Raw materials are still the most attractive investments in 2021.

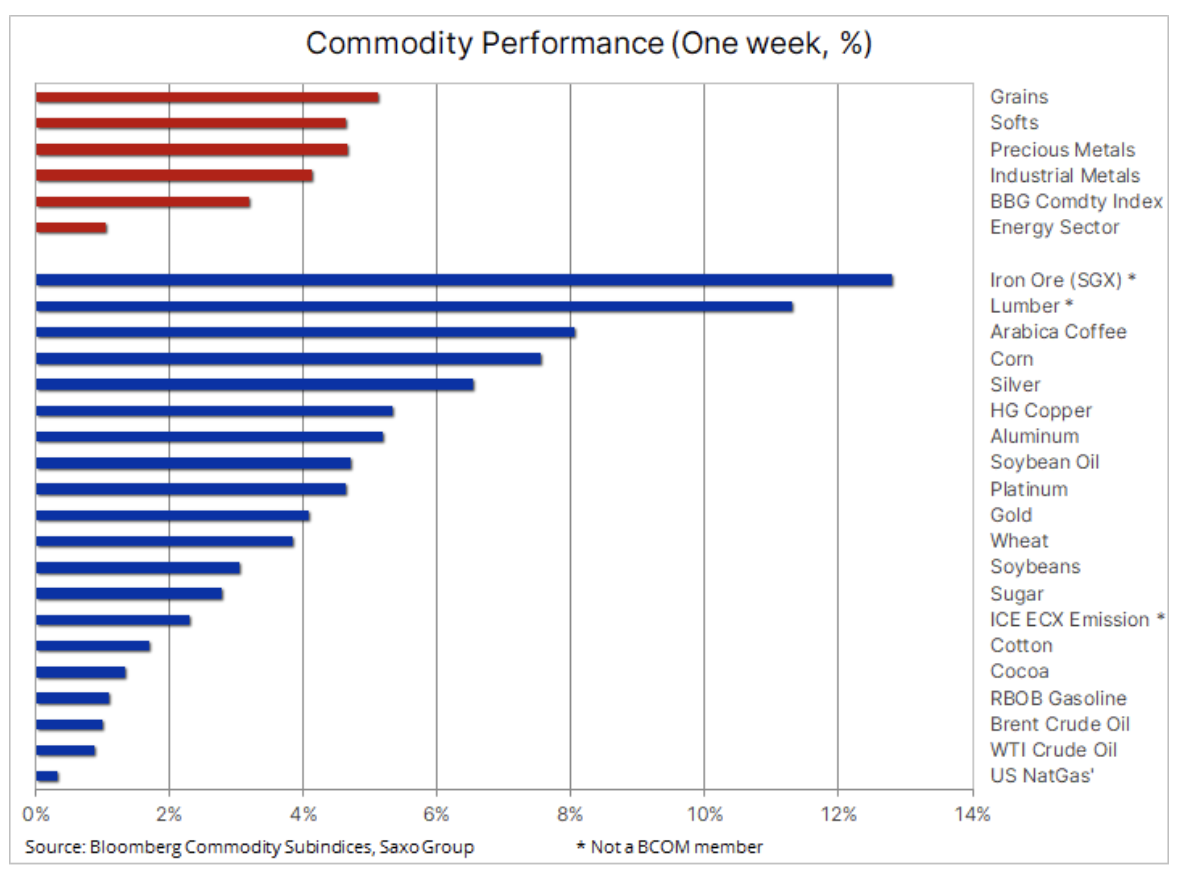

The so-called Commodities' boom for everything continues to gain momentum: the Bloomberg spot commodity index has been increasing for the fifth consecutive week, reaching its highest level since 2011. A number of factors contribute to this, ranging from the vaccination-related recovery to global growth, to transport bottlenecks to delivery, concerns over the weather in key growing areas, to the growing fear of inflation and a speculative frenzy translating into increased demand for investment.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Recently, all key commodities have grown, most notably iron ore, arabica coffee, corn and wood. All metals also went up: copper reached a record high, while gold, supported by silver, managed to break above $ 1. The energy sector was the worst performing - crude oil had a hard time breaking out as a result of new virus outbreaks in Asia, which negatively impacted the pace of the recovery in demand.

