Banks' problems, profits of technology companies

Today's release of HSBC and Societe Generale's second-quarter earnings shocked investor confidence in banks as profits turned out to be surprisingly low and HSBC forecasts bad loans to hit $ 19bn as a result of the COVID-13 pandemic. HSBC has been struggling with the economic downturn, the increase in bad loans, primarily among commercial customers, and the decline and flattening of the yield curve. The same problems are noted by Societe Generale, and moreover, it has to face a decline in investment activity, as a result of which in the second quarter the bank's net income fell by as much as EUR 1,3 billion.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Negative forecast for banks

As a result, European banks have declined by 1% after today's sessions and are hitting the lowest levels since 2009. The STOXX 600 overall banking earnings index has fallen by 2001% since its inception in 57, and has gained more than the 2009 lows. only 19%. Central banks and private commercial banks are essentially extensions of government; commercial banks have generated profits over the last hundred years, but as a result of the current central bank policy and tighter regulation, the sector has become purely "utilitarian", offering very low profitability and limited growth potential. The COVID-19 pandemic has forced many governments to issue loan guarantees to ensure that banks continue to lend, bringing the banking industry even closer to quasi-state lending. Overall, it is difficult to be optimistic about banks - even US banks - and we suggest that investment in this sector be minimal regardless of region.

Technology Companies Surprising Profits

Last week we learned about the profits of all of America's largest tech companies. Against a backdrop of overall weak economic activity, all performance has proven solid, boosting investor confidence in tech equities. Facebook and Google in particular have shown significant ad revenues, highlighted by the fact that even when the economy is struggling, tech giants are able to increase revenues as their online business continues to grow. This means that the market valuations of technology companies will continue to rise, and due to the fact that 0,54-year US bond yields are XNUMX%, investors will accept such high valuations.

It is typical of growth stocks in an environment of low yields that investors are willing to pay for a very high valuation both for the alternative and for overall growth. Imagine a tech company growing 15% yoy and having a free cash flow valuation of 2%. Yield as such is low, but still four times higher than that of risk-free bonds. Investors buying these stocks at such a high valuation can readily accept a slowdown in growth to 7,5% per annum and a 30% increase in free cash flow, and it will still be a much more attractive offer in terms of their expected long-term return. This, at a glance, is our newest paradigm - at current profitability levels, the entire pair goes into stocks, except for low-growth stocks.

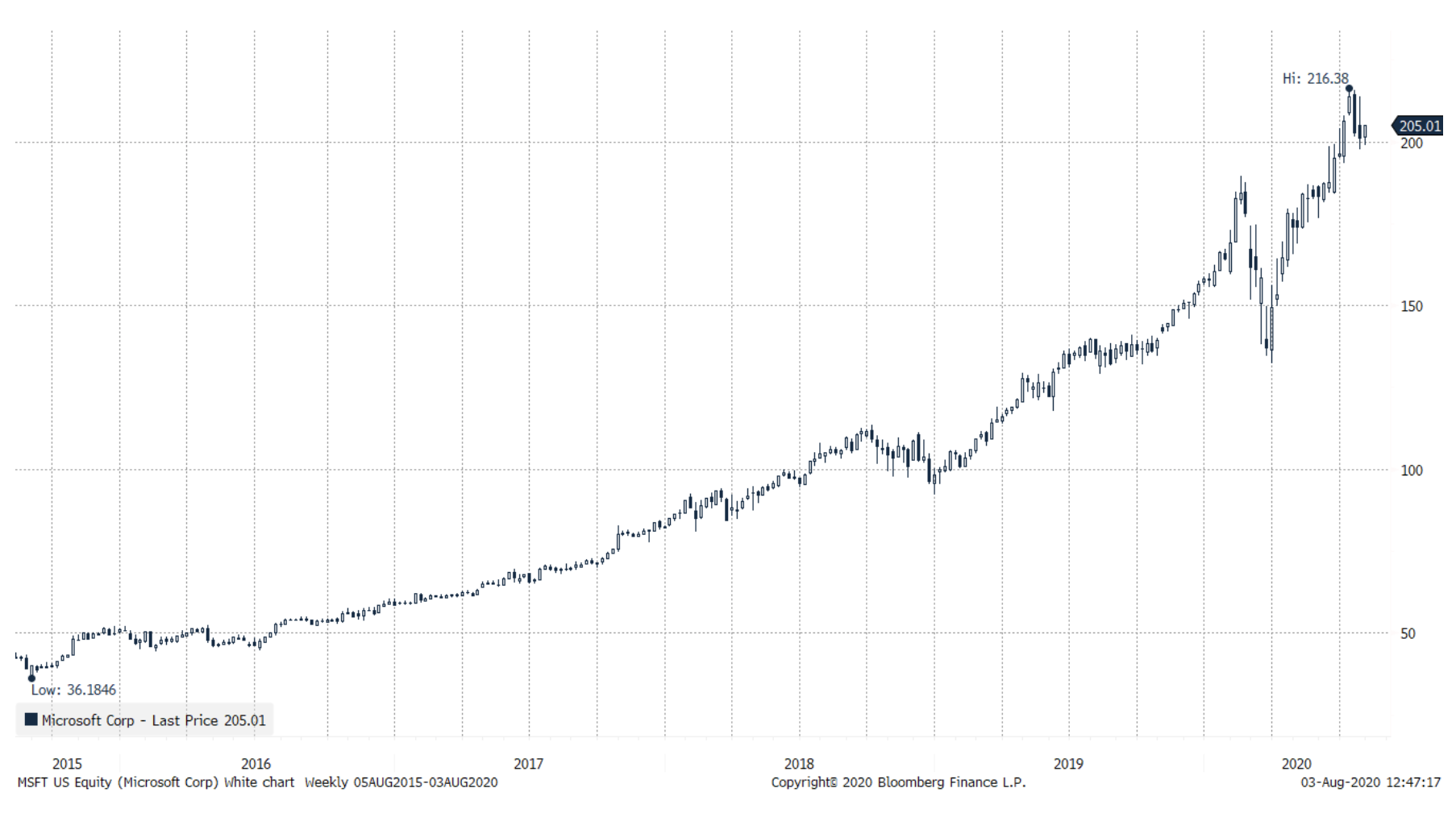

Perfect timing for Microsoft

During the Sino-US trade war, we argued all the time that this conflict was evolving into a new "cold war" and that it was essentially based on a struggle for technology, which would naturally lead to two internet "systems".

After the recent banning of the TikTok application in the United States by the Trump administration, its owner - ByteDance - is trying to save its business in the US market. The company is considering establishing a separate entity, but such a solution would still enable it to maintain operational ties with the Chinese entity, which will certainly be opposed by the American intelligence apparatus. Microsoft is negotiating an agreement to take over TikTok's operations in the United States, Canada, Australia and New Zealand, and aims to close this transaction by September 15. According to a Reuters report, ByteDance values TikTok at $ 50 billion, so a Microsoft takeover in four countries would cost a significant portion of that amount; in the US market alone, this application has 100 million users.

In recent years, Microsoft has already acquired assets beyond its core operating system and cloud operations business with the Minecraft and LinkedIn acquisitions. In our opinion, this transaction may turn out to be crucial for Microsoft, as the company is not a major player in the social media and online media industry, and TikTok will develop enough to be able to threaten Facebook and Google. The takeover of Instagram by Facebook was initially considered too expensive, but from the perspective it turned out to be a brilliant move. Similarly, the potential acquisition of TikTok by Microsoft may prove to be a breakthrough for the company and solidify its presence in the online media market, which will become even more important in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)