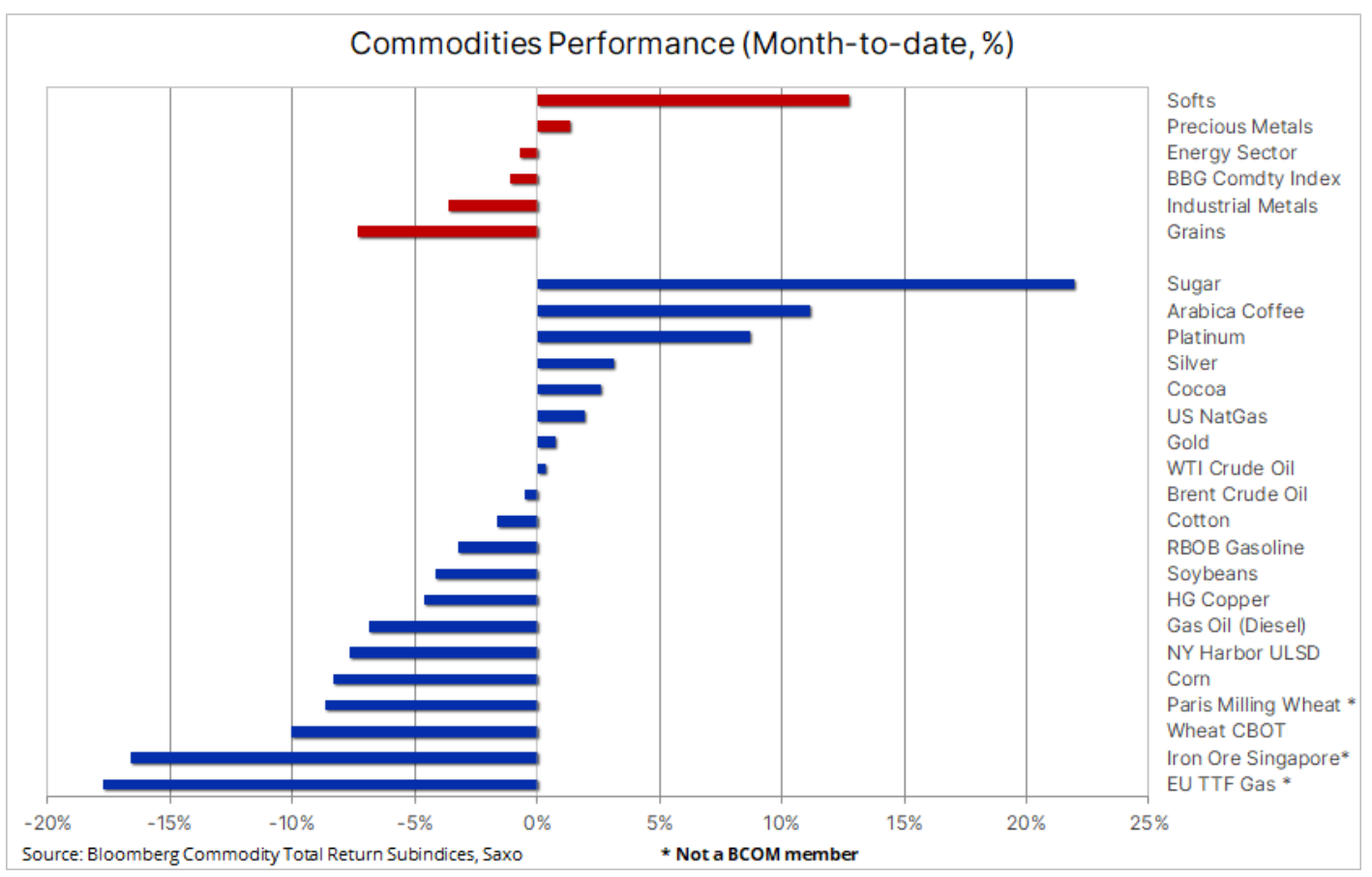

Cereals and industrial metals sector with the biggest losses in April

Commodities fell for a fifth straight month-on-month decline, with Bloomberg's Bloomberg Commodity Total Return index, which tracks the performance of the 24 most important commodity futures evenly distributed among energy, metals and agricultural products, at its monthly low at close from January 2022. In April, the energy, grain and industrial metals sectors suffered extensive losses as amid continued concerns about the global economic outlook and the fact that China's recovery turned out to be less commodity-related than the government-supported recovery so far growth waves. The acceleration in China's growth, which could reach 6% this year, was driven by consumer demand and the service sector, rather than spending on infrastructure and construction.

Overall, as noted above, the Bloomberg Commodity Index was down 1,1% on a monthly basis, with the only sectors that moved up being so-called "soft" products - in particular sugar i kawa – and investment metals, headed by platinum and silver. At the very bottom of the table was again the EU gas FTT, which is near a 21-month low (€38 per megawatt hour, or $12,3/MMBtu), driven by heavy LNG imports and inventories at 58% compared to a long-term average of around 38% for the corresponding part of the year.

