Broken Europe but avoidable recession

We were too pessimistic about the eurozone. Lower energy prices, lack of major power outages (resulting from both diversification of supply sources and better weather conditions) and solid hard data (particularly in Germany) are prompting experts to revise their forecasts for the 2023 recession. in the euro area in 2023 increased from -0,1% to 0,0%. This is a small but significant adjustment, and there are no signs that it will end there. We still believe that this consensus is too low. In mid-January, Goldman Sachs became the first international bank to completely reverse its forecast for the Eurozone, revising its forecasted GDP growth from -0,1% to 0,6%. IN Saxo Bank we are not so optimistic, but we are confident that the eurozone can avoid recession this year with a GDP growth target of around 0,3-0,4%. It should be remembered that just a few months ago, over 90% of forecasts assumed that a recession would be inevitable this year.

What changed?

The economy is indeed stronger than expected. Citi's Economic Surprise Index (Citi Economic Surprise Index shown in the chart below) is currently at an annual high. This means that economic data is better than expected by economists. This is particularly evident in the case of Germany. Gas consumption recorded a double-digit decline, while industrial production remained largely unchanged. Not only can this be considered a remarkable achievement, based on the latest November data on industrial production, it can be concluded that there was no recession in German industry in the fourth quarter. The first estimates of German GDP in 2022 also significantly exceed the forecast value and amount to 1,9%, which is 0,5 points above the government's target. Everything indicates that in the short term the pace of economic development will remain dynamic, and all nowcasting models point to an economic recovery in the current quarter. As a result, the probability of a recession is currently falling quite rapidly. We also believe that there will be no extreme macroeconomic and market events in 2023 – which may be positive from the perspective of economic growth. If the economy performs much better, however, ECB members will have more confidence to raise rates, as Christine Lagarde pointed out in December.

The index of economic surprises in the euro zone looks better and better. The consensus of 0,0% GDP growth in 2023 seems a bit too conservative and will certainly be revised upwards.

There is risk on the horizon

However, this does not mean that 2023 will be without challenges:

- Credit stress is on the rise – for the first time in a decade, we are starting the new year with a yield on European corporate bonds with an investment grade rating above 4%. It is to be expected that many companies will have difficulty accessing new sources of financing. Many small- and mid-caps are likely to have no choice but to resort to ultra-dilutive financing, such as convertible bonds. Retail investors should stay away from such listed companies.

- The market will have to absorb around EUR 700bn of liquidity as the ECB continues to tighten. This complex operation will result in tighter financial conditions and possibly greater volatility in the stock market.

- The energy crisis will again become the number one topic. This is not politically correct, but climate change has certainly helped us to avoid an energy crisis in Europe so far. However, when it comes time to replenish depleted stocks in the spring, it is to be expected that prices will go up again. We are confident that the EU will be able to find energy suppliers (for example, liquefied natural gas (LNG) from the US, Australia or even Mozambique), but this will come at a high cost. This will ultimately drive up inflation in the second half of the year, as well as an increase in oil prices due to higher demand in China (we estimate that China's reopening to the world will increase oil demand around spring by 4 million barrels a day - about three times the increase in demand predicted by the market).

