Raw materials: Selling pressure returns as policy tightens

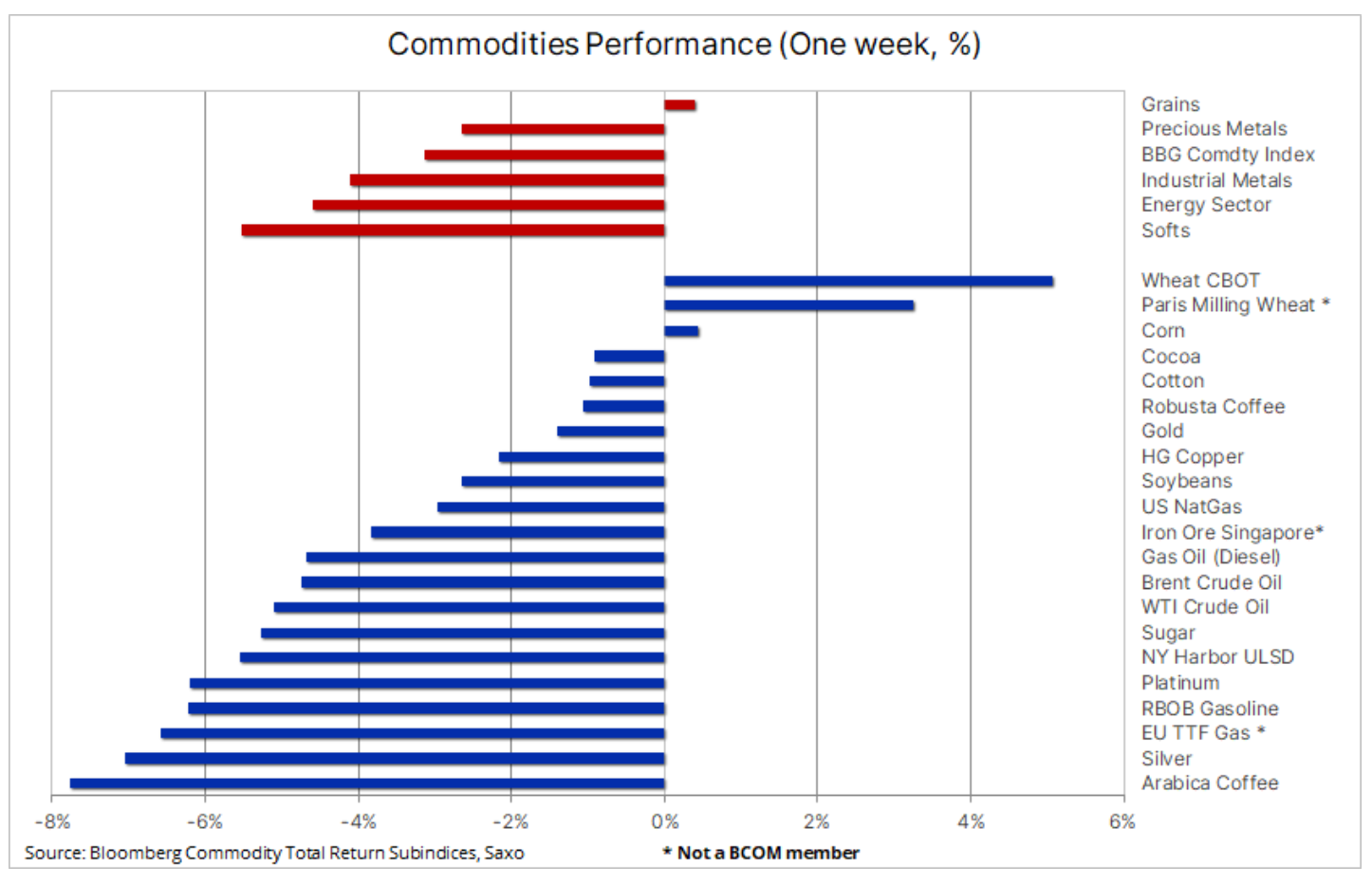

The commodities sector fell for the first time in three weeks, reversing part of a series of recent strong gains that pushed the sector's monthly results to a 15-month high. While the Bloomberg Commodity Index is down 3% this week, it is heading towards its first monthly gain since November. The temporary decline was mainly due to performance-dependent commodities in the energy and manufacturing sectors after Fed chairman Jerome Powell suggested to the US Congress that further interest rate hikes were needed to curb inflation, which has persisted in some areas.

