Nvidia's revenue forecast confirms the opportunities associated with AI

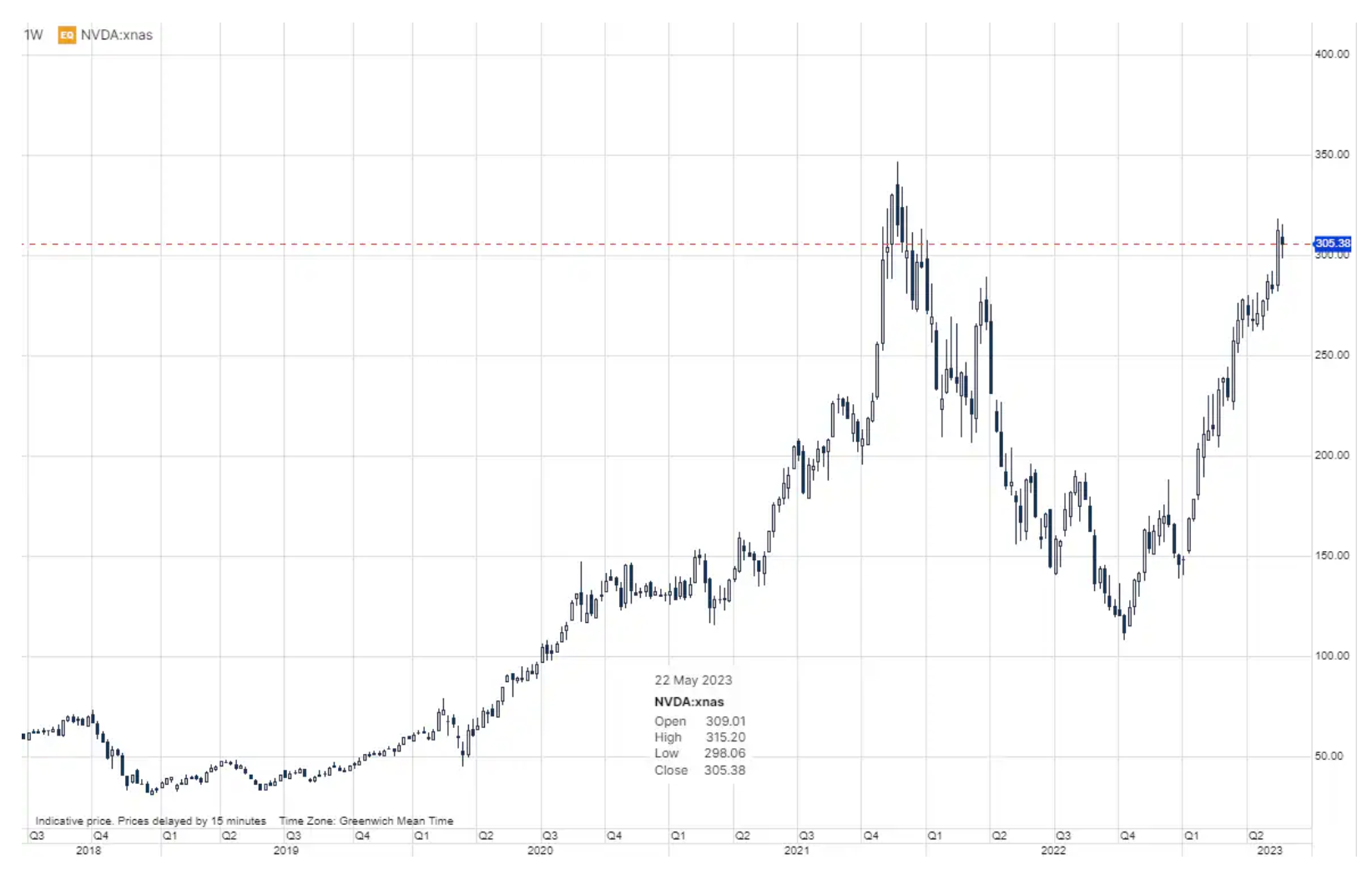

Nvidia shares jump 27% in pre-market trading after the company released its Q11 revenue forecast of $XNUMX billion (for comparison, the estimated amount was USD 7,2 billion), beating even the most optimistic estimates and highlighting the incredible increase in demand for AI chips as part of the ongoing AI race after the commercial success of chatbots such as ChatGPT and Bard. Extremely high expectations for the future of Nvidia are clearly visible in the valuation of the stock of this company, which is currently ranked number one on the S&P index.

