Oil ready to be minted, coffee revives and gold rests

The Bloomberg Commodities Index rose for a third straight week on the back of overall gains, even as the energy sector was dragged down by further weakness in the natural gas market, which saw prices fall to their lowest level since June 2021.

Gold seems ripe for consolidation copper takes a breather with Chinese workers celebrating the New Year, and crude oil is close to attacking a key resistance level. We also discuss in more detail the wheat, coffee and natural gas markets and Australia's role as an investment indicator in the reopening of the Chinese economy.

Markets see a weaker dollar

Bloomberg Commodity Index (BCOM) by increased for the third week in a row, continuing the strengthening after the sell-off from the beginning of January, caused by the IMF's warning about the possibility of a global recession. All sectors moved up, although the energy sector was pulled down by further weakness in the natural gas market, which saw prices fall to their lowest level since June 2021.

The themes shaping the price level remain unchanged, with financial markets seeing a weaker dollar and lower yields in anticipation of a move by the US Federal Reserve to halt its aggressive cycle of rate hikes. Since early March last year, the US Fed funds rate has increased to 4,5%, with the market now pricing in less than two 25 basis point rate hikes before the cycle is finally paused.

The demand side, in addition to the risk of a slowdown in the global economy, supported by the prospect of reopening the Chinese economy to the world, which increases the expectations of an increase in demand from the world's largest consumer of raw materials. However, due to the prolonged closure of markets in China for the New Year celebrations, some of the winners so far, including copper, iron ore and crude oil all slowed down, allowing other commodities to take the lead this week.

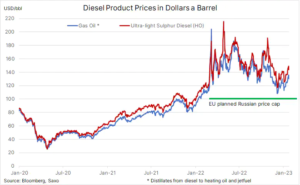

In the coming weeks, the risks associated with the supply of Russian fuel products could provide an additional layer of support for gasoline and, above all, diesel, thereby shielding crude oil from the impact of recession-related demand concerns.

The BCOM Agricultural Index headed to its highest weekly close in nearly three months, and after a difficult start to the year, both grains and softs showed signs of rebounding as improved fundamentals allowed some of the hedge fund's elevated shorts to come under control - in especially for wheat and coffee.

Reopening of Chinese economy leads to biggest monthly increase in Australian stock prices since 2020

Australian stock market - seen as attractive in terms of dividends and commodities, as well as an indicator of the reopening of the Chinese economy due to its significant exposure to finance and materials companies - recorded the largest month-on-month increase since November 2020., amounting to 6,5% so far this month. Mining giant BHP expects its dividend to increase by 17%, and iron ore companies forecast higher demand for high-grade iron ore from China, which could mean higher profits.

Despite a slowdown in activity over the Chinese New Year celebrations, iron ore - a component of steelmaking - hit a six-month high on the Singapore Futures Exchange (SGX) this week at $128 a tonne. This was due not only to expectations that China will increase its purchases after the New Year celebrations, but also to the fact that Fortescue - Australia's largest single iron ore mining company - expects sales to increase in the first half of 2023.

Wheat is consolidating above a key support, rice hits a two-year high in Asia

Chicago wheat, one of the top three commodities short-selling by hedge funds (the other two being Arabica coffee and natural gas), surged short-covering as growing conditions in Texas, the second-largest U.S. state for winter wheat production have deteriorated. In addition, short-term weather forecasts point to a significant cooldown in the US Midwest next week, increasing the risk of freezing in areas without a protective snow cover.

This year's lower supply corn and wheat from the Black Sea region is likely to attract more investor attention in the coming months. Ukraine predicts that corn production in 2022 will be 22-23 million tons, down from 41,9 million tons in 2021, while wheat production is estimated at only about 20 million tons. Reducing sowing due to the ongoing war could cause these numbers to fall even further in 2023, to 18 and 16 million tonnes respectively.

By the time of recent price-enhancing developments, the March wheat futures near expiration fell to its lowest level since September 2021, thus contributing to the largest speculative net short position since May 2019. After finding support again in a key area 7 USD per bushel wheat may continue to strengthen, while after a break above USD 7,6 and below USD 8, there may be overlapping of short positions.

Due to wheat supply disruptions from Ukraine and strong demand, Thai rice - Asia's benchmark - has surged to its highest level in nearly two years. Rice is the staple of half the world's diet, and while wheat hit an all-time high last March, the price of rice remained moderate for most of 2022, thus limiting food price inflation in Asia. At the same time, the Chicago-listed paddy rice contract is up 21% year-on-year and, apart from a brief surge in Covid infections, is near a 2020-year high in XNUMX.