The prospect of even higher interest rates caused a stir in stock markets, while bond yields rose and the strengthening dollar helped to reverse some of the recent declines. There are fears that economic growth, and with it the demand for goods, could suffer as central banks continue to apply the brakes by raising interest rates. There are some important questions to ask yourself about the effectiveness of anti-inflation measures in relation to the potential economic damage they could cause if they continue. At Saxo, we stand by our long held view that inflation is becoming a persistent phenomenon and is unlikely to return to the levels that central banks are targeting. If this sentiment continues to spread, we may see increased volatility as markets adjust, thus significantly strengthening the commodities sector from an inflation hedge perspective.

In addition to the interest rate actions of central banks, the commodities sector appears to be unaffected by China's recent initiative to support and stimulate growth, which has stalled in the face of a global economic slowdown and a less intense post-pandemic recovery driven by the service sector. In Europe, meanwhile, the fall in factory production rates is further evidence of the difficulties in the industrial economy, especially in Germany, where a sharp contraction in activity contributed to a larger-than-expected fall in the Eurozone's manufacturing PMI in June.

The grain sector is strengthening, but concerns remain

The recent recovery in the grain sector has shown some signs of cooling, but with continued drought in key growing regions, the prospect of a significant price reversal appears limited at this stage. However, much depends on whether the current weather situation continues in the coming weeks, not only in the US, but also in drought-affected areas in northern Europe, as well as in the Black Sea region. In the United States, the drought has so far not caused irreparable damage to corn and soybean crops, but the clock is ticking and there is no sign of rain.

After months of falling prices, the grain and soybean sectors are up about 16% this month, according to the Bloomberg Grains Index. CBOT wheat leads the way up (23%), while soybeans and corn are up 16%. The market keeps a close eye on the weekly crop data published every Monday. A recent update showed that the percentage of corn fields rated as good or excellent fell to 55%, down from 61% the previous week, the lowest reading for this time of year since 1992. The statistics for soybeans were 54% (good to excellent fields) compared to 59%, while the values for the portion of spring wheat in this category fell to 51% from 60% in the previous week.

In addition to needing to consolidate as prices reached overbought levels and a stronger dollar made US grain exports more expensive for overseas buyers, the gains generated late in the week can also be partly explained by reduced buying pressure from speculators. After the weaker months, these traders traded the grain sector from a short-term perspective, leaving them completely unprepared for the sudden price surge that forced them initially to cover short positions and, more recently, to buy more than sell. Based solely on positioning, the wheat market could potentially see further gains after hedge funds held large short positions for months from which they are likely not yet fully recovered.

In the last update our stock strategist Peter Garnry, he writes that agribusiness stocks are among the stock market segments that perform best in June, up 8,1% versus just 5,1% for total shares. The combination of stable and higher crop prices and a focus on initiatives to support production despite increased volatility in weather conditions is likely to lead to more M&A across the industry in support of prices in the coming years.

The iShares Agribusiness UCITS ETF has exposure to 69 companies and tracks the S&P Commodity Producers Agribusiness Index. It is designed to track manufacturing, distribution and processing companies as well as supplying equipment and materials. All companies that are required to improve global access to food resources.