Artificial intelligence and the huge wave of demand for GPUs

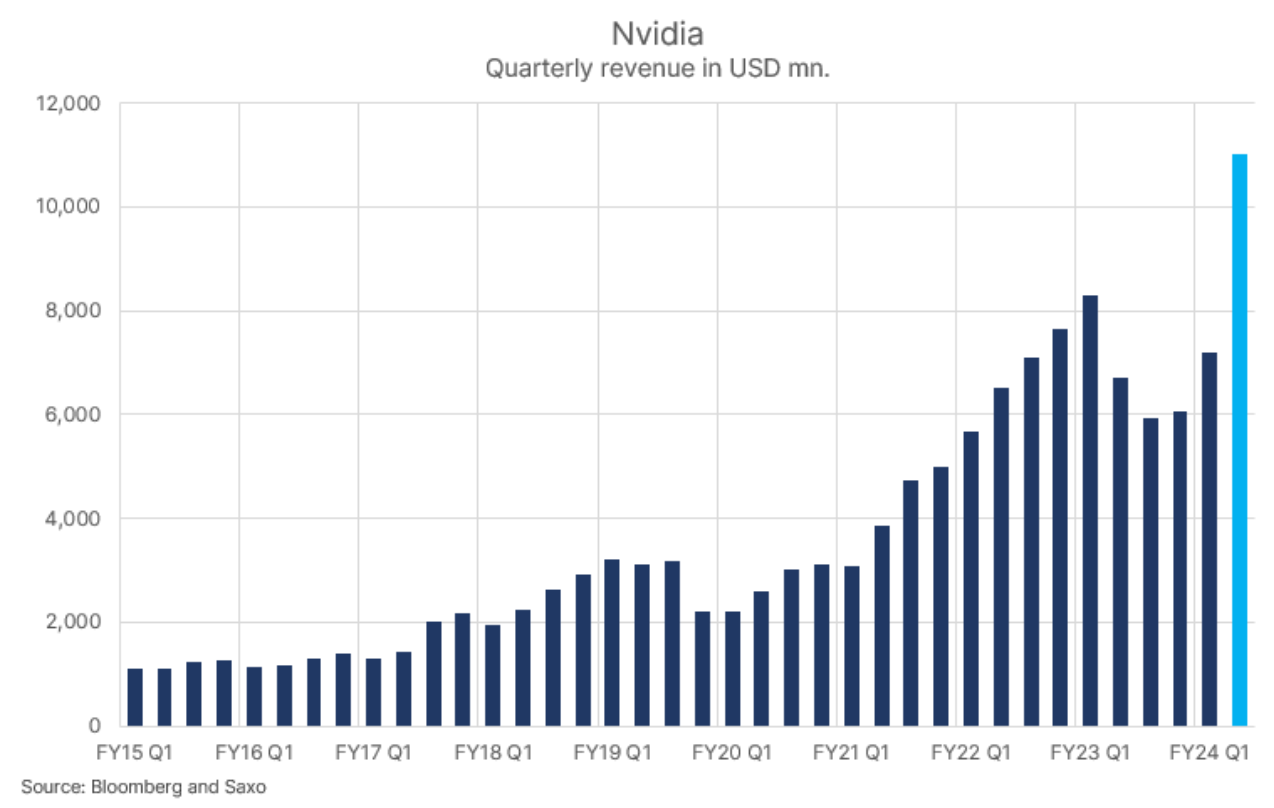

A difference in revenue of more than 10% in just two months is one thing; the second is that Nvidia's Q11 revenue forecast was ridiculous at $2 billion (light blue in the chart below) plus or minus 7,2% compared to $XNUMX billion projected. Thanks to this until the end of July nvidia revenue will reach a new historical record.

