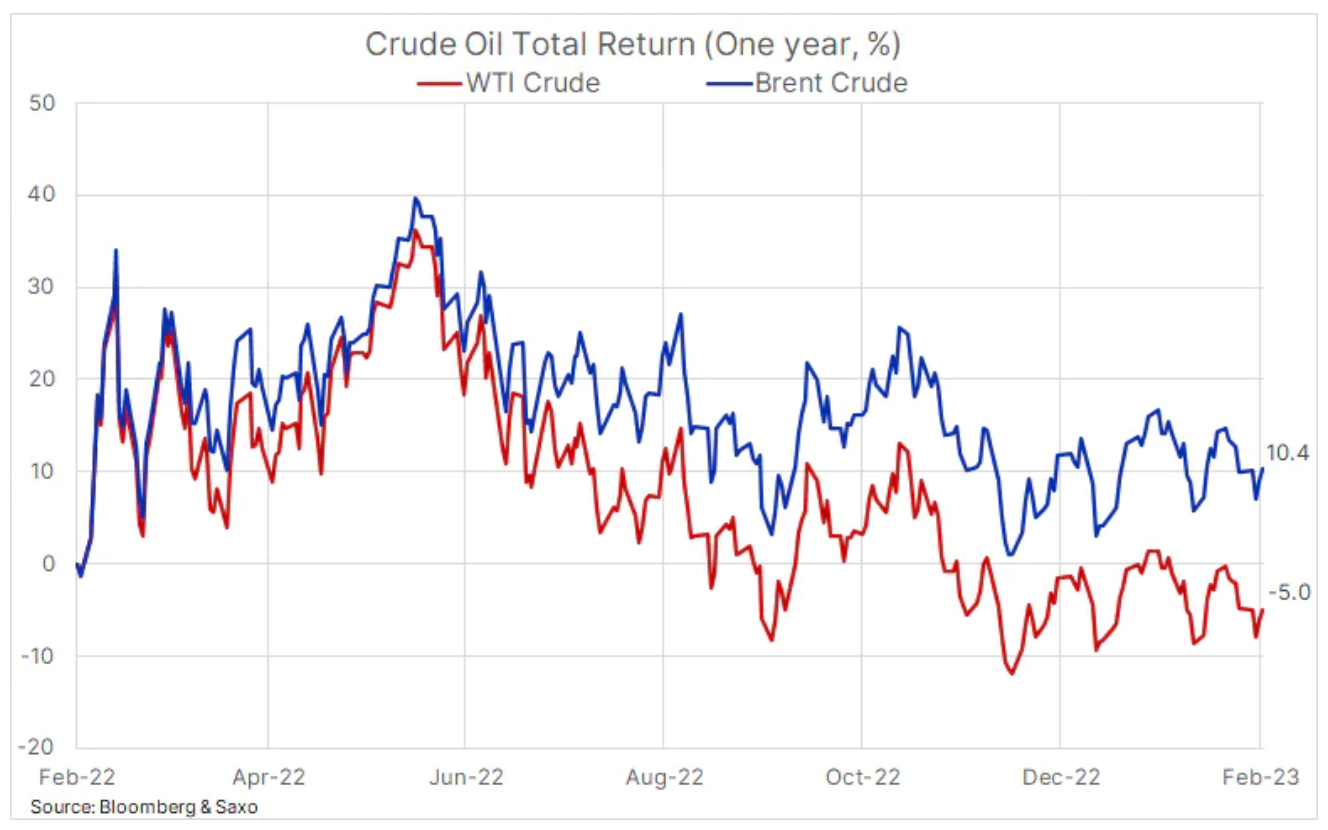

Petroleum, which has been trading within a range since November ($80-89 Brent, $73-83 WTI), is still waiting for a directional impulse to break out. As noted above, the recent weakness is primarily due to lower investment appetite, with the price-favorable increase in demand from China and India more than offset by macroeconomic developments, including the prospect of US interest rates rising and staying high for an extended period of time.

After the longest run of declines in the oil market this year, new buyers emerged as prices approached the lower end of the current range. The buy orders came despite a ninth straight week of increases in US crude oil inventories, with total inventories now at 479 million barrels, the highest since May 2021. Refineries' demand for crude oil to produce fuel products such as diesel and gasoline fell sharply, as well as demand for gas, both in Europe and, above all, in the United States, due to the warmer-than-expected winter in the northern hemisphere.

Despite strong exports, primarily to Europe, rising US oil inventories are likely to weigh on the market and investor sentiment, particularly in the case of WTI oil, which has been in a contagion at the front end of the forward curve. The opposite is true for Brent oil – the global benchmark – where the deportation is supported by sanctions on Russian oil, the reduction of OPEC+ production and the aforementioned revival of demand in China. The impact of these two different curve structures on investment returns is clearly visible in the chart below, which shows the annual total return of Brent and WTI crude oil. Taking rollovers into account, an exchange-traded fund that tracks Brent crude prices has generated a return of 10,4% over the past year, while a similar investment in WTI oil has resulted in a loss of 5%.

The US dollar dictates the short-term direction of the gold price

Gold fell below $1 this week; since gaining more than $820 since early November, the price has already fallen by about $340. The impetus for the price to drop after rejecting the $140 level was the recent flurry of better-than-expected economic data from the US - highlighting the challenge facing the US Federal Reserve as it tries to bring inflation down towards its long-term target of 1% . This led to a re-strengthening after several months of dollar depreciation; at the same time, bond yields also increased. Both of these phenomena, given their inverse correlation, mean another hardship for gold.

For now, gold is likely to take much of its inspiration from the dollar and will continue to look for support until another turnaround occurs. Demand for gold remains patchy, but in the short term, we expect central bank demand to more than offset the continued lack of appetite from investors in the exchange-traded fund market, where the total position continues to decline, since early November when a strong rally began price of gold, this item fell by almost 50 tons.

Until the macroeconomic situation improves and the dollar changes direction once again, there is a risk of further weakening to around USD 1 and then to the two-day moving average area, i.e. USD 788. The Fed's preferred inflation indicator - the PCE deflator - was under close watch on Friday, with a stronger-than-expected reading clearly indicating that inflation is heading in the wrong direction and further action is needed FOMC, which could mean another hike of 50 basis points. Core PCE inflation increased by 0,6% m/m and by as much as 4,7% year-on-year.

The deportation indicates a further strengthening of raw materials

Limited supply in the commodity sector, which has contributed to a solid performance over the past few years, has eased somewhat in recent months as China grapples with lockdowns, but despite fears of an economic slowdown, most of the major commodities tracked by the Bloomberg Commodity Index - weighing on the index above 2,5% - still deported. However, the annual implied rollover profit, based on a weighted average, is currently showing a small amount contagion, as the entire index is dragged down by a strong annual 55%. contagion on the natural gas market. Taking into account our expectations regarding a strong recovery in China and a shallow economic slowdown in other countries, we expect that the deportation, which is favorable for investors, will start to grow from QXNUMX, mainly due to the situation in the energy sector.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)