Poland - The European Tiger Against the Background of the EU? We check!

It is not necessary to convince too many people that the Polish economy benefited a lot with the accession to the European Union. The opening of developed economies of Western Europe to goods, investments and people from Eastern Europe contributed to the rapid convergence of the economies of the "new Europe". Poland was one of the greatest beneficiaries of the enlargement of the European Union in the first decade of the XNUMXst century. Of course, in the beginning, development was fueled by the simple reserves of the Polish economy. The country's greatest strengths include a relatively young population, low labor costs and proximity to the industrial heart of Europe - German.

Economic boom in Poland

In the years 1992 - 2019, there was an uninterrupted economic growth in Poland. The period of economic growth was interrupted only as a result of the closure of a large part of the economy as a result of the fight against COVID-19. At the same time, the German economy was in recession for four years. The longest was two years (4-2002). It is worth noting that in the years 2003-1992, the German economy only grew faster than the Polish economy three times.

Economic growth and a decline in population (also due to the migration of Poles to the "west" of the European Union) resulted in a significant increase in GDP per capita (after taking into account the purchasing power parity - PPP). In 1992, GDP per person of PPP in Poland was 27,7% of the German level. In 2021, the Polish rate was already 64,9% of the German level. Of course, the average Pole still earns less than the average German and has less net assets. However, the difference in living standards 30 years ago was even more drastic.

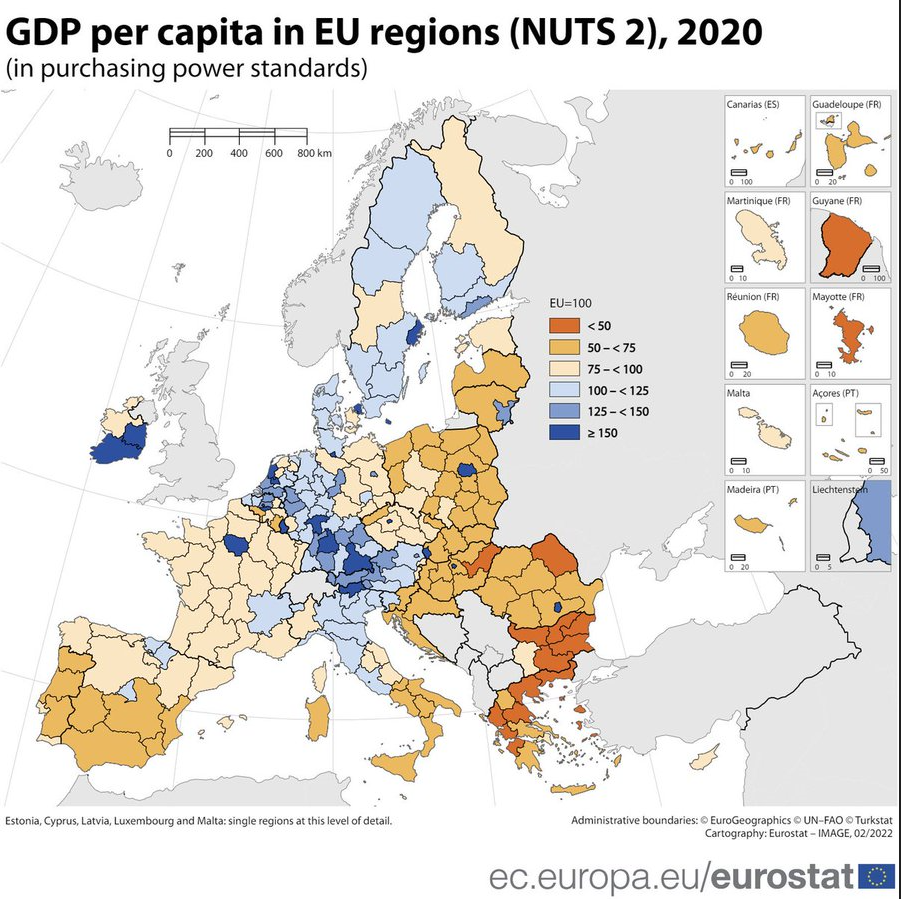

Economic growth does not spread evenly across regions. The Warsaw agglomeration stands out the most, where the level of PPP GDP per capita is over 150% of the EU average. Three subsequent voivodships: Wielkopolska, Śląska and Dolnośląska have a level of development similar to that of the "eastern federal states" of Germany and many French regions. The remaining voivodships, however, are among the poorest in the European Union.