Coffee fends off attacks by hedge fund short sellers

New York Stock Exchange-listed arabica coffee futures surged, supported by a rise in the price of robusta coffee, which hit a three-month high in London above $2 a tonne after stocks monitored by exchanges fell to their lowest level since 000. as a result of strong demand. In New York, high-quality Arabica rose for the tenth consecutive day since falling to $2016 a pound, a 1,42-month low.

Month-long sales amid recession concerns and stocks monitored by stock exchanges surged from their lowest level in more than 20 years fueled speculative sales by hedge funds. It culminated in the week ending January 17, when the net short position increased by 34% to 40,5k. contracts, the highest since November 2019, with a nominal value of USD 2,4 billion. This highlights the risk of a sudden reversal when oversized positions unexpectedly collide with a change in the technical and/or fundamental forecast.

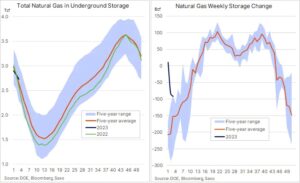

US natural gas falls to April 2021 low as a result of high supply

global natural gas prices continue to fall, and futures markets took significant losses this month as a combination of ample supply and mild winter weather led to a reduction in heating demand. While the European benchmark TTF contract for natural gas down 30% this month - and is now near a 50-month low of €16/MWh ($3/MMbtu) - US natural gas has fallen below $2021/MMBtu to its lowest level since April 100. , primarily as a result of robust supply as daily production continues to exceed XNUMX billion cubic feet.

This resulted in smaller-than-expected weekly inventory reductions, with last week's 91bn cubic foot release being less than half the seasonal average of 190bn cubic feet. In addition, the long-closed Freeport LNG export facility in Texas began receiving small amounts of natural gas from pipelines in preparation for last June's reopening explosion that slashed US export capacity by 20%.

Brent crude oil hits the $90 level, but support remains strong

Crude oil is trading almost unchanged this month and while the risk of recession remains and has increased in some respects, the market has managed to find support from the expected increase in Chinese demand and supply concerns related to the EU embargo imposed on February 5 for the sale of Russian fuel products by sea.

Following the entry into force of the EU embargo on the export of Russian fuels by sea, petrol prices, and in particular diesel fuel, are likely to remain supported by increasingly limited supply - especially if, after the introduction of the embargo the price of diesel oil will be capped at USD 100 per barrel, which is about $30 below the current market price. However, Russia may find it difficult to sell diesel to other buyers as key customers in Asia are more interested in heavily discounted Russian oil, which can then be processed into fuel products sold at world market prices.

Diesel deliveries to Europe from the US and the emerging refining hub in the Middle East could replace some of the missing barrels from Russia, but a deficit seems likely, especially given the prospect of a strong recovery in China leading to lower export quotas. In addition, the recovery in demand for jet fuel will put pressure on diesel production, thus creating another layer of support for cracked distillate on both sides of the Atlantic.

Brent crude oil is currently trading in a $9 wide ascending channel as part of a medium-term downtrend, with both ranges offering solid resistance at $89-90. A break out of this channel is likely to push further up towards the 97,50-day moving average, currently at $80,35. Prior to channel support at $83,50, the XNUMX- and XNUMX-day moving averages may provide some support, currently around $XNUMX.

Gold slows down after reaching a new high of the cycle

Gold traded almost unchanged this week, but earlier managed to hit a new cycle high of $1 as speculators and investors demanded in response to improved forecasts. Last year's difficulties are now becoming a driving force as interest rate hikes finally stop and yields and the dollar move lower amid concerns about the economic outlook. Last week, investors also revised their estimates of how low inflation would eventually fall. This change is due to the awareness that some inflation indicators are not so easy to break, despite the inflation-limiting impact of the current cycle of interest rate hikes.

However, given the strong growth gold prices over the past two months, which has put it about $330 above its November low, already a period of consolidation has been necessary for a long time. Whether it will be a consolidation or a correction will depend on the ability of the yellow metal to hold the trend line and the 1-day moving average, which are currently trading around $890.

Aside from dollar movements and yields – both of which are key to guiding algorithmic trading systems – we will be keeping a close eye on exchange-traded fund exposure, which hit an 11-week high after a slight increase last week, the aforementioned rise in US zero-coupon inflation swaps, and next week's FOMC meeting to find out the next line of reasoning of the most important central bank in the world.

Aside from this week's highs at $1 and $950, a 1% retracement from the 963 correction line, there is no major resistance level ahead of the psychologically important $76,4 level while support is well defined near $2022 where the 2-day moving average line meets the uptrend line from the November low.

More analyzes of commodity markets are available here.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)