Singapore iron ore futures fell 17% m/m on reduced demand from Chinese smelters, while wheat prices in Singapore Paris i Chicago reached new cycle lows, thus extending the longest series of losses since 2021 due to strong supply and optimism regarding the forecasted grain production in the most important growing regions in the northern hemisphere, from the United States and Canada to Europe and Russia. The failure of negotiations to extend the agreement on the Ukrainian grain corridor, which Russia has repeatedly threatened to withdraw from, may provide some support, but for now more ships are still leaving Ukrainian ports.

The price of iron ore fell to $100 after Chinese smelters cut production

An example of how the change in the direction of economic growth in China negatively affected commodity prices is Brown iron, which, after a strong 17% drop on the Singapore futures exchange over the past month, hit $100 a tonne before seeing a slight gain as steel mills began to restock ahead of China's Golden Week in early May. The recent weakness was driven by a reduction in demand from Chinese steelmakers, some of which, according to the China Iron & Steel Association, were forced to cut back on loss-making production after a period of disappointing demand and falling prices. The impact of lower prices has been felt across the mining industry as iron producers in Australia and Brazil have spent recent months preparing for a strong recovery in demand in China, whose smelters account for 70% of global demand. As a result, BHP, RIO, Vale and FMG posted losses of between 6% and 9% last month.

