Metals at the top after a historic week in the markets

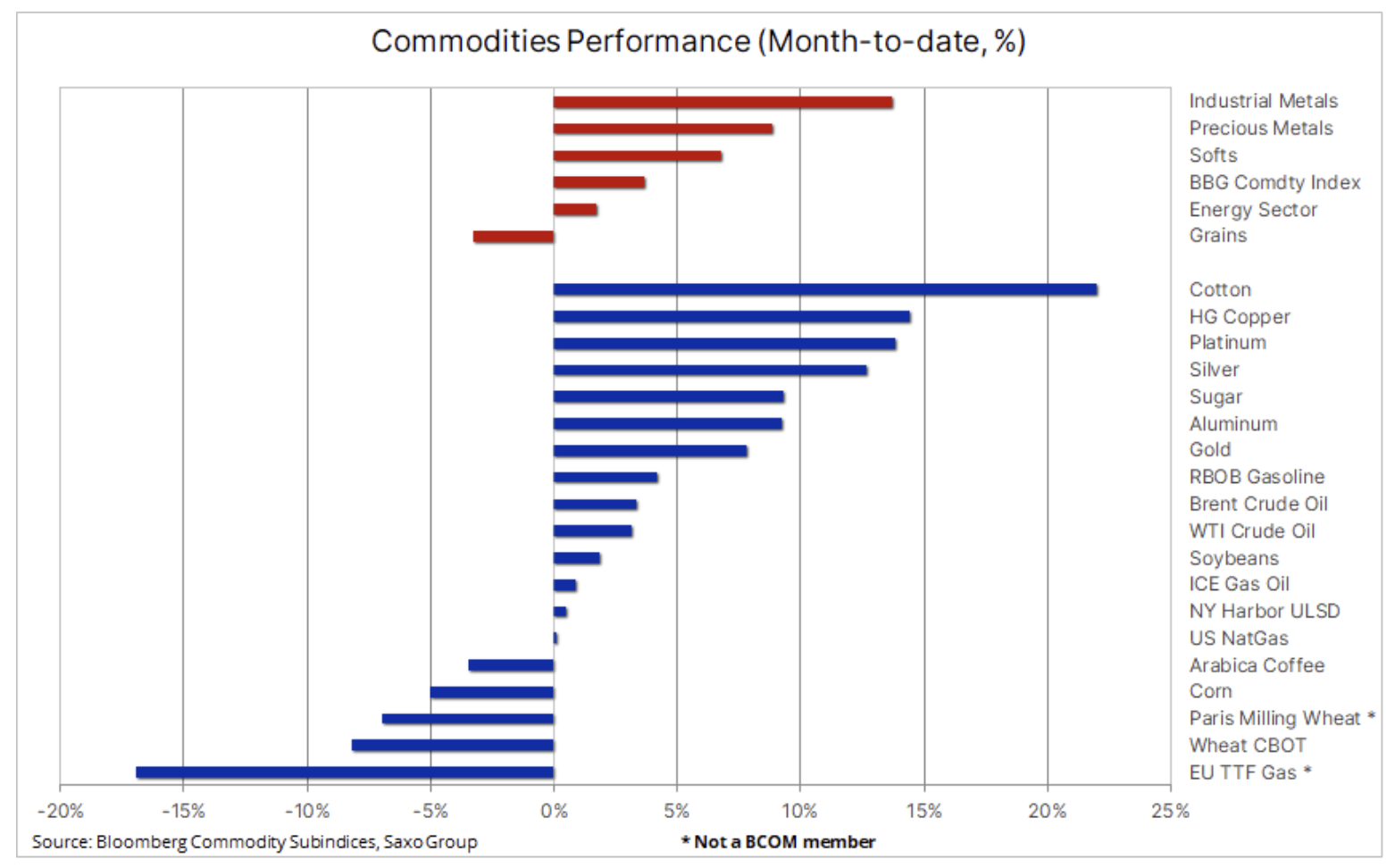

For the commodities sector, this month is varied, but overall solid thanks to support from weaker dollar following a surprise in the form of the US CPI reading and China easing some of its strict covid restrictions. Industrial and precious metals recorded the best results, while the cereals sector, led by wheat, showed declines. The metals that recorded the highest growth were gold, silver i coppershowing signs of an upward breakout, potentially forcing you to change your sales strategy during the growth phase. sell-into-strength), favored by traders in recent months.

Traders in the commodity and financial markets occasionally obtain information that causes immediate historical movements. The past week will be marked in the annals of history thanks to a slightly softer-than-expected US CPI reading for October, which was followed by frenzy in the markets over the belief that the US Federal Reserve could finally get the information it needed to slow policy tightening.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The US Consumer Price Index in October rose less than expected, showing a rise of 0,4% m / m to 7,7% compared to the same period last year. At the same time, core inflation - which is closely monitored by market participants - increased by 0,3% m / m and by 6,3% in the last twelve months. Although both indicators turned out to be 0,2% lower than expected, it is still an inconvenient level for the US Federal Reservewhich, however, seems to confirm that inflation in the United States is slowly slowing down.