On the macroeconomic level, both the dollar and profitability US treasury bonds provided further support; the US currency slightly depreciated and nominal yields remained stable. They have come into the spotlight after increasing emphasis on growth inflation caused the ten-year profitability above the break-even point to reach the eight-year maximum, while the real profitability returned to -1%.

Agricultural commodities

One of the greatest concerns in view of the recent rise in world commodity prices is the impact of higher food costs on those nations and economies least able to afford it. The FAO global food price index, which includes a basket of 95 food prices from around the world, surged sharply in April, achieving annual growth of more than 30%. This pace of food price inflation was last recorded in 2011 - higher food prices contributed to the outbreak of the Arab Spring - and all sectors surged, most notably cooking oils, which grew by 100%, sugar (58%) and cereal products (26%).

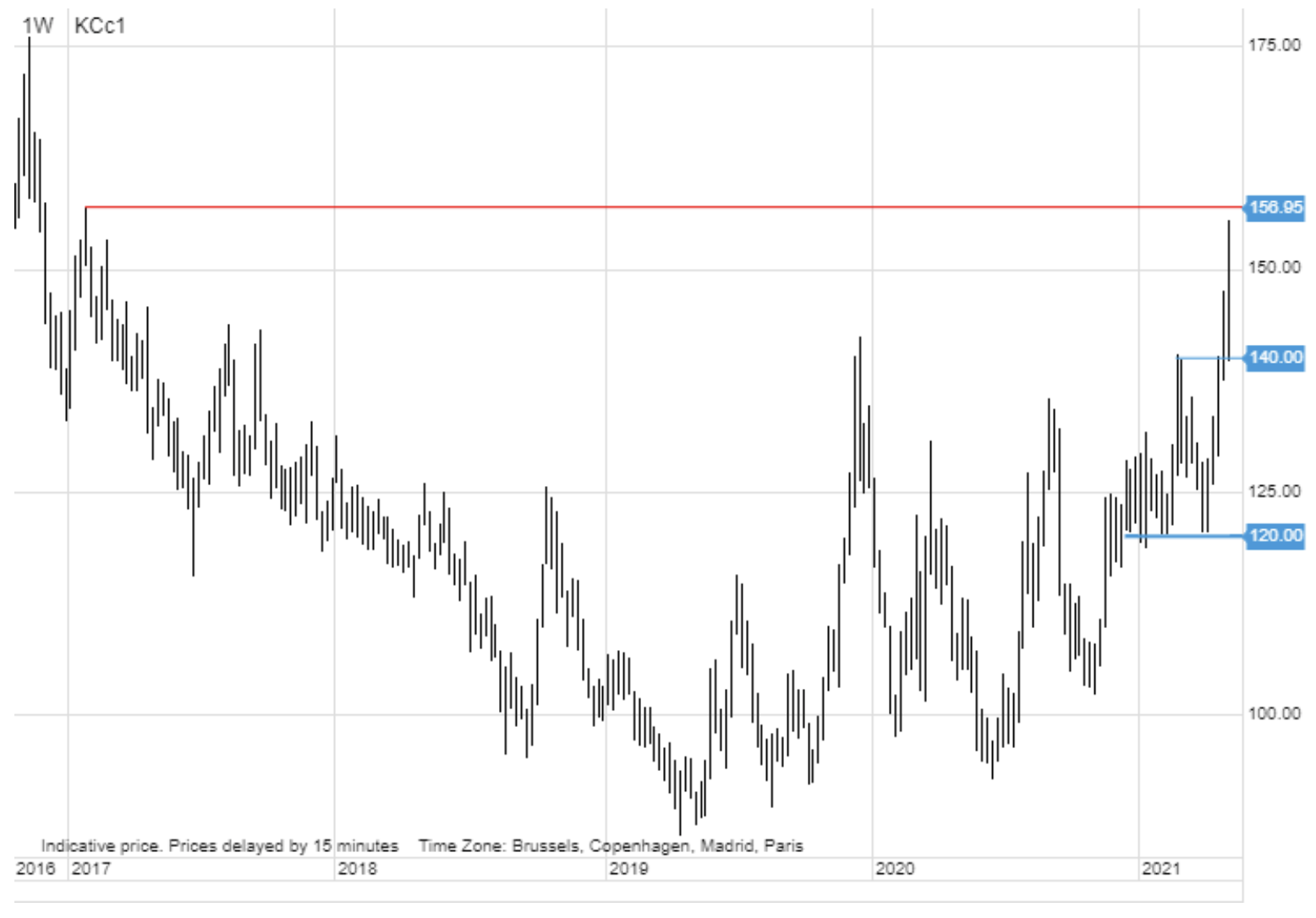

The Chicago Grain futures remain a driver for the continued boom in the agricultural commodities sector. Permanent fears of drought in Brazil and strong demand from feed producers have fueled the growth of the maize market, as well as supporting sugar and coffee prices. Corn, wheat and soybeans recorded new eight-year highs, while arabica coffee hit a four-year high above $ 1,5 / lb.

Technical note on the subject arabica coffee: After breaking the resistance at $ 1,40 so far, the uptrend accelerated and a number of indicators support hopes for an upward trend. The current positive outlook could only be worsened by a close below $ 1,3950 in the short term; in the longer term, the growth forecast remains unchanged above $ 1,20. The next key stage of growth will be the 2017 high of $ 1,57.

Copper

Copper recorded a record high above USD 10 per ton on the London Metal Exchange and USD 300 / lb on the New York Stock Exchange. This metal is at the forefront of the boom, with raw materials currently reaching long-term or even record highs. As an integral part of the green transition process, including the production of electric cars in the coming years, copper appreciated against both physical and paper demand from investors seeking hedge against inflation in markets with strong fundamentals. According to Glencore and Trafigur, two titans in the field of physical raw materials, a strong outlook may require a price increase of 4,72%, encouraging mining companies to look more intensively for sources of additional supply.