Source: Eurostat

Currently, the level of GDP per capita (PPP) in Poland is a country similar in terms of development to countries such as Greece or Portugal. Even 30 years ago, reaching this level seemed like a pipe dream. As you can see, the development of Poland cannot be taken with a grain of salt.

Development of trade and services in Poland

Of course, many will raise the voices that Poland is an "assembly plant" of Western countries that are setting up their factories in Poland. The offered work is simple and exposed to mechanization. Yes, production in such factories is export oriented. It is worth mentioning, however, that Polish exports are very diversified. As a result, the Polish economy is not dependent on the condition of one or more European industries.

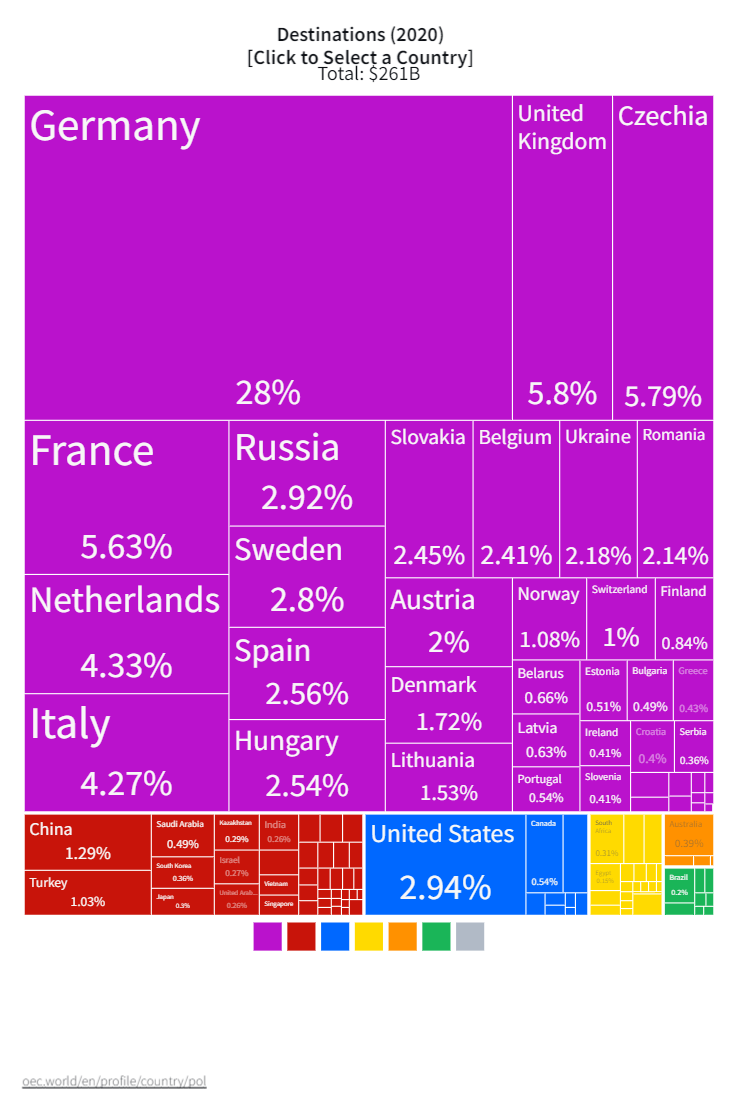

At the same time, lower labor costs (labor cost arbitration) meant that many Polish manufacturing companies began to gain customers in other European Union countries. Due to the size of the economy and geographical proximity, Germany is the most important trading partner for Poland. According to the report OECD as much as 28% of exports went to our western neighbor. The disadvantage of Polish exports is its very strong orientation towards European countries (especially the European Union). It is worth noting that exports to China (one of the most important countries in the world economy) amount to slightly more than 1% of total exports (less than Polish exports to Lithuania!).

