Strong November under the sign of metals

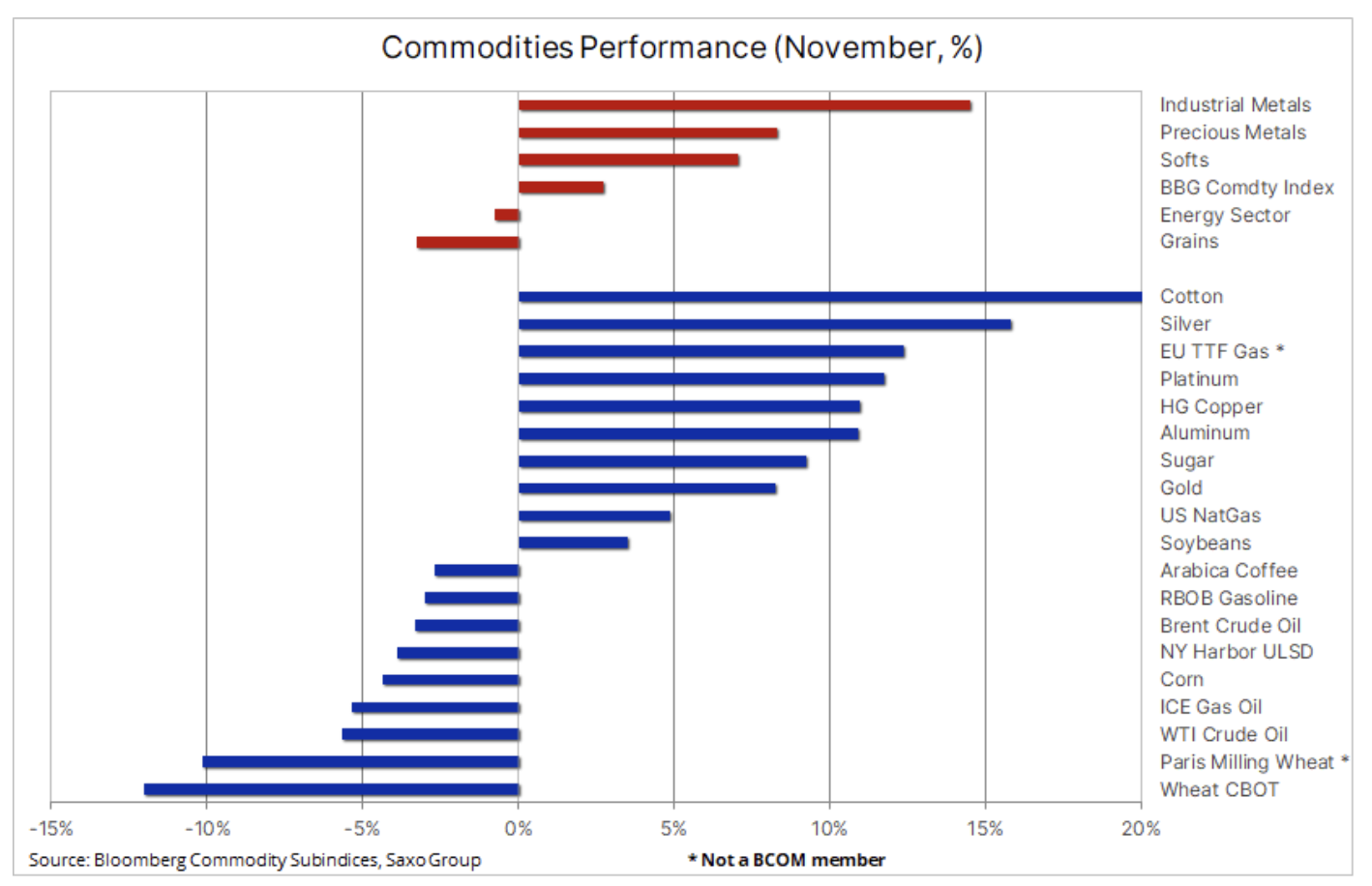

Bloomberg's Bloomberg Commodity Total Return Index was up 2,7% in November, up 19% yoy. Leading the way were precious metals and industrial metals, which found support after many difficult months as the dollar depreciated and bond yields fell in reaction to a lower-than-expected CPI reading. This sparked speculation that the US Federal Reserve may soon slow down the pace of rate hikes. In addition, China is signaling a more pragmatic approach to Covid controls, potentially giving metals additional support in the coming months.