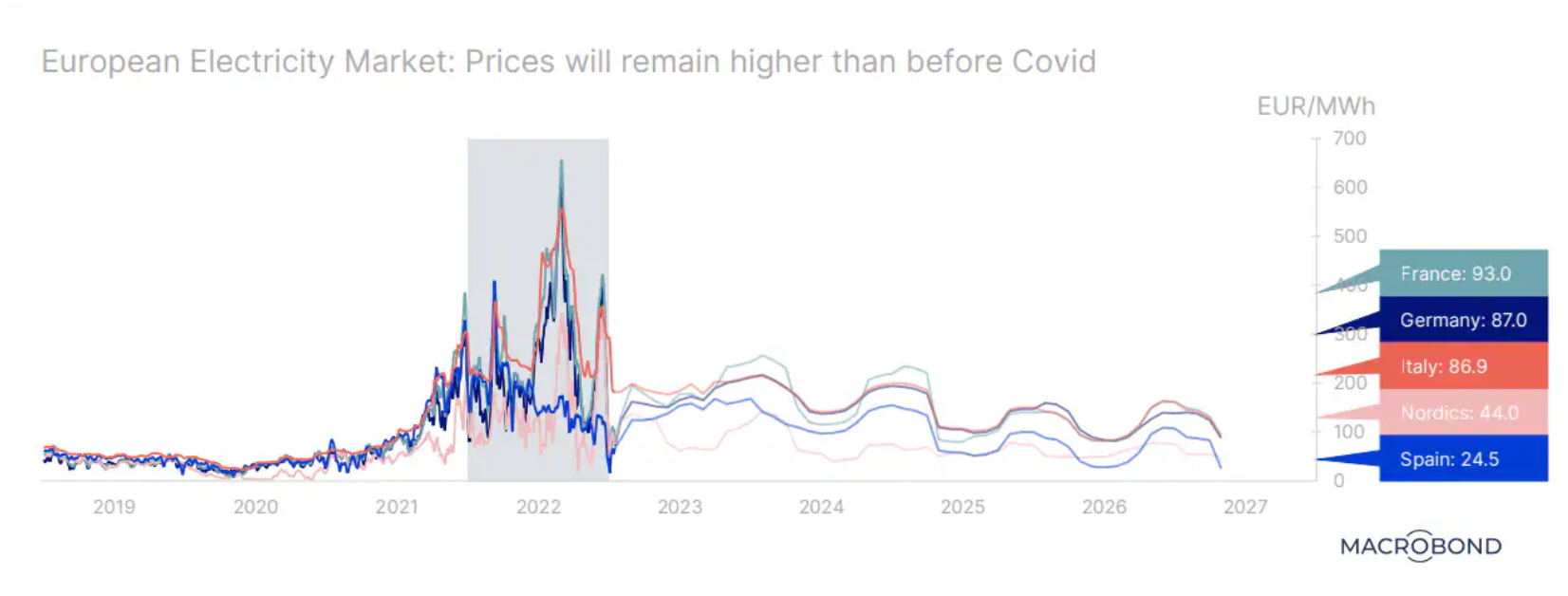

At the height of the 2022 crisis, wholesale electricity prices in several EU Member States increased tenfold. This was partly explained by rising gas prices due to the war in Ukraine and problems with nuclear power in France. Prices are now falling. However, the market does not anticipate a return to the situation before the Covid pandemic - when prices were below EUR 60 per MWh.

What about the risk of a wage-price spiral?

Labor supply in the euro area remains limited. The latest figures show that in November 2022 unemployment in the euro area was at 6,5% and in the European Union at 6,0%. Of all EU Member States, Spain has the highest official unemployment rate (12,4%), and Germany and Poland the lowest (3,0%). In a working paper published in mid-January, economists from the ECB pointed to the risk of high wage growth in the coming quarters - well above historical trends: "This reflects strong labor markets that have not been significantly affected so far by the slowdown in the economy, increases in national minimum wages and a kind of narrowing of the gap between wages and a high rate of inflation growth. We tend to disagree with this assessment. Wage growth obviously fuels inflation in Central and Eastern Europe, but this is clearly not the case in Western Europe. The probability that wages will increase significantly, thus becoming a problem in the context of fighting inflation, is rather small in our view. Indeed, in many countries wage growth lags dramatically behind inflation. In Spain, the average real wage is now lower than it was 15 years ago! It is hard to believe that there will be a wage-price spiral. but if EBC considers this to be a significant risk, it may decide to tighten too much, thereby increasing credit stress.

Overall, we believe that the consensus has been, and still is, too pessimistic for euro area GDP growth in 2023. recession. That said, Europe is still messed up. The energy crisis remains the main risk in the context of next winter - with the EU still reluctant to view nuclear energy and unable to take quick decisions on the electricity market reform project. Although the ECB predicts that wages will increase significantly, we see that in reality workers are getting poorer in most countries. A number of companies that have benefited from periods of unusually negative interest rates are now waiting for the moment of truth - many of them are likely to go bankrupt. Politically, we are not optimistic. EU presidencies show little ambition; Sweden, which heads the EU Council, is focusing - not surprisingly - on the war in Ukraine, while Spain's presidency in the second half of 2023 will be dominated by national elections. No major positive changes are to be expected in politics this year.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)