Source: OEC

It is worth noting, however, that the country on the Vistula River is also one of the places where a shared service center is located by foreign corporations. The development of this type of service has resulted in a significant demand for work in large cities. The largest cities in Poland (Warsaw, Kraków, Gdańsk and Wrocław) have become the driving forces of the economy.

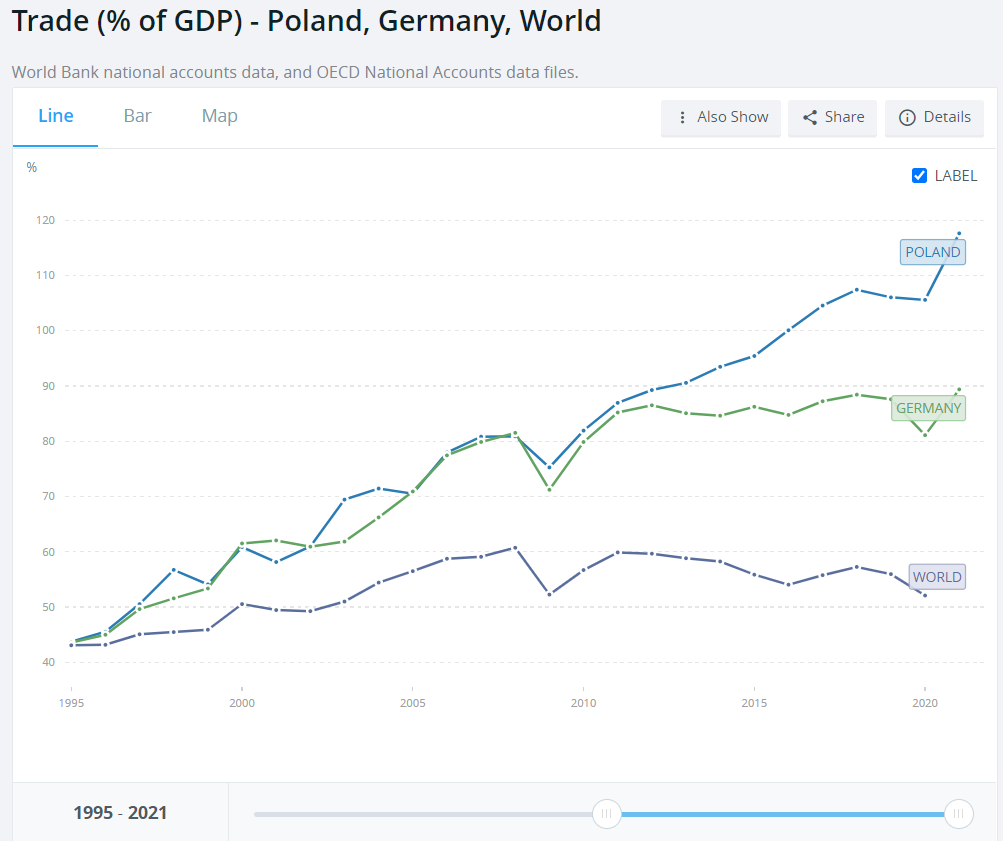

Poland is very dependent on trade openness. An excellent indicator that determines the importance of trade in an economy is the ratio of trade (exports and imports) to Gross Domestic Product. In Poland, in 2021, the trade to GDP ratio was over 118%, and the average value was around 50%. For comparison, in 1995 trade exchange was at the level of 44% (similar to the world average). It can be seen, therefore, that Poland is much more open to international trade than most countries.

Source: World Bank

Basic economic data of Poland

In 1989, economic liberalization began in Poland (the famous Wilczek Act). Thanks to the entrepreneurship of Poles, small and medium-sized enterprises developed dynamically. On the one hand, the liberalization of the economy allowed for a better allocation of capital in the economy, and on the other hand, it had a negative impact on many social groups (including employees of state farms). Problems in agriculture were not solved before joining the European Union. Until then, agriculture in Poland was underinvested and suffered from a surplus of labor.