Technical Note on HG Copper: Copper's strong uptrend last year not only caused prices to double, but also accelerated the pace of growth since the last correction last month. The RSI divergence appears to be increasing on the daily charts, which could indicate a short-term risk of exhausting the uptrend; however, changing the trend is not an option.

Petroleum

Both Brent and WTI lagged behind metals and agricultural commodities, and despite growing hopes for Brent's price to rise above $ 70, the market wisely decided to wait and follow these developments. Before the fall the price of oil Brent found it dangerously close to $ 70 / b, a level it briefly broke two months ago before there was a 15% correction. The market, already supported by investment demand, is increasingly focused on the opening-up of economies in Europe and the United States, which translates into a strong revival in fuel demand.

However, the oil bulls need to be patient with OPEC + increasing production, the prospect of a new nuclear deal with Iran leading to increased production, and the current risk to demand in pandemic regions in Asia. Since the end of March, Brent crude oil recorded a four-dollar upward trend, currently ranging between $ 66,50 and $ 70,50.

Precious metals

After several failed attempts in the past weeks gold it eventually managed to launch a strong enough attack to break through above $ 1. While lower real US bond yields and a weaker dollar provided a fundamental boost, gold needed support from a strong demand silver - one of the best performing commodities last week. Last month, the continued boom in industrial metals provided relatively greater support for silver than for gold. This is reflected in the gold-silver ratio, which has been going downhill since the end of March.

Silver is currently in an ascending corridor and after reaching its top end at $ 27,55, it may need to consolidate for a while before attempting to further strengthen towards the 2021 high of $ 30. In contrast, for gold to continue strengthening, it needs to establish support above $ 1 before following the long-term trend associated with short positions. The next key milestone of growth is $ 795, a two-hundred-day moving average, and a 1% retracement of the January-March markdown.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)