Analysts apparently didn't realize how big the demand was, so no one came up with an accurate revenue model for Nvidia based on a true understanding of revenue growth drivers. However, investors were also unprepared for the data as even their high expectations, reflected in a 109% increase in the share price, fell far behind considering that the company's shares were up 27% in pre-market trading.

Is Nvidia the once-in-a-decade exception?

Nvidia stated that demand for its AI chips had only just begun, and CEO Jensen stated that this was only the beginning of a ten-year cycle. While these remarks are obviously true, they also reflect a poor understanding of a potential speculative bubble in AI stocks such as Nvidia. Comments like this will only increase the momentum of such a bubble, drawing many retail investors into stocks that already reflect huge expectations. The problem is that no one can predict what the situation will be ten years from now. The range of results for AI chips is extreme and due to this high volatility it is almost impossible to price Nvidia, which means a high probability of mispricing and even bubble-like dynamics.

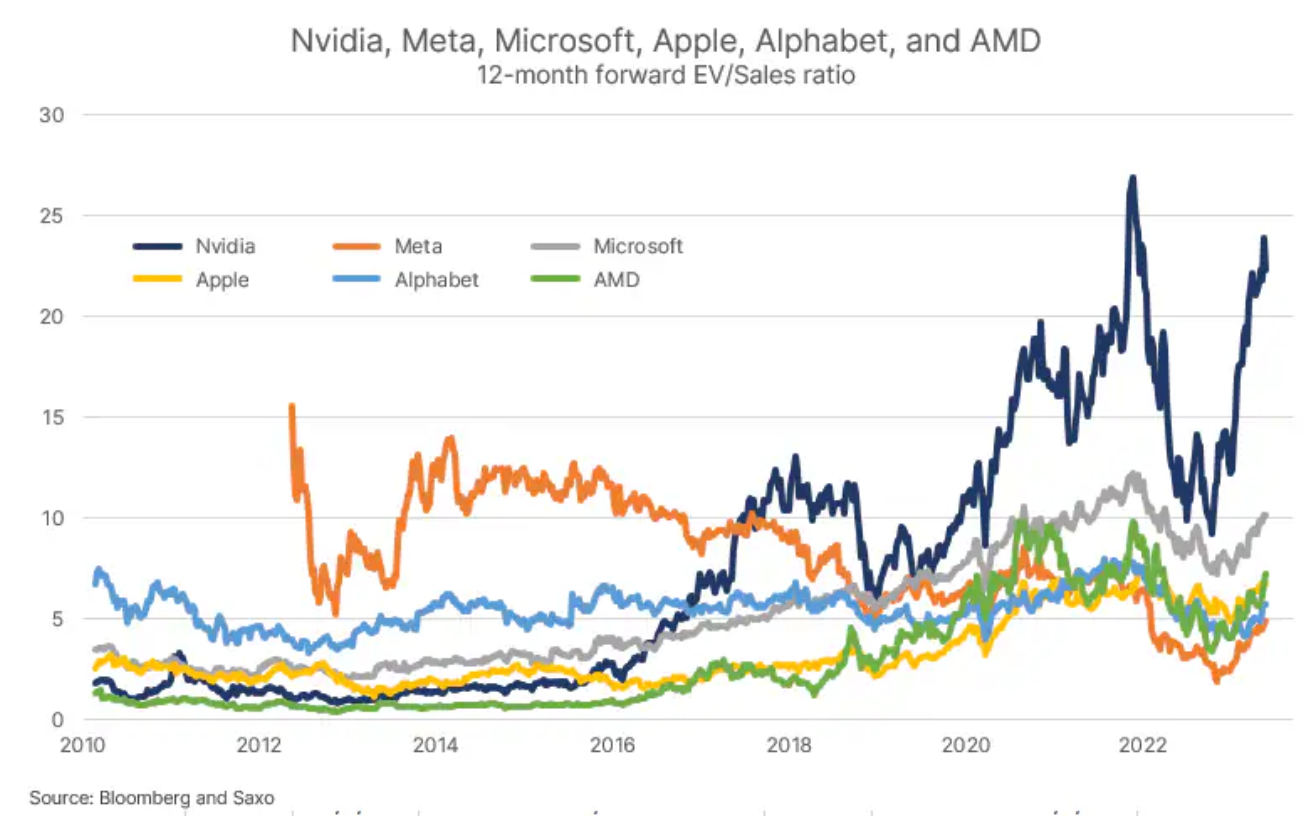

The increase in Nvidia's enterprise value was equal to the upward revision of twelve months' future revenue, meaning that there was no change in the valuation of the company's future value after the earnings release. The 22,3-month future enterprise value-to-sales ratio is still 1,1x compared to XNUMXx around a decade ago, reflecting both strong growth momentum and improved operating margins, and more importantly, investors' extrapolation of AI technology into the future as a phenomenon. which is more or less unlimited. Nvidia has the highest XNUMX-month future enterprise value-to-sale ratio of any stock on the market the S&P 500 index.

The XNUMX-month future value-to-sales ratio is one of the best quantitative factors in backtesting due to the significant Tobin q factor, which means that the spread of returns between the lowest and highest decile stocks is quite significant. In other words, stocks with the highest ratio of future enterprise value to sales tend to underperform stocks with the lowest ratio. These observations are of course an aggregation phenomenon where there will always be outliers. For almost twenty years, Amazon has been such an outlier. So perhaps Nvidia will also turn out to be one of those random outliers contradicting the aggregated observations. The important difference between Amazon and Nvidia is that Amazon defied aggregate dynamics because it started out as a small company sailing into a veritable ocean of growth, while Nvidia starts out as a valuation leader with a market value of nearly $1 trillion.