Despite economic difficulties, especially visible before joining the European Union, Poland became one of the examples of the successful transformation of a post-communist country. It's worth mentioning that Poland introduced many reforms pushed by the supporters of the Washington Consensus. One of them was a 3-pillar pension system, in which the first two were compulsory (ZUS + OFE), and one was voluntary. The pension reform was slowly dismantled in 2014 and continues to this day. Poland was the only country in the European Union not to secede during the 2007-2008 crisis. What's more, in 2019, Poland set the EU record for 28 years of uninterrupted economic growth. Of all the countries in the world, only Australia could boast of a longer period of uninterrupted economic growth. It is worth mentioning that the economic liberalism that prevailed during most of the economic transformation has resulted in the country having one of the lowest labor unionization rates in Europe. Years of development have contributed to the fact that Poland has been classified by the World Bank as a highly developed economy. The service sector dominates the economy, followed by the industrial sector.

According to data Of the International Monetary Fund (IMF) The Polish economy is to be worth around $ 700 billion. When adjusted for purchasing power parity (PPP), the size of the Polish economy is $ 1,5 trillion, which makes Poland the 20th largest economy. According to IMF data, in Poland GDP per capita (PPP) in 2022 will amount to 41,7 thousand. $. For comparison, the indicator for Spain will be 46,4 thousand. $. On the other hand, the average for the European Union will be $ 53,2 thousand. This means that currently Poland has this indicator at the level of 78,4% of the EU average.

The stable macroeconomic environment helped in the economic development. Poland has kept inflation in check for many years. Especially in the years 2002-2020, inflation was below 4,5% annually.

Source: World Bank

The stable level of inflation allowed interest rates to remain in a downward trend. By 2022, each subsequent peak of interest rate increases was at an ever lower level. As a result, financial costs fell, which in turn encouraged more investment and consumption in the economy. The real estate market was the beneficiary of falling interest rates and a wealthier society.