Fed Chairman Powell in his speech on Wednesday signaled that the December rate hike would be smaller, as he believes it is possible to bring inflation down without pushing the economy into a deep recession. Whether or not this plan succeeds or fails, it could prove to be the most important driver of risk appetite in 2023, with precious metals particularly benefiting if it fails.

The industrial metals sector recorded a dynamic growth of 14,5% m/m, thus reducing the year-on-day loss to 4,5%. Aside from the weaker dollar, the main factor behind this increase was optimism that China could move away from its zero Covid policy and provide additional stimulus to boost demand in the world's largest metals-consuming economy. Copper last month it was up 11%, recording the best month since April 2021 and the first month-on-month increase since March. After starting the year on a strong note due to post-pandemic optimism, the price of copper has fallen sharply since March as a result of the extension of the "zero Covid" policy in China. As a result, despite the good performance in November, the price of this metal fell by 17% on an annual basis.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In the precious metals sector, November also turned out to be a good month: the Bloomberg precious metals index rose by 8%, reducing the annual loss to just 5%. Silver rose 16% to $22,16, recouping half of the losses incurred between the March high ($30) and the September low ($17,50). Gold, which had been underappreciated by traders and investors for months due to the strengthening dollar and rising US Treasury yields, made a strong turnaround, gaining as much as 8% to $1 - thus reducing the dollar-denominated loss on a year-over-year basis by the day to only 768%. This is an impressive result in a year in which the dollar rose by 3,3% despite its recent depreciation, and 8-year real US bond yields rose by around 2,3%.

Silver's impressive rally continues into December: the metal has broken above $22,25, a 50% retracement from the March-September sell-off line, and is well on its way to the next resistance level of 23,35, $1. At the same time, gold is breaking through a key resistance area between $788 and $1. However, with the market increasingly focused on a change in Fed policy, potentially without containing inflation, a break higher would confirm the low of the cycle around $808 and with it a potential move up.

Crude oil moves higher after unfounded fears about demand in China

November saw a slight decline in the energy sector, but the sector continues to grow by 55% yoy thanks to very strong increases in diesel, petrol and natural gas prices. All major futures except natural gas fell in November as the market spooked by further lockdowns in China, a seasonal slowdown in demand and a sharply inverted yield curve in the US that increasingly points to a sharp economic slowdown next year.

Petroleum it bounced back from a XNUMX-month low all week after renewed and, in our view, unjustified concerns about a deterioration in China's demand forecast. The rebound was supported by a weaker dollar and traders reacting to signals that China may relax its zero Covid policy after the PRC's vice president in charge of combating Covid admitted that the omicron variant is less deadly.

This forced the reduction of recently created short positions ahead of Sunday's OPEC+ meeting. This meeting is likely to have strong words but not action, given the unclear impact of the EU embargo on Russian oil starting on December 5. In addition, U.S. crude inventories fell by 12,6 million barrels last week, the largest drop since June 2019, while U.S. oil and oil exports hit a closing record of nearly 12 million barrels per day, highlighting the continued strong demand from buyers looking for an alternative supplier to Russia. Moreover, the US administration is likely to halt the sale of oil from its strategic reserves soon, thus eliminating an important source of supply that has brought 205 million barrels to the market this year.

Recession and limited supply

The risk of an economic slowdown during the period of limited supply of a number of important commodities will be one of the key aspects that, together with the strength of China's economic recovery after the pandemic, will help to set the direction for commodity markets in 2023. After many months of aggressive interest rate hikes, the US Federal Reserve is signaling currently, the pace of future increases will be slowed down - while their final maximum level will depend on the incoming data. From an investment perspective, the commodity sector outperformed most other asset classes this year, and despite the recent weakness and a slight increase in supply, we stand by our view that investors should maintain broad commodity exposure in 2023.