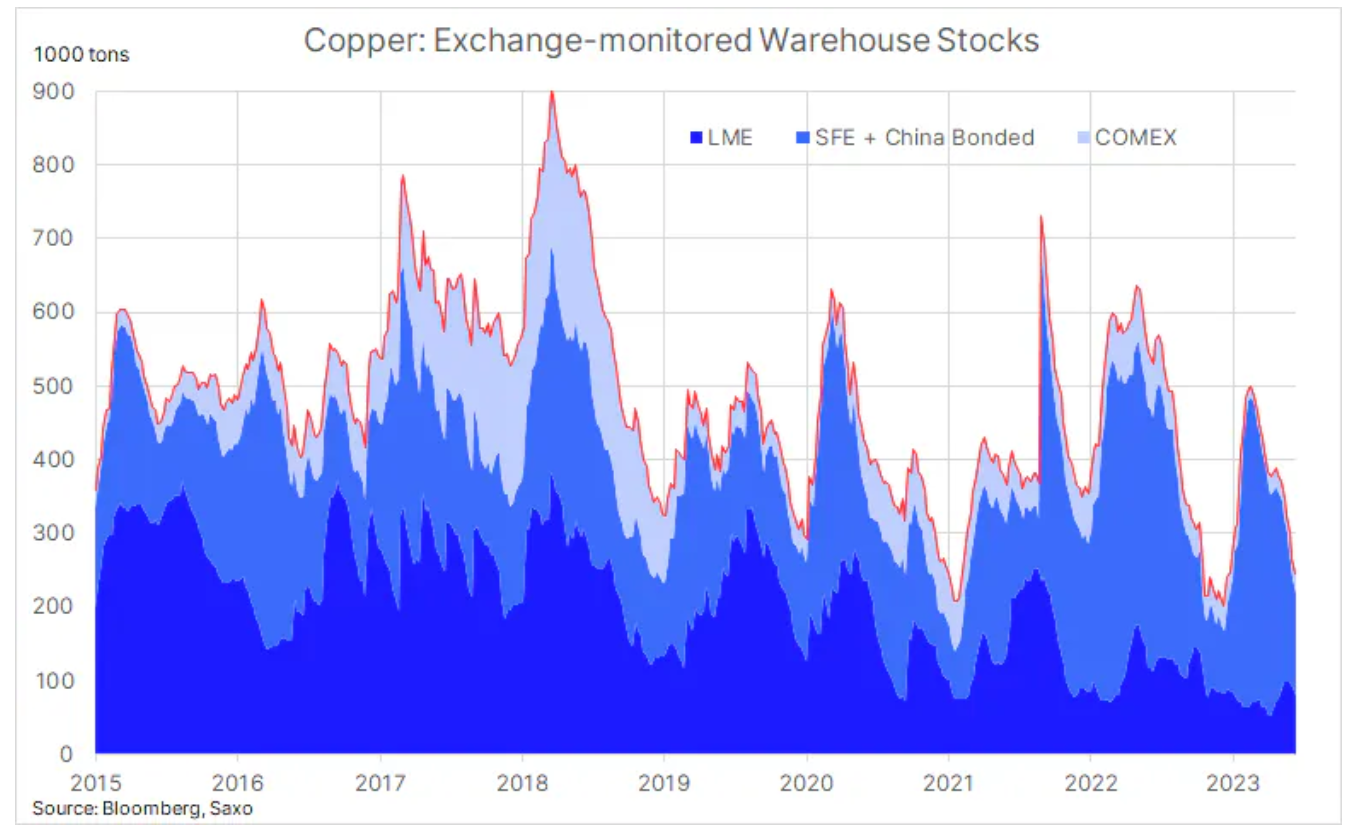

Copper: Falling stock prices offset diminished hopes for stimulus from China

Copper prices fell after a three-week sprint that saw stock prices in London and New York rebound strongly from six-month lows. Apart from concerns about growth caused by rising interest rates and a weak PMI for EU industry, the various stimulus measures announced by the Chinese government and the People's Bank of China have so far failed to impress the market. In our opinion, also taking into account recent developments, copper prices remain at a very good level. The reason for this is a long-term decline in stocks in warehouses monitored by three major futures exchanges in London, New York and Shanghai. A new six-month low of 246 tonnes was recently recorded, which is less than 000 tonnes above the multi-year low recorded last December.