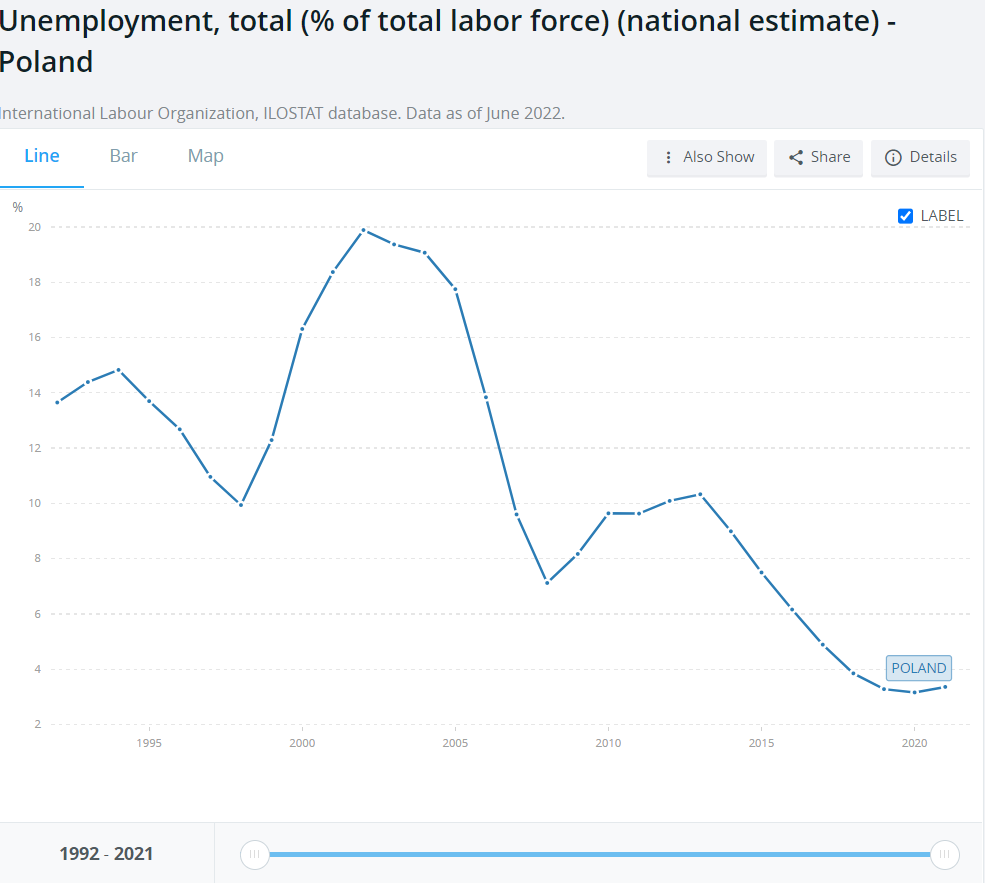

Poland, after starting shock therapy, struggled with very high unemployment. Some of it was of a structural nature. This was due to the fact that ineffective industrial plants and inefficient state farms had to lay off their employees, who did not have the resources and often the opportunity to learn new skills useful on the labor market. Another problem was the weakness of the transformed economy, which was not able to create enough jobs to employ highly qualified workers. The situation on the labor market began to improve rapidly after joining the European Union. Then several million Poles emigrated to the Benelux countries, the United Kingdom and Ireland.

Source: World Bank

Currently, Poland has one of the lowest unemployment rates in the entire European Union. The drop in unemployment increased the pressure on wage increases. As a result, both the average salary in the economy and the median salary are growing. This translates into an increase in the standard of living in Poland.

At the beginning of the economic transformation, Poland had a problem with servicing its foreign debt. As a result, there were long negotiations with the Paris Club and the London Club. Thanks to debt reduction, economic development and a reasonable fiscal policy, Poland has no problem with servicing its debt, which is still below the constitutional threshold of 60%.

Comparison of the economic situation of Poland and the European Union

In this part of the article, we will compare the economic situation of Poland and selected European Union countries in the years 2020 - 2022. We will also discuss the forecasts for the coming year for Poland and other EU countries.