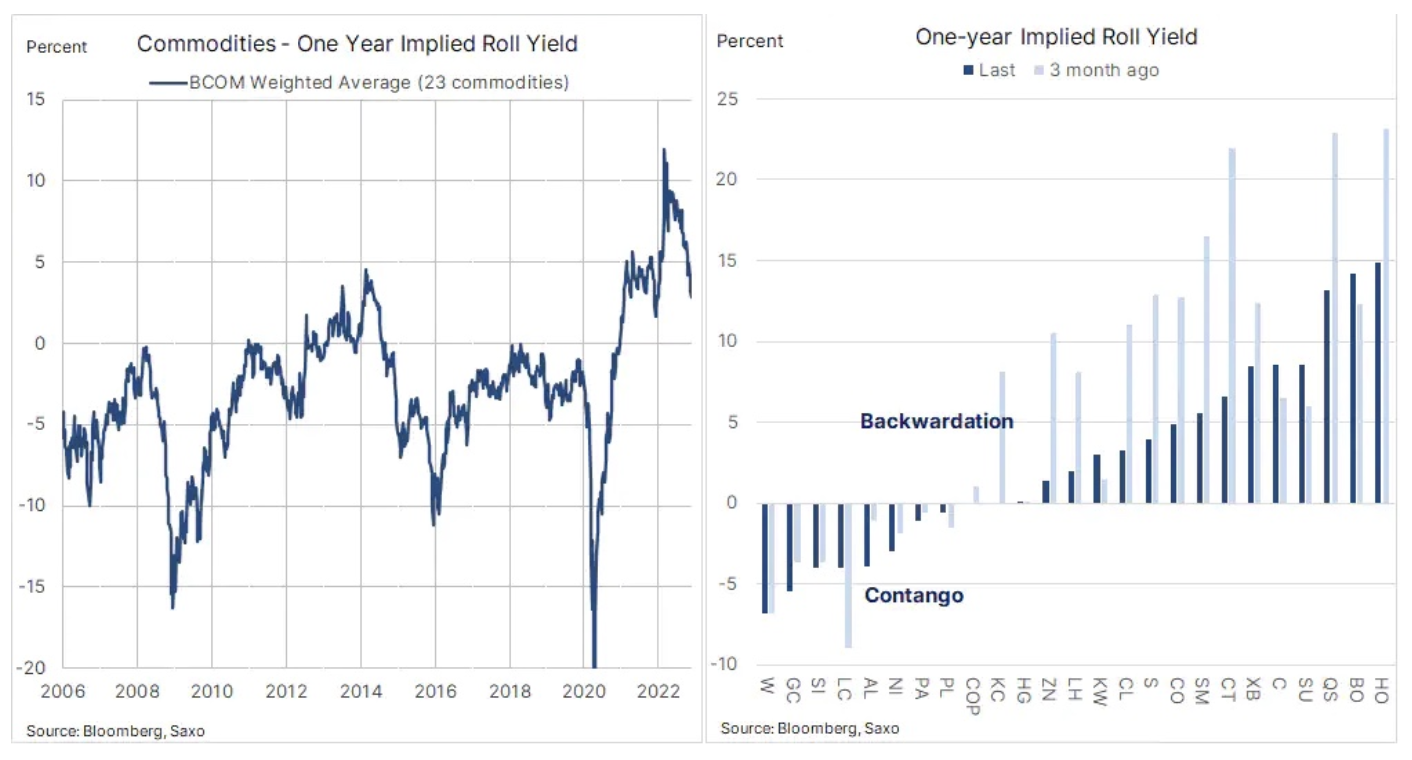

The annual implied rollover profit, based on a weighted average of the 23 commodities in the Bloomberg Commodity Index, remains positive, although lower than at the start of the year. A positive rollover profit or deportation predicts limited supply for most commodities, primarily energy, cereals and the so-called soft products.

Deportation and its positive impact on return on investment

The positive rollover profit, i.e. the sale of an expiring futures contract at a price higher than the price at which the next one is bought, supported the strong return achieved by investors this year thanks to investments in futures contracts and exchange traded funds (ETFs). The chart below shows the performance of the Index Monitoring Fund Bloomberg Commodity Total Return and Bloomberg Spot on a year-to-day basis, excluding additional income from rollover gains. The fund returned 17,6% year-on-day, while the underlying spot index returned 6% less. We expect that in the coming months the factors positive for prices related to limited supply in the markets in repatriation will intensify again. This results, among others, from from increasingly limited supply across the energy sector as the embargo on Russian oil, and from next year also on fuel products, adds upward pressure to the front end of the futures curve.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)