Commodity markets: The fall in the dollar causes a commodity boom

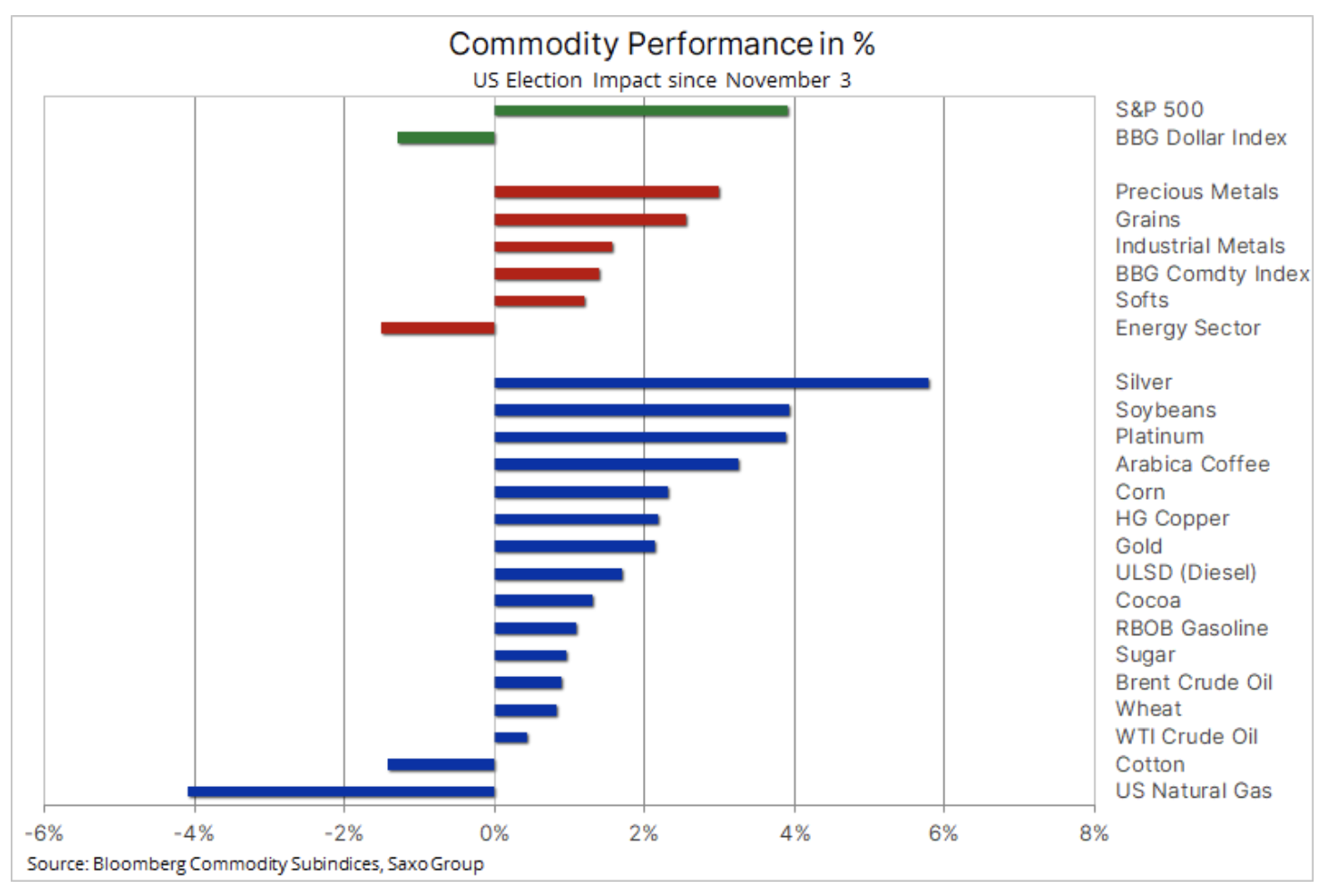

Almost all assets, including most commodities, appreciated significantly since the US election on Tuesday. The asset boom, with the dollar weakening at the same time, occurred despite the possibility of at least two years of political stalemate in Washington, preventing the inflow of fiscal stimulus to the struggling economy and weakening the potential of reflation.

Commodities markets, however, experienced a strong boom as it became increasingly clear that Joe Biden would be the new president despite Trump's unsubstantiated allegations of electoral fraud. While commodities appreciated in response to the decline in volatility, precious and industrial metals, as well as other assets, received an additional boost in response to a weaker dollar. After the election, the Bloomberg commodity index rose by 1,4%, with strong gains recorded silver, platinum, gold i copper.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Agricultural sector

Most notably, soybeans, coffee, and corn have appreciated, suggesting that food costs may increase. Soybean contracts traded on the Chicago Stock Exchange hit a four-year high after local prices in China hit record highs amid shortage of supply. Dry weather conditions in key agricultural regions, from the Black Sea to South America and the American Midwest, coupled with strong Chinese demand, and now also a weaker dollar, have pushed major crop prices up in recent weeks.

The FAO released the monthly world food price index for October which showed a continuation of the upward trend. While the year-on-year increase was 6%, it was 3,1% month-on-month due to significantly higher prices for sugar, dairy, cereals and vegetable oils; only meat prices recorded a slight decline.

Precious and industrial metals

Both groups of instruments surged as the dollar plunged to its lowest level in two and a half years; gold broke above the previous resistance level ($ 1 / oz) and, together with copper, recorded its biggest weekly gain since July. The best results were achieved by silver, which gained almost 930% since Tuesday. Due to the simultaneous decline in the ratio of gold to silver, silver may have entered a period of better results, and the said ratio may again amount to 6 (ounces of silver to one ounce of gold).

The weaker dollar also contributed to the decline in bond yields as the risk of reflation went down as the US government split. Although the Federal Reserve did not introduce additional stimulus at its last meeting, it announced that support in the form of monetary and fiscal policy may be necessary. It is currently speculating in the market that with Biden unable to spend money due to resistance from the Republican Senate, the Fed will soon be forced to step in and fill the gap. Hence the strong bullion of precious metals, but also of shares due to the new interest in the TINA slogan (ang. There Is No Alternative, there is no alternative).

Gold may now be moving towards our projected year-end target ($ 2 / oz), but to do so, it needs to stay above the support area between $ 000 / oz and $ 1 / oz.

Energy

After hitting its five-year low earlier this week amid concerns over Covid-19 and increased production in Libya, Petroleum made a sharp reversal in response to the significant decline in US stocks coupled with increasing speculation that OPEC + would intervene to support price. However, the boom began to wane after investor attention shifted from the US election back to the coronavirus pandemic and record numbers of infections in both Europe and the United States.

Overall, Brent crude oil continues to decline broadly; the resistance is currently at USD 42 / b, while the support is at USD 35,50 / b. As already mentioned, the only appropriate solution for oil at such relatively low levels would be to eliminate the coronavirus threat by discovering a vaccine that could be applied at a global level. Only then will the market be able to consider to what extent a lack of investment in innovation may contribute to price increases in the coming years. For the time being, global demand remains under threat - to what extent will be revealed this week after the monthly oil reports are released: by the EIA on Tuesday, by OPEC on Wednesday and by the IEA on Thursday.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)