In the oil market, the gap turned into a crack

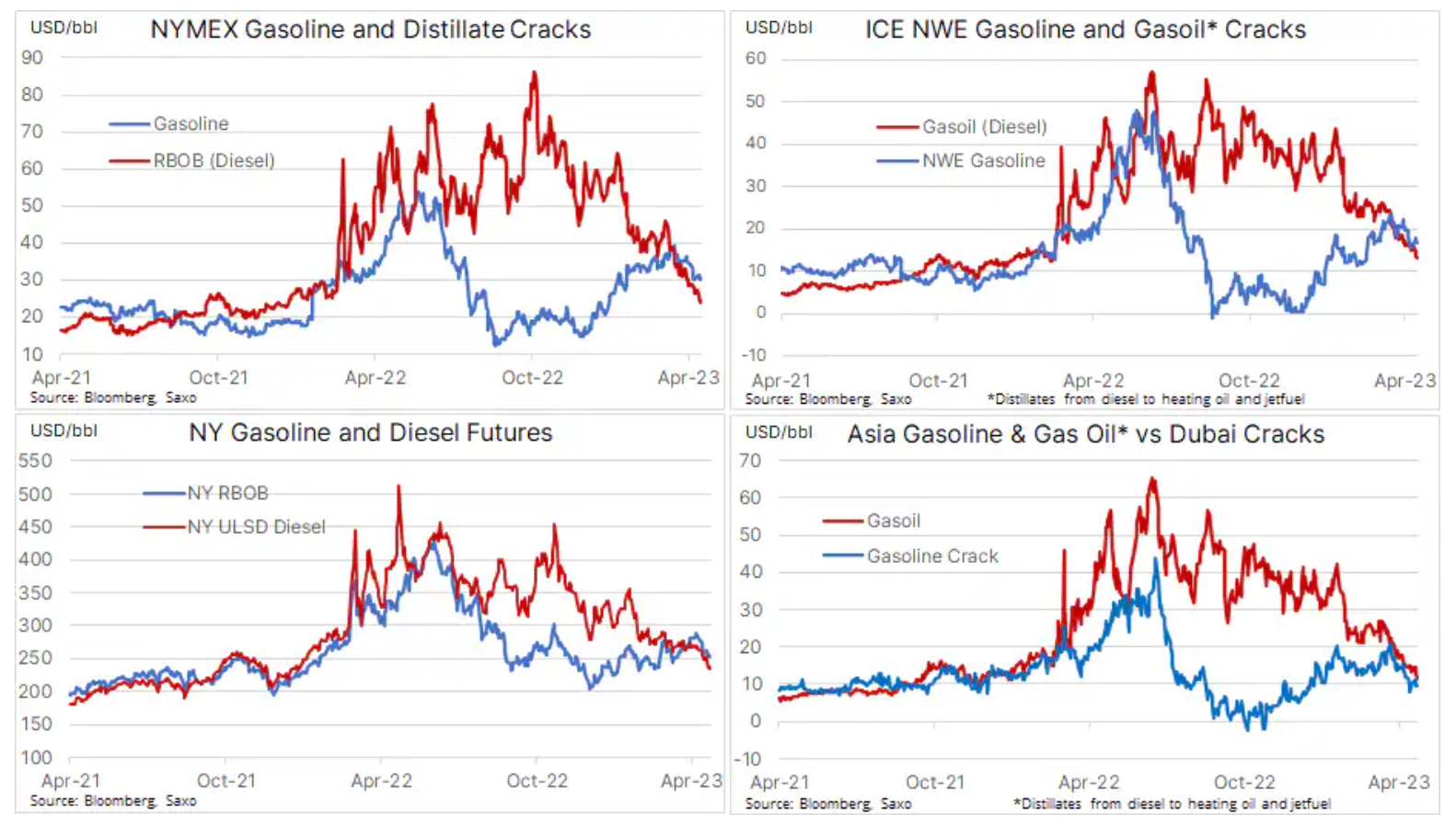

Once again, last week most attention was paid to the continued decline in oil prices. Four weeks after OPEC+'s surprise production cut helped drive prices up, both oil Brent, and WTI returned to the levels before the announcement regarding the reduction of production. This was the result of concerns about global demand, visible in the form of lower refining margins, e.g. in the case of diesel, a fuel used in heavy machinery such as trucks and construction equipment. As can be seen in the table below, refining margins fell significantly last month diesel fuel and gasoline in key centres, and although some of the factors behind this decline may be temporary, it may lead to a reduction in refinery processing capacity and, consequently, to a reduction in demand for crude oil.

Don't post important production announcements on the weekend!

It is also becoming clear that OPEC's greater propensity to micro-manage oil supply to get the highest price possible in the coming years, before demand begins to slow as the energy transition gains momentum, is increasingly enabling it to influence trader behavior and has contributed to the current weakness, which followed OPEC's decision to release an announcement of a major production cut over the weekend when markets were closed. Let me explain: after the weekend announcement of April 2nd, oil futures opened significantly higher the next day, giving buyers and sellers no chance to react before the price surged by about $XNUMX.

The price increase not only left a significant price gap that acted as a magnet for short sellers for weeks, but also forced buyers looking for higher prices to go long around $85 for oil Brent and $80 for oil WTI. The subsequent weakening in prices due to the aforementioned drop in refining margins due to lower-than-expected demand, as well as the disappointing momentum of China's economic recovery, initially gave wind to short sellers seeking to close this gap, and over the past week, short sales have accelerated as traders increasingly they were more often forced to get rid of long positions inspired by OPEC decisions.