Market opportunities and threats related to artificial intelligence

In a presentation to Nvidia's investors in February this year, the chip maker says the market opportunity is around $1 trillion in terms of revenue. It's not clear if this figure represents total revenue in these categories or Nvidia's revenue opportunity with a given market share. However, this slide contributes to creating a specific narrative about the perceived scale of this market. By comparison, the global economy is expected to grow to $106 trillion at current prices this year.

Such a market opportunity is not without risk, however, and it is our responsibility as investment analysts to identify these risks. In our analysis entitled Huge opportunities and threats for semiconductors we have highlighted two key risk areas, but one more needs to be added, so the three key risk areas for Nvidia and the wider AI and semiconductor market are as follows:

First, tensions between the US and China, which resulted in Washington imposing restrictions on semiconductor exports to China, could escalate further, seriously damaging the global semiconductor supply chain. It was this threat that Nvidia CEO Jensen pointed out in yesterday's interview with the FT ahead of the publication of the earnings report.

Secondly, perfluoroalkyl compounds (so-called PFAS) are very important for the production of a wide range of consumer goods, including semiconductors; however, these substances have been found to cause cancer and other serious diseases in humans. 3M phases out PFAS production by the end of 2025, and the EU introduces a ban with a thirteen-year transition period. However, there is no cheap and obvious alternative to PFAS in the industry, which could make microprocessor production more expensive in the future.

Thirdly, electricity consumption will increase dramatically in the coming years due to electric vehicles, heat pumps replacing gas boilers, as well as data centers. If there is an explosion in the adoption of AI, the demand for electricity will increase even more and there is a real risk that both electricity production and grid modernization and expansion will not be able to keep up, creating a physical barrier for the semiconductor industry and artificial intelligence.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)