The reaction of the markets was historic - US stocks rose by more than 5% and 30-year US bond yields fell by 1998 basis points. The sharp fall in the dollar improved sentiment in the markets, in particular in the commodities market, where metals once again recorded strong gains and crude oil recovered from previous losses. The Japanese yen - the currency that has been the most oversold in favor of the dollar - recorded the biggest one-day increase since 1,0350, while the euro strengthened on the back of sentiment improvement, reaching a three-month high in the region of EUR XNUMX.

After weeks of speculation that China was considering easing some of the harsh restrictions on Covid, it finally came on Friday, after the Chinese health authorities issued 20 new guidelines. Key measures included reducing the number of quarantine days, easing some centralized quarantine rules in favor of home quarantine, restricting PCR testing, prohibiting extending lockdowns too much, promoting vaccination and treatment, and prohibiting local authorities from closing manufacturing facilities, schools and transportation without proper approval.

The easing introduced during a spike in new cases is a strong signal that China is finally shifting its stance to one that is more favorable to economic growth and that commodity prices have responded accordingly. The industrial metals sector achieved its best fortnightly performance since March, leading to a + 12% appreciation - primarily of copper, which surged, challenging the months-long sales strategy in a period of growth.

As seen in the scoreboard above, November broadly started with a strong emphasis on the commodities sector. Industrial and precious metals recorded the best performance, while the cereals sector fell despite the weakening of the dollar. The main factor behind the weakening was wheat, the prices of which fell in Chicago and Paris due to the anticipated larger world supply in the market. The U.S. Department of Agriculture, in its monthly supply and demand report (World Agricultural Supply and Demand Estimates) concluded that world wheat stocks are at 268 million tonnes, which is a slight increase compared to forecasts and is higher than analysts forecast a slight decrease to 266,5 million tonnes. In addition, wheat prices were under pressure from the news that Russia had ordered its troops to leave Kherson, which could potentially improve the prospect of extending the current agreement on a safe Ukrainian corridor after the expiry of the current agreement on November 19.