Whether or not there is stimulus from China, we see a clear trend towards higher prices in the coming years as the issues of the green transition and its impact on several so-called green metals will continue to provide strong winds in the sails, especially for copper, the most optimal electrically conductive metal for the green transformation, which is used in batteries, electric traction motors, devices for generating renewable energy, energy storage and modernization of the grid. In the coming years, producers will face the challenges of lower grades of ore, rising production costs and a pre-pandemic lack of investment appetite as the emphasis on ESG has reduced the available pool of investments offered by banks and funds.

In the short term, we are seeing copper move around the 200-day moving average with High Grade at $3,82/lb and LME at $8410/tonne, with the biggest risk being a deeper downward correction.

Gold and silver fall as central banks continue to raise rates

Gold traded below its previous support level of around $1930, while silver, given its importance to the industry, fell even further in response to the strengthening dollar and rising US Treasury yields following Fed Chairman Powell's comments on the need to raise interest rates in to combat inflation, which has not yet been fully brought under control. In addition, the hawkish surprise from central banks in Norway and the UK has raised additional concerns about the short-term outlook for interest-free investments such as metals.

The peak interest rate scenario has been, and in our view will remain, a factor that could drive precious metals up again, and given the recent signals from the US Federal Reserve, this timing could potentially be further delayed before reaching its inevitable climax. Market reaction in the coming weeks will depend heavily on the data as any signs of economic weakness will weigh in on how the market is pricing in the prospect of a rate hike as only one additional 25bps hike before year-end is currently under consideration .

For reasons highlighted in previous updates, and despite the current situation, we maintain a long-term positive outlook for gold. Technically, for that to change, gold would have to fall below $1800. In the short term, a close above the 21-day moving average (most recently at $1950) would be the minimum requirement for a reversal of the market's current defensive stance.

Crude oil: The decisive quarter is approaching

Petroleum remains in a sideways trend within the low of the cycle in the range between USD 71,50 and USD 78,50, as investors continue to assess the impact of Saudi Arabia's decision to cut oil production itself at the latest OPEC+ meeting. However, once again the lower end of the range was called into question after central banks, continuing to raise interest rates, raised concerns about the economic outlook.

Earlier this month International Energy Agency (IEA) presented an optimistic assessment of short-term demand prospects. In its June monthly oil market report, both OPECAnd MAE raised their global demand forecasts for 2023. Organizations expect some constraints to come in the coming months due to OPEC+ production cuts, but with nearly half of this year's demand growth expected in the coming quarter, there is some scope for disappointment and risk of price growth stalling in the short term .

With this in mind, it should be emphasized that the coming quarter may be decisive for the oil market, because - depending on whether the decisions OPEC and the IEA are right, or rather Saudi Arabia was right to unilaterally cut production earlier this month, we may see economic activity slowing to a point that could cause prices to fall further. It will be interesting to see how OPEC and especially Saudi Arabia deal with this situation. The Saudis, which have already cut production, giving up market share to support prices, are likely to put strong pressure on other producers to make similar cuts.

However, we believe that a recession in the US will be avoided and that China will step up its efforts to support the economy. However, it is not known whether this will be enough to support higher prices by tightening the market. In the current situation, macro funds again prefer to trade oil from a short-term perspective as a hedge against further economic weakness.

In the near term, OPEC will focus on supply management, keeping prices above $70 for now. An upward breakout seems unlikely if the economic outlook continues to deteriorate. From a technical point of view, the $80 Brent level will be a big resistance, and funds bent on further weakness are unlikely to change their negative stance until we see a return to the top XNUMX.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response