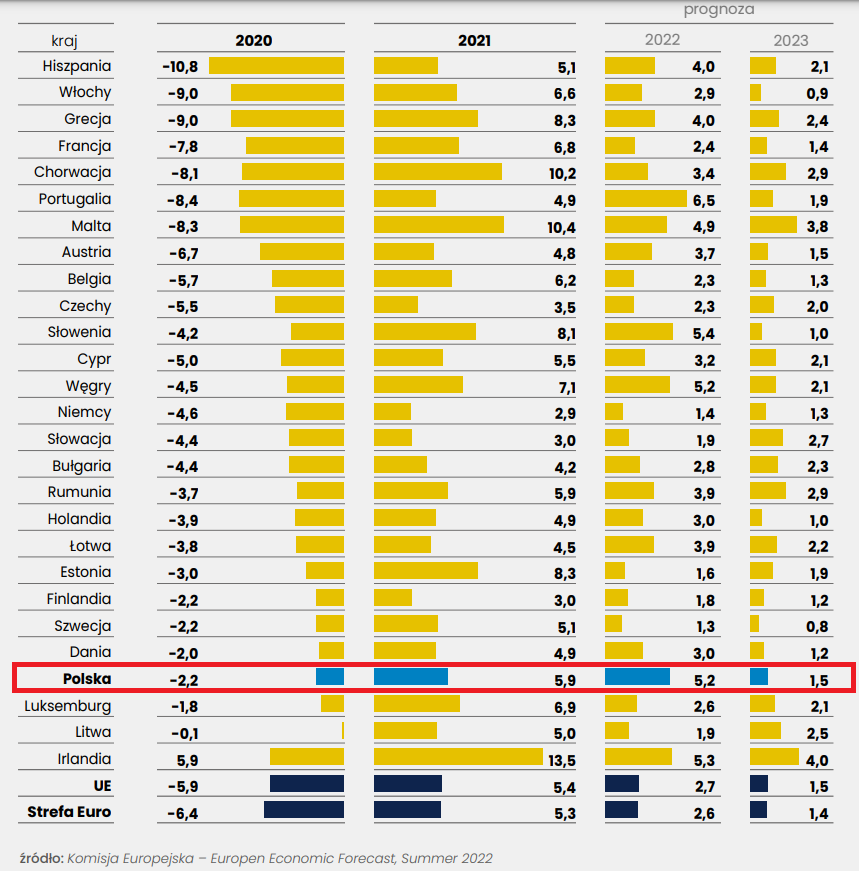

Poland and selected countries during the 2020 pandemic

The COVID-19 period has hit the European economy very hard. Restrictions on the movement of people had a strong negative impact on economic development in countries chosen as holiday destinations (Spain, Italy, Portugal, Greece, France, Croatia). As a result, the decline in GDP in these countries was very strong and ranged from -10,8% (Spain) to -7,8% (France). Of course, the decline in economic activity has translated into economies less dependent on tourism. For example, GDP decreased by 2020% in Germany and by 4,6% in 6,7 Austria. Poland passed the period of the pandemic relatively calmly, ending 2020 with a GDP decline of 2,2%. However, such a slight decline was also possible thanks to the huge stimulus package organized by the Polish government and National Bank of Poland (the so-called anti-crisis shield). Help under The shield was very broad and can be divided into four pillars:

- Government cash aid worth PLN 67 billion. It consisted of the expenses of the state budget, ZUS and special purpose funds.

- Government liquidity component worth PLN 75,5 billion. This pillar includes credit holidays and providing liquidity in the form of loans. In addition, government agencies (PFR, BGK, KUKE, ARP) offered specialized financial instruments to ensure capital for enterprises.

- The liquidity package of the National Bank of Poland worth PLN 70 billion. It was supposed to ensure the necessary liquidity and preferential credit conditions.

- Financial shield - project value estimated at PLN 100 billion. The support program was supported by the Polish Development Fund (PFR). It was directed to approximately 670. Polish entrepreneurs. The aid was directed both to large enterprises employing several thousand employees and to micro-enterprises.

Summarizing, the value of the aid package exceeded PLN 312 billion, which corresponds to approximately 15% of Poland's GDP. The government aid helped to protect the labor market (mass layoffs were not allowed) and not to deteriorate too much the financial condition of the majority of the enterprise. Of course, the tourism and catering industry found itself in a deplorable financial situation due to lockdowns. As a result, hotels and restaurants were forced to significantly reduce employment, and many weaker entities were no longer able to continue their activities. Except that, the activities of the NBP helped to improve the condition of financial institutions operating in Poland.

Poland was not the only country to apply pandemic mitigation packages. Below we will list selected aid packages from Europe and large non-European economies:

- United States - around 10% of GDP package

- Japan - a package of around 19% of GDP

- Germany - around 20% of GDP package

- France - around 14% of GDP package

- Spain - a package of around 15% of GDP

As you can see, the Polish aid package did not differ positively in relation to large economies. Of course, some solutions used by other countries were not used in Poland. For example, in Germany, families with the lowest incomes received government assistance of € 180. In turn, in the United States, it was introduced "Stimulus check"which was paid in April 2020, December 2020 / January 2021 and March 2021. The maximum aid from these stimulus was $ 3200 per adult. In Poland, it was decided not to introduce a solution of this type. The aid went mainly to entrepreneurs. It is worth adding, however, that in Poland there is already an extensive program of benefits to help certain groups of voters (the famous 500+ program and the thirteenth and the fourteenth pension).

Coping with inflation

Supply constraint associated with zero Covid policy in the People's Republic of China, combined with the soaring prices of container ships and the large fiscal and monetary aid from developed economies, have created a significant imbalance between supply and demand. This translated into an increase in prices. In the case of Central and Eastern Europe (CEE) countries, the increased inflation was already visible in 2021. For this reason, a monetary tightening cycle has begun in these countries. Increased inflation was also visible among some developed countries. Russia's aggression towards Ukraine resulted in another problem, which was the imbalance in the gas and oil market. This, in turn, translated into rising costs of transport and electricity. At the same time, drought in Europe resulted in a sharp drop in the water level in rivers. In effect many nuclear power plants have had to limit their electricity production.

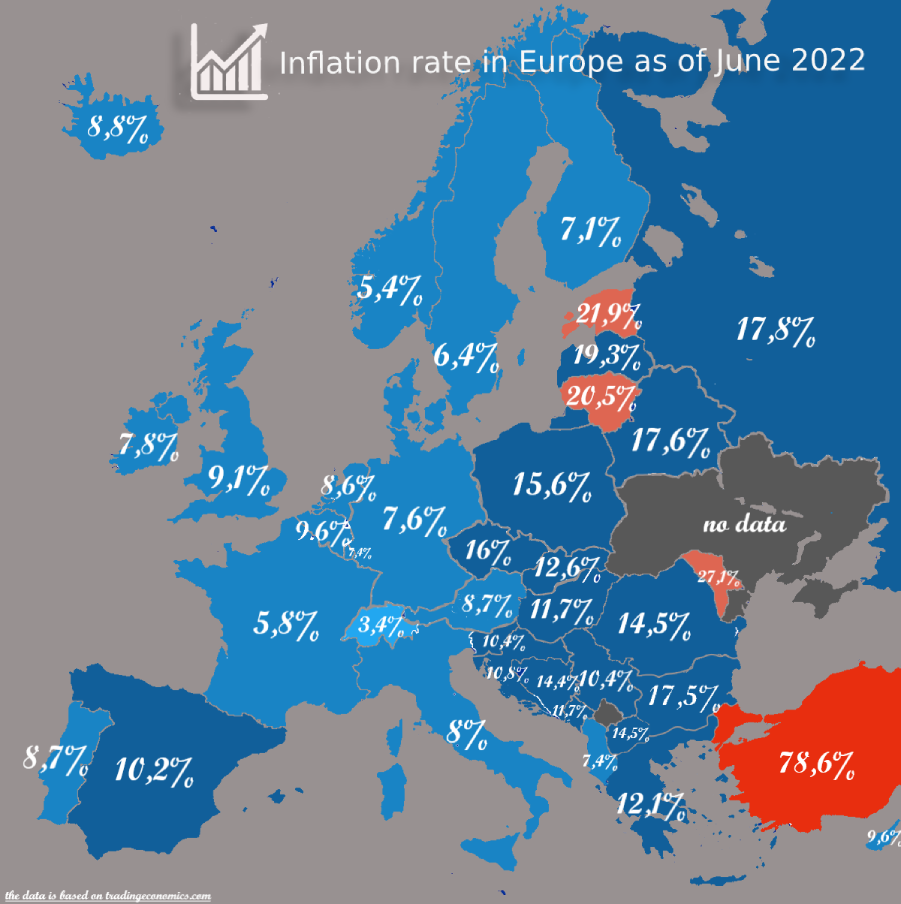

The countries of Central and Eastern Europe in 2022 are struggling with a really high level of inflation. While countries such as Poland, the Czech Republic, Romania or Hungary have their own currencies, which allows them to manage their monetary policy in a more flexible way (e.g. by raising interest rates), countries such as Slovakia, Lithuania, Latvia and Estonia depend on the policy European Central Bankfor which the macroeconomic stability of the entire Eurozone is more important than its periphery.

Source: Map published on Reddit.com, based on data from tradingeconomics.com.

The Polish inflation index is underestimated due to the introduction of the so-called anti-inflationary shield. According to its rules, many food products are exempt from VAT. The shield will last until the end of October 2022. If it is not extended, then one should expect inflation pressure to increase in the coming months (ceteris paribus).

The high inflation rate left people in financial difficulties who took out large mortgage loans at a time when interest rates were at historically low levels (naively thinking that interest rates would not change for 30 years). Foot changes contributed to the increase in WIBOR, on which mortgage loans are based with a variable interest rate granted in PLN. The rapid increase in WIBOR caused the indicator to suddenly become a manipulation and the government started to develop a new indicator (probably more "socially equitable"). It is worth mentioning that when WIBOR was falling, borrowers and politicians had no contraindications as to the method of calculating the ratio. The government, trying to ease the tension among borrowers (which could translate into worse election polls), decided to introduce "credit holidays", which burdened the Polish banking sector. In 2022 alone, the cost for the banking sector will amount to several billion zlotys. The total cost of the holidays is to be over PLN 25 billion. The banking sector will have poorer solvency ratios and will have problems offering cheap financing to the corporate sector and clients. This may cause a slowdown in investment in the economy and weaker retail sales for this reason. The weaker condition of banks will also translate into greater pressure to reduce employment in the banking sector.

However, another problem is rising energy costs. As a result, some energy-intensive sectors of the economy are already limiting their activities. An example is the activities of ArcelorMittal, which recently announced the shutdown of a furnace in a steel plant in Dąbrowa Górnicza. The reason is the increase in gas and electricity prices. As a consequence, the competitiveness of European steel producers is declining. Rising energy costs will have an impact producer inflation (PPI) and will exert inflationary pressure.

Developed economies also struggle with high inflation. For example, inflation in June 2022 in the United States was 9,1%, making it the highest since 1981. In Germany, inflation in August reached 8,8%. This meant that inflation was at its highest in 40 years. The reason for high inflation in Germany was the increase in energy prices (+ 35,6%) and food (+ 16,6%). Core inflation net of food and energy prices stood at 3,1%. High inflation negatively affects the condition and competitiveness of German industry (including steel and automotive).

Economic growth forecasts from 2022 to 2023

According to the forecasts of the European Commission, the Polish economy is expected to grow by 1,5% in 2023. As a result, economic growth in Poland will not differ from the average economic growth in the European Union. The high costs of obtaining financing (the effect of high interest rates) will certainly hinder Polish economic growth. At the same time, banking holidays will cause the banking sector to be more restrictive in granting investment loans or consumer loans. At the same time, a large slowdown in the real estate market will reduce the demand for building materials and renovation services. It is worth adding, however, that economic growth in the European Union will be quite rickety. According to forecasts, only two EU economies will record GDP growth above 3%.

Source: Polish Bank Association

Polish stock market

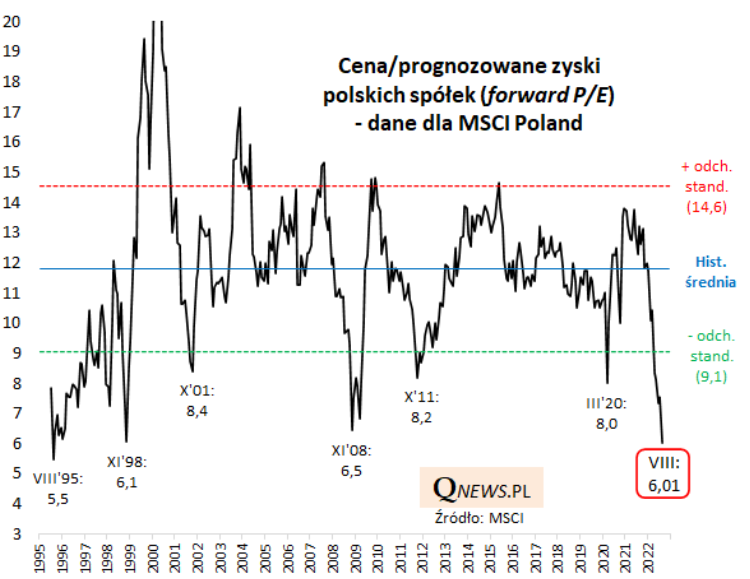

The deteriorating macroeconomic environment coupled with Russia's aggression towards Ukraine made the valuation of many Polish stocks attractive at the multiplier level. This can be seen in the chart prepared by the Qnews.pl portal. The MSCI Poland index is the lowest price to profit ratio (projected profit) for over two decades.

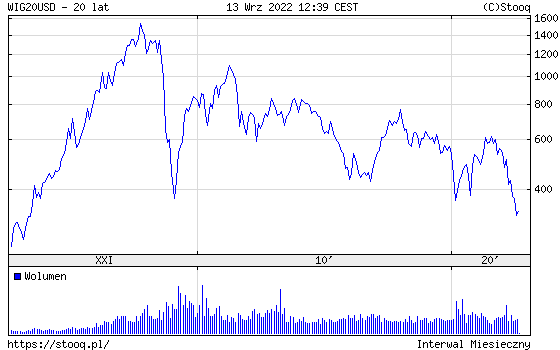

To the full picture of the situation, one should also add, as seen by the Polish market, a foreign investor. The "dollar" WIG20 index, which until recently was lower than during the "covid trough" and was at levels similar to the low from March 2009, is perfect for this.

However, it should be remembered that the index has a large representation of companies from the banking, raw materials and petrochemical segments. Another problem for some investors is the high representation of State Treasury companies in the index.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)