Co dalej?

Saxo maintains its view that the price of Brent crude oil will continue to hover around $80 in the near future in anticipation of the expected, albeit lower, increase in demand in the second half of the year – in line with OPEC, IEA and EIA projections repeated many times in recent oil market reports. This could drive up prices and deepen the supply deficit starting in the second half of 2023. However, the recovery in demand is still very uneven, with China and the recovery in the airline industry accounting for the largest part of the expected increase so far. However, before calm can be restored, the recent downtrend needs to reverse, and for that to happen, WTI should return above $76,50 and Brent crude above $80,50.

Further extended consolidation in the gold and silver market

After a period of strong increases from March to early April, the market sideways course gold it is already the second week; at that time, the yellow metal continued to rebound ahead of key support at $1-950. Factors that have so far supported consolidation rather than correction include concerns about economic growth driving higher expectations for US interest rate cuts, lower bond yields, and continued anxiety in the banking sector, highlighted by a +1% drop in First Republic Bank share price % in just two days after the release of worse-than-expected results.

Exchange-traded funds based on the bullion, after a slight reduction, recorded another strengthening - total shares reached 2 tonnes, which is the highest level since January 911,7. Speculative traders in the COMEX gold futures market have been net sellers over the past two weeks, but the 10 million ounce cut so far is a slight change from the 1 million ounces purchased in the previous four weeks. Ahead of the FOMC meeting on May 12, the market is pricing in a rate cut of almost 3bps by the end of this year and of almost 75bps in the second half of 100. Any signal from the Fed that contradicts this assumption could act as a short-term brake on prices .

Overall, Saxo maintains a positive outlook on precious metals for the reasons detailed in our recent weekly commodities overview, available here. In the case of gold, the resistance is at the levels of USD 2 and USD 012, while silver holds support in the $24,50 area, reversing less than a quarter of recent strong gains so far, perhaps thanks to the results of a recent study on the global silver market World Silver Survey 2023. According to this publication, last year the silver market experienced its biggest deficit in history, and another deficit is forecast in 2023 due to a lack of supply caused by limited organic growth, project delays and disruptions.

Copper loses as the long-term forecast of limited supply is offset by weak demand in China

HG copper it went down by about 5% on a monthly basis; this weakening came after another attempt at strengthening ended around $4,2 per pound. This underscores the struggle between short-term demand drivers and the long-term forecast of supply constraints as global electrification gains momentum and mining companies struggle to meet future demand. This is due to the fact that in the coming years the mining industry will face challenges related to the deterioration of ore grades, rising production costs and a post-pandemic lack of investment appetite as the focus on ESG has reduced the available investment pool offered by banks and funds.

This situation is likely to cause the market to enter and remain in deficit in the coming years, which will strengthen prices and thus increase the profitability of mining companies and their appetite to start new multi-billion and multi-year ventures to increase supply. According to Goldman Sachs, the number of regulatory approvals for new copper mines has fallen to its lowest level in a decade, which is a major challenge as the process of obtaining a permit and building a new mine often takes 10 to 20 years.

The sector's challenges were the focus of the World Copper Conference recently held in Santiago, Chile. As predicted, the main conclusion of the conference was that the growing global demand for copper over the next decade would outstrip supply unless new mines were developed. For the time being, demand for copper is also affected by less pressure on commodities as part of China's economic recovery, including due to weak demand from the real estate, energy and automotive industries, which account for about two-thirds of China's copper consumption.

As you can see in the chart below, the metal is currently looking for support, having initially found it around $3,82/lb, its March low. An additional weakness would put the 3,77-day simple moving average, currently at $4,3550/lb, back into play. As a reminder, it was the break above the two-day simple moving average in January that helped create a strong buying impulse all the way to $XNUMX/lb, the current peak of the cycle, from where the price has been drifting down ever since. We stand by our positive outlook for copper so far, but given that global growth concerns are attracting a lot of attention, it may take longer to see a real strengthening.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response