Gold shifts upwards, signaling a long-awaited reversal

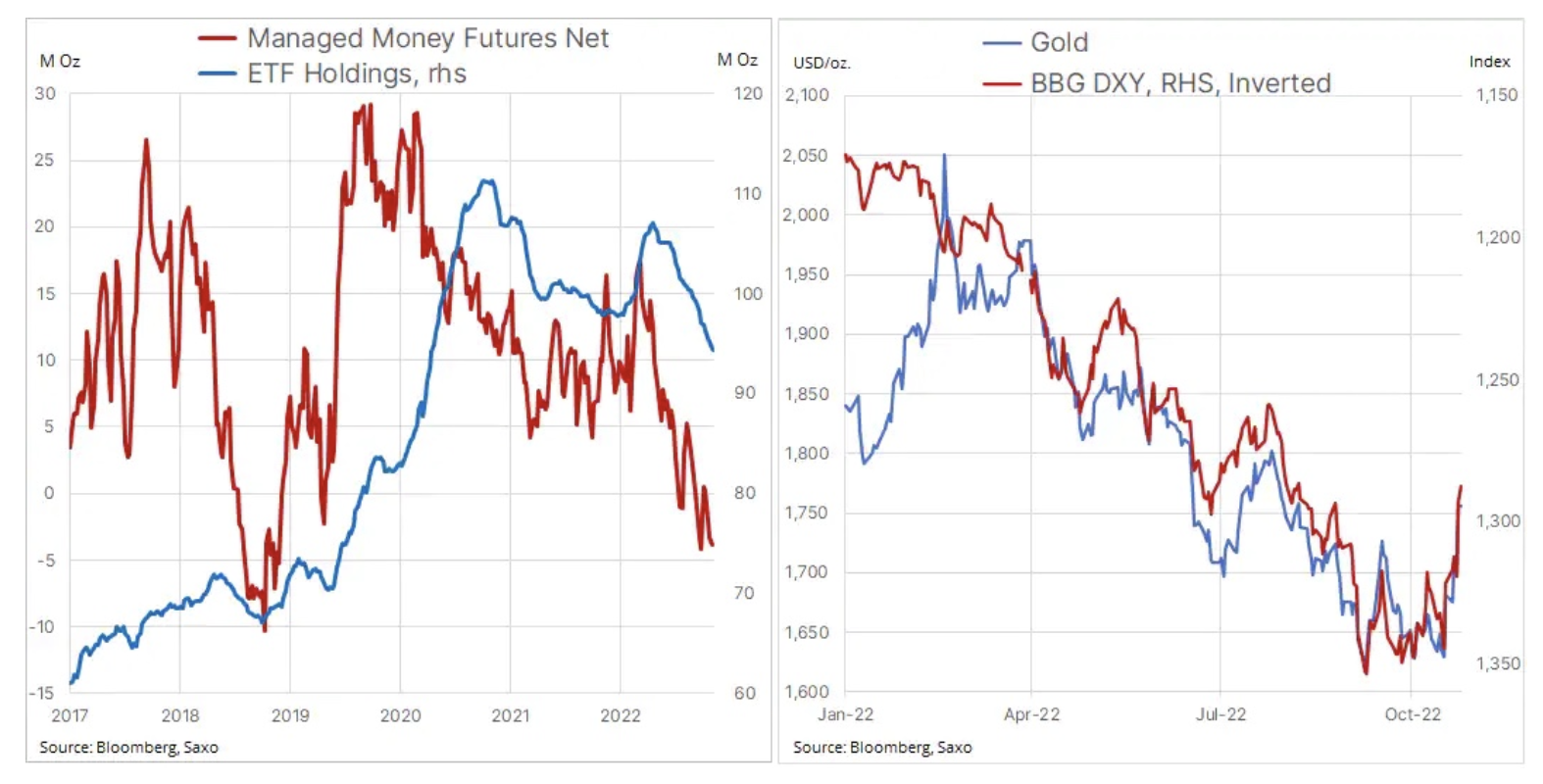

Gold may record the largest weekly increase since March after the worse-than-expected CPI reading provided metals, including silver, with a significant boost in the form of the following decline in yields and the dollar. The yellow metal has appreciated 7% in the past two weeks after finding support again in the $ 1 region, now a triple bottom. It is not yet known whether the breakthrough of the resistance, which became a support at USD 615, will be a signal of a change in the strategy of speculative investors from selling in the growth stage to buying in the decline stage.

The recently published World Gold Council (WGC) report supported the fundamental improvement in sentiment. Trends in gold demand in Q2022 XNUMX (Gold Demand Trends Q3 2022). It emphasized that central bank demand, despite an 8% drop in the price of gold, reached a quarterly record of nearly 400 tonnes, offsetting 227 tonnes of outflow from gold-based stock exchange funds. On a year-to-day basis, demand increased by 18% compared to the same period in 2021, signaling a return to pre-pandemic levels.

Overall, we maintain our positive forecast to date. This is mainly due to the anticipated significant overestimation, when the market realizes that long-term inflation will remain higher than currently valued below 3%. Investors in publicly traded funds - net selling for months - and speculative investors in the futures market (negative traders) have just obtained a key that could unlock further profits. Without the support of these important market segments, gold and silver will continue to draw most of their directional inspiration from movements in US Treasury and dollar yields. Expect consolidation and potentially a re-test of support at $ 1, with resistance at $ 735 and $ 1.

Copper at the forefront of the industrial metals sector in terms of growth

Copper hit the five-month high, with + 12% growth over the past two weeks supported by a weaker dollar and the prospect that China will be inclined to support economic growth by allowing covid easing, even though the number of infections has peaked from April. Given that black clouds still hang over the global economic outlook in the form of the prospect of recession in some economies, it is probably too early to talk about a potential permanent recovery. For now, we see traders and investors reacting to higher prices by reducing positions established with negative bias.

We are reiterating a long-term positive outlook for the industrial metals sector given the expected increase in demand due to the global drive towards electrification. In the case of copper, the leader of the so-called green metals, we predict that the prospect of a temporary capacity expansion next year by mining companies around the world, particularly in Central and South America and Africa, is likely to limit the short-term prospect of re-growth to a new record level.

Global electrification based on copper will continue to gain momentum after a year of intense weather pressure around the world and the need to become independent from energy produced in Russia, natural gas for oil and coal. However, in order for power grids to be able to cope with the additional baseload, a significant amount of new copper-based investments will be required in the coming years. In addition, we are already seeing that producers like Chile - the world's largest copper supplier - are struggling to meet their production targets due to the decline in ore quality and water scarcity. The slowdown in China is seen as temporary, and the economic recovery from the stimulus is likely to focus on infrastructure and electrification - areas that will require industrial metals.

HG Copper approached the key resistance area around $ 4; falling below this level resulted in a sharp drop in June. As with gold, we expect investors to focus on consolidation to discover if the current demand and supply forecasts are strong enough to support the current levels.

Crude oil remains within the range due to the dollar and China

Brent and WTI crude oil prices rose during the week, but still remain within agreed ranges, around $ 95 per barrel for Brent and $ 90 per barrel for WTI. While slightly worse CPI reading supported prices due to improvement in moods and dollar weakening, prices were also affected by the aforementioned easing of tightening in China. This decision may improve the outlook for economic growth, thus strengthening the growth in demand for raw materials, including oil.

While Petroleum Has remained broadly within the range since July, the market for fuel products continues to tighten as deliveries in Europe and the US are increasingly scarce, increasing refinery margins on gasoline and distilled products such as diesel, heating oil and aviation fuel. The main factor in this regard remains the product market in the Northern Hemisphere, where the scarcity of diesel and heating oil stocks still gives cause for concern. The chaos in this market was caused by the war in Ukraine and sanctions against Russia, the main supplier of refined products to Europe. In addition, the high cost of gas has accelerated the shift from gas to other fuels, particularly diesel and heating oil.

As long as the product market remains so limited, the downside risk for oil prices - despite fears of a recession - appears low. We reiterate our forecast for a price range of USD 85-100 for Brent crude oil in the current quarter, with the increasingly constrained product market, OPEC + production cuts and the upcoming EU sanctions on Russian crude oil tipping the scales more and more